An EA 'Diva Perfect Scal Ltd' packed with the logic of a highly skilled trader who placed third in the WTC

A portion of the highly popular『Diva Perfect Order』logic turned into an EA

A high degree of freedom that makes it easy to implement strategies for each country's market is a major attraction

【Diva Perfect Scal Ltd Overview

Currency pair:[USD/JPY]

Trading style:[Scalping]

Maximum number of positions: 1

Maximum lots: 50 (Depends on each broker's limit settings)

Used timeframe: M15

Maximum stop loss: 45

Take profit: 100(With trailing stop)

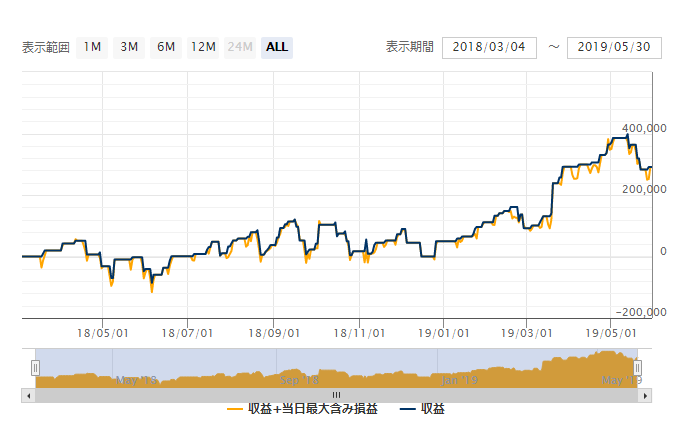

The forward period was from March 2018 to May 2019, for 1 year and 2 months, with a win rate of 82%.

The currency pair is USD/JPY and the timeframe is 15 minutes. Compounding settings are also available.

