Multi-currency pair support for "The Simple Multi-Pair" has shown excellent results in long-term backtests!

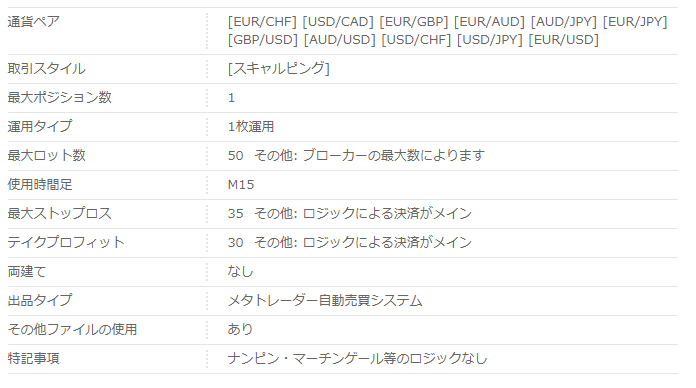

Supports 11 kinds, including rare currency pairs.

A scalping EA with a single position, low stop-loss, and low drawdown.

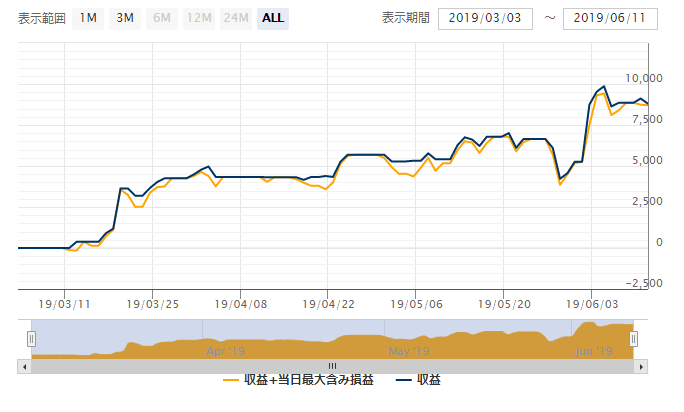

The forward test has been running for three months since the start, and the results are positive, with a PF of 2.21 as a strong start.

【The Simple Multi-Pair Overview】

It has a simple, low-risk EA specification with a maximum position count of 1 and a maximum stop loss of 35.

There are 11 currency pairs listed on the product page. Since most major pairs appear to be supported, it should meet the needs of a wide range of users.

