Hedged scalping to nab profits! A highly anticipated EA "Crimson Flame"

Profit from hedged scalping on USD/JPY

An EA with a high win rate and promising future'Crimson Flame'

【Crimson Flame Overview】

Currency pair:[USD/JPY]

Trading style:[Scalping]

Max number of positions:4(Two positions on one side, hedging allowed)

Maximum lot size:10

Used time frame:M5

Maximum stop loss:0(1.0% from entry price)

Take profit:0(0.3% from entry price)

It seems to operate with four total positions: two on one side for USD/JPY hedged scalping—buying on dips and selling on rallies.

According to the product page, it avoids entries when volatility is too low or too high, featuring high safety.

■Monthly Analysis

The monthly analysis is for May only, achieving 50 pips.

In a volatile market, it started superbly, making the next year look promising.

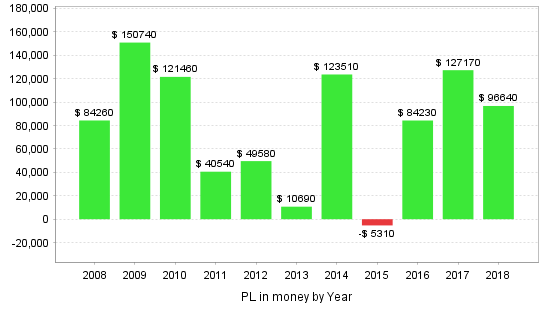

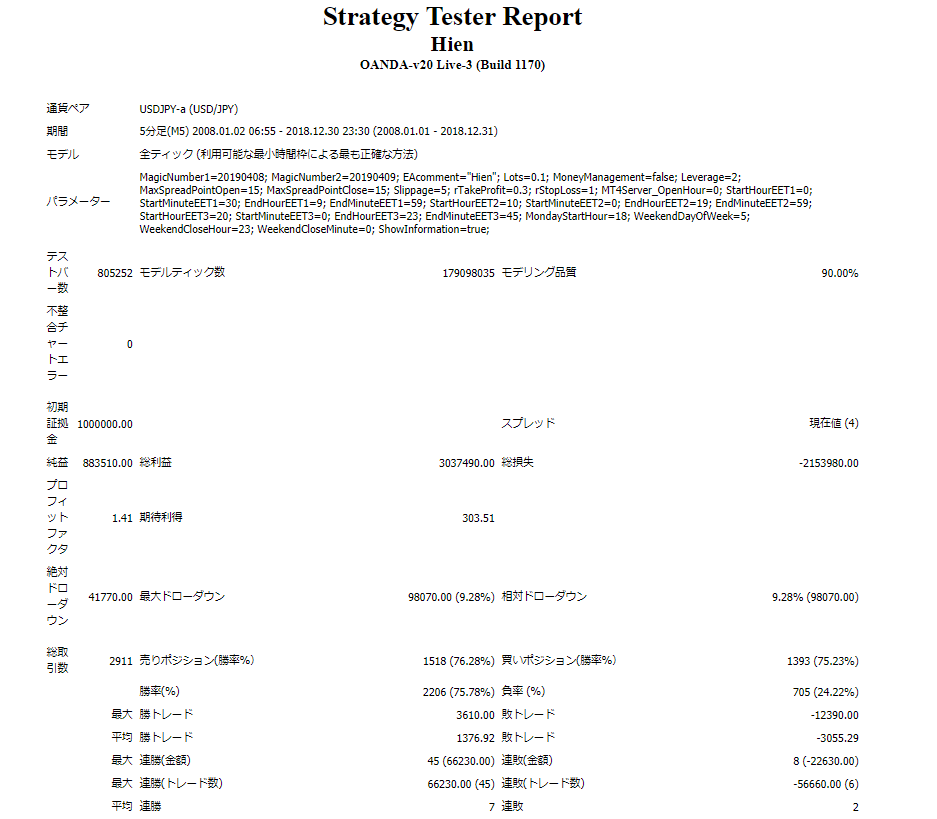

2008.01.01‑2018.12.31

Spread 4.0

0.1 lot fixed

Net profit +¥884,000 (annual average ¥80,000)

Maximum drawdown −¥98,000

Total trades 2,911 (annual average 264 trades)

Win rate 75.78%

PF 1.41

The maximum drawdown with hedging up to four positions is −¥98,000, with a drawdown ratio of 9.28%, which seems relatively low and favorable.

Recommended margin amount is fixed at 0.1 lot

(4.4*4)+(9.8*2)=37.2 (万円)

This yields an expected annual return of 21%.

