Don’t be distracted by overseas materials! One wrong step could lead to the Nikkei stock average continuing to fall, and the possibility of a yen-buying market as well...

The USD/JPY is said to be heavy at 115 yen due to option influences, but

when it breaks, it tends to break through easily.

At this stage, as the Japan-US summit has been postponed for trade and exchange rate issues,

investors would likely want a clearer answer around this area.

Also, during the Trump era, it was said that USD/JPY would fall below 100 yen,

but it did not turn into a panic market, and recently there have been rumors that such plunging-position bets

are being reversed (short covering), so if such movement occurs,

the market could change rapidly, which is something to watch out for.

For a while we were being driven by US data, but domestically too

there is not no material at all.

One wrong step could lead to a continued decline in the Nikkei stock average and a yen-buying environment...

Technically, USD/JPY backed by the weekly cloud rose, but

it has entered the daily cloud and is transitioning, so perhaps by the end of this month

the movement is likely to start near the cloud’s twist area.

Domestic factors

In Parliament, unusual references to the exchange rate; the Finance Minister, keeping in mind 120 yen, says, “We have never heard of a yen depreciation.”

★U.S.-Japan Economic Dialogue, Finance Minister Aso: “If things go well, as early as April”

It's the kind of news you don’t want to hear, but a major scandal could be on the horizon

★Morimoto School land deal: Questions arise about the sale of government-owned land to a Shinto school whose honorary principal is the prime minister’s wife

The situation decades from now is unknown! Realities we are not told as well…

★<Fukushima No. 2 reactor> damage beyond expectations

There is a possibility of a second or third Toshiba-like situation emerging…

★Nuclear power plant miscalculation, Toshiba’s “lost decade”

★ The Forex Tug-of-War Market Compass

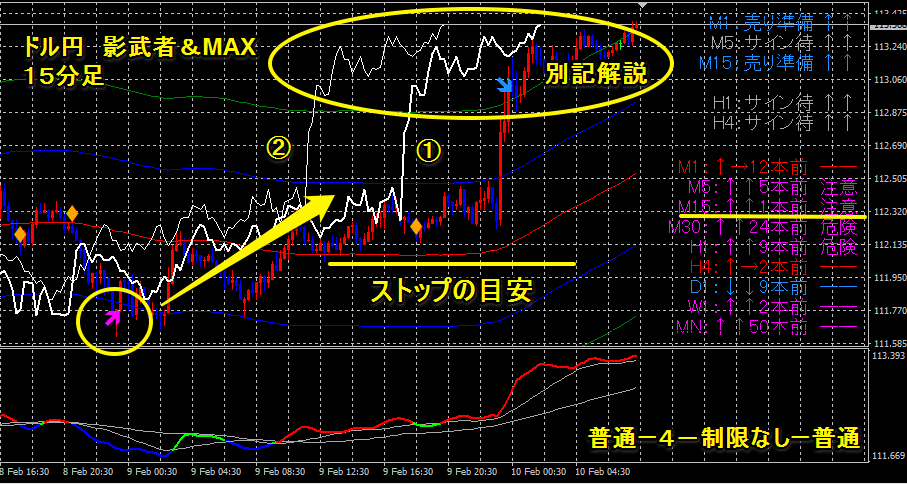

This is a combined USD/JPY chart, and from below 112 yen it formed a lower shadow and began to rise

If the unconventional lagging lines ① and ② cross over but do not, holding might be possible, but…

The Shadow Trader signal has already lit up the opposite trades, so since this is not a swing position, locking in profits would be

the best course of action. After midnight in overseas hours, there could be

sharp moves and Monday could see a jump in prices…

On the second day of Yellen’s testimony, the USD/JPY rose again, but afterward

it sharply retreated and stalled in the early 113 yen range.

For traders who love USD/JPY, here is the ultimate edition!

Three development indicators for the “Forex Tug” plus an Ultimate indicator

Limited to USD/JPY edition with bonuses, a 9-item set for sale!

Ask ver1.0 ¥17,800

● Day-trading breakout method

Ask Ultimate MAX USD/JPY Limited Edition ¥4,980

● Medium-to-long term trend-following method

Ask Ultimate Shadow USD/JPY Limited Edition ¥9,800

● Entries and take-profit signals included for scalping as well

Total regular price ¥32,580

Bonus set of 9 items price¥29,800