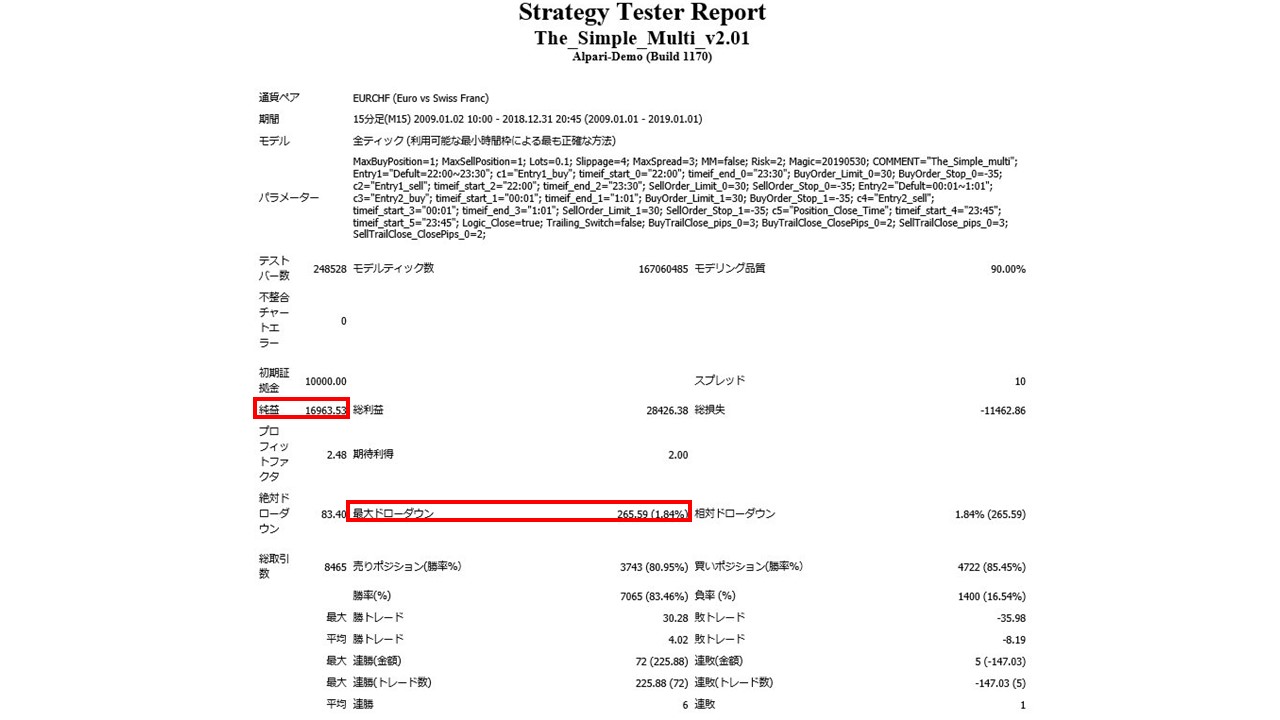

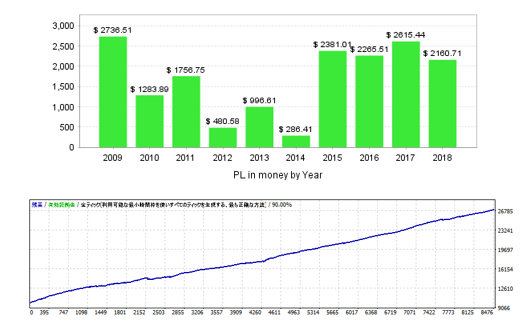

【Backtest Analysis】

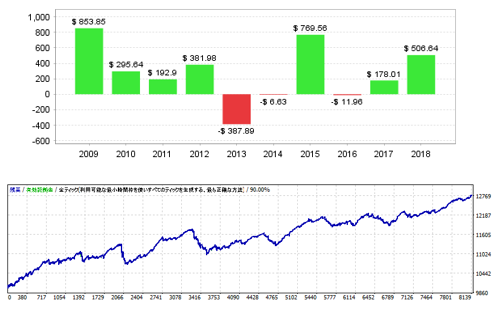

Because multiple currency pairs can be traded, we analyze each currency pair in USD terms for the ten-year period from 2009 to the end of 2018, with a fixed 0.1 lot and a spread of 10 (backtest environments are unified across all pairs, so actual performance may differ).

① EUR/CHF

Recommended margin is fixed at 0.1 lot,5+(2.9*2)=10.8(万円)

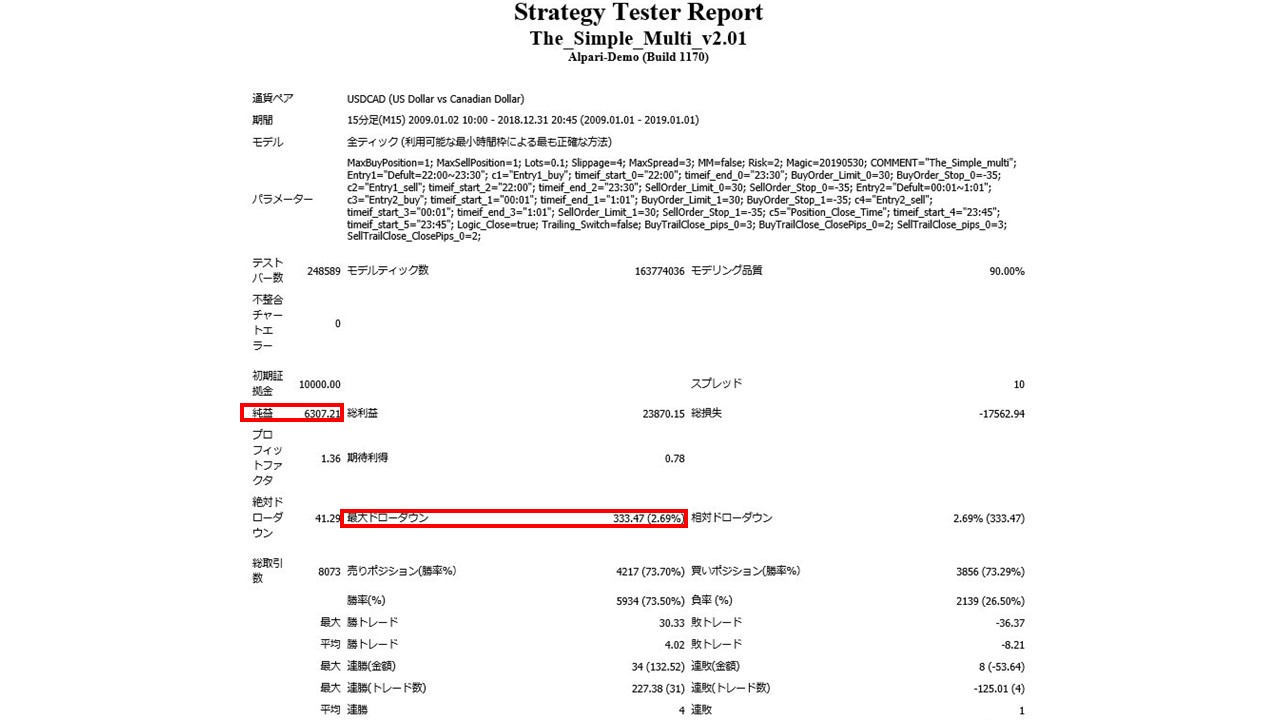

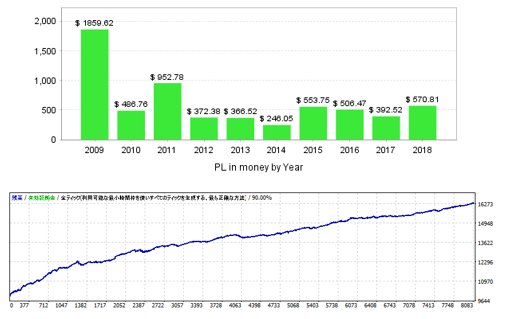

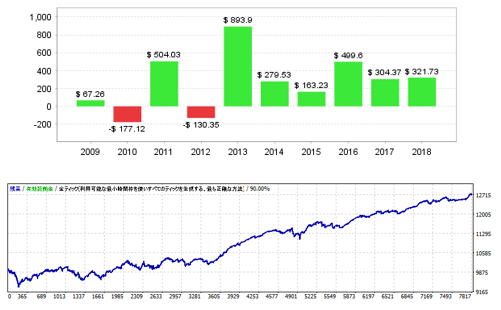

② USD/CAD

・Net profit +$6,307 (¥693,000 / annual average ¥69,000)・Maximum drawdown −$333 (−¥36,000)

