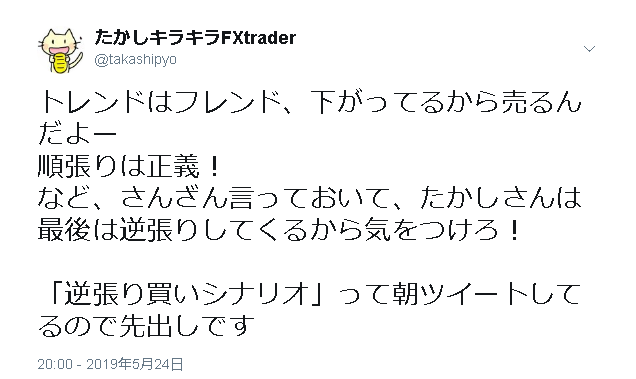

20190524 (Fri) Pound-Yen Trade. Counter-trend and trend-following.

Basically it is a trend-following approach, but there are also contrarian strategies aimed at when the trend ends.

I think this appears quite a bit in past articles and old blogs as well.

【230 billion yen earned, Winning Mind cis】

When investors or people starting investing ask me for “any advice,” I often say only, “What goes up continues to go up, what goes down continues to go down.”

In rising phases, if you believe it will rise further and bet on it, that is called “trend-following,” and when you bet on a reversal from a decline to an increase, that is called “contrarian.”

Basically, I speak of being a “trend-follower.”

That’s all.

cisさん also does a lot of contrarian trades, but the basic stance is trend-following.

GBP/JPY four-hour chart

It has been falling all along. The red vertical line marks yesterday morning (May 24).

A buying scenario here would be completely contrarian, right?

> Betting on things that are falling to reverse and rise is called “contrarian.”

GBP/JPY five-minute chart

It came down, and you could say I bet on it reversing and rising at the glittering pink line (138.657).

Rather than deciding in advance that it would reverse at this line, the basic rule is to wait for it to be stopped several times by the line and confirm.

It worked in favor with the pink line, reversing, but I exited after seeing a strong drop.

Even so+55 pipsswas captured, which is a big profit.

The target was up quite a bit, but I simply followed the price action honestly.

Even if you think, “I’ll go up to 153 yen!”, it is important to respond to what the market actually does.

After taking profit, it continued to fall, so in hindsight that was the correct call.

After that, I entered on the sell side. This is also a trend-following move aligned with the flow, selling a rebound within a large downtrend.

I was able to take a screenshot when I entered here.

The stop loss is about 12 pips.

The take profit target is the lower glittering pink line (138.657).

For more detailed market analysis and entry rationale,FX Members Blogwill explain it.

If it had declined cleanly, I would have netted 50 pips, but

I couldn’t take it all! lol

Midway I thought pound/dollar might move better, and I rode that to take a profit, but staying with GBP/JPY would have yielded more.

GBP/JPY was moving straightforwardly, and I wasn’t. Reflecting on this.

That tweet said I had switched away from the pair.

Watching other currency pairs while trying to maneuver nicely, I engaged in a bit of trickery. This is something I should deeply reconsider.

Let’s just be straightforward and simple.

For a steady account, in the two days since then, it surpassed the previous week’s profits.

Nine days yielded a 7.1% return.

This account achieves a high win rate by stacking small take profits.

Looking at the monetary amount alone, it might seem like a modest profit, but the rate isn’t small.

If this pace continues, 14% per month would result in a profit of 140,000 yen on a 1,000,000 yen capital over one month.

Over a year of operation,

168,000 yen profit with simple interest

about 4.81 million yen profit with compound interest.

Past articles link collection↓

https://www.gogojungle.co.jp/finance/navi/699/11076