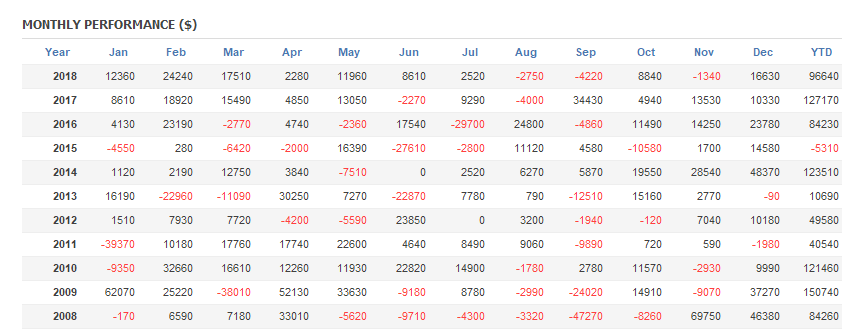

■Yearly and Monthly Profit and Loss

Looking at yearly results, there was a loss in 2015, but all other years were profitable.

The 2015 loss isn’t large, so it was quickly covered in the following year.

Looking at monthly results, there are months with significant losses.

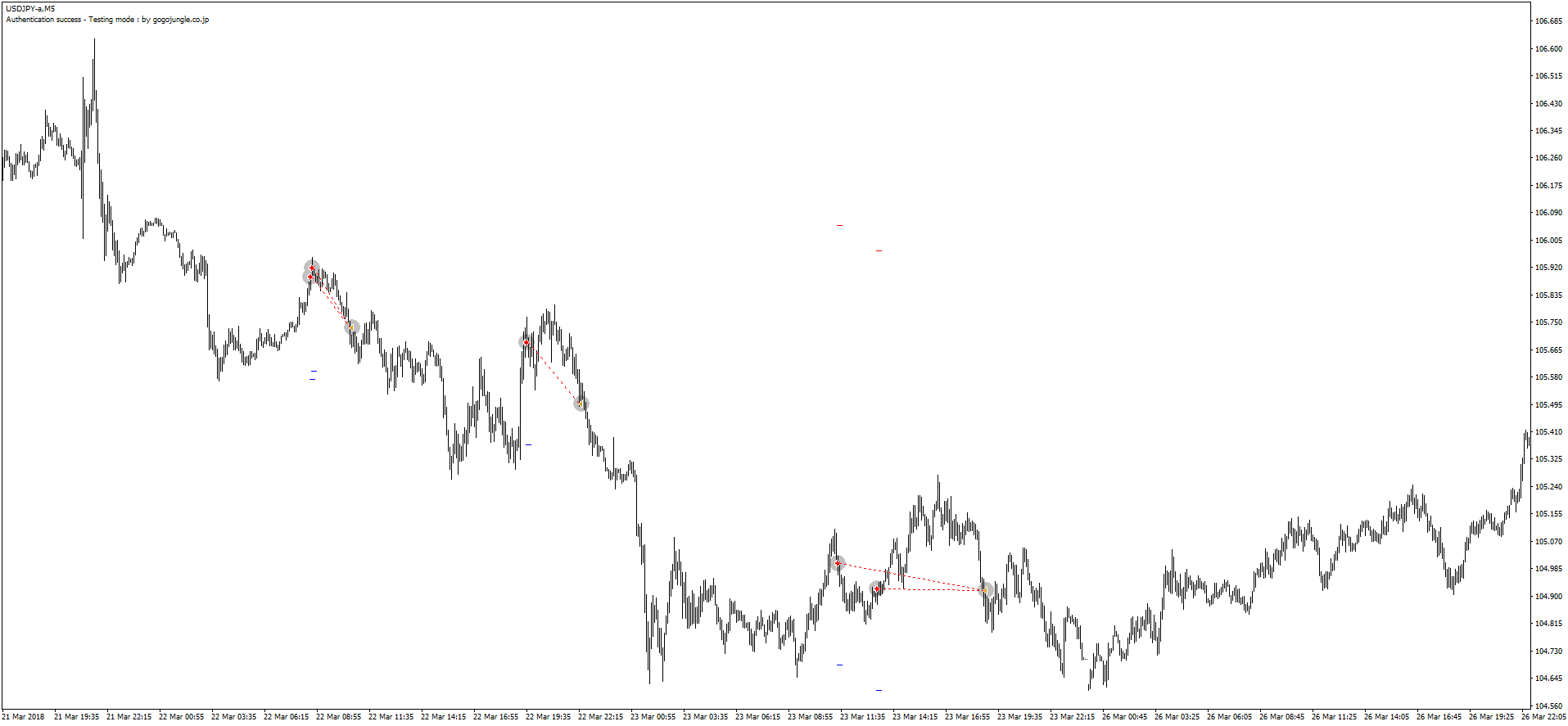

■Trade Image

▲Red indicates selling. It shows trading on retracements by selling.

▲Blue indicates buying. It trades by buying on dips.

▲In this image, a short position is held while a long trade is opened. The product page notes the one-side single-position logic × 2 for a total of 2 positions.

Drawdowns can be large, so margin management should be done with ample headroom.

Since the currency pair is the orthodox USD/JPY and the logic is hedging-type, it could be interesting to include in a portfolio.

Because the forward period is short, let's expect results in a year.