・Total trades 8,073・Win rate 73.50%

・PF 1.36

推奨証拠金額は0.1ロット固定で、4.5+(3.6*2)=11.7(万円)

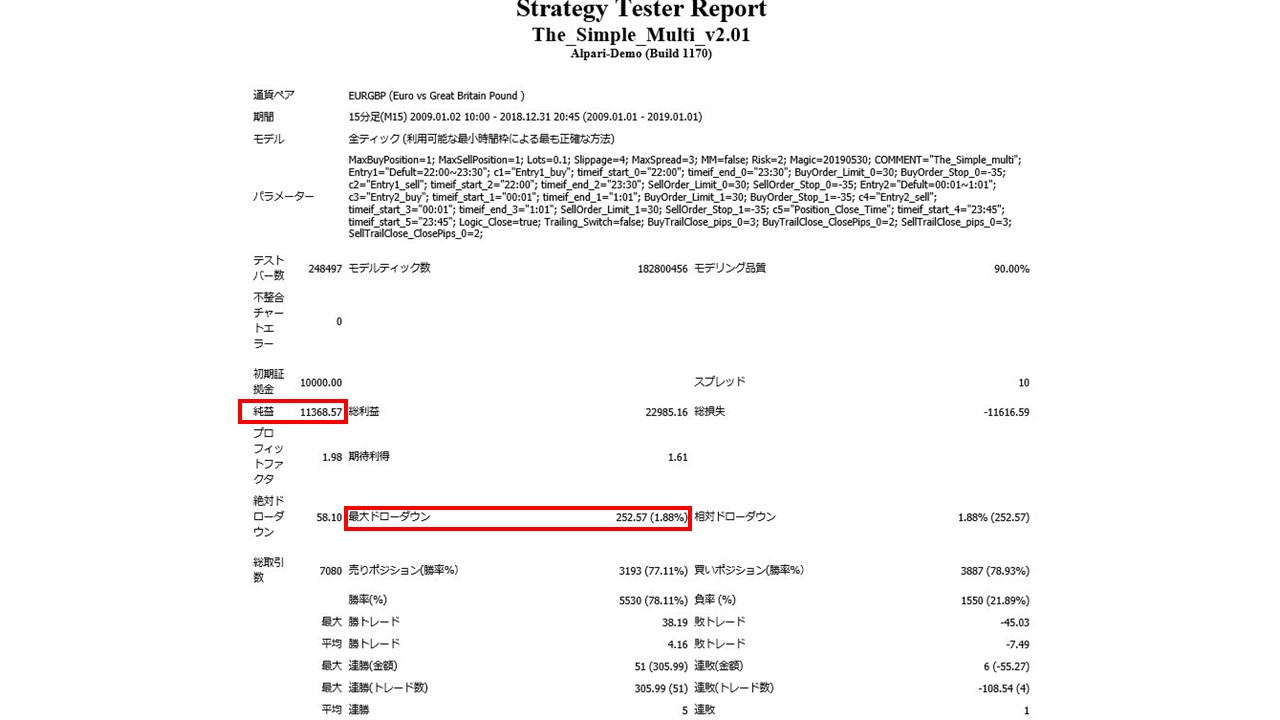

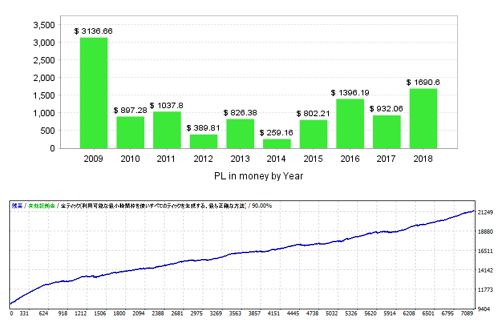

③ EUR/GBP

・Net profit +$11,368 (¥1,250,000 / annual average ¥125,000) ・Maximum drawdown −$252 (−¥27,000)

・Total trades 7,080 ・Win rate 78.11%

・PF 1.98

推奨証拠金額は0.1ロット固定で、5+(2.7*2)=10.4(万円)

