ドル円EA『千紫万紅』を長期バックテストや複利、「山紫水明」とのポートフォリオ結果で検証!

An easy-to-use EA for everyone with excellent win rate, drawdown, and PF.

Profit growth can be targeted through compounding and by increasing the maximum number of positions.

【千紫万紅】意:さまざまな色の形容。色とりどりの花が咲き乱れること。

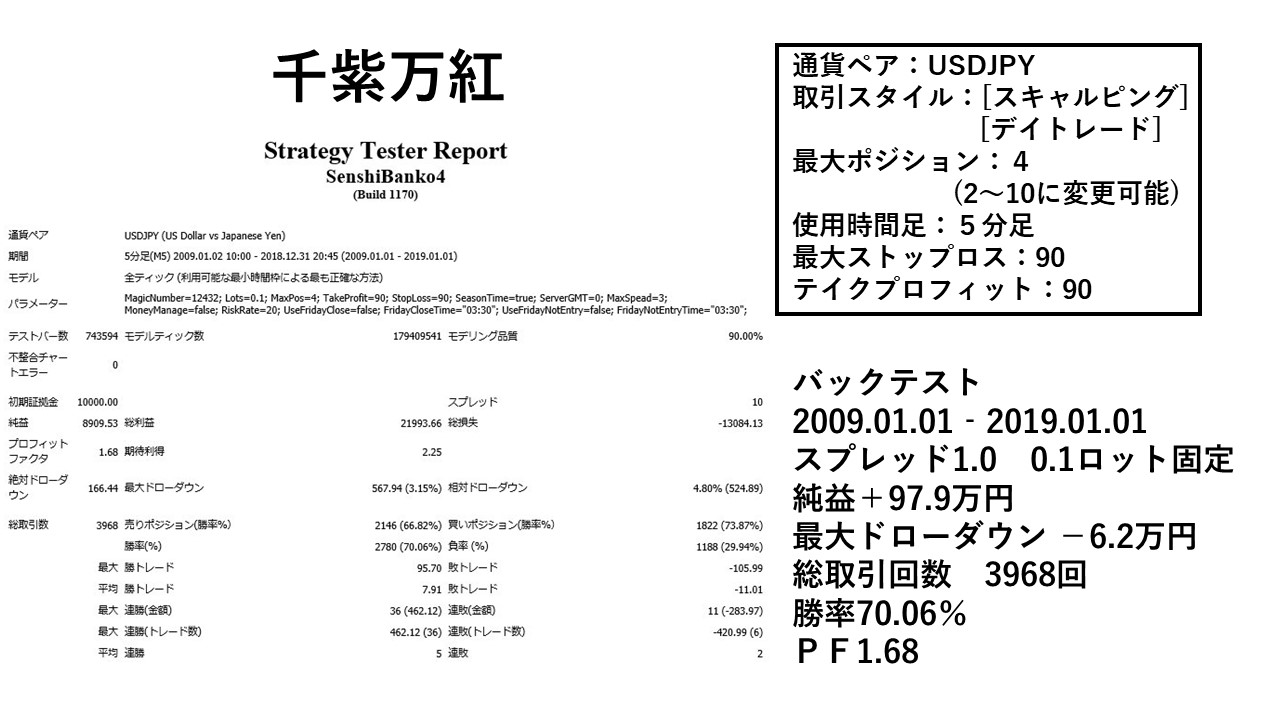

【千紫万紅概要】

通貨ペア:[USD/JPY]

取引スタイル:[スキャルピング][デイトレード]

最大ポジション数:2~10(パラメーターで変更可能)

使用時間足:5分足

最大ストップロス:90

テイクプロフィット:90

The currency pair is USD/JPY on the 5-minute chart, and it appears to use a simple pullback buy and retracement selling logic based on indicators such as moving averages and Bollinger Bands.

With parameter settings, you can adjust the maximum number of open positions as well as either simple and compound returns.

On the product page, the seller, EA Master, provides numerous backtest results showing how position size and lot size changes affect the EA, which should be helpful when you operate it yourself.

