A swap trading technique that profits no matter whether the market goes up, down, or stays flat: "Money Grazing Triple Arb" Sequel

How to Generate Profit

If you manage your finances carefully, you can earn a profit at any time using the Triple Arb method I developed.

By “any time,” I mean regardless of whether the market is rising, staying flat, or falling.

In this article, I will explain using the TRY/JPY Triple Arb (pseudo-hedged) strategy.

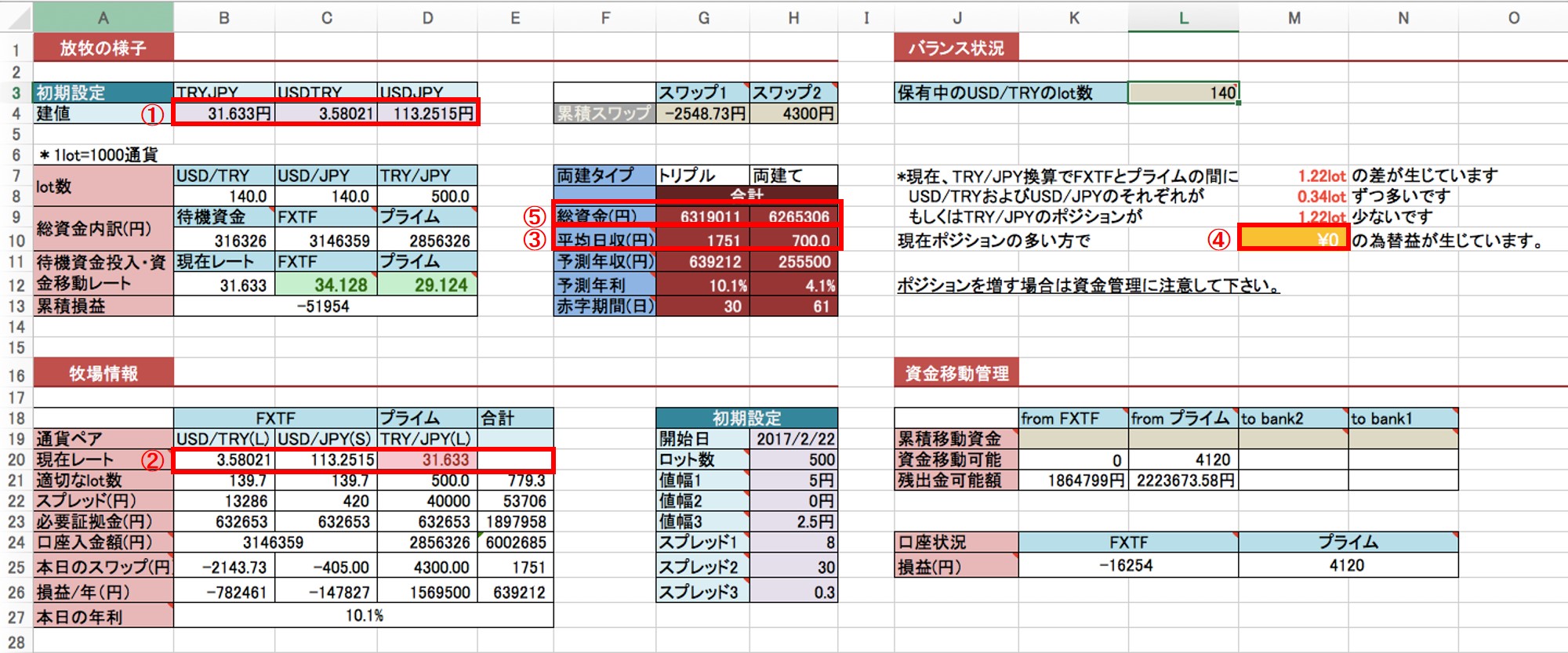

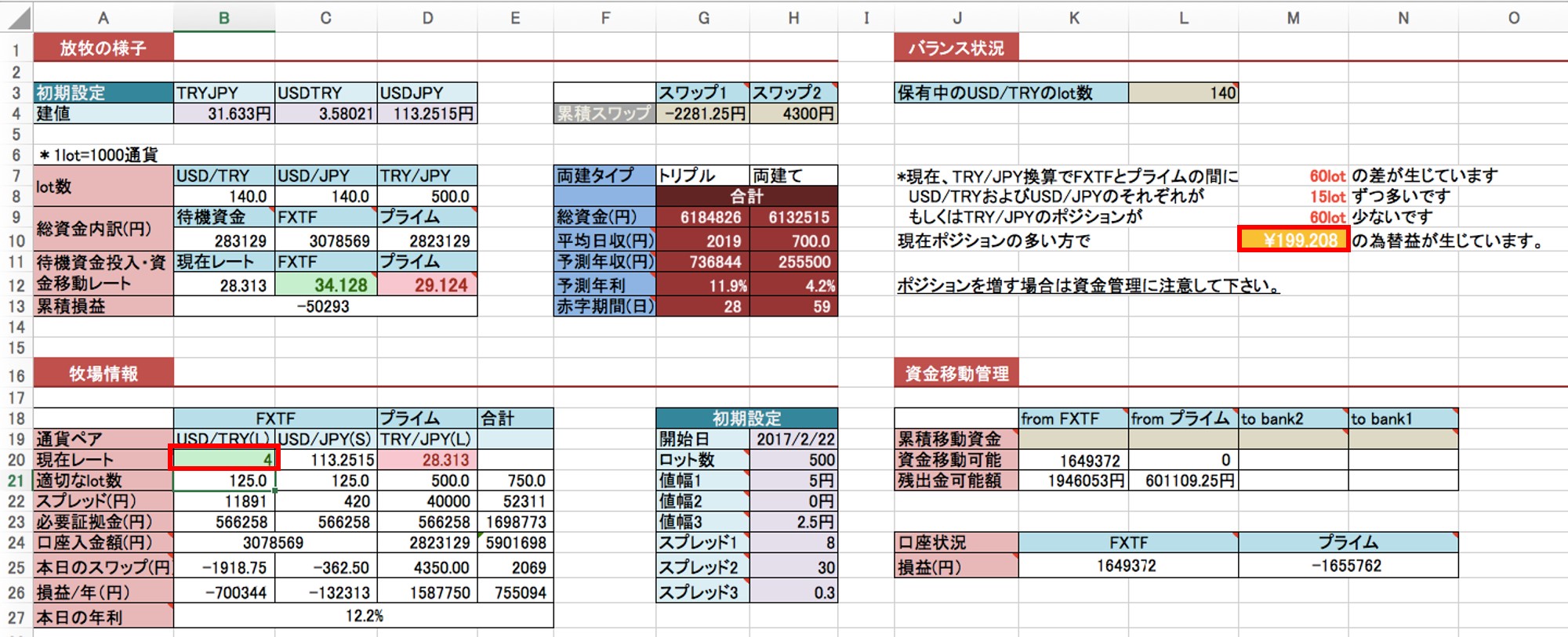

The following table is the latest version of the funds-management calculation tool (as of the end of February 2017).

For beginners, this may look cluttered and be hard to understand what is written.

Here I will keep explanations to the minimum so you can understand it intuitively.

*Not the default settings; parts have been customized for Potemato, so total assets and annual yield differ from the commercial version.

*Table 1

Key points to note

・Value entered in the purple cell in the 4th column

・Current rate in the 20th column

・G10 average daily income (average carry trade amount)

・M10 orange cell

・G9 total funds vary with the rate (because the required margin changes)

In Table 1 the entry price and current rate are the same, so M10 is 0 yen.

However, as a result of the Triple Arb, you gain swap points through swap carry arbitrage via the pseudo-hedge.

These swap points accumulate daily as long as there is a carry (spread).

From my experience, over four months about two weeks will be in reverse-hedge and be negative.

However, this is not a cause for alarm. The reasons are below.

① Even after deducting the reverse-hedge period, viewed as a carry trade, there is a high likelihood of net positive profit.