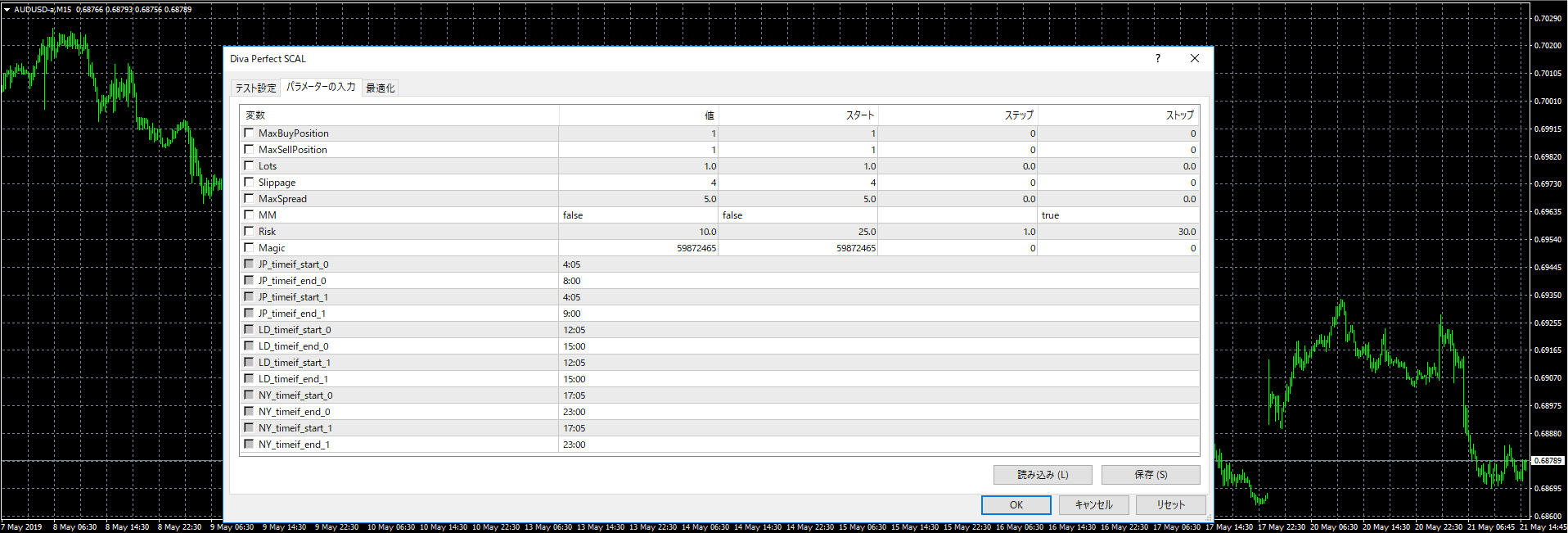

As stated on the product page, it appears to follow a trend-following approach with time-zone strategies for Japan Time, London Time, and New York Time.

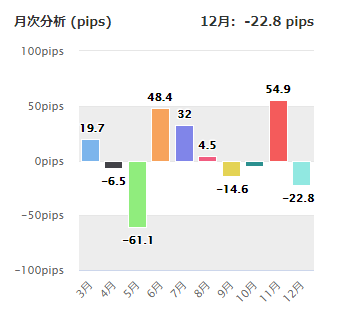

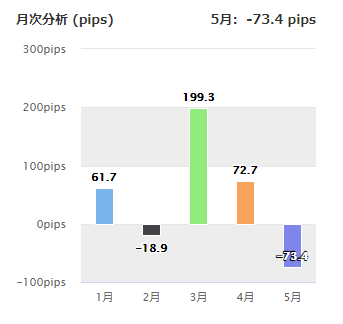

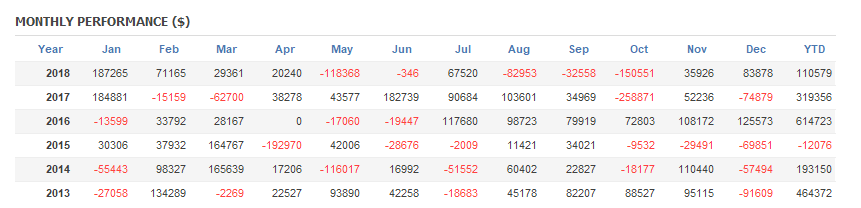

■Monthly Analysis

●2018

●2019

In the monthly analysis, 2018 shows large fluctuations, but overall gains of +49.4 pips.

In 2019 there are months with substantial gains, but May shows a large loss.

Both 2018 and 2019 show positive gains, so it is likely a profitable EA.

