KML Portfolio 3rd Edition — Half-Price Campaign on EA Set Sales Underway

KML, the developer of popular EAs such as 'Scalping Capybara' and 'Estoc GBPUSD M15', has his EAs on sale as a set.

They are high-performance EAs on their own, but when you build a portfolio, you can expect even greater synergy.

This set product changes the EA combinations weekly, and I would like to detail exactly what kind of portfolio each combination forms.

■Week 2 Set

【Estoc GBPUSD M15】

【Scalping Penguin】

【Martingale Impala】

This is on sale until May 11, 2019. Let's review the portfolio forward and backtest analyses.

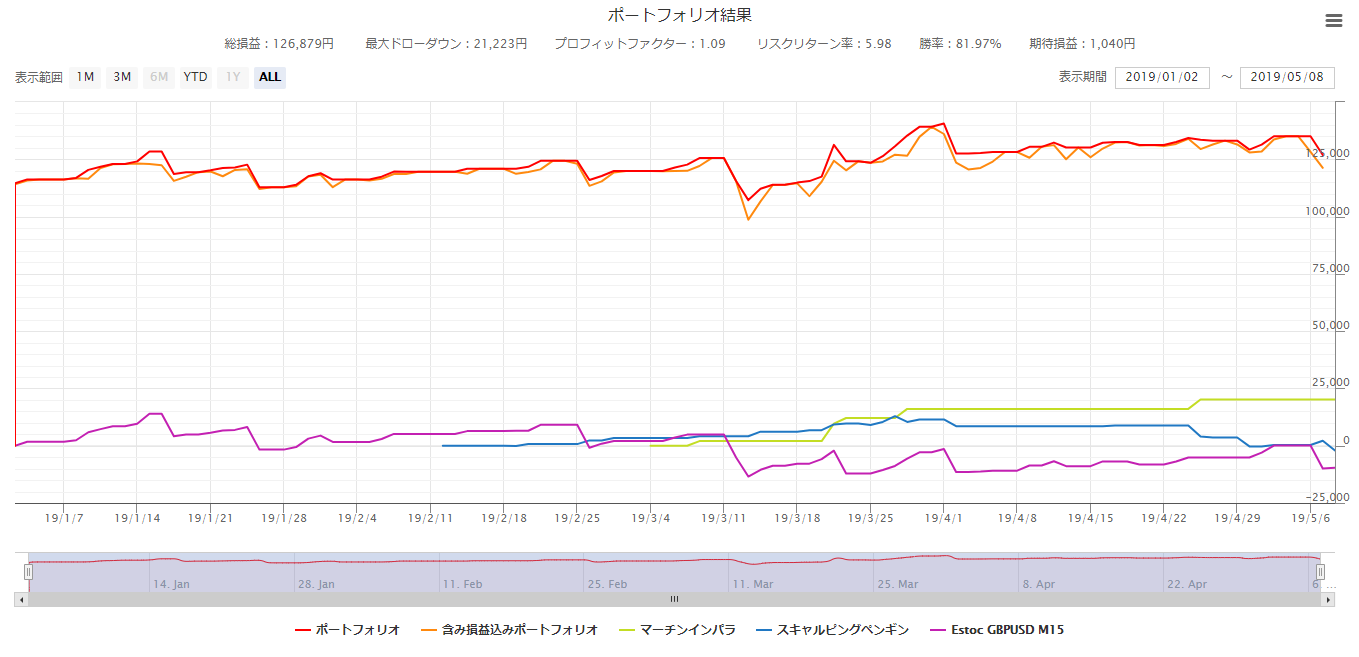

●Forward Analysis

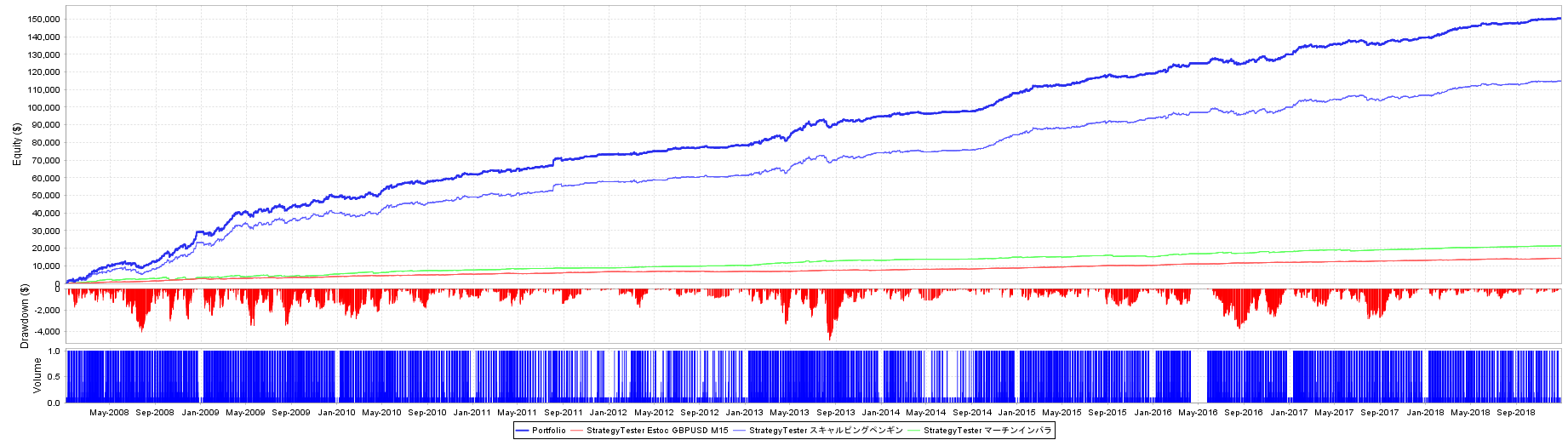

●Backtest Analysis

Annual P/L

Forward is fixed at 0.1 lots, with a maximum drawdown of 21,223 yen and a net profit of 126,879 yen; the risk-reward ratio is about 6, and the portfolio performs well. The win rate is about 80%, making it an excellent portfolio.

Looking at the backtest, the graph shows a large drawdown in September 2013, but the annual return graph shows 2013 performed well. The entire 11-year period also remains stable without losses.

■3rd Week Set

【Gram USDJPY M15】

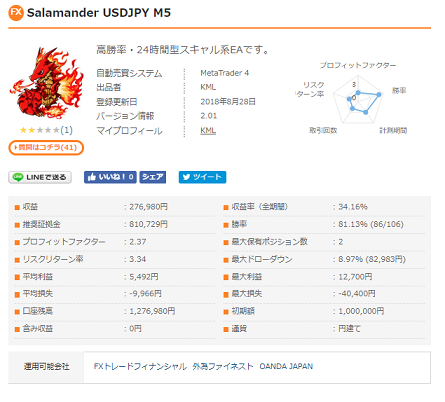

【Salamander USDJPY M5】

【Scalping Panda】

【Scalping Mole】

