Aim for a 20% monthly return! Earn efficiently with multiple EA portfolios!【fx-on Portfolio Feature】

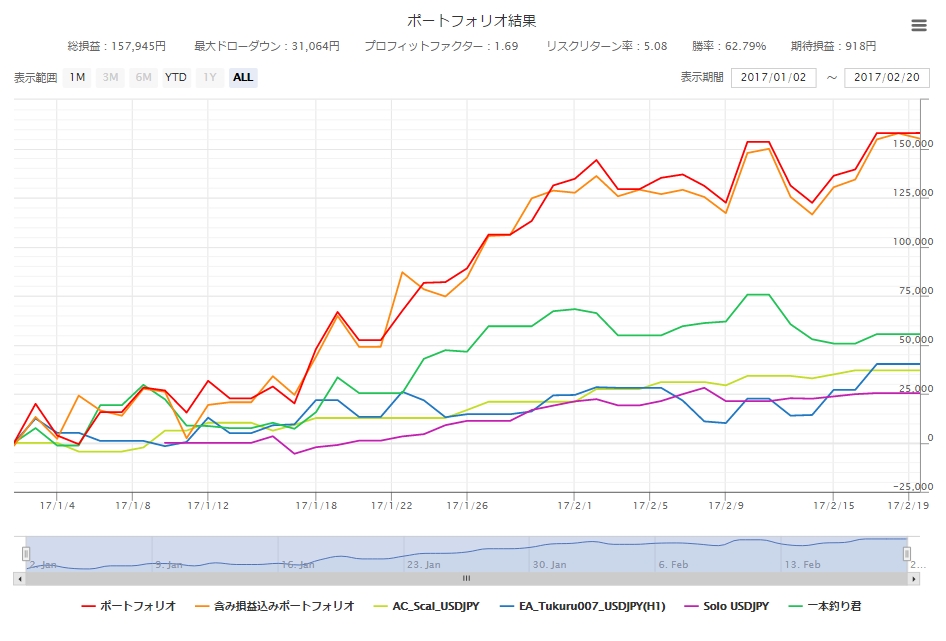

With the portfolio feature now having a period-setting function, the cumulative profit and loss of multiple EAs over a given period is easier to view.

So now I would like to explore a recommended EA portfolio that’s on an upward trajectory!

(We’ve deliberately left out the ultra-famous ones!)

1. Beginner-friendly! A single-position-focused EA portfolio

The appeal of a 1-position EA… you can anticipate the loss of one trade in advance

The drawback of a 1-position EA… fewer trades

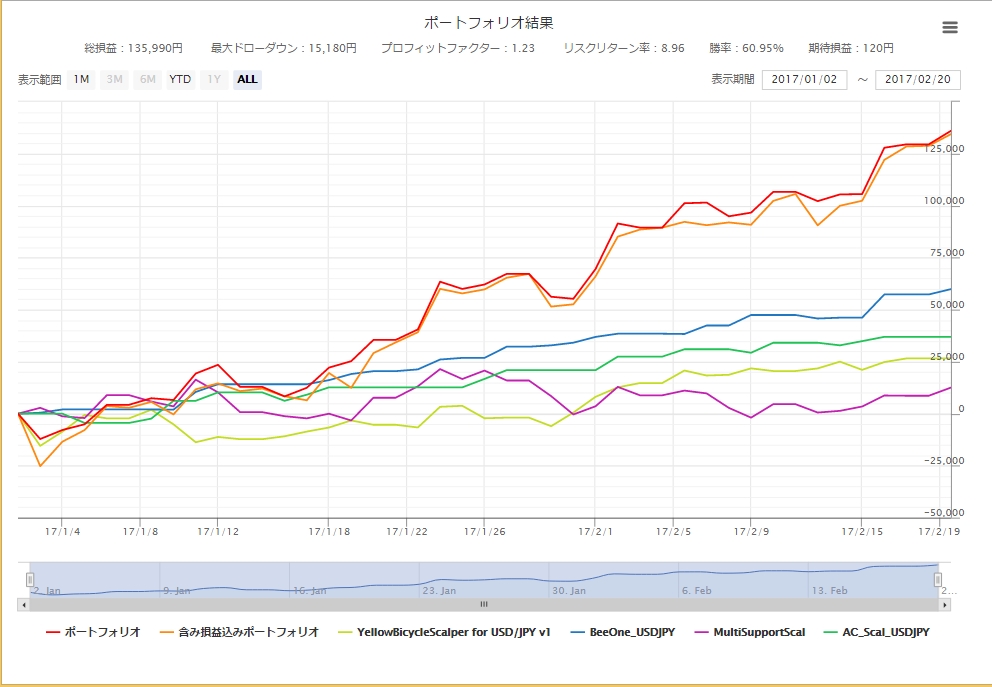

From 2017/01/01 to 2017/02/21, about two months, with a portfolio of four EAs

Total P/L: ¥157,945 Maximum drawdown: ¥31,064 PF: 1.69 Risk-reward ratio: 5.08

Win rate 62.79%

That’s it!

