Not only EURUSD! Earn big with an overwhelming advantage over the US dollar『Covering_EA_EURUSD』

Bring it on for USD currency pairs!

An EA capable of delivering high profits on USD pairs

“View Covering_EA_EURUSD”

【Covering_EA_EURUSD Overview】

Currency pair:[EUR/USD]

Trading style:[Scalping] [Day trading]

Maximum positions:1

Maximum lots:300 (Complies with the maximum number of lots allowed by the FX broker)

Used timeframe:M1

Maximum stop loss:50(Loss cutting will be done at or below 50 pips depending on market conditions)

Take profit:150(Profits pursued to the maximum depending on market conditions)

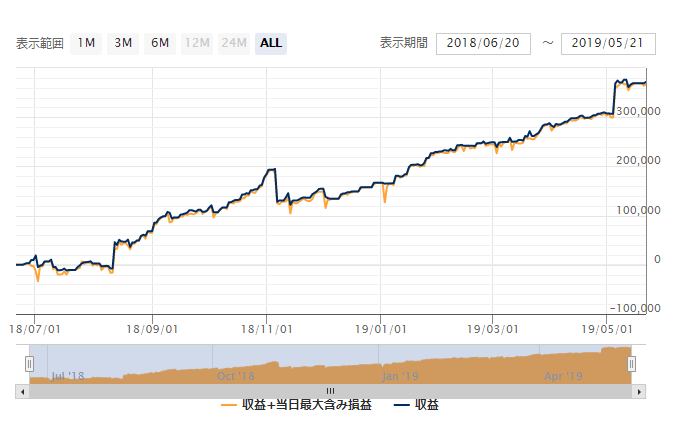

The forward period was about one year from June 2018 to May 2019, with a win rate of 69%.

Profit factor is 1.75, and the risk-return ratio is 4.31.

As described on the product page, a major feature is that by assessing the medium- to long-term strength/weakness of the USD within a day and using a 1-minute chart to time precise buy/sell entries, it enables highly accurate trading and appears to have a strong edge against the dollar.

Therefore, it seems to trade from 6:00 to 14:00 Japan Time.

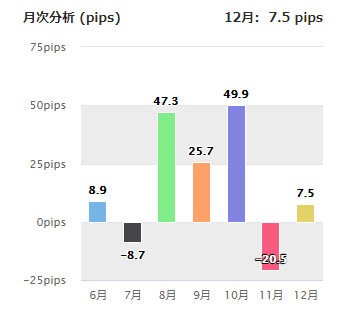

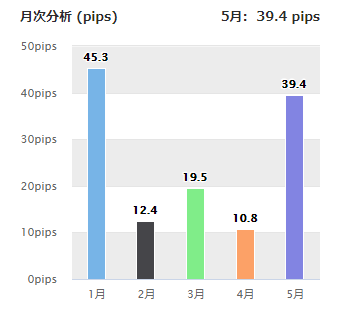

■Monthly Analysis

●2018

●2019

Looking at monthly earned pips, 2018 showed periods of large gains as well as losses.

In 2019, pips have been earned more steadily.

Given recent unstable market conditions, there may be potential for further gains.

