Were you able to take it as per the Euro/Yen front-running scenario on 20190510 (Fri)?

Yesterday, a reflection on Friday's EURJPY.

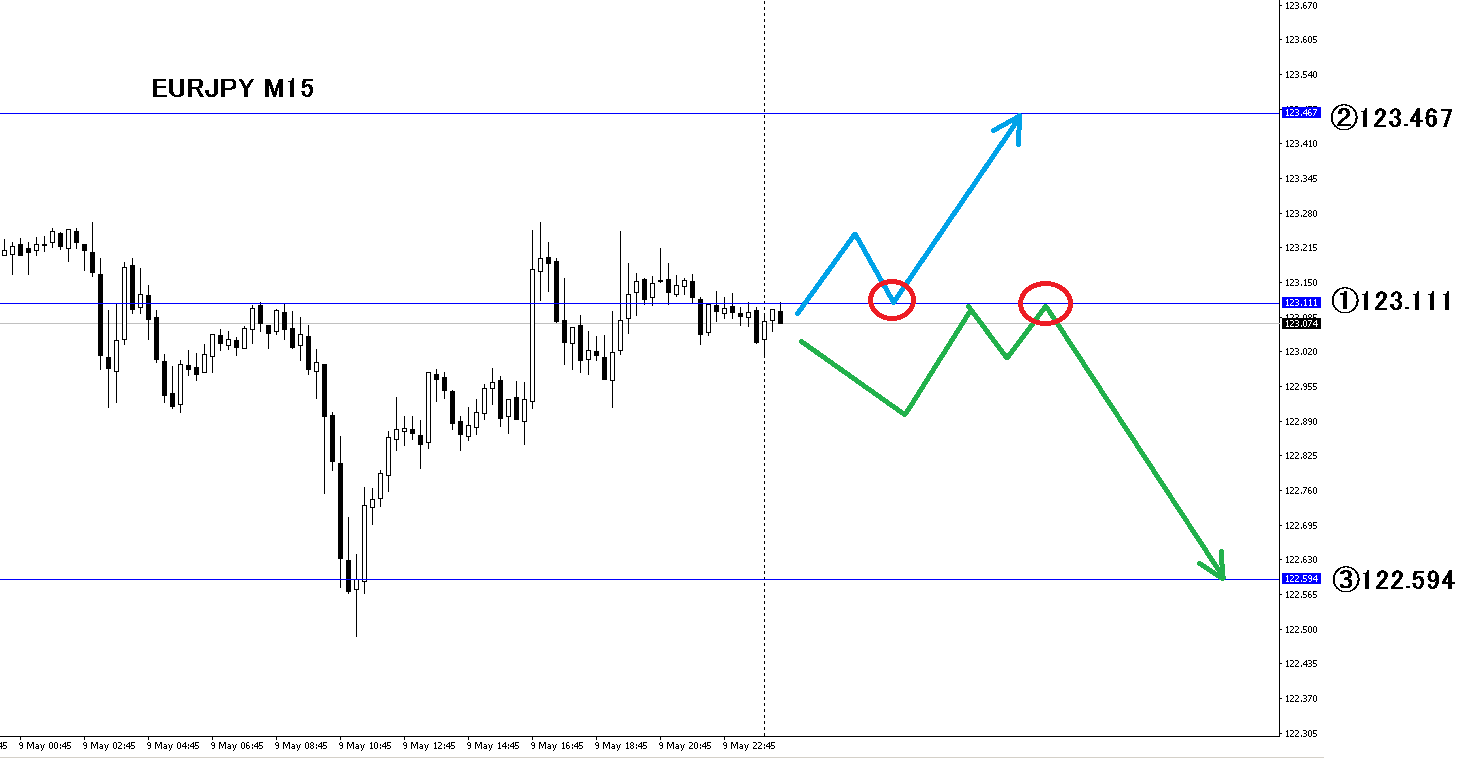

This was the front-loaded scenario. ⇒【Free】20190510 (Fri) EURJPY Front-Loaded Scenario - Morning Session -