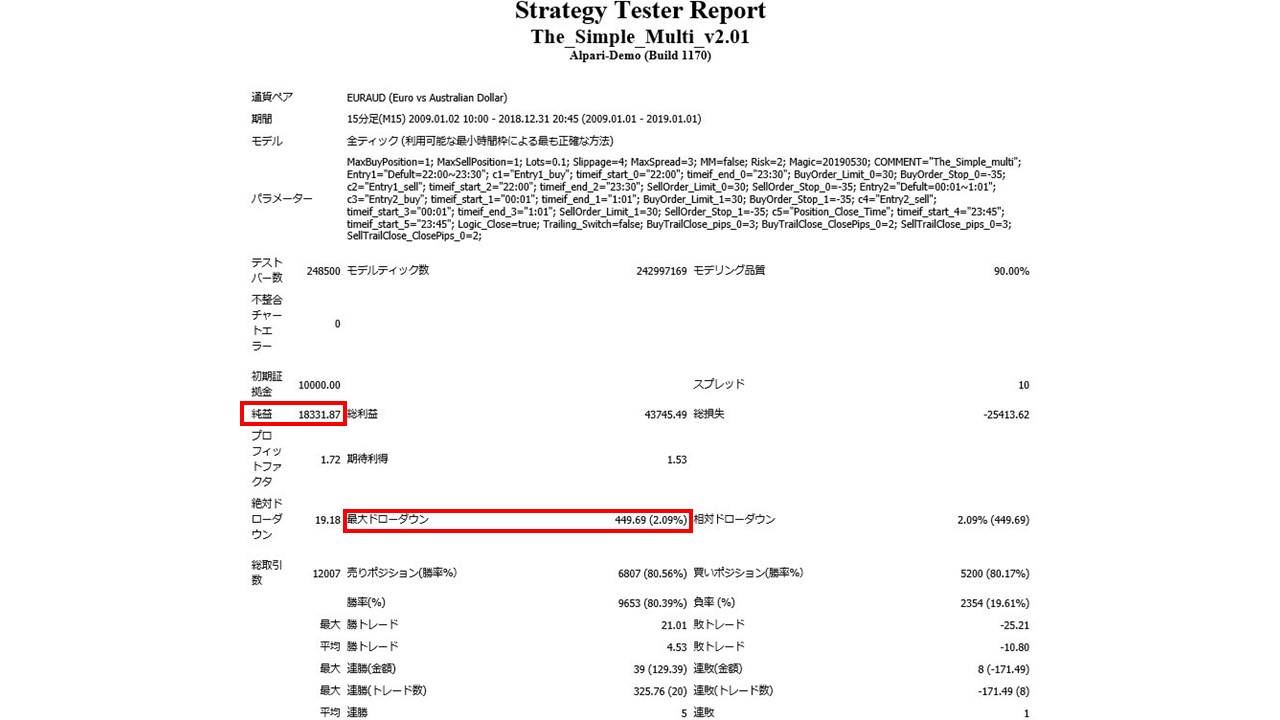

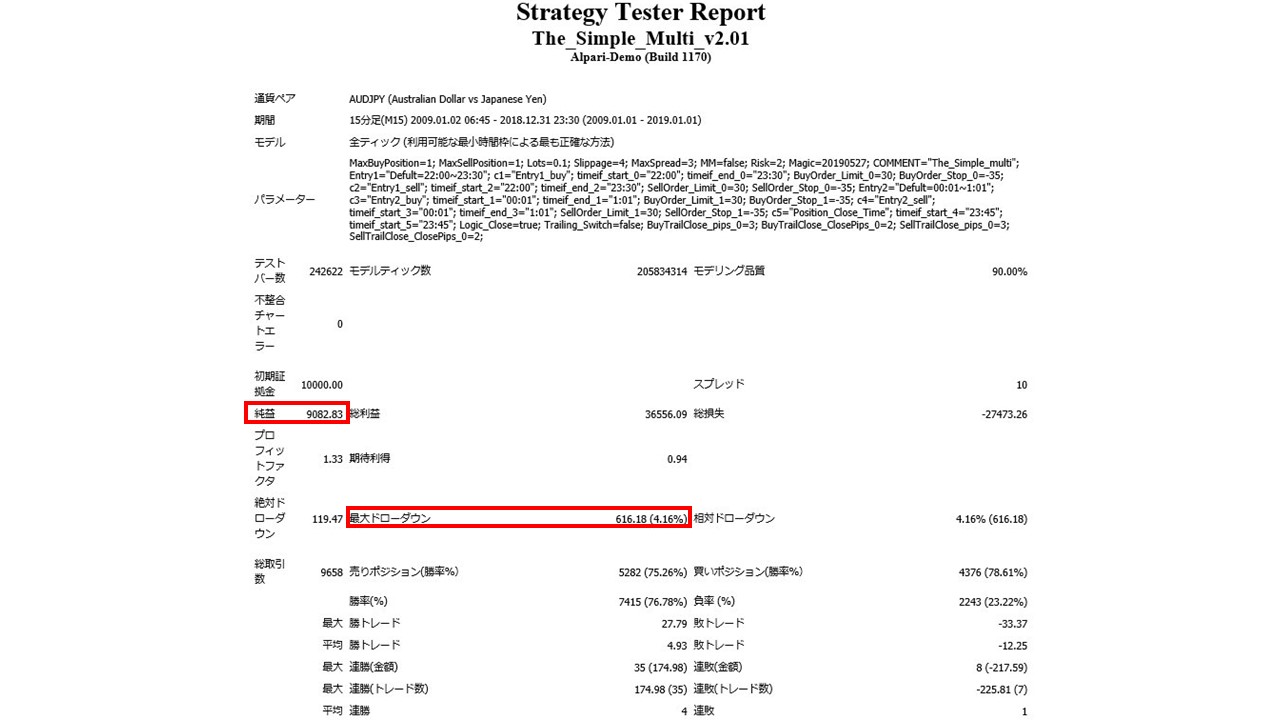

➃ EUR/AUD

・Net profit +$18,331 (¥2,016,000 / annual average ¥201,000) ・Maximum drawdown −$449 (−¥49,000)

・Total trades 12,007 ・Win rate 80.56%

・PF 1.72

推奨証拠金額は0.1ロット固定で、5+(4.9*2)=14.8(万円)

