Scalping and multiple positions consistently yield profits > losses 『Be Wave 2 -AUDJPY M15-』

Earn substantial net profit with a high win rate

Monitor rates and take profits on the chart

You can operate while confirming them!

In the current forward test, the win rate is 92.65% and the PF is 9.85, which are high figures.

The maximum drawdown is kept low at 64,000 yen, so we can expect good performance in the future.

【Be Wave 2 -AUDJPY M15-Overview】

Currency pair: [AUD/JPY]

Trading style: [Scalping][Day trading][Swing trading]

Maximum number of positions: 20

Used time frame: 15-minute chart

Maximum stop loss: 250

Take profit: 5 (applies when multiple positions are open; for a single position, closure depends on the situation)

The currency pair is AUD/JPY, and the maximum stop loss is set high. Take profit is 5 when multiple positions are open. In a single-position scenario, it seems to capture more than that.

【Backtest Analysis】

We will analyze two periods: the most recent four years and the ten years.

2015.02.01‐2019.02.27

Spread 1.0

0.1 lot fixed

Net profit +723,000 yen (annual average 180,000 yen)

Maximum drawdown −927,000 yen

Total trades 1,554 (annual average 388)回

Win rate 83.14%

PF 1.74

There are many trades, with a high win rate of 83.14% and PF of 1.74, but the maximum drawdown became quite large.

Ultimately it adds up to a positive balance thanks to the win rate and number of trades, but there are times when drawdown is substantial, so long-term operation or insufficient required margin would make safe operation difficult.

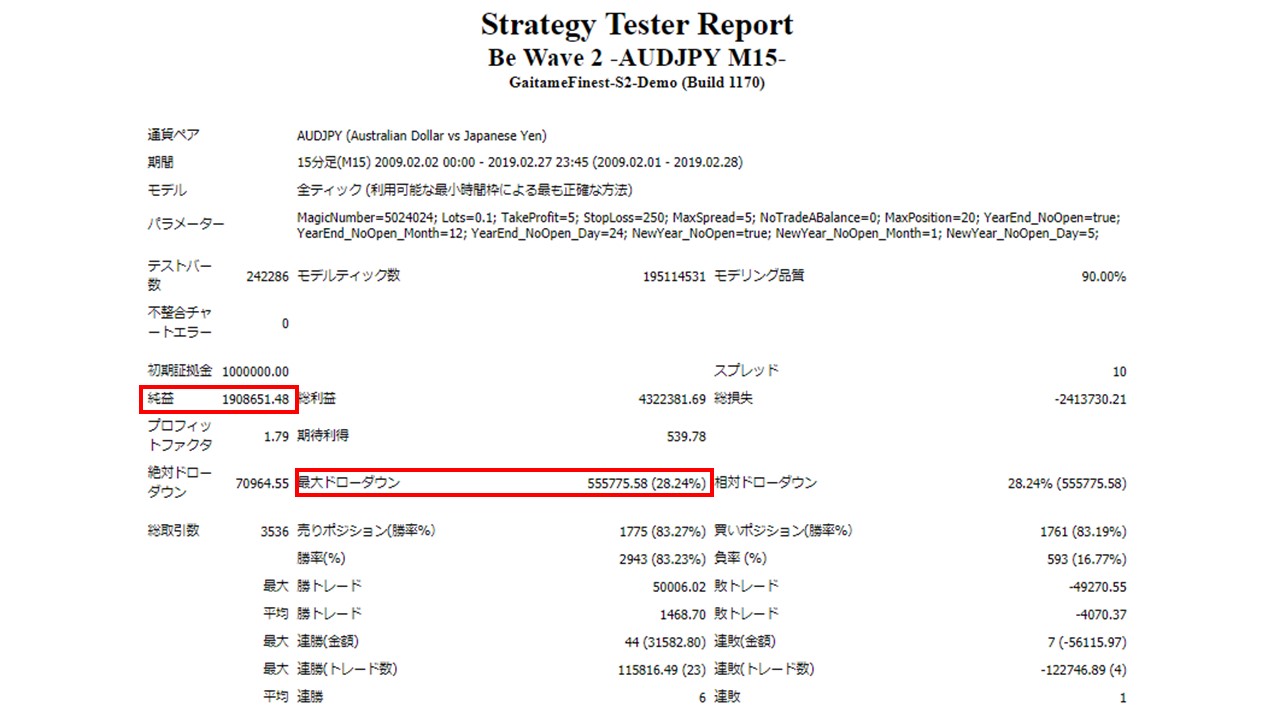

Next is the ten-year backtest.