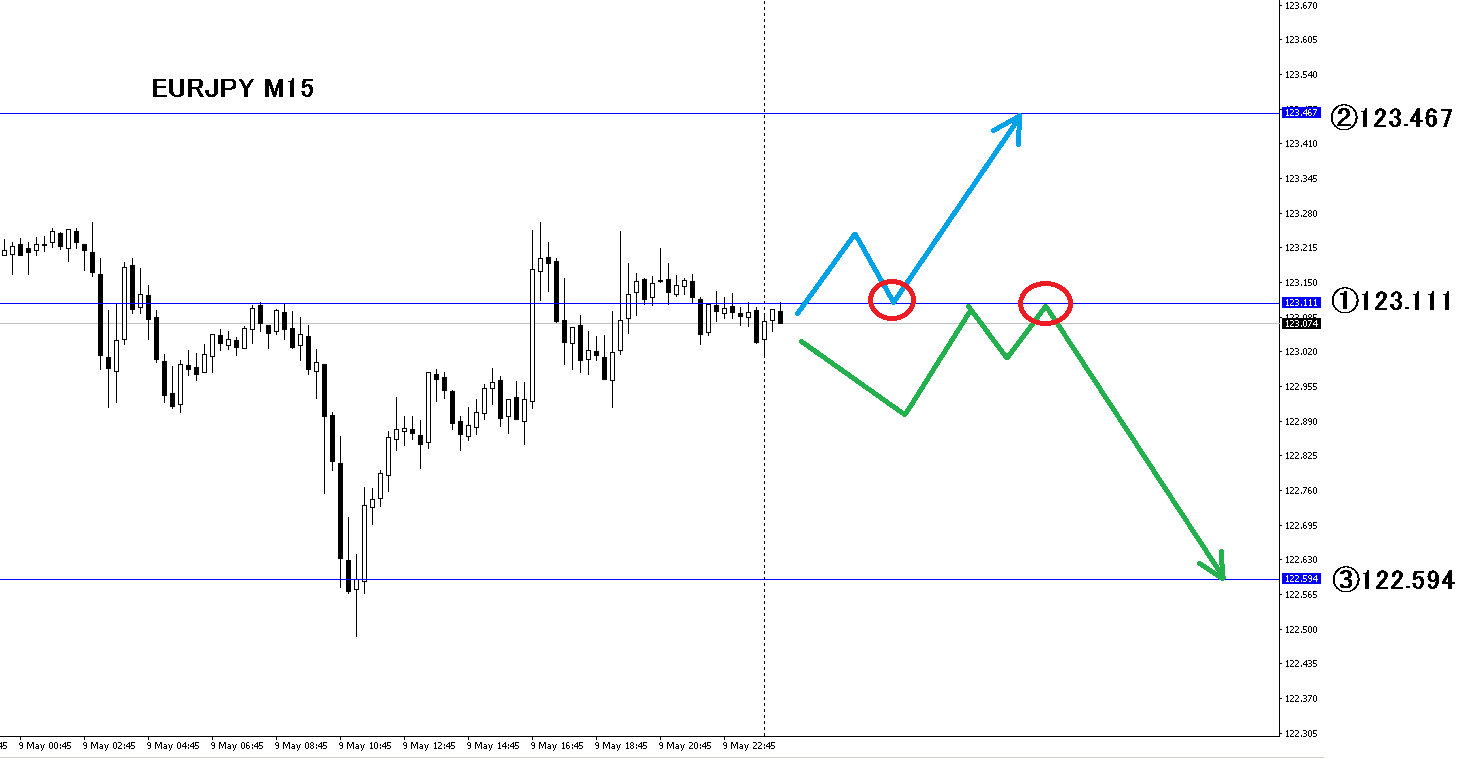

1) The line was viewed as the entry-point line.

The scenario was to buy near the line, and if it drops, to come back to the line and aim to sell from the 1st line.

