A swap trading method where the required margin is halved and the yield also increases 'Hedge GO'

Let's manage funds aiming for high-yield swaps with minimal risk!

What HedgeGo can do

・Find hedge currency pairs that reduce risk when paired with high-swap currency pairs

Currency pair name and quantity, swap points, and leverage input will automatically calculate correlation coefficients, maximum risk, required margin, swap yield, etc.

We perform calculations for required margin, swap yield, etc. This helps to suppress FX fluctuations and enables efficient capital management, allowing you to design hedging strategies.

You can devise hedge strategies.

・Also usable for swap operations with FX brokers that do not support MT4

Because you can freely configure leverage and swap points, you can simulate to match the accounts of the FX broker you actually use.

Simulation is possible.

・Display technicals for synthetic currency pairs

In a sub-window, it displays the opening price, moving average, and Bollinger Bands, enabling you to consider entry/exit timing. (No buy/sell signals)

Note: In swap-focused operation, positions are held long-term, so currency losses may exceed the swap points earned.

To minimize FX fluctuations as much as possible, a hedge strategy that combines high-correlation currency pairs (moving similarly) or inverse moves with low swaps is effective.

HedgeGo calculates correlation coefficients and simple financial engineering calculations to determine the risk reduction effect, supporting swap operations.

HedgeGo uses two types of indicators: main and sub.

The main indicator calculates and displays correlation coefficients, historical volatility, maximum risk, required margin, swap yield, etc.

The sub-indicator graphs the price rate of the chart currency pair and hedge currency pair combined, along with moving average and Bollinger Bands.

Note: there are no entry/exit signals for positions.

(1) Available currency pairs: xxxJPY, xxxUSD, xxxCHF, xxxCAD, xxxNZD, xxxAUD, xxxGBP

xxxTRY, xxxZAR, xxxSGD—the xxx part can be any currency.

(2) Chart used: Daily chart (D1) only

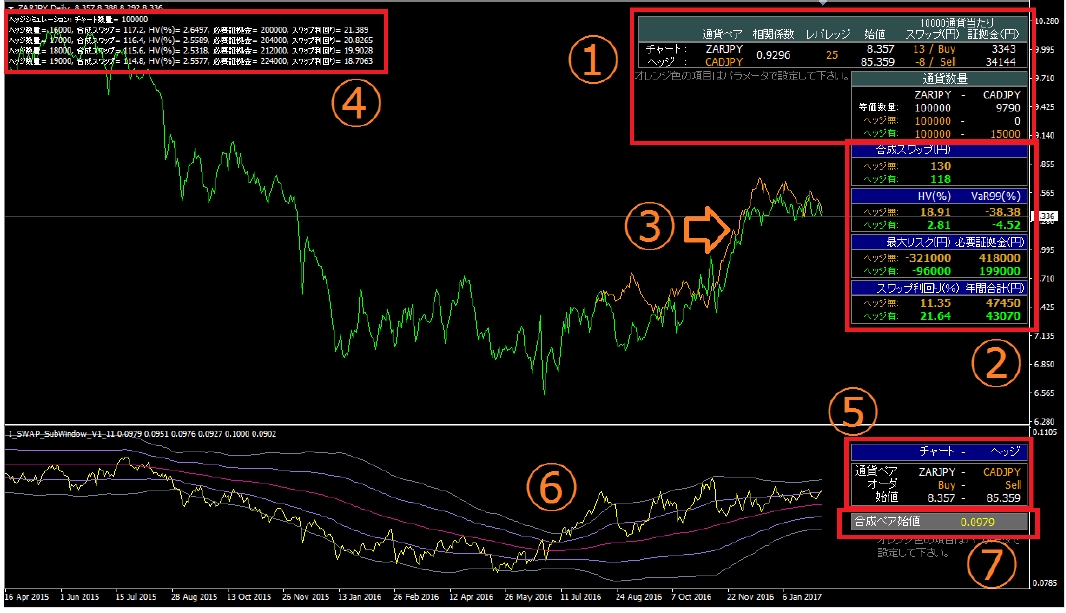

① Parameter setting items and calculation results (orange display shows the parameter settings)

・Currency pair display: shows the chart currency pair and the hedge currency pair names configured by the parameters

・Correlation coefficient: correlation between the chart currency pair and the hedge currency pair over the period specified by the PastBars parameter.

・Correlation calculation result: the closer to 1, the more similar the movements; if you long one and short the other, price changes cancel and hedge effects are expected.

・If the movement is opposite, the hedge effect can be expected by buying both or selling both.

0 near indicates weak correlation and hedge effects cannot be expected.

・Leverage: displays the leverage specified by the leverage parameter. Used in margin calculations.

・Opening price: the day's opening price for each currency pair. Used in margin calculations.