2009.02.02‐2019.02.27

Spread 1.0

0.1 lot fixed

Net profit +1,908,000 yen (annual average 190,000 yen)

Maximum drawdown −555,000 yen

Total trades 3,536 (annual average 353)

Win rate 83.23%

PF 1.79

This period is longer, but the win rate and PF are almost the same as the four-year period, and the maximum drawdown is lower.

The recommended margin with 0.1 lot fixed is

(3*20)+(55.5*2)=171(万円)

In this case, the expected annual return is11.1%.

Since the maximum number of positions is 20, the recommended margin increased.

According to the product page description, the backtest shows up to a maximum of 8 positions over 5 years, so if we assume the maximum number of positions is reduced to half, 10 positions, then,

(3*10)+(55.5*2)=141(万円)

Thus, the expected annual return in this case is13.5%.

Safe operation would require a substantial margin starting from 1.4 million yen.

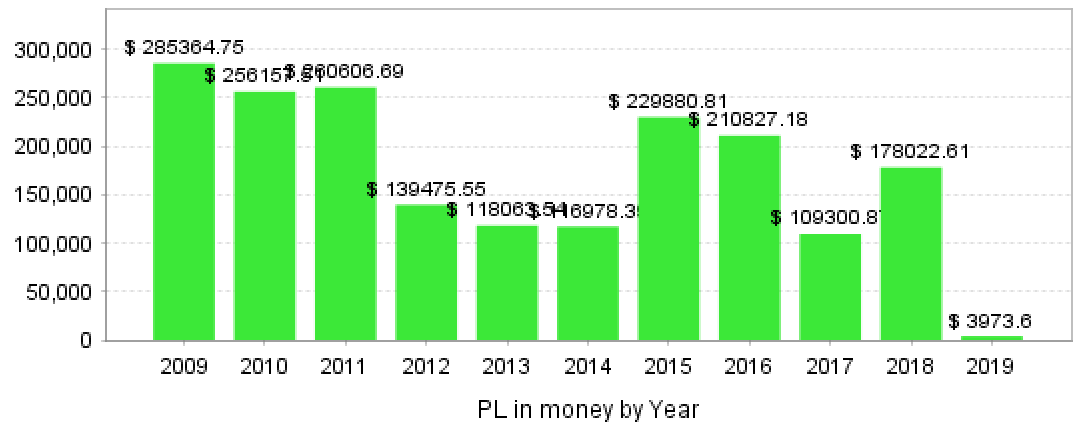

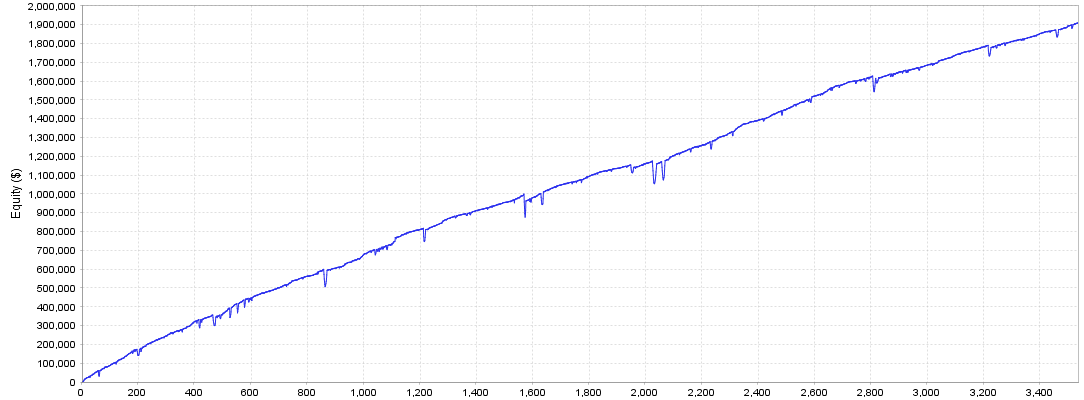

・Annual profit and loss

Profits were earned in every year of the measurement period.

“Designed to be profitable at settlement even when multiple positions are open,” so the profit curve trends upward.