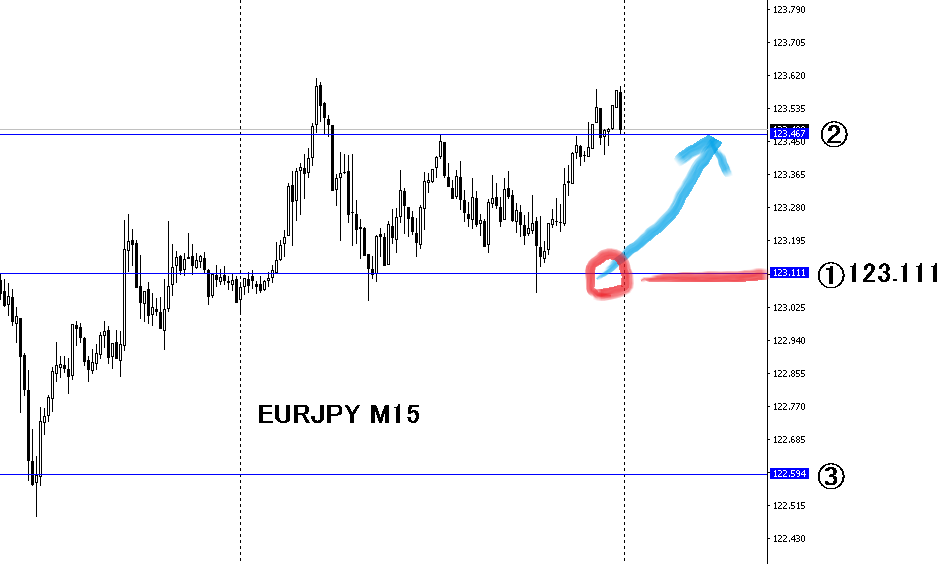

It moved like this.

It became a move where you could profit from buying from the 1st line.

Buy from the 1st line up to the 2nd line to take profits.

With this movement, there probably wouldn’t be a stop-out.