② From the entry price, USD/TRY movesupordownstill yields profit, more than offsetting the loss from the reverse-hedge.

① is due to luck, but ② is theoretically certain.

Why ② is certain is explained below.

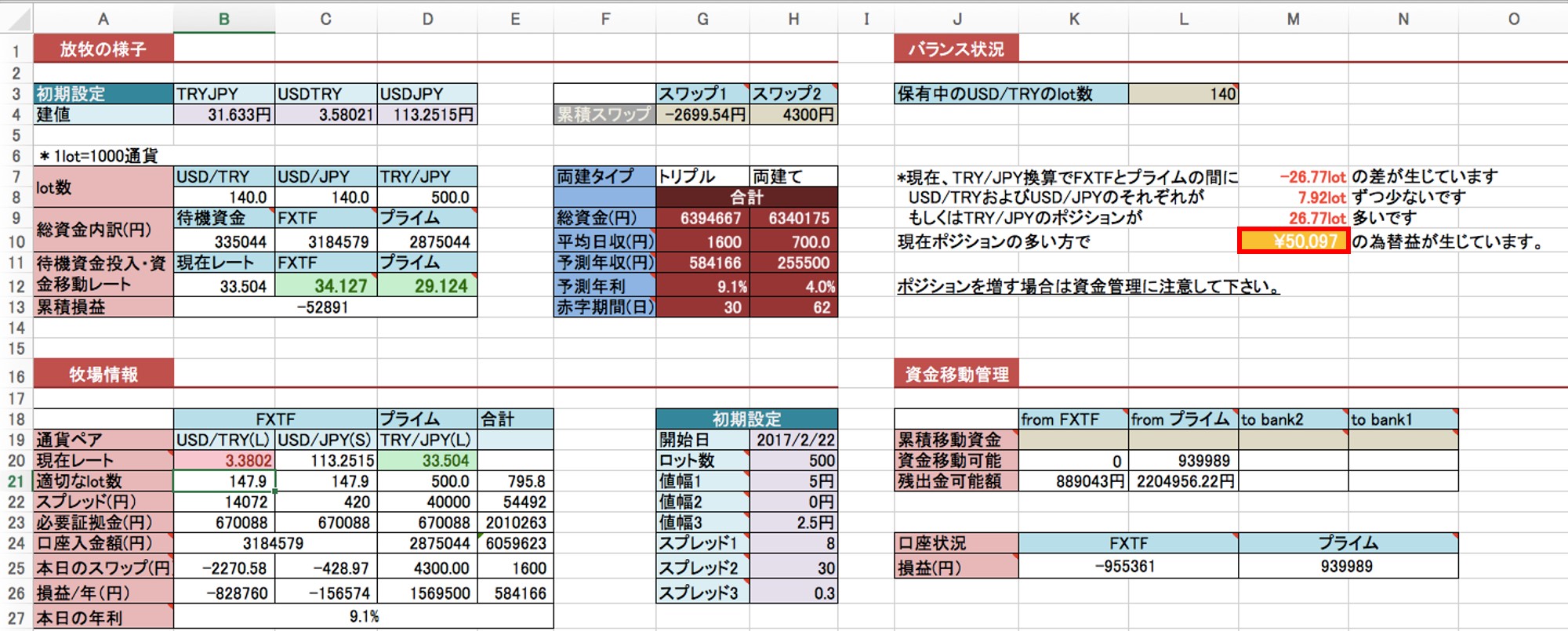

Suppose the USD/TRY rate falls by 0.2 compared to Table 1.

Table 2

Then the orange cell in M10 is about 50,000, right?

This becomes the FX gain.

Also, the entry price is lower than the Turkish lira rate has risen.

This yields gains on the long position.

Of course, the pseudo-short position will incur losses, but the gains from the long position exceed that, so overall it is positive.

*The above scales with principal, so for example if the principal is 1/10, the FX gain is 5,000 yen.