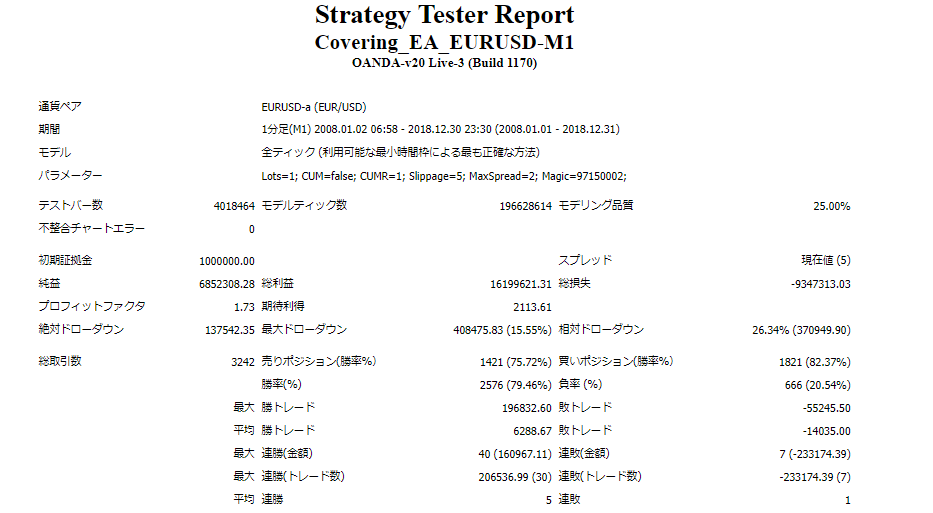

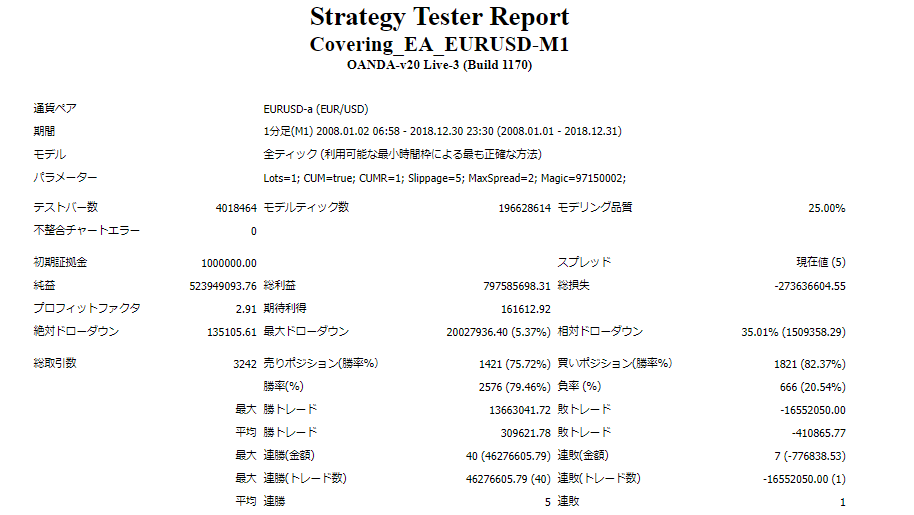

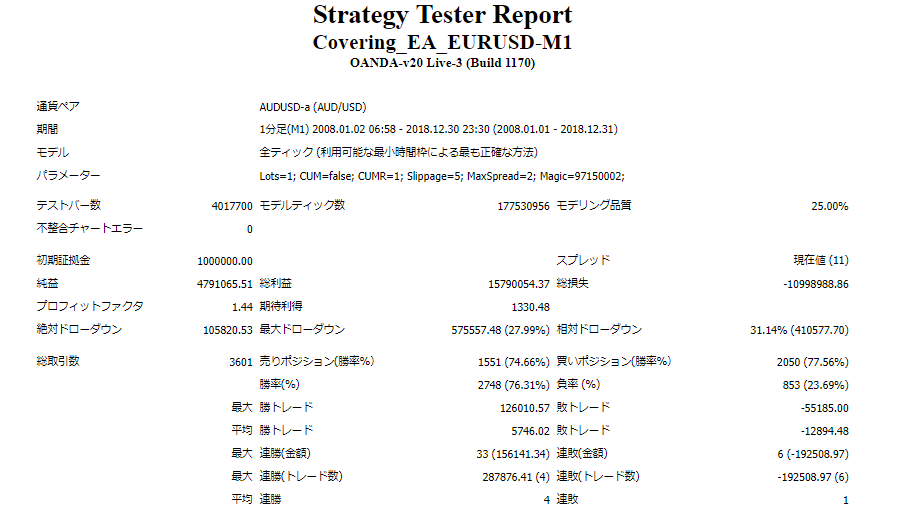

【Backtest Analysis】

2008.01.01‐2018.12.31

Spread 5

1 lot fixed

Net profit +685.2万円(年間平均 62.3万円)

Maximum drawdown -40.8万円

Total trades 3242回(年間平均294回)

Win rate 79.46%

PF1.73

Win rate about 80%, annual trades also 294 times, roughly one trade per day.

