Available at almost all brokers! An EA that profits with a single position "ZERO SUM INDEX USDJPY"

No averaging down with 1 position!

An EA that is easy to use for both beginners and advanced traders‘ZERO SUM INDEX USDJPY’

【ZERO SUM INDEX USDJPY Overview】

Currency pair:[USD/JPY]

Trading styles:[Scalping][Day trading][Position trading]

Maximum positions:(1 position. No risky averaging down)

Maximum lot size:(Settings can be freely changed)

Used timeframe:

M1Maximum stop loss:00.5~1.6 in the variable principle)

Take profit:0(Exits according to the logic

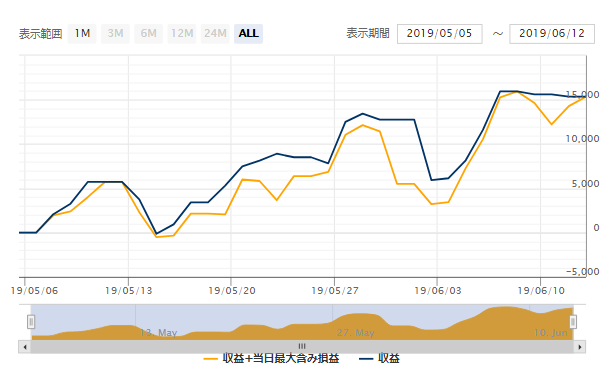

Forward period was about one month from May 2019 to June 2019, with a win rate of about 70%.

Trading is based on a single USD/JPY position, and it seems not to use averaging down.

According to the product page, spreads may need to be adjusted depending on the broker.

OANDA TY3-5, Golden Way (formerly FXTF), Forex Exchange, Rakuten, and Gaitame Finest default to 10, EZ Invest Securities has 1 Pip = 100 Points, so setting around 100 is recommended.

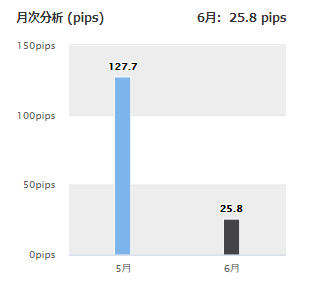

■Monthly Analysis

May’s gained pips are 127.7, which is strong. June is mid-month but maintains 25.8 pips and remains strong.

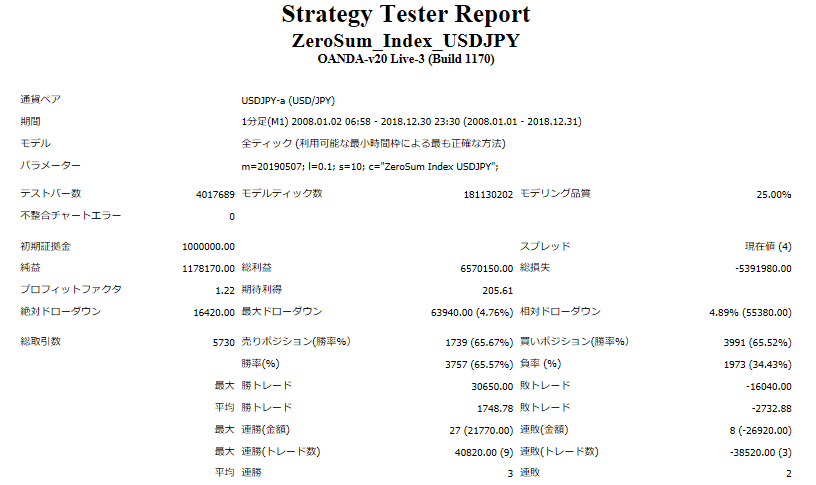

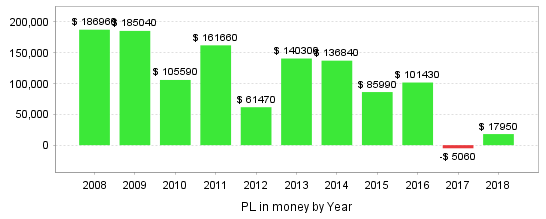

【Backtest Analysis】

2008.01.01‑2018.12.31

Spread 4.0

0.1 lot fixed

Net profit +1,178,000 yen (annual average 107,000 yen)

Maximum drawdown −64,000 yen

Total trades 5,730 (annual average 520)

Win rate 65.57%

PF 1.22

The maximum drawdown is −64,000 yen, about 4.76% of equity, indicating relatively low risk.

Recommended margin amount is fixed at 0.1 lot

(4.4)+(6.4*2)=37.2(万円)

This yields an expected annual return of 28%.