(All entries assumed at 0.1 lot)

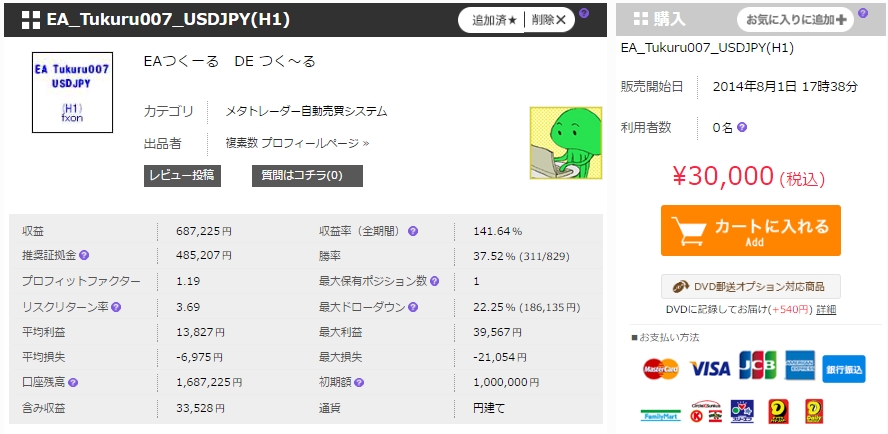

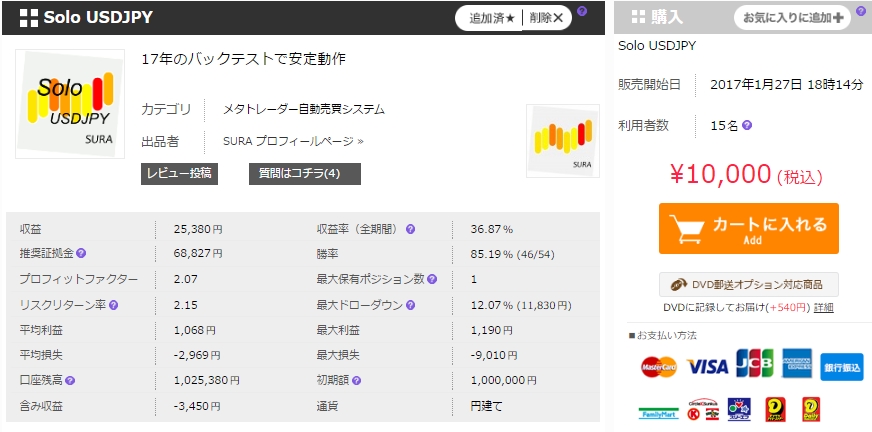

Details of each EA

Scalping EA using Accelerator Oscillator and moving averages

Stable operation in 2017 backtest

Stable operation in 2017 backtest

This one uses compounding for forward testing, so with fixed 0.1 lot operation, the maximum stop loss is 40 pips, which is ¥4,000.

AC_Scal_USDJPYAC_Scal_USDJPY Monthly average trades: 18

Ippon Tsuri-kun Monthly average trades: 31

Solo USDJPY Monthly average trades: 47

EA_Tukuru007_USDJPY(H1) Monthly average trades: 28

Surprisingly many trades, wasn’t it! It seems it will enter at least once per day.

Cost for 1-position EA portfolio (EA purchase price): ¥52,800!

2. Want to trade a lot through scalping? (For those with larger account funds)

For those who want many trades via scalping but also profits, of course.

Because scalping involves more positions than a single-position EA, please ensure you have ample margin.

Counter-trend 1-minute scalping combining Bollinger Bands and proprietary logic

Counter-trend 1-minute scalping combining Bollinger Bands and proprietary logic

Multi-timeframe, multi-logic scalping EA

Multi-timeframe, multi-logic scalping EA

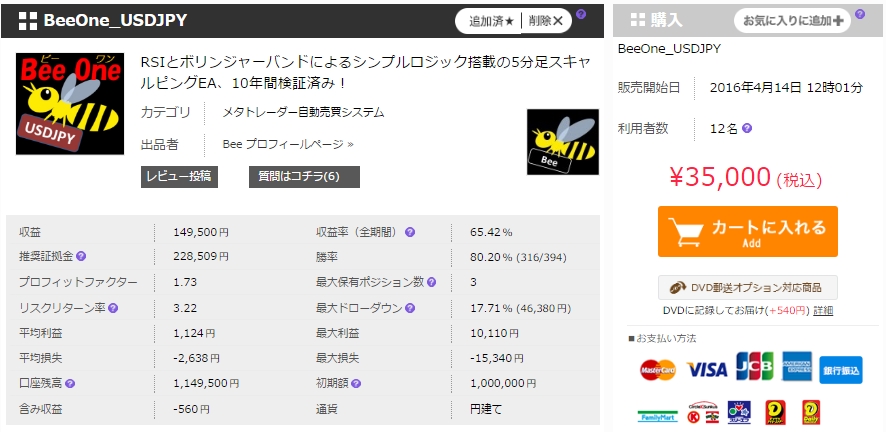

5-minute scalping EA with simple RSI and Bollinger Bands logic, tested for 10 years!