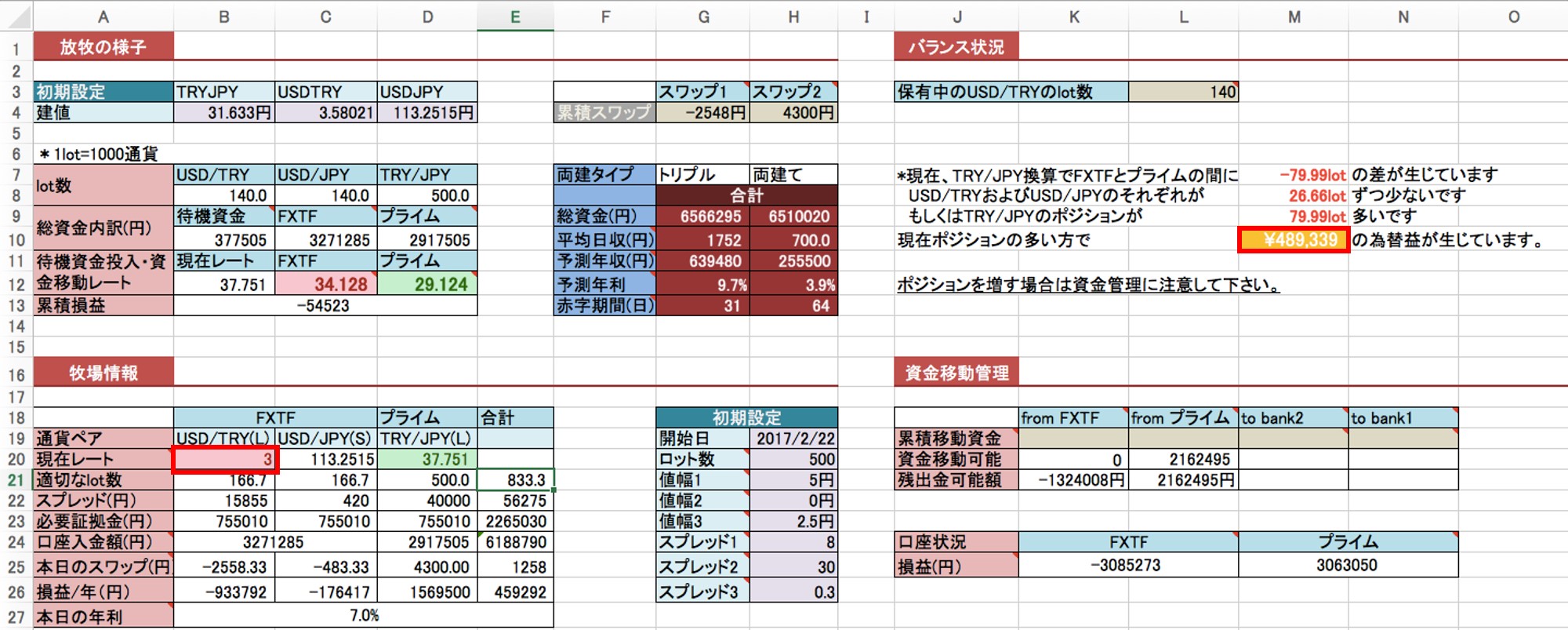

Next, suppose it falls further and USD/TRY becomes 3.

Table 3

As a result, FX gains of about 490,000 yen occurred.

Furthermore, the Turkish lira has risen.

Also, when USD/TRY becomes 2.5,unrealized gains of about 2,000,000 yenare realized.