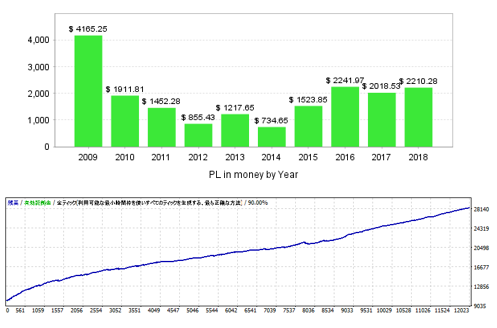

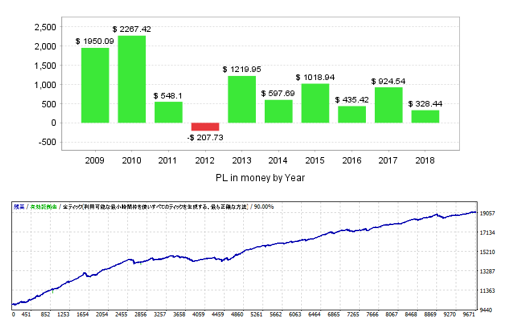

⑤ AUD/JPY

・Net profit +$9,082 (¥999,000 / annual average ¥99,000) ・Maximum drawdown −$616 (−¥67,000)

・Total trades 9,658 ・Win rate 76.78%

推奨証拠金額は0.1ロット固定で、3+(6.7*2)=16.4(万円)

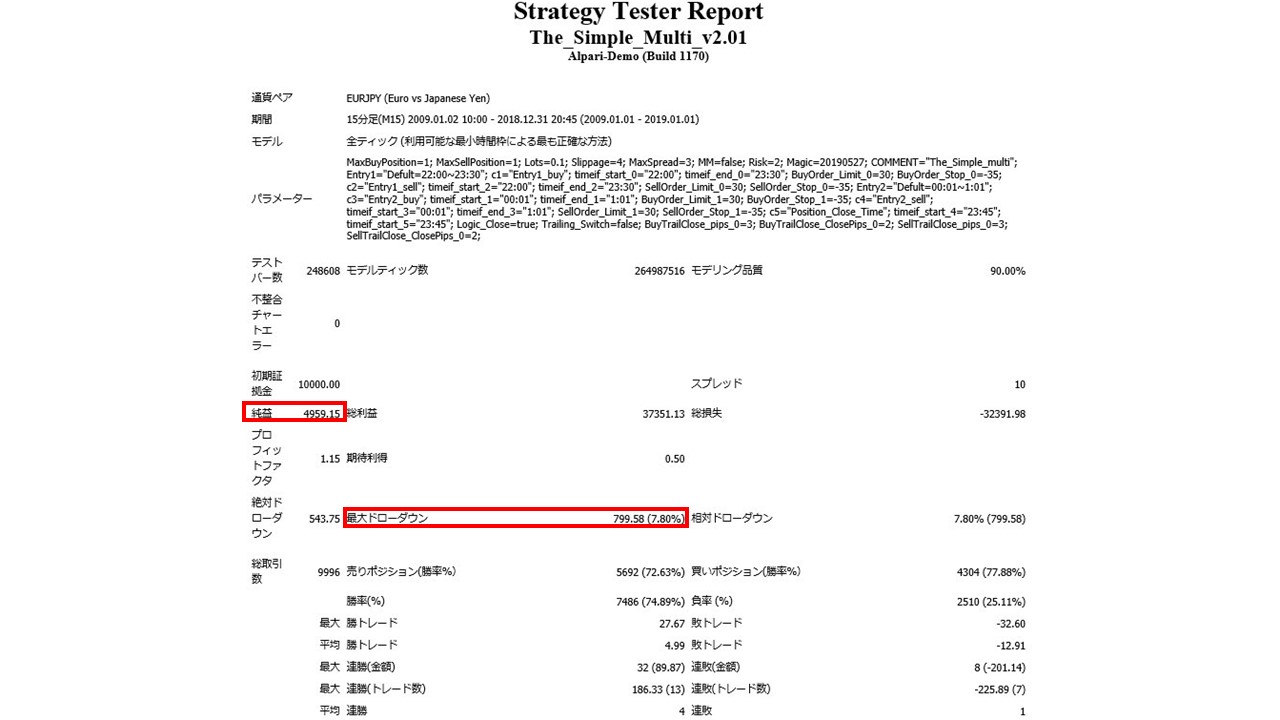

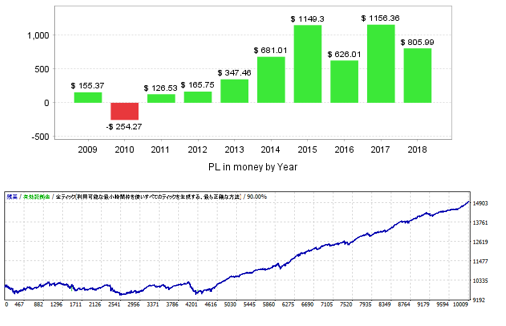

・Net profit +$4,959 (¥545,000 / annual average ¥54,000) ・Maximum drawdown −$799 (−¥87,000)

・Total trades 9,996 ・Win rate 74.89%・

・PF 1.15

推奨証拠金額は0.1ロット固定で、5+(8.7*2)=22.4(万円)

