Do not speculate! Only by accepting that you cannot predict can you stand at the starting line.

No warning needed, let's play rock-paper-scissors!

Rock-paper-scissors go!

What did you throw?

I threw “Paper.” Did I win?

(©LUCKY LAND COMMUNICATIONS / Shueisha)

“Let’s decide fairly with rock-paper-scissors.”

Sometimes you hear that, right?

Is rock-paper-scissors fair?

A gamble where you don’t know if you’ll win or lose?

My choosing “Paper” wasn’t arbitrary.

I chose “Paper,” which has the highest probability of winning among Rock, Paper, Scissors.

Aren’t the probabilities all the same?

Actually, the probabilities differ. Since humans are playing, biases and trends appear.

There is a study on rock-paper-scissors by Mitsuo Yoshizawa, Professor at Obirin University.

725Gathering people11567The results of having them play rock-paper-scissors 11,567 times are as follows.

Rock 35.0%

Scissors 31.7%

Paper 33.3%

The highest probability was to throw Rock.

From this, it can be said that throwing Paper has the highest chance of winning.

The official site of the Japan Rock-Paper-Scissors Association also notes that beginners tend to throw Rock first.

“Paper” has an advantage.

If you do rock-paper-scissors many times, it can be said that by consistently throwing Paper you can win overall rather than by thinking (predicting) each time.

Trying to predict what the opponent will throw each time can become a gamble where you don’t know if you’ll win or lose.

This also applies to trading.

Even if you try to predict the next move each time, you cannot reliably hit it.

In trading, accepting that you can’t consistently predict is the starting point.

Many people trade by predicting.

In other words, many people haven’t even reached the starting point.

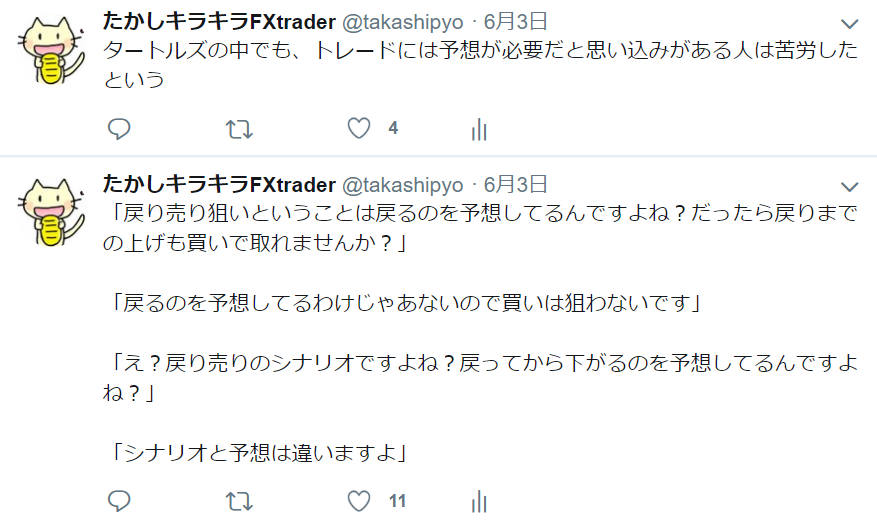

Some people believe you cannot trade without making predictions.

This kind of conversation has happened before.

“If you entered a trade, you must be predicting it will go up, right?”

“No, I’m not predicting it will go up.”

“No, no, no, you can’t buy if you don’t predict it will go up, right? Do you think it will go down instead, perhaps?”

“No, I don’t think it will go down. Nobody knows whether it will go up or down, and there’s no need to predict it, so I don’t forecast.”

“I have no idea what you’re talking about….”

In the rock-paper-scissors discussion, Paper has an edge, so by repeatedly throwing Paper you can maintain a winning balance.

Does that imply you are predicting that the opponent will throw Rock?

That isn’t the case.

You throw Paper as part of a long-run strategy to accumulate wins, so you don’t need to know in advance whether the current opponent will throw Rock or not.

No matter what the opponent throws, you keep throwing Paper, so it doesn’t matter what they do.

In a strategy aimed at winning overall

“Throwing Paper” is not about predicting that the opponent will throw Rock.

“Entering a buy” is not about predicting that it will go up.

You don’t have to predict whether it will go up or down.

