Low-spread accounts? High-execution-quality accounts? Let’s find the best account with Spread Comparison

Do you know that fx-on's content includes a "Spread Comparison"?

This data continuously tracks real spreads for domestic live accounts (with some exceptions) (MT4-enabled FX brokers only).

You can go back as far as the most recent 1 hour up to 1 week.

I think both discretionary traders and system traders are concerned about this, but

when the spread is wide, you may experience slippage and have difficulty getting filled,

and even when filled, the widened spread can cause a few pips to be added unfavorably, leading to entry (or exit) at a disadvantage, so it's best to be aware of this in advance.

【When do spreads widen?】

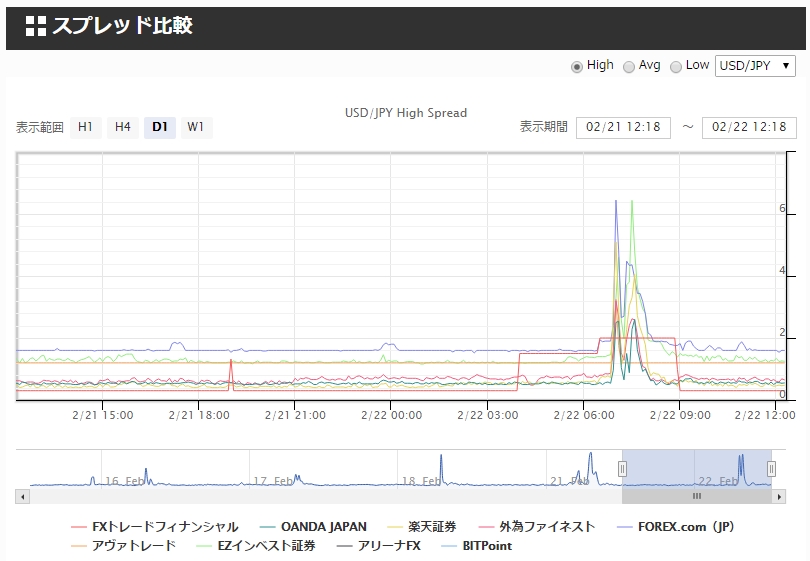

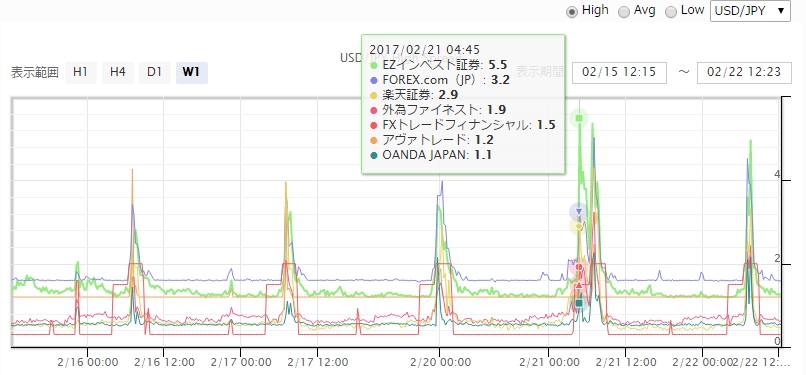

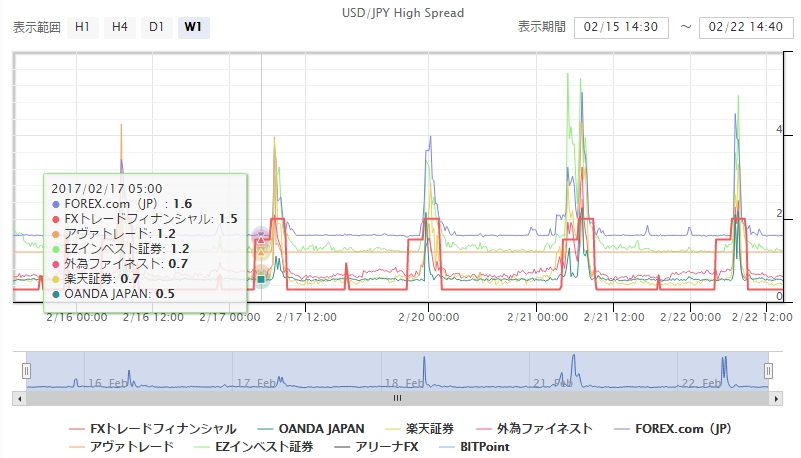

①Spreads widen the most on Monday mornings each week.