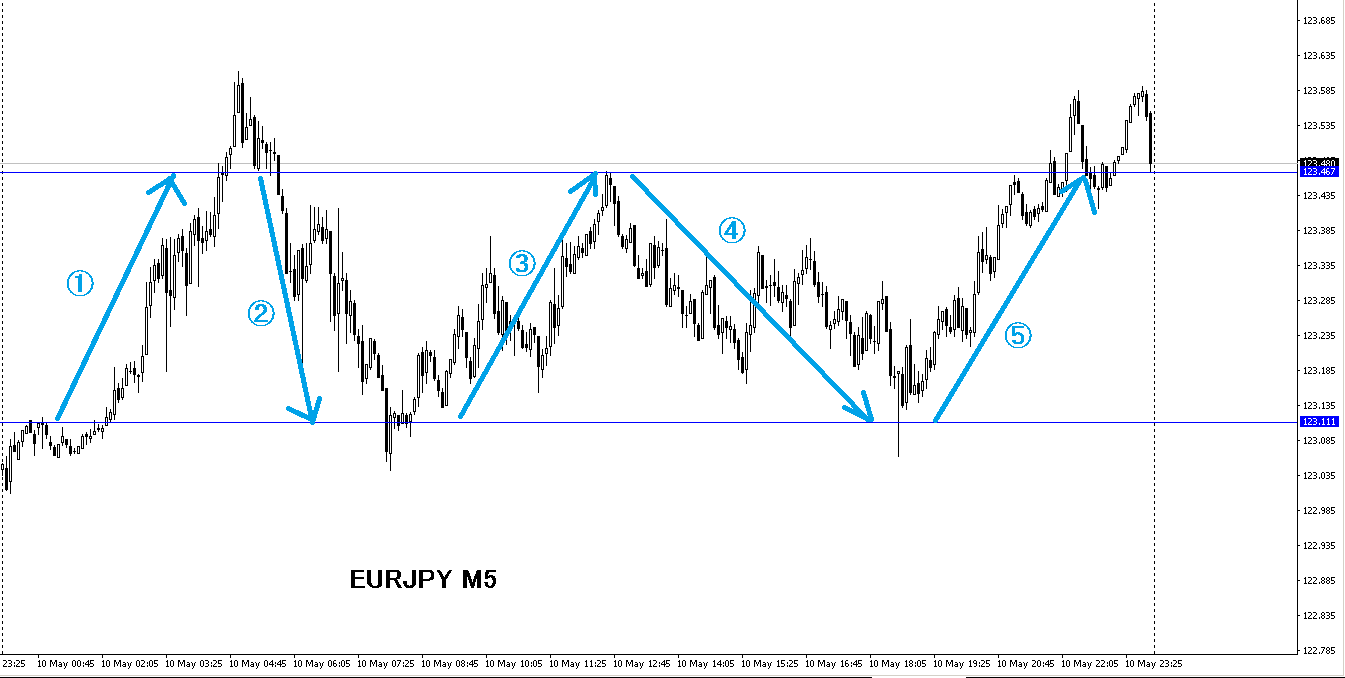

The 5-minute chart showed a range-going back and forth.

I captured the rise from the 1st line and the fall from the 2nd line.

I received a report that I was able to catch the rise from the 3rd line. Thank you.

I look forward to reports of both successful and unsuccessful trades.

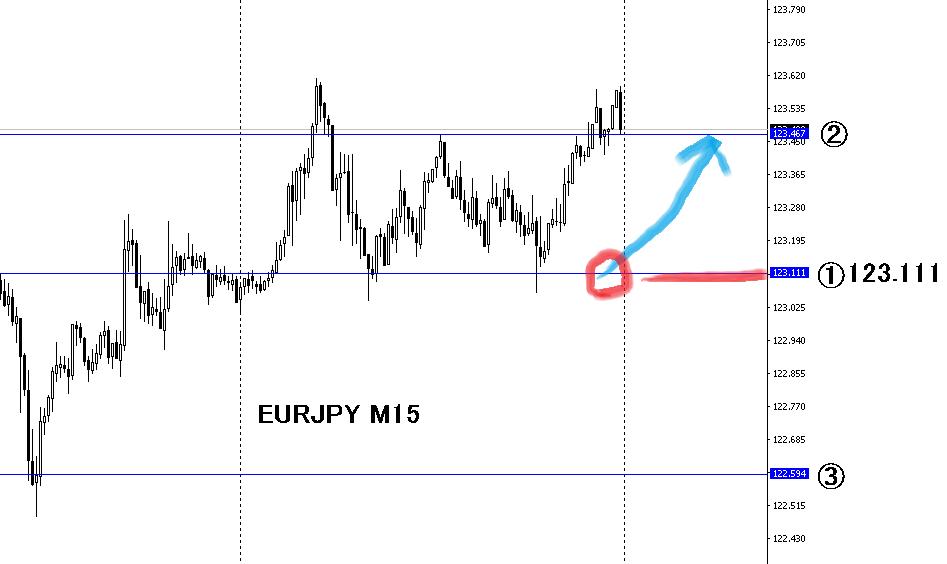

Although I did not front-run the sell, the reasons and basis for the sell entry are explained here. ⇒20190510 (Fri) EURJPY Trade Analysis

Cancellation not only for buying, but also for selling, was possible because

with proper market context.

The EURJPY market context is explained here. ⇒20190510 (Fri) EURJPY Market Context

I will write about market context again in the next installment.

This time, we looked back at the front-loaded scenario and the resulting movements.

I don’t recommend leaving a limit order idle, but it was possible to buy at the 1st line with a limit order and to close a sell at the 2nd line.

Also, there will be times when I publish front-loaded scenarios for free, so subscribing to avoid missing them is recommended.

Past article index ↓

https://www.gogojungle.co.jp/finance/navi/699/11076

I would be happy to receive your thoughts, etc. I would like to use them as references for future series.

Contact: takashipsychology@yahoo.co.jp