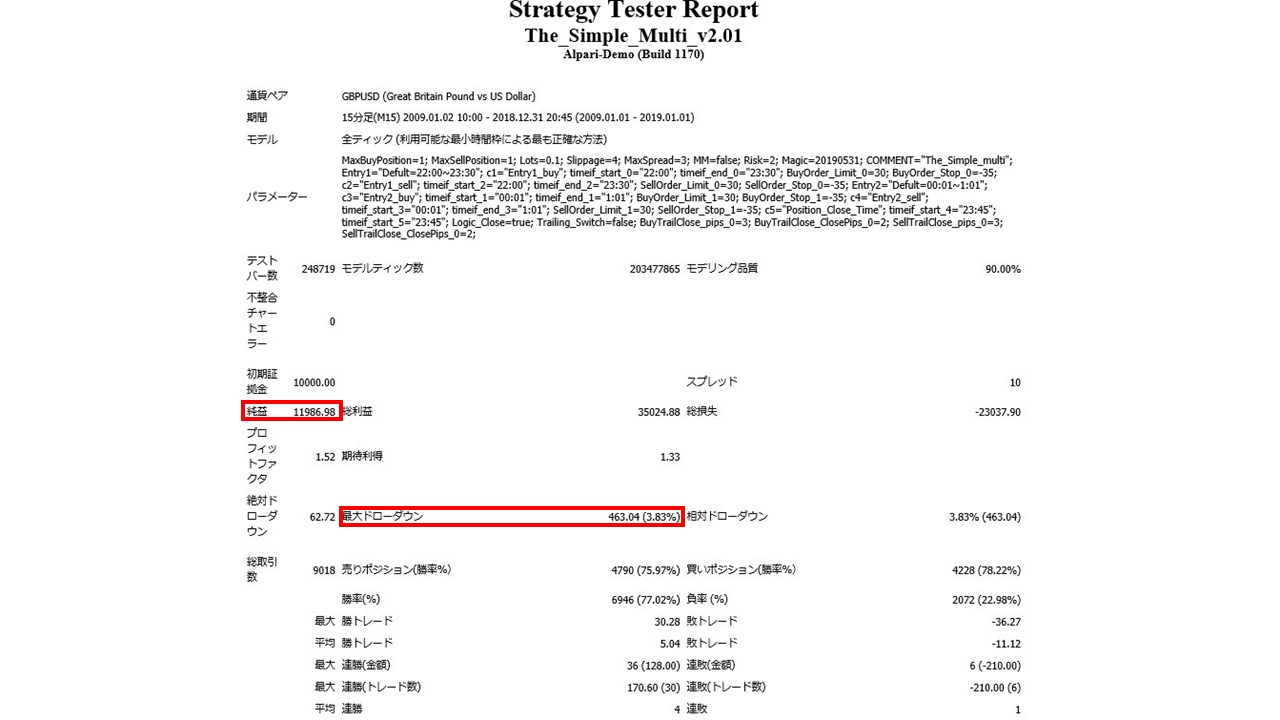

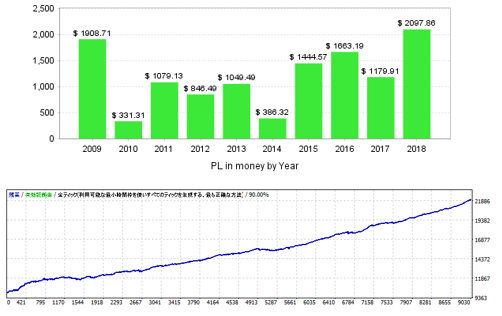

⑦ GBP/USD

・Net profit +$11,986 (¥1,318,000 / annual average ¥131,000) ・Maximum drawdown −$463 (−¥50,000)

・Total trades 9,018 ・Win rate 77.02%

・PF 1.33

推奨証拠金額は0.1ロット固定で、5.5+(5*2)=15.5(万円)