On Monday around 5:00–7:00, in wide markets spreads can widen by about 5 pips.

As the term "gap opening" on Monday suggests, prices can start with a sizable gap from Friday's close, so spreads naturally widen as well.

Generally trading becomes available from 7:00 AM on Monday, but

spreads widen during the 4:00–5:00 AM period before that.

If you hold positions opened on Friday over the weekend, and your stop-loss is shallow, there is a possibility you will be stopped out due to spread widening.

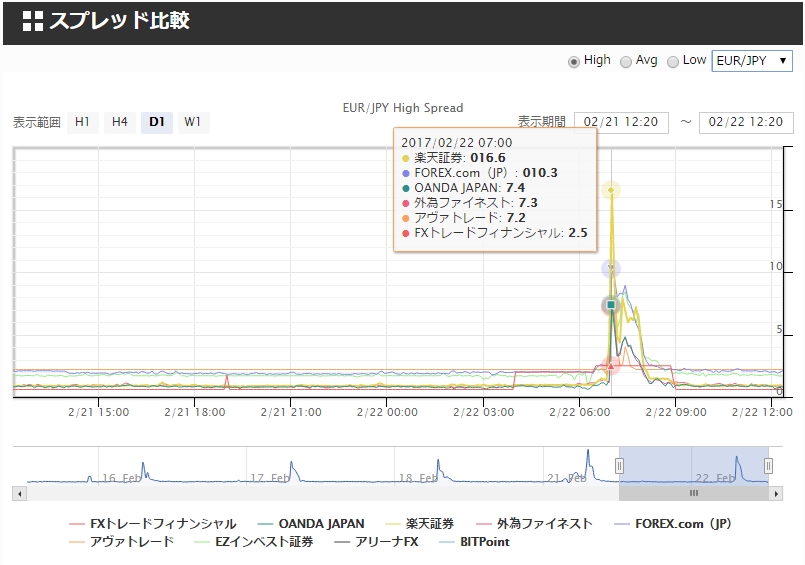

②Because rollover happens every morning from 6:00–7:00, spreads widen

Spreads of each broker as of 7:00 Japan Time.

FXTF tends to have relatively tight spreads.

③Spreads also widen around economic data releases

Not as pronounced as during rollover, but spreads widen at data releases as well.

【Choose times when spreads are less likely to widen for trading】

That said, outside of certain times, spreads are generally flat.

Here is a real-time comparison of spreads across brokers.

As expected, USD/JPY has the lowest spreads among the major currency pairs.

Volatile currency pairs or minor pairs tend to have higher spreads.

When using an EA, the "Spread Filter" is often set to xx pips as a parameter, and entries won't occur if the spread exceeds that.

Please operate considering each broker's spreads and the EA spread-filter values.

【Among major currencies, which FX company had the lowest average spread?】

During rollover and at data releases, the lowest spreads were

“FX Trade Financial”!

It's almost a fixed spread, you could say!

USDJPY 0.3 pips

EURJPY 0.6 pips

EURUSD 0.8 pips

It shows particular strength in major currencies.

If I had to point out a drawback, perhaps the spreads stay wider for a longer period.

While others widen only briefly, there are times when spreads widen for 1 hour or more.

【Gaitame Finest has low spreads on EURUSD and AUD-related pairs and high execution power!】

Gaitame Finest uses the NDD model (interbank direct-connected), therefore,

there are no extreme rate deviations or abnormal spread widenings.

it's written in detail there.

【OANDA has an overall excellent rating】

OANDA has relatively low spreads across all currency pairs, and with the Tokyo server (TY3 server) now available, order execution speed has improved.

They also offer exclusive EAs and indicators to users, making it a valuable account to have.

Rakuten Securities has generally lower spreads on the demo, but since it's a demo, it's hard to judge, so we have omitted the introduction.

fx-on offers many account-opening campaigns in collaboration with MT4-enabled accounts!

For details, please see the "Gifts" page!

https://fx-on.com/campaign/list.php

written by Tera