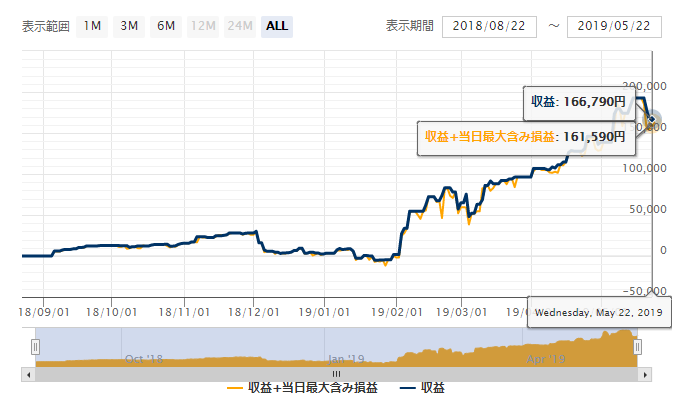

Forward Performance

The forward test has been running for nine months since the start, and results have been steadily improving.

In particular, since February this year it has performed well; there have been temporary losses and unrealized losses, but it has generated significant profits.

【Backtest Analysis】

Both simple and compound operations are possible, so let's look at their backtest results.

The maximum number of open positions is set to 4.

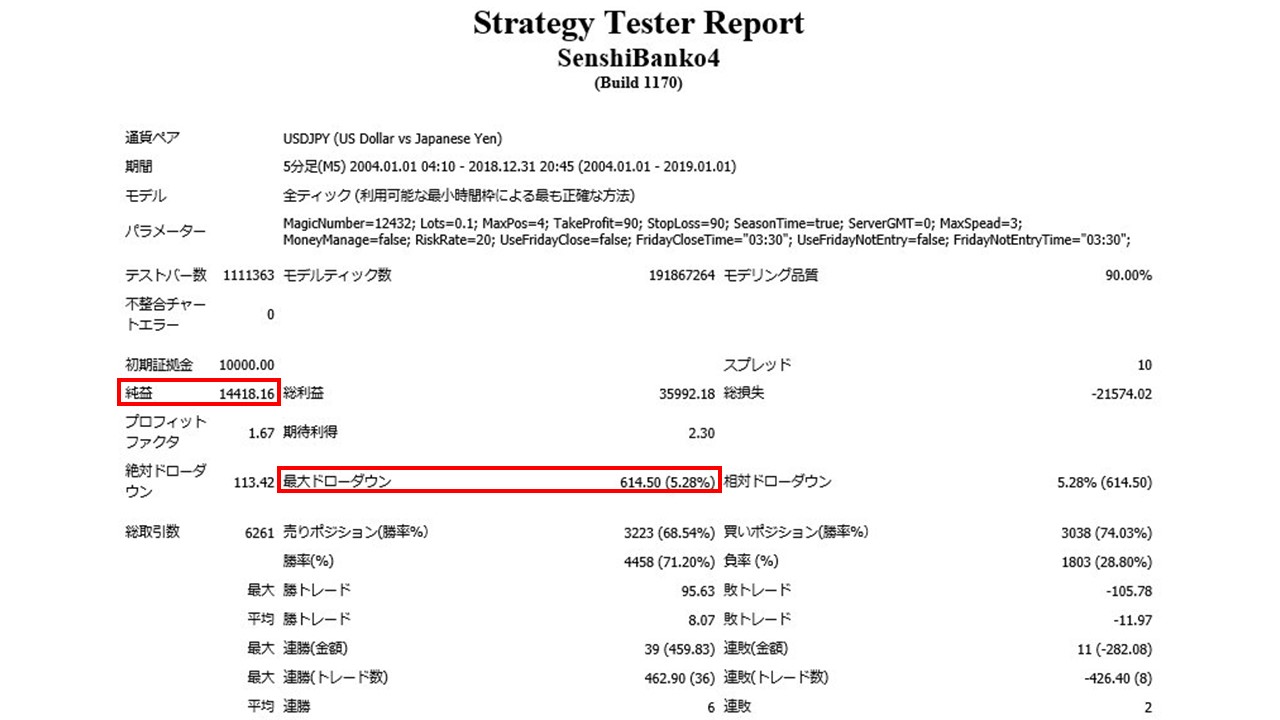

Simple-Interest Operation

The simple operation was backtested over a longer period of 15 years.