Realize this quickly

The market can move in any direction at any time, so, within a sequence,

a management approach that piles up profits over time will naturally encompass those movements

and lead to winning more often.

by BNF

If you stop talking about predictions, it can be a sign that ego-driven thinking is correcting itself

A true professional is someone who understands that the movement up or down is unknownand believes predictions are unnecessaryand thinks this way.

Price movement cannot be predicted by anyone.

Even with today's computers, hitting it exactly is impossible.

People who think they can hit it when they predict are called “predictors” or “pundits.”

Many people fit this description.

Quoted from ~The Institute of Market Techniques of the Red Sea~

Predictor

The view is that the market should be taken by forecasting.

Also called a forecasteras well.

All beginners eventually belong to this faction for a time.In the old days, it was common to listen to a broker’s advice and trade; in the Internet era, this has largely faded, and now the prominent figures are those who are called “method traders.”They believe all market information—data, technicals, fundamentals—exists to predict the market. All roads lead to prediction.In other words,Making money in the market equals having a correct market forecast.They firmly believe this and view materials and analysis as existing for that purpose.They aim to predict the market, and many of them have never questioned whether the market can truly be predicted.The belief that predicting the market is natural is unquestioned.This arises from how difficult it is to distinguish whether a forecast was a coincidence or a necessity.There is little doubt among this faction that single trades are mostly just luck.EndEven if a single trade hits, it’s usually by chance.No matter how much analysis or forecasting you do, if you hit it, it’s by luck. It’s just a coincidence.There are famous “predictors” that appear in any era.“I can predict. I can hit.”Indeed, occasionally someone hits perfectly and predictions align well.There were people like that again this year.“This person’s forecast is accurate! Amazing!”And they launched products for sale. They sold fairly well.Recently, people started saying, “That guy misses all the time and is done.”That’s the pattern of a predictor.This history repeats. Even before FX could be traded by individuals, the stock market had the same pattern.Temporarily, there are predictors who hit often by chance. But in the end, they stop hitting and disappear.A fool learns from experience, a wise man learns from historyHistory repeats, so by studying it, there are many things you can avoid.Predictors cannot keep winning. History proves it.Starting point is reached only when you accept that prediction is impossible.No matter how hard you analyze or predict, you won’t get results.Efforts are rewarded only when they are correct, and correct efforts require proper method.Prediction should instead be deliberately avoided.Takuro CurtisIt is something to absolutely avoid to form the habit of predicting the future.I intentionally avoided trying to read the market’s direction.Why is predicting best avoided?Returning to the rock-paper-scissors tale, if you keep throwing Paper you will win more often, so you decide to keep throwing Paper.Then what if you predicted that the opponent would throw Scissors?Wouldn’t it be hard to throw Paper if you think you will lose?You might break the rule and try to grab a short-term win.That becomes a betting on prediction. It’s not a favorable kind of win.Even if the opponent might throw Scissors, you must throw Paper! You must throw Paper!(©LUCKY LAND COMMUNICATIONS / Shueisha)Kishibe Rohan’s famous line before a rock-paper-scissors match while throwing Paper.Beating others isn’t that hard…The truly difficult thing isListen up!The truly difficult thing isTo overcome yourself!I will overcome my own “luck” from now on!!Rohan Kishibe won by pushing with Paper.This is now a battle with himself, right?Trade also means doing it by the rules, placing the rules above oneself.One could say it’s a battle with oneself.The enemy is not the market, nor the market participants, but yourself.A true professional is someone who understands that you cannot know whether it will go up or down, and believes that predictions are unnecessaryPrice movement cannot be predicted by anyoneEven if predictions hit, it’s only by chanceThe result is always randomYou can stand at the starting line only when you accept that predictions are impossibleAvoid predictions deliberatelyDo not become a predictor or follow predictorsTrade according to your own strategy rules, not predictionsUltimately, it’s a battle with yourselfPast articles link collection belowhttps://www.gogojungle.co.jp/finance/navi/699/11076

In the old days, it was common to listen to a broker’s advice and trade; in the Internet era, this has largely faded, and now the prominent figures are those who are called “method traders.”