Recommended margin amount 固定1ロットで

50+(40.8*2)=131.6(万円)

Expected annual return is 47% and looks promising as an EA.

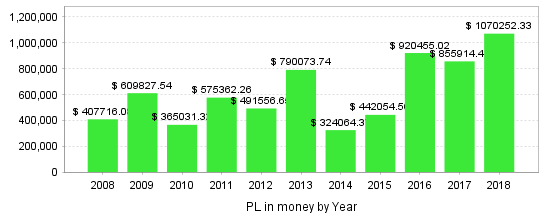

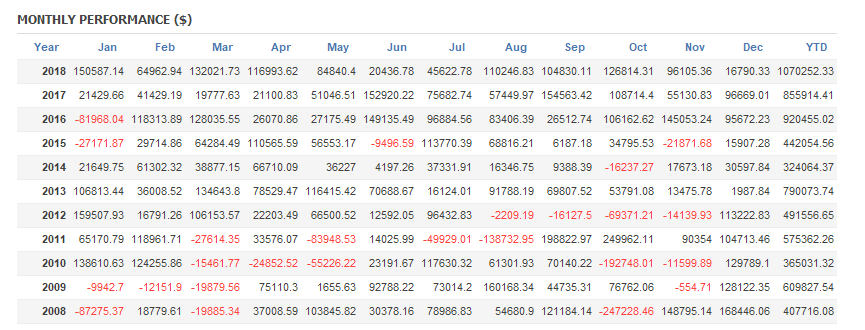

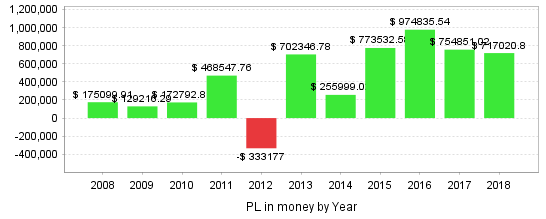

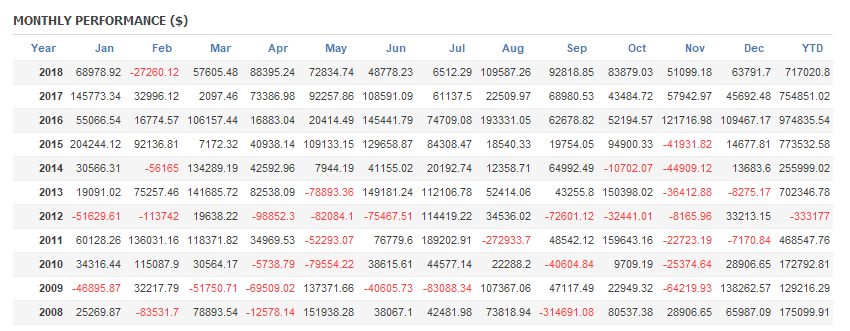

■Yearly and Monthly Profit/Loss

Yearly results show no losses over 11 years, delivering high profits.

Monthly results also show substantial profits. There are months with losses, but they recover quickly and yield profits larger than the losses.

■Compounding Feature

The compounding feature can be used, so it’s worth taking a look.

The low drawdown is appealing. The win rate is 79%, excellent. Needless to say, the power of compounding is amazing.

■Backtests for Other USD Crosses

Since it seems effective against USD pairs, I’d also like to view the backtests for GBPUSD and AUDUSD.