However, as mentioned earlier, the maximum drawdown can be sizable, and there can be large unrealized losses, so please be careful.

・Trade Analysis

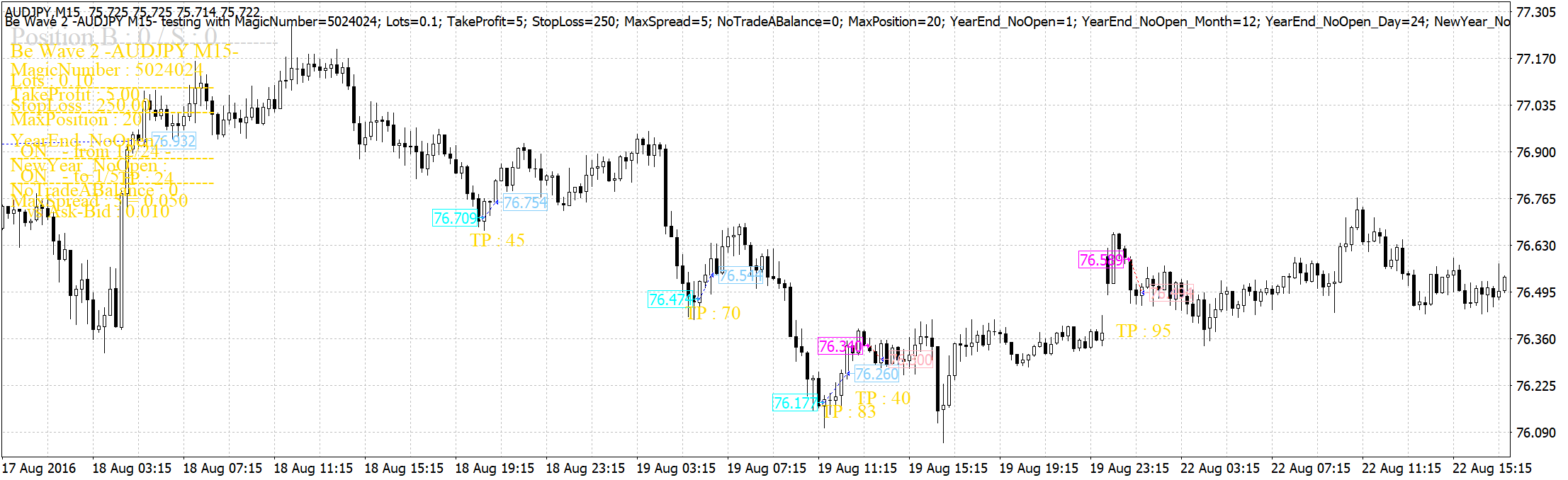

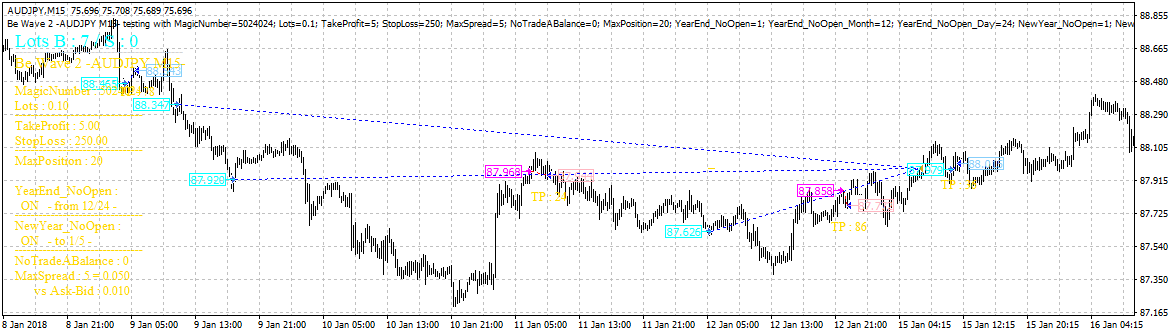

We review trades from the backtest period on the chart.

Blue: Long Red: Short

Entries with a single position are taken in small increments via scalping.

With multiple positions open, positions are held longer, but profits are firmly realized as soon as there is any profit.

As seen above, the maximum drawdown can be somewhat large, but the more you run it, the more profits the EA reliably yields. Because the maximum number of positions is high, consider reducing it in the settings and managing the required margin with a comfortable buffer.