■Yearly and Monthly Profit/Loss

Looking at yearly results, profits were earned in almost all of the 11 years from 2008 to 2018.

Only in 2017 was there a loss, but it was covered by other years.

It can be considered a stable EA.

Looking at monthly results, there are periods of large gains and periods of large losses.

The sole annual loss occurred in 2017, driven by particularly large losses.

However, apart from 2017, monthly results show substantial profits, so no issue is expected.

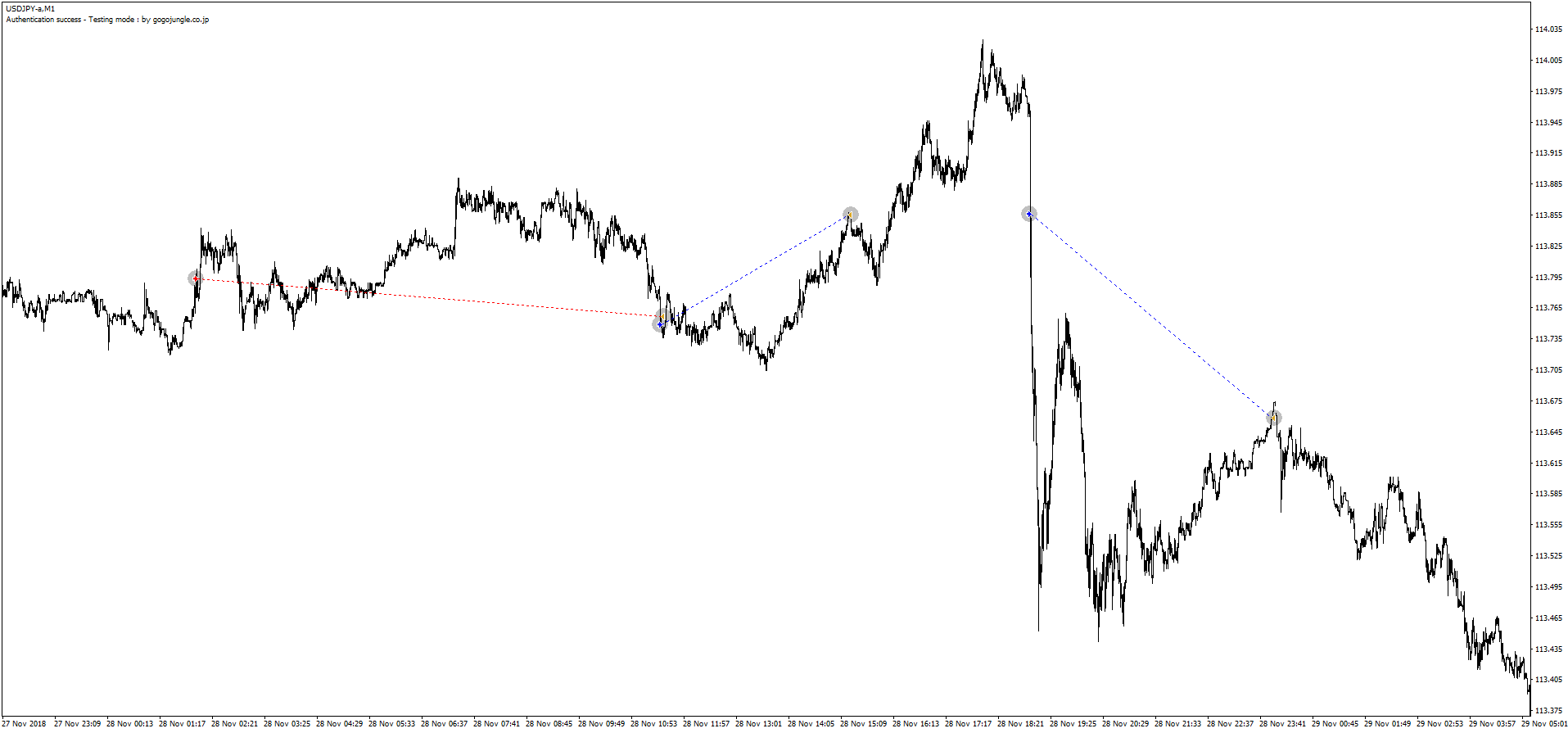

■Trading Image

▲Red is sell and blue is buy. Trading is done with one position as stated on the product page.

Entries can be trend-following or contrarian.

It appears usable with most brokers, but since the number of trades is high, it’s better to choose brokers with tight spreads.

Also, note that spreads may vary by broker.

Since the currency pair is the common USD/JPY and averaging down is not used, it should be beginner-friendly.

The forward period is still about a month, so we should look forward to future results.