2004.01.01‐2019.01.01

Spread 1.0

Fixed 0.1 lot

Net profit +1,585,000 yen (Average annual 105,000 yen)

Maximum drawdown −670,000 yen

Total trades 6,261 (Annual average 417 trades)

Win rate 71.20%

PF 1.67

Even with a 15-year horizon and a maximum of 4 positions, the drawdown is only −67,000 yen, which is quite low; with sufficient margin you could actively increase position counts and lot sizes.

Recommended margin amount is fixed at 0.1 lot

(4.5*4)+(6.7*2)=31.4(万円)

This yields. The expected annual return in this case is31.4%.

If you want to operate with even less capital, by setting the maximum number of open positions to the minimum of 2 in the parameter settings, the maximum drawdown will also decrease, making it feasible to operate with around 200,000 yen.

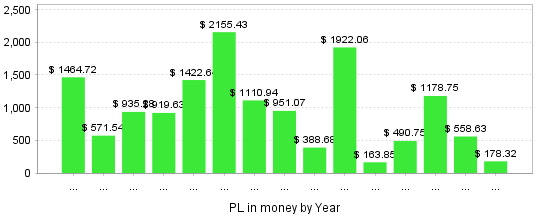

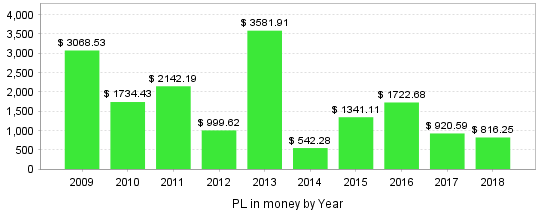

Annual Revenue

Profits in every year.

Revenue by Year/Month

Even in the last two years, only 6 months were negative, so the results align closely with the win rate (about 70%). A lower annual yield does not necessarily mean losses dominate.

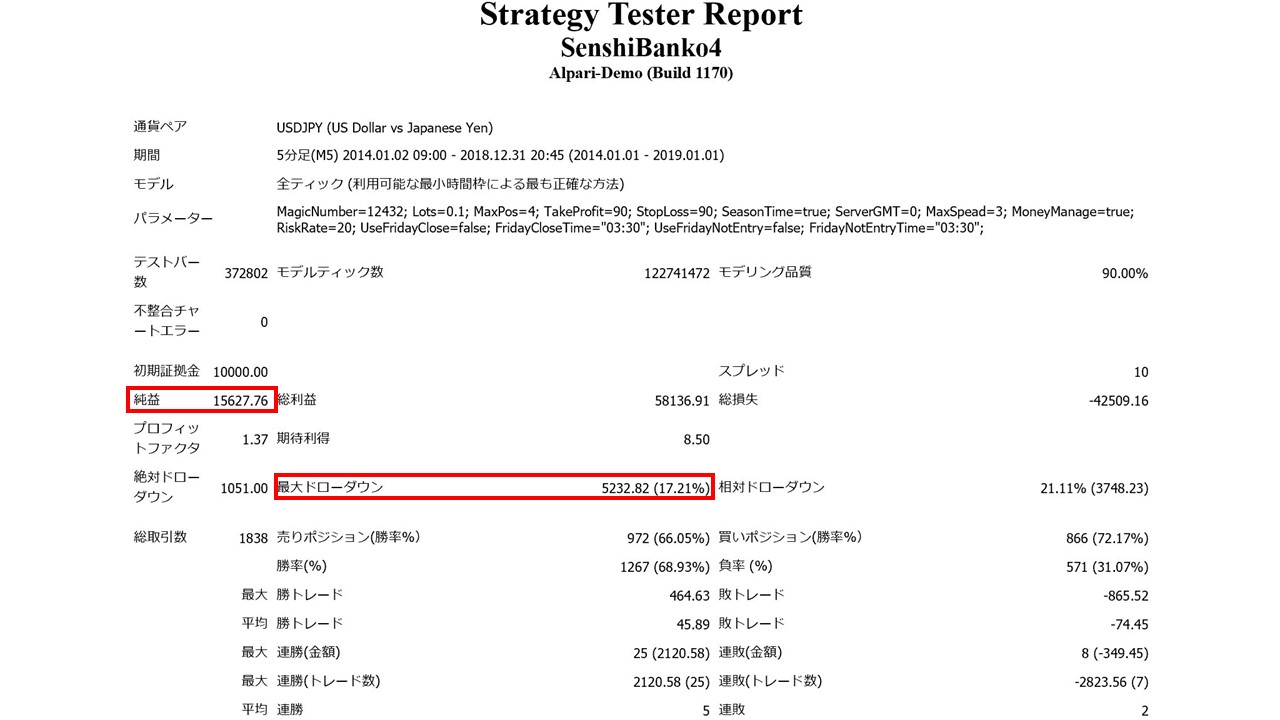

Compound-Interest Operation

With compounding, performance improves and, the longer the period, the more the numbers accelerate upward, so the period is set to five years (other conditions unchanged).