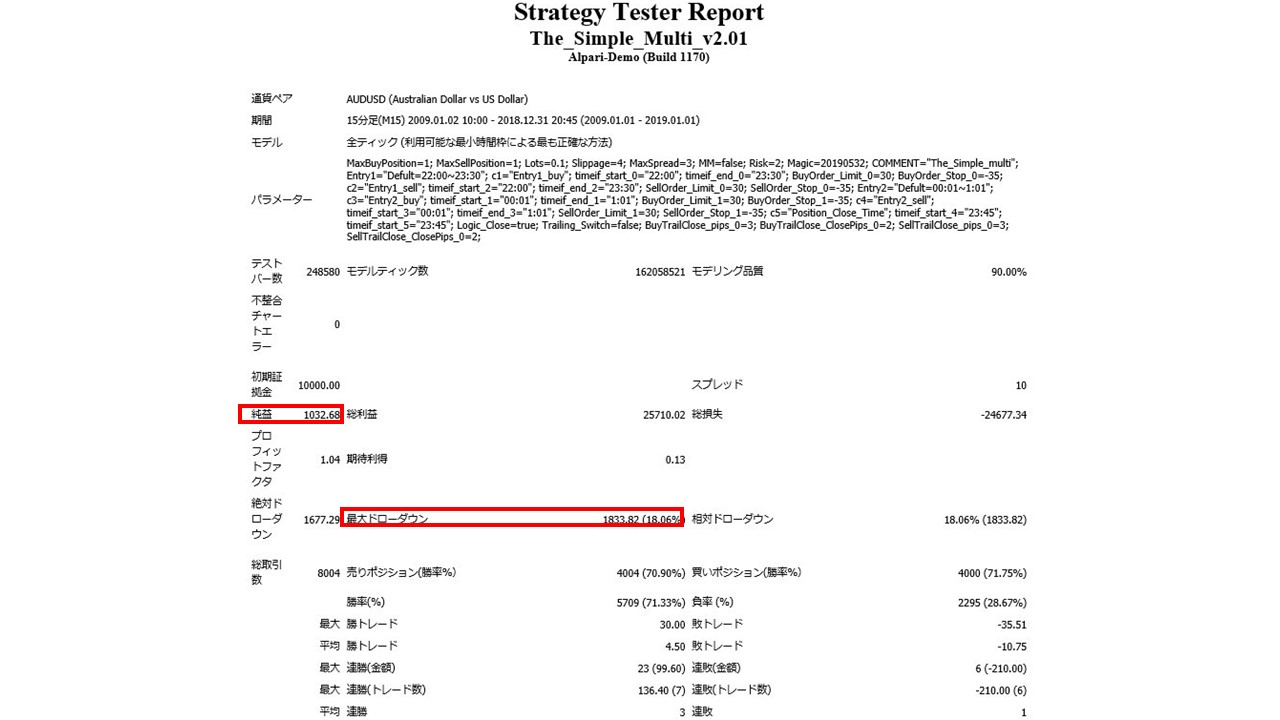

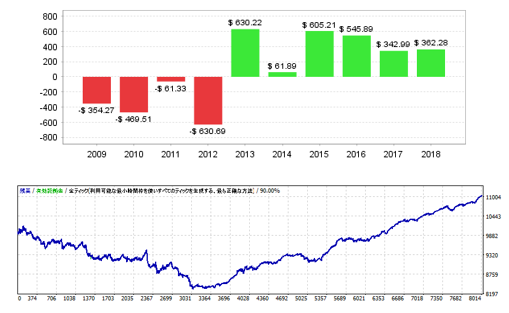

⑧ AUD/USD

・Net profit +$1,032 (¥113,000 / annual average ¥13,000) ・Maximum drawdown −$1,833 (−¥201,000)

・Total trades 8,004 ・Win rate 71.33%

・PF 1.04

推奨証拠金額は0.1ロット固定で、3+(20.1*2)=23.1(万円)

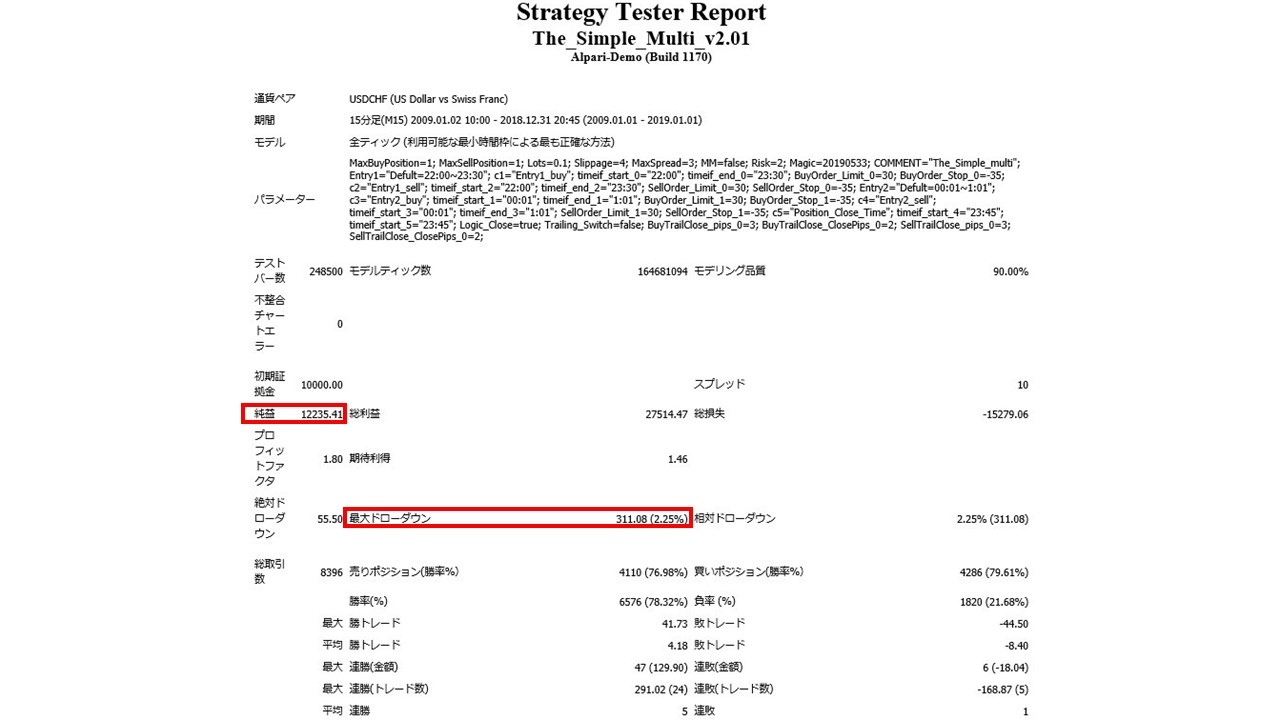

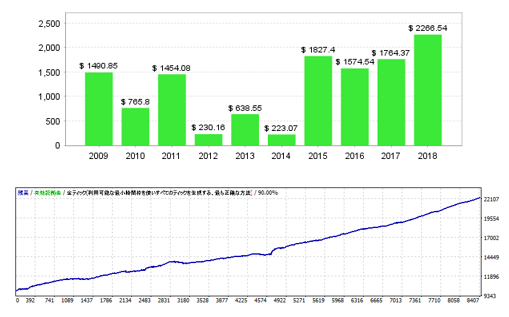

⑨ USD/CHF

・Net profit +$12,235 (¥1,345,000 / annual average ¥134,000) ・Maximum drawdown −$311 (−¥34,000)