・Swap: configured swap points per 10,000 units (in yen)

・Margin: calculated from the opening price and leverage, converted to yen per 10,000 units

・Equivalent quantity: the hedge currency pair quantity that is equivalent to the quantity set for the chart currency pair

・No hedge: value when operating with only the chart currency pair displayed

・Hedge on: value when operating by combining the chart currency pair and the hedge currency pair

② Risk calculation results

・Synthetic swap: daily swap points (in yen) displayed

・HV(%): Historical volatility calculation result (percent), standard deviation of annual price variation

A smaller value indicates lower price fluctuation, making it suitable for swap operations.

・VaR99(%): Value at Risk (99%) calculation result. The annual variation is expected to be at or below this value with 99% probability. If following a normal distribution, it is shown as a negative value.

Thus, the smaller the negative value, the lower the risk.

・Maximum risk (yen): The maximum risk calculated from currency quantity, VaR99, and the day's opening price.

It is believed that the annual loss at 99% probability will be less than or equal to this value. Shown as a negative value.

Thus, the smaller the negative value, the lower the risk management approach.

Note: A minimum risk is assumed to be 3% of the yen-converted rate multiplied by the currency quantity.

・Required margin: The result of adding a 20% cushion to the maximum risk and adding the margin for the currency quantity.

(in yen) Even if the maximum risk loss occurs, the margin remains at 100% or more, preventing a forced loss

caution. The amount is such that margin calls do not occur. The smaller, the lower the risk hedge.

・Swap yield(%): (annual swap total / required margin) × 100, not accounting for FX fluctuations

This is the yield from swaps alone. The larger, the more efficient the operation.

・Annual total: annual total calculated from the configured swap points (in yen)

③ Overlay of hedge currency pair price charts.

They are scaled so that opening prices align to the same value.

If the correlation coefficient is negative, it is displayed inverted.

④ Simulation results display

If the Sim parameter is true, it shows the risk calculation results for a case where the hedge currency pair quantity is increased by four steps according to the MT4 lot step in use. This reduces the number of recalculations needed to find a hedge quantity with high hedging effectiveness.

⑤ Sub-window settings display:

Shows the hedge currency pair, Buy/Sell classification, and opening price in the sub-window indicator, and you can review the settings.

⑥ Technical display of the synthetic currency pair

:Opening price, moving average, Bollinger Bands of the currency pair synthesized via hedging

will be shown. You can consider entry/exit of positions.

⑦ Display of the synthetic currency pair opening price

:Today's opening price of the synthetic currency pair.

【Usage example】

Data as of 2017.2.4 using HedgeGo for ZARJPY yields the following results.

FX company: YJFX, Leverage: 25x, Chart currency pair: ZARJPY (South African Rand / Yen), Currency amount: 100000,Swap points: 13 yen

Unhedged (ZARJPY alone) HV(%)=18.96, Required margin=422,000 yen, Swap yield=11.24%

Correlation coefficient calculation bars: 130 (about six months) results

■CHFJPY sell, quantity=16000, swap=26 yen, correlation=0.9460, HV(%)=1.97,Required margin=178,000, swap yield=35.19%

■EURJPY sell, quantity=15000, swap=11 yen, correlation=0.9268, HV(%)=2.25, required margin=209,000, swap yield=25.58%

■CADJPY sell, quantity=15000, swap=-8 yen, correlation=0.9293, HV(%)=2.81, required margin=201,000, swap yield=21.43%

■USDJPY sell, quantity=11000, swap=-19 yen, correlation=0.9266, HV(%)=2.91, required margin=205,000, swap yield=19.42%

■GBPJPY sell, quantity=6000, swap=-14 yen, correlation=0.7836, HV(%)=5.94, required margin=294,000, swap yield=15.10%

■EURUSD buy, quantity=10000, swap=-34 yen, correlation=-0.8650, HV(%)=4.34, required margin=289,000, swap yield=12.12%

HV: Historical volatility,

Required margin: VaR(99%) maximum risk (the annual loss is within this amount with 99% probability) plus a 20% cushion, added to the total margin for the 100,000 ZARJPY and hedge currency pair quantities in yen. Even if the maximum risk occurs, the margin remains at 100% or more, preventing forced liquidation.

Swap yield: ratio of annual swap total to required margin, ignoring currency movements

If you short 16,000 CHFJPY as a hedge, the required margin becomes less than half of operating ZARJPY alone, and swap yield improvements of over 20% are expected.

(However, this is based on the past half-year correlation; long-term CADJPY hedges are more stable.)

With this indicator that eliminates the need for tedious calculations, let's perform swap operations safely and efficiently!

A swap-based annual yield over 30% is amazing!

Supported by financial engineering for swap operations!

¥4,500