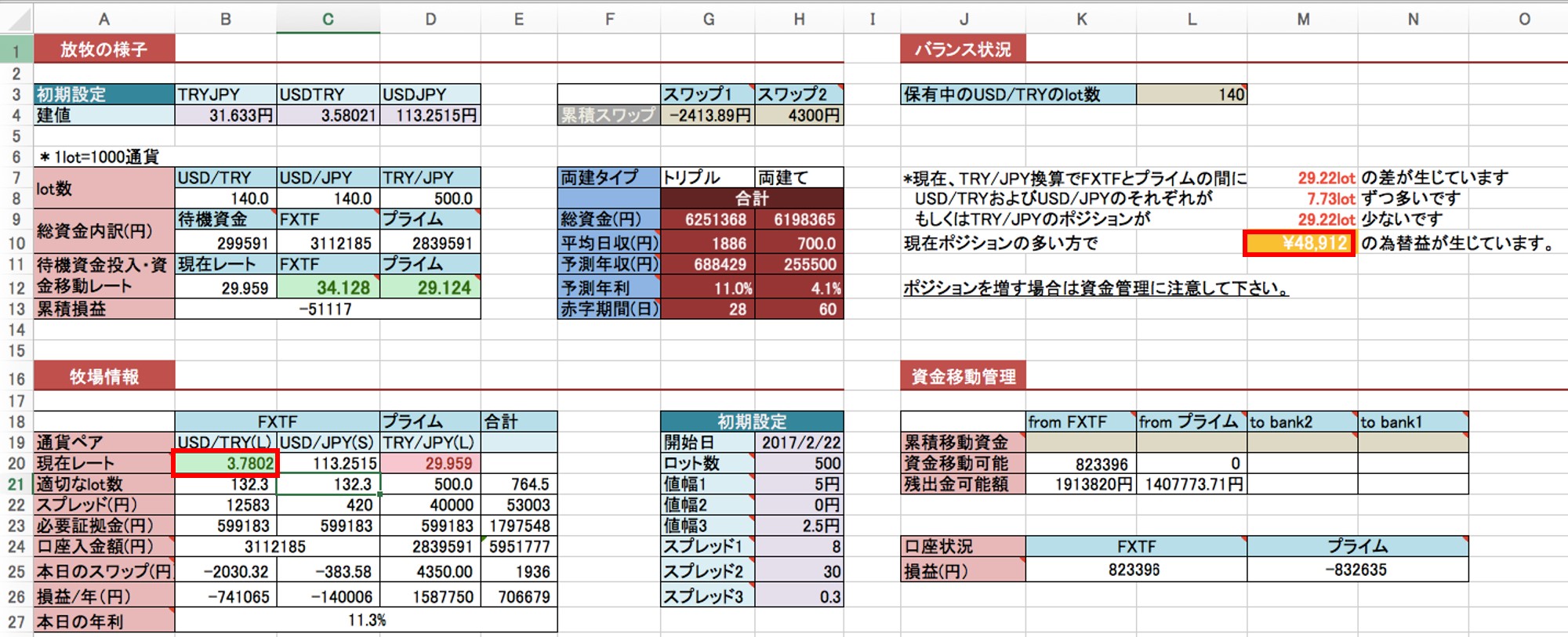

Next, let's look at what happens if USD/TRY rises 0.2 from Table 1.

Table 4

As in Table 2, there are FX gains of about 50,000 yen.

At this time, the TRY rate is falling.

This means FX gains are arising on the pseudo-short position.

Of course, the long position shows unrealized losses, but

the pseudo-short position will surpass it, so total is positive.

Finally, if USD/TRY rises to 4.

Table 5

There are FX gains of about 200,000 yen.

Also, if USD/TRY reaches 5,unrealized gains of about 1,800,000 yenwill result.

Why this happens is because when you opened the position initially to create a pseudo-hedged state you hold the necessary number of each currency pair.

The number of positions required actually changes with the USD/TRY rate.

When that required amount changes, FX gains must occur as a matter of logic.

*There are exceptions, though.

So, when the rate doesn’t move, we make money with carry arbitrage.

So, the market can profit whether it goes up, stays flat, or goes down.

*However, under certain conditions you will incur unrealized losses.

*When a reverse carry occurs, swaps are negative every day. You have to endure or give up.

Because of these drawbacks, it isn’t a perfect Holy Grail, so please keep that in mind.

(Source: Poteto Life)

======================================

The Triple Arb introduced this time can be done with the

Manual & Tool Set “Money Grazing”is available here!

↓↓↓

This is a somewhat unusual arbitrage tool that will make you go wow.