They believe all market information—data, technicals, fundamentals—exists to predict the market. All roads lead to prediction.In other words,Making money in the market equals having a correct market forecast.They firmly believe this and view materials and analysis as existing for that purpose.They aim to predict the market, and many of them have never questioned whether the market can truly be predicted.The belief that predicting the market is natural is unquestioned.This arises from how difficult it is to distinguish whether a forecast was a coincidence or a necessity.There is little doubt among this faction that single trades are mostly just luck.EndEven if a single trade hits, it’s usually by chance.No matter how much analysis or forecasting you do, if you hit it, it’s by luck. It’s just a coincidence.There are famous “predictors” that appear in any era.“I can predict. I can hit.”Indeed, occasionally someone hits perfectly and predictions align well.There were people like that again this year.“This person’s forecast is accurate! Amazing!”And they launched products for sale. They sold fairly well.Recently, people started saying, “That guy misses all the time and is done.”That’s the pattern of a predictor.This history repeats. Even before FX could be traded by individuals, the stock market had the same pattern.Temporarily, there are predictors who hit often by chance. But in the end, they stop hitting and disappear.A fool learns from experience, a wise man learns from historyHistory repeats, so by studying it, there are many things you can avoid.Predictors cannot keep winning. History proves it.Starting point is reached only when you accept that prediction is impossible.No matter how hard you analyze or predict, you won’t get results.Efforts are rewarded only when they are correct, and correct efforts require proper method.Prediction should instead be deliberately avoided.Takuro CurtisIt is something to absolutely avoid to form the habit of predicting the future.I intentionally avoided trying to read the market’s direction.Why is predicting best avoided?Returning to the rock-paper-scissors tale, if you keep throwing Paper you will win more often, so you decide to keep throwing Paper.Then what if you predicted that the opponent would throw Scissors?Wouldn’t it be hard to throw Paper if you think you will lose?You might break the rule and try to grab a short-term win.That becomes a betting on prediction. It’s not a favorable kind of win.Even if the opponent might throw Scissors, you must throw Paper! You must throw Paper!(©LUCKY LAND COMMUNICATIONS / Shueisha)

In other words,

Making money in the market equals having a correct market forecast.

They firmly believe this and view materials and analysis as existing for that purpose.

They aim to predict the market, and many of them have never questioned whether the market can truly be predicted.

The belief that predicting the market is natural is unquestioned.

This arises from how difficult it is to distinguish whether a forecast was a coincidence or a necessity.

There is little doubt among this faction that single trades are mostly just luck.

End

Even if a single trade hits, it’s usually by chance.

No matter how much analysis or forecasting you do, if you hit it, it’s by luck. It’s just a coincidence.

There are famous “predictors” that appear in any era.

“I can predict. I can hit.”

Indeed, occasionally someone hits perfectly and predictions align well.

There were people like that again this year.

“This person’s forecast is accurate! Amazing!”

And they launched products for sale. They sold fairly well.

Recently, people started saying, “That guy misses all the time and is done.”

That’s the pattern of a predictor.

This history repeats. Even before FX could be traded by individuals, the stock market had the same pattern.

Temporarily, there are predictors who hit often by chance. But in the end, they stop hitting and disappear.

A fool learns from experience, a wise man learns from history

History repeats, so by studying it, there are many things you can avoid.

Predictors cannot keep winning. History proves it.

Starting point is reached only when you accept that prediction is impossible.

No matter how hard you analyze or predict, you won’t get results.

Efforts are rewarded only when they are correct, and correct efforts require proper method.

Prediction should instead be deliberately avoided.

It is something to absolutely avoid to form the habit of predicting the future.

I intentionally avoided trying to read the market’s direction.

Kishibe Rohan’s famous line before a rock-paper-scissors match while throwing Paper.

Beating others isn’t that hard…

The truly difficult thing is

Listen up!

The truly difficult thing is

To overcome yourself!

I will overcome my own “luck” from now on!!

Rohan Kishibe won by pushing with Paper.

A true professional is someone who understands that you cannot know whether it will go up or down, and believes that predictions are unnecessary

Price movement cannot be predicted by anyone

Even if predictions hit, it’s only by chance

The result is always random

You can stand at the starting line only when you accept that predictions are impossible

Avoid predictions deliberately

Do not become a predictor or follow predictors

Trade according to your own strategy rules, not predictions

https://www.gogojungle.co.jp/finance/navi/699/11076