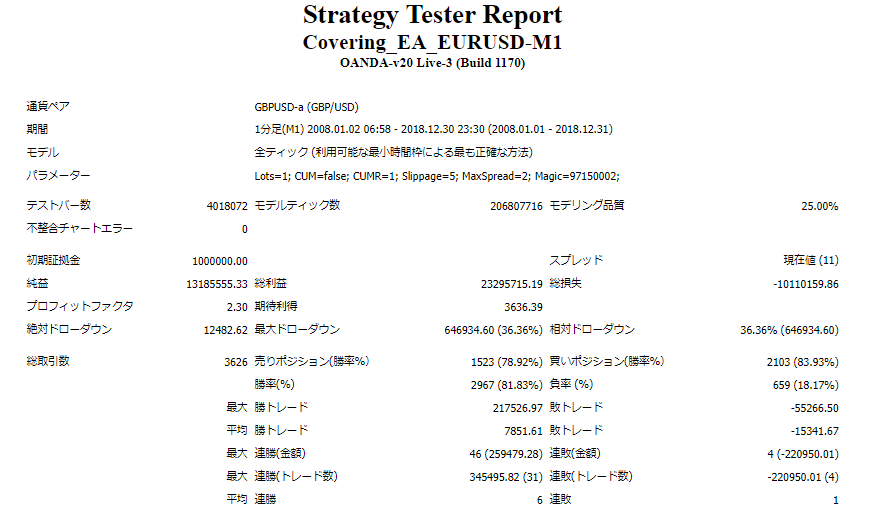

●GBPUSD

2008.01.01‐2018.12.31

Spread 11

1 lot fixed

Net profit +1318.6万円(年間平均 119.9万円)

Maximum drawdown -64.7万円

Total trades 3626回(年間平均330回)

Win rate 81.83%

PF2.30

Win rate is over 80%, PF is 2.30 and it's excellent with many trades.

Recommended margin amount is 固定1ロットで

55+(57.6*2)=170.2(万円)

Expected annual return is a remarkable 70% and very promising.

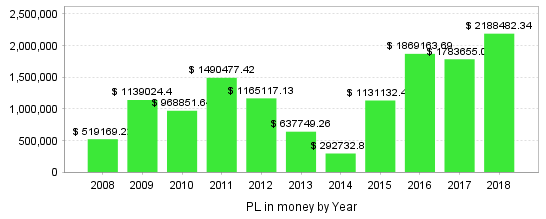

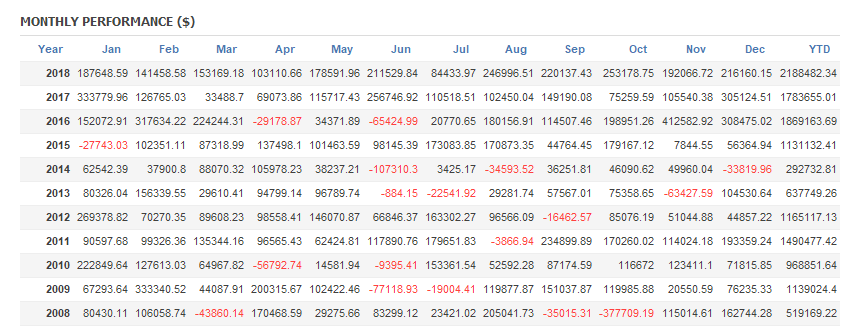

■Yearly and Monthly Profit

Yearly results remain stable; notably, during 2016–2018 Brexit-driven bond volatility, large gains were achieved.

Monthly results also show few months with losses; most months show substantial gains.

●AUDUSD

2008.01.01‐2018.12.31

Spread 11

1 lot fixed

Net profit +479.1万円(年間平均 43.5万円)

Maximum drawdown -57.6万円

Total trades 3601回(年間平均327回)

Win rate 76.31%

PF1.44

Win rate is about 76.3%, and, like others, a relatively high number of trades.

Recommended margin amount is 固定1ロットで

30+(57.6*2)=145.2(万円)

Expected annual return is 29%.

■Yearly and Monthly Profit

Yearly results show a loss in 2012, but in other years they were positive.

Monthly results show that there are times with significant losses, so careful margin management is advisable.

【Summary】

USD has an inherent edge, so it is very versatile and could be valuable when building a portfolio.

Not only USD pairs, but compounding can be configured, so the operating options are broad.

Although the required margin is substantial, based on forward and backtests it is an excellent EA, so why not give it a try?