Win rate 78.32%

・PF 1.80

推奨証拠金額は0.1ロット固定で、4.4+(3.4*2)=11.2(万円)

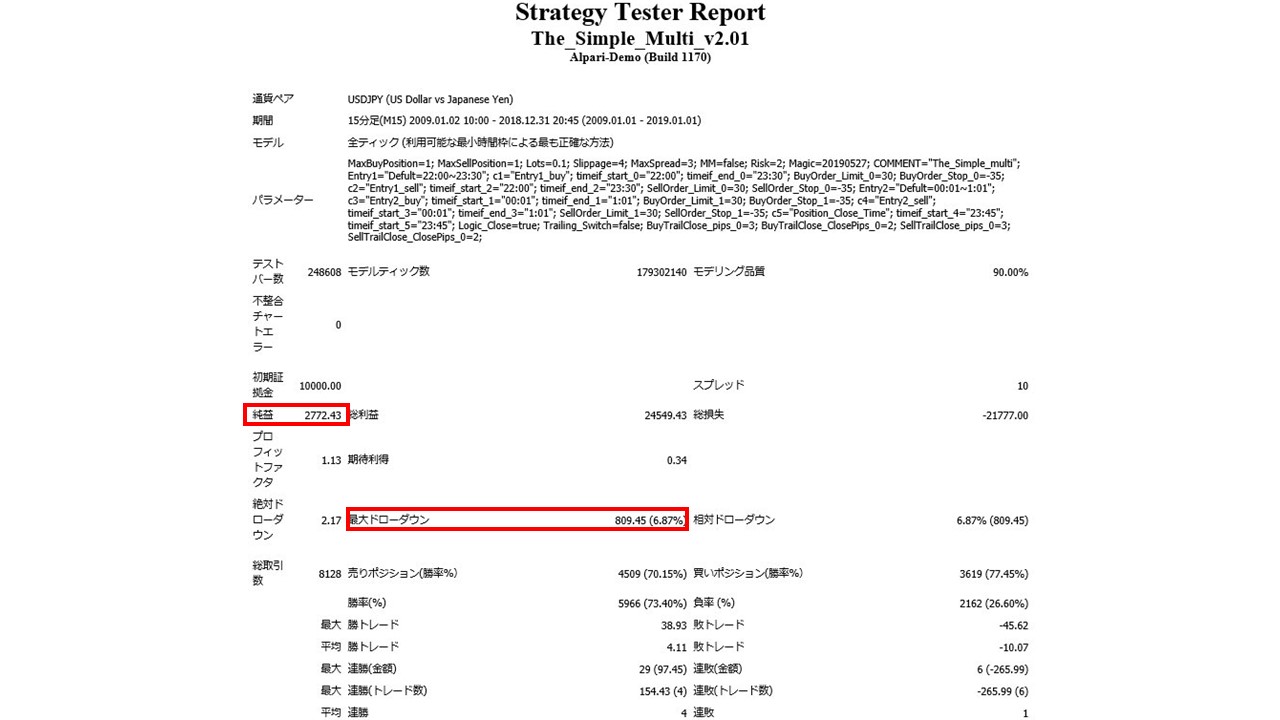

⑩ USD/JPY

・Net profit +$2,772 (¥304,000 / annual average ¥30,000) ・Maximum drawdown −$809 (−¥88,000)

Win rate 73.40%

・PF 1.13

推奨証拠金額は0.1ロット固定で、4.5+(8.8*2)=22.1(万円)

⑪ EUR/USD

・Net profit +$2,726 (¥299,000 / annual average ¥29,000) ・Maximum drawdown −$713 (−¥78,000)

Win rate 72.91%

・

推奨証拠金額は0.1ロット固定で、5+(7.8*2)=20.6(万円)

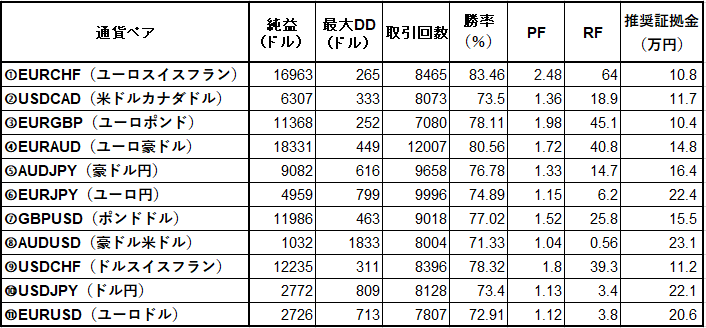

・Comparison of each strategy

We have summarized the results of each backtest.

For reference, we also include the Recovery Factor (RF: Net Profit / Maximum Drawdown).

All currency pairs overall performed very well.

The number of trades varies by currency pair, but is at least 7,000 and can exceed 10,000. With high-frequency trading and a high-win-rate result using a maximum stop loss of 35, this scalping EA is expected to steadily accumulate small profits and avoid major losses.

Because the maximum position is 1, the maximum drawdown is kept low. Even for AUD/USD, where drawdown was larger, the overall result is still positive, and PF has not fallen below 1.

As the recommended margin at 0.1 lot is low, it's easier to leverage the advantages of multi-currency pairs by building a portfolio with just this one EA.

Of course, it also works well when combined with other EAs.

In particular, EUR/CHF and USD/CAD, which performed well, don't have many currency-pair-specific EAs themselves, so they may smoothly fill gaps in an already-built portfolio.

From what we've seen, as the product name suggests, it offers simple operation across multiple currency pairs, making it one of the EAs you'd want to have as an option.