Scalping EA using Accelerator Oscillator and moving averages

Scalping EA using Accelerator Oscillator and moving averages

YellowBicycleScalper for USD/JPY v1 max open positions: 5 monthly trades: 243

MultiSupportScal max open positions: 3 monthly trades: 289

BeeOne_USDJPY max open positions: 6 monthly trades: 63

AC_Scal_USDJPY max open positions: 1 monthly trades: 18

Together, the maximum simultaneous positions will be 11.11.

However, since it’s scalping, the stop-loss pips are shallow, and for the four-EA portfolio, even with fixed 0.1 lot, the maximum drawdown is ¥15,180.

Isn’t that a bit expensive?! This is aimed at seasoned traders with ample account funds.

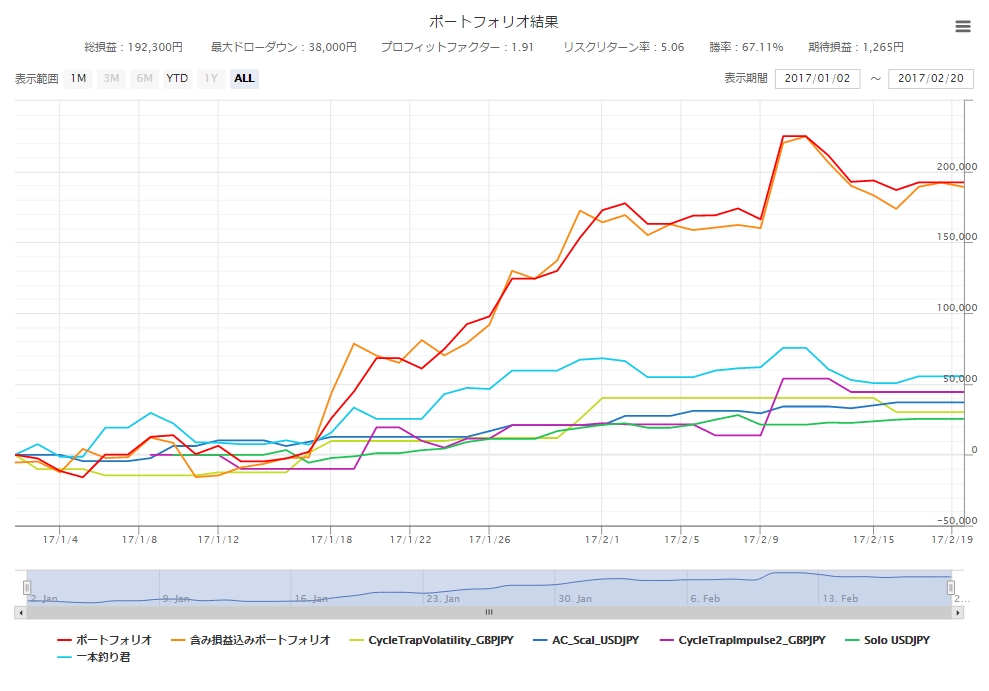

3. Want to assemble a nice portfolio at low cost!

Even cheap EAs actually have targets too!

All are under ¥10,000!But it ended up with five items!

The maximum drawdown is the largest so far at ¥38,000, but

the return is also the largest at ¥192,300, and the profit curve might be the prettiest!

The newly added CycleTrap series from Yumokin-san is here.

Despite the low price, it has good risk-reward and a high win rate, making it recommended for a portfolio.

Enter during volatility. Backtested over the past 12 years.

The portfolio’s maximum number of open positions is

CycleTrapAsianBreak3_GBPJPY 2 monthly trades: 8

CycleTrapImpulse2_GBPJPY 2 monthly trades: 13

Solo USDJPY 1 monthly trades: 47

AC_SCAL 1 monthly trades: 18

Ippon Tsuri-kun 1 monthly trades: 31

no7 positionsとなっています。

Trade count is decent, returns are good, and price is affordable!

Reasonably priced EA portfolio purchase cost: ¥42,400

For reference, in a 25x leveraged FX account, the margin for USD/JPY 0.1 lot is about ¥45,000,

EUR/USD and EUR/JPY are around ¥48,000,

GBP/JPY is around ¥70,000.

In addition to the margin × lot for each currency pair, an account balance that keeps the maximum drawdown to around 30% of the account is recommended.

Please make good use of the portfolio feature for EA trading!

Note: However, compounding EAs and martingale-type EAs are not suitable for portfolios, so please use them separately.

Written by Tera