Net profit +1,718,000 yen (Average annual 343,000 yen)

Maximum drawdown −575,000 yen

Backtests show that it surpassed the profits earned in 15 years of simple operation within 5 years.

On an annual average basis, it is about 3.2 times higher. Compound interest is indeed an attractive setup if you can account for drawdown, but the maximum drawdown is larger than in simple operation.

Not dramatically larger drawdown than other EAs; when comparing simple vs compound under the same environment and settings, both return and risk increase.

Therefore, if you want to operate with compounding to increase returns, it is important to analyze the risks you can tolerate by looking at changes in position count and lot size shown on the product page, such as reducing the maximum positions.

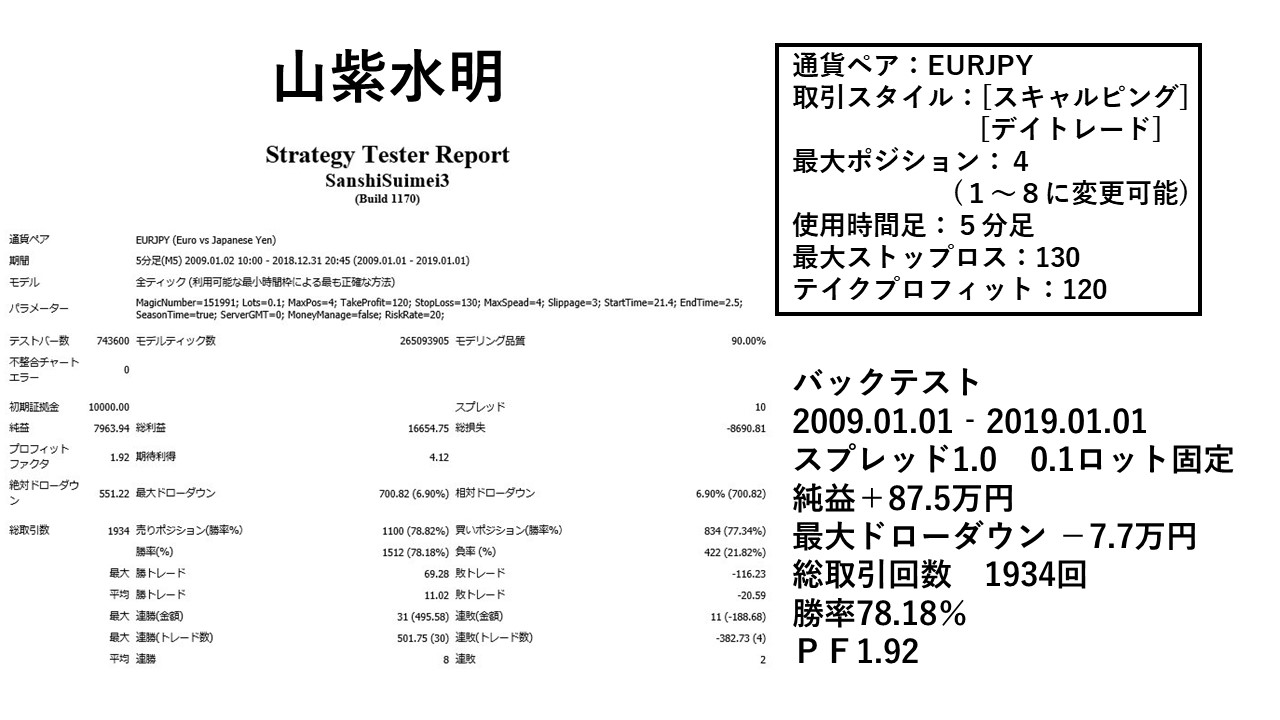

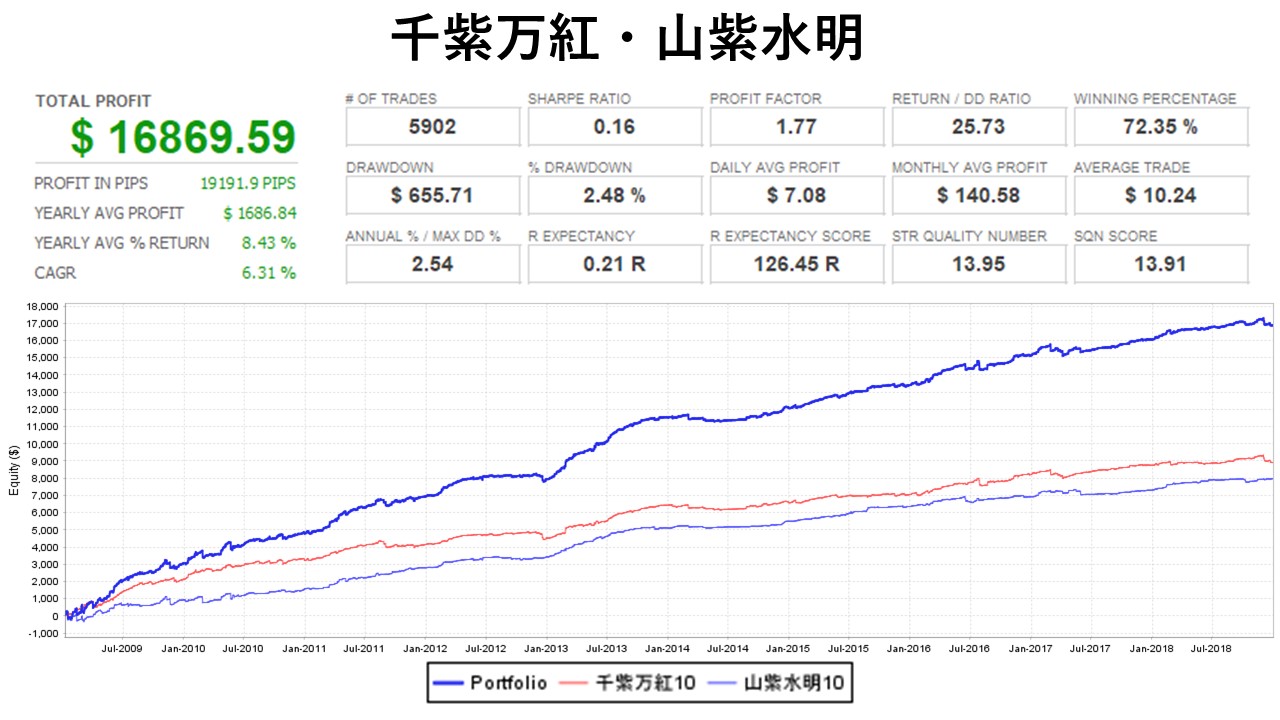

【Portfolio Analysis (& Sansi-Suimei)】

Here, we analyze what happens when running it concurrently with other EAs from the same seller (the EA Master).

This time we analyze a portfolio pairing with EUR/JPY and "Sansi-Suimei".

Analysis environment is a 10-year period, simple-interest 0.1 lot fixed, spread 1.0.

Portfolio

Net profit +1,855,000 yen

Maximum drawdown −72,000 yen

PF:1.77

Both are yen-linked currency pairs, so their behavior is similar.

Number of trades is about 1.5 times that of Sen Shi Man Kou, and PF sits around the middle of the two.

Net profit sums up, while the maximum drawdown increased compared to running Sen Shi Man Kou alone, but it remains below the maximum drawdown of Sansi-Suimei when run alone.

By year, overall profits rise; particularly in the last five years, the graph showing large revenue differences with Sen Shi Man Kou becomes more uniform and yields an average profit.

From these impressions, the classic, simple pullback buy and retracement selling logic remains stable in win rate and profit. Moreover, by adjusting the number of positions and using simple vs compounding, you can finely tailor the operation to your capital.

Additionally, pairing with other EAs from the same seller in a portfolio can help reduce risk while aiming for higher returns, so if you have financial concerns about managing an EA, why not simulate using the product page data?