Profit by slowly watching the trend『Miami 9:00 AM EURUSD』

A classic trend-following logic for EUR/USD that tends to continue the trend

A day-trading EA that holds one position for a long time to generate large profits

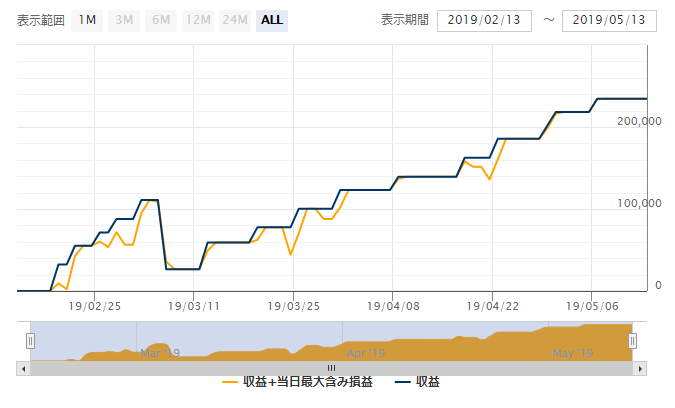

About three months have passed since the forward test began, but it remainsWin rate over 90%at a high level and stable.

Because this type trades a small number of times, the win rate is naturally highly important.

Because this type trades a small number of times, the win rate is naturally highly important.

【Miami 9:00 AM EURUSD Overview】

Currency pair:[EUR/USD]

Trading style:[Day trading][Scalping]

Maximum number of positions:1

Used timeframe:5-minute chart

Maximum stop loss:83 pips (varies within 83 pips)

Take profit:21 pips (varies within 21 pips)

According to the product page description, this EA is built on the classic dip-buying and pullback-selling logic.

The fact that both stop loss and take profit values are set with fine granularity shows attention to detail.

The time frame is 5 minutes, but the main activity appears to be day trading with positions held relatively long.