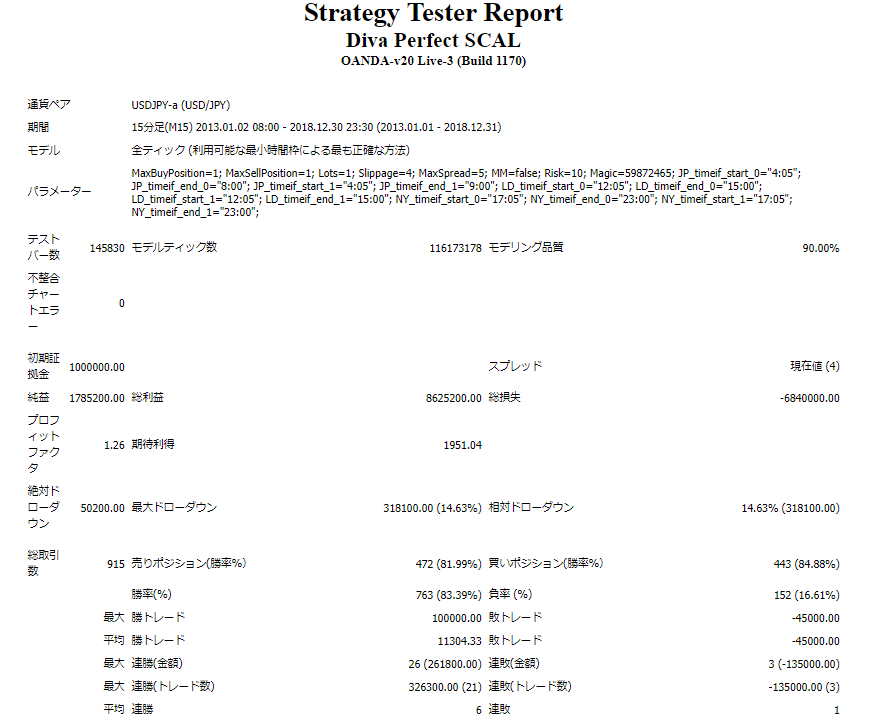

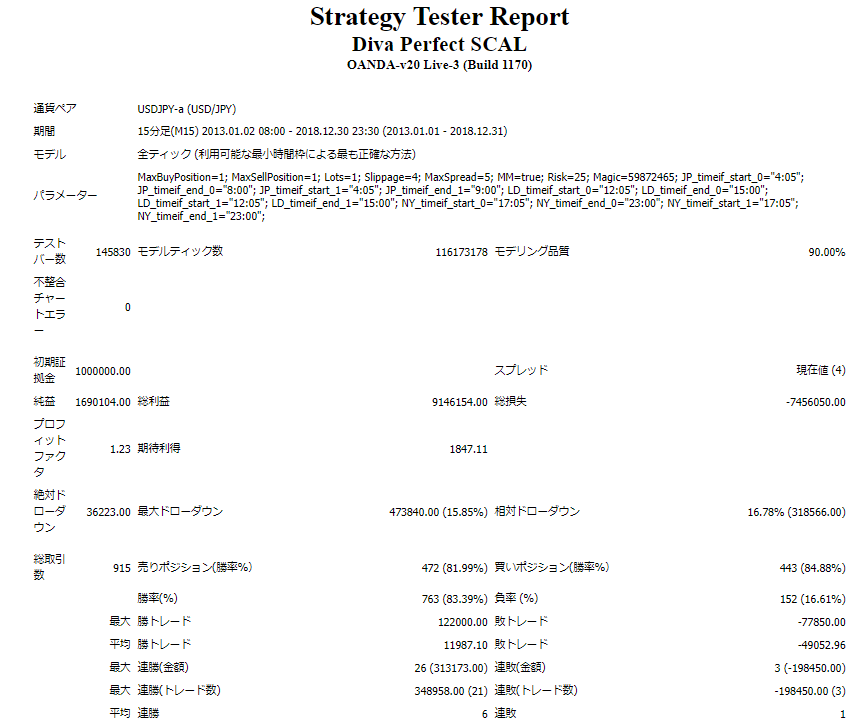

【Backtest Analysis】

2013.01.01‑2018.12.31

Spread 4

1Fixed lot size

Net profit +178.5 million yen (annual average 29.8 million yen)

Maximum drawdown ‑31.8 million yen

Total trades 915 times (annual average 152 trades)

Win rate 83.39%

PF1.26

Win rate is high at 82%.

The recommended margin for safe operation is0.1 fixed lots and

45+(31.8*2)=108.6 (万円).

In this case, the expected profit is 27%.

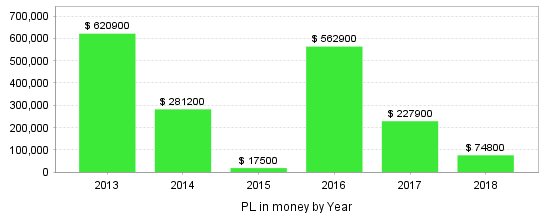

■Yearly and Monthly Profit/Loss

Yearly, all six years are positive. 2015 dipped, but 2016 recovered.

Monthly results show some months with large profits, but there can be substantial gains or losses. It’s wise to leave a generous margin. Overall it’s positive, so no problems.

■CompoundedOperation

Backtest with compounding enabled. The high win rate remains.

2015 was negative, but other years are stable.

■Trading Image

Let's look at the trades

▲Red is buy and blue is sell. It seems to trade using trend following after all.

■Other

As noted on the product page, you can set by market for Japan Time, London Time, and New York Time. This enables a high level of strategic capability.

【Summary】

A high win rate is attractive. There are times of substantial losses, but profits seem large enough to cover them.

Because settings can be aligned with the time zones of the three major markets, its versatility is high.

A larger margin is advisable, but why not try operating it as part of a portfolio?