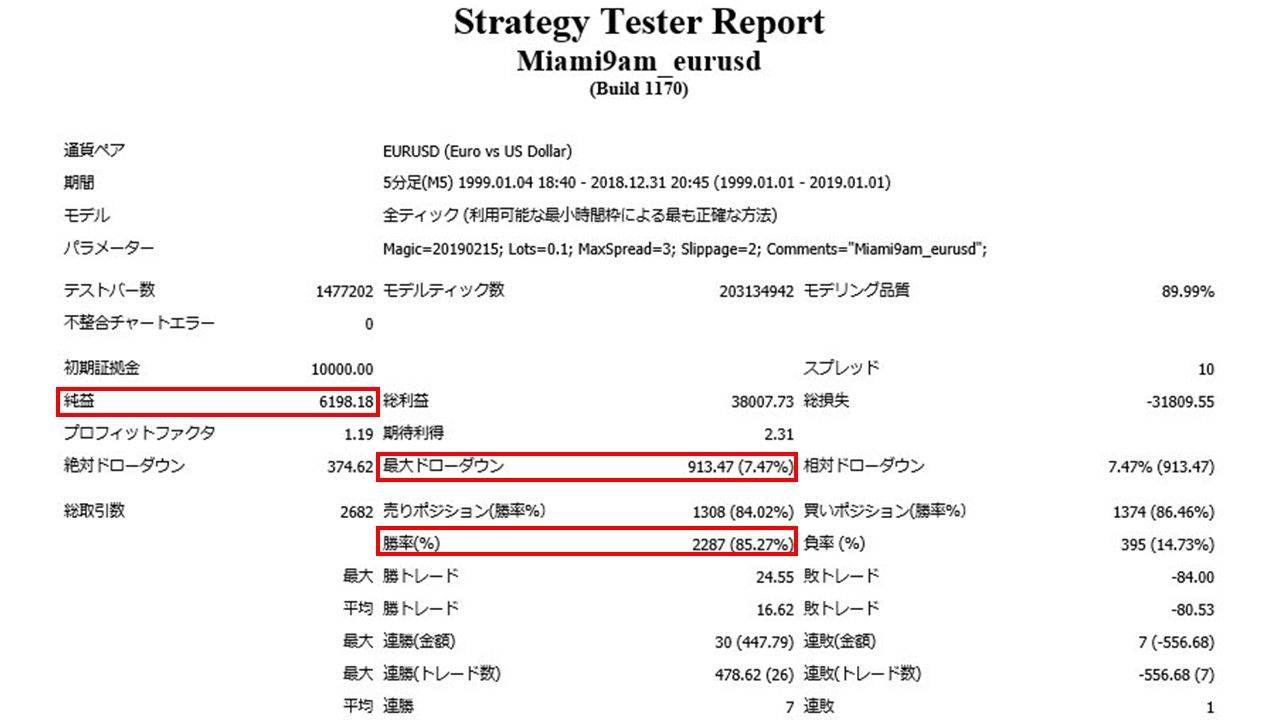

【Backtest Analysis】

We will look at the backtest results over a longer 20-year period.

1999.01.01‑2019.01.01

Spread 1.0

Fixed 0.1 lot

Net profit +681,000 yen (annual average 34,000 yen)

Maximum drawdown −100,000 yen

Total trades: 2,682 (annual average 134 trades)

Win rate 85.27%

PF 1.19

Although the number of trades isn’t large, the 20-year backtest shows a win rate above 85% as well, which is quite high. Like the current forward performance, it clearly reflects a tendency to build profits by leveraging a high win rate.

The recommended margin calculated from this, with 0.1-lot fixed, is

5+(10*2)=25(万円)

Thus, a safe operating threshold starts from 25万円.

In this case, the expected annual return is13.8%.

The expected pips per trade are 2.5 pips, and the average gain when winning isapproximately 16.6 pips.

Focusing more on more recent performance,

over the last 3 years (net profit 163,000 yen, max drawdown 56,000 yen), the expected annual return is20.1%.

over the last 3 years (net profit 163,000 yen, max drawdown 56,000 yen), the expected annual return is20.1%.

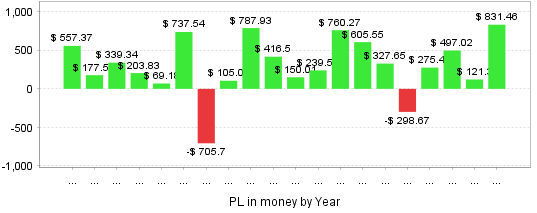

Yearly revenue.

Over 20 years, losses occurred in only two years: 2005 and 2014.

Focusing on profitability, the latest 2018 revenue wasthe highest ever, suggesting it has adapted to recent market conditions.

Focusing on profitability, the latest 2018 revenue wasthe highest ever, suggesting it has adapted to recent market conditions.

As a single-position EA, if the logic does not align well with the market and profits cannot be generated, it would be prudent to supplement it with a portfolio that combines other EAs.

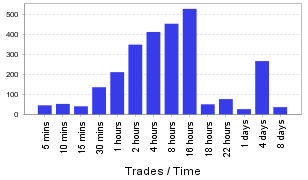

・Trade Analysis

Blue: Long Red: Short

With a single position, it reliably buys on dips and sells on rallies.

At the same time, although the time frame is 5 minutes, positions are held relatively long.

At the same time, although the time frame is 5 minutes, positions are held relatively long.

When looking at trades by holding time, some trades finish in a few minutes, but most are day-trading with positions held for hours to days. The EUR/USD market tends to be active after Japan's night, so entries confirmed on Monday night may close as early as the next morning, or, if late, be held until Friday. Consider monitoring with a long-term mindset.

“Miami 9:00 AM” provides a simple, classic one-position EA that has versatile and practical use.

Since EUR/USD has high liquidity and potential for long-term trend continuation, this trend-following EA is well-suited to the market, which is a strong plus.

Since EUR/USD has high liquidity and potential for long-term trend continuation, this trend-following EA is well-suited to the market, which is a strong plus.

I think many traders trade using discretion for scalping. While I myself engage in discretionary scalping, entrusting a different style like “Miami 9:00 AM EURUSD” to handle stable day trading could contribute to diversified returns and risk management.

Miami 9:00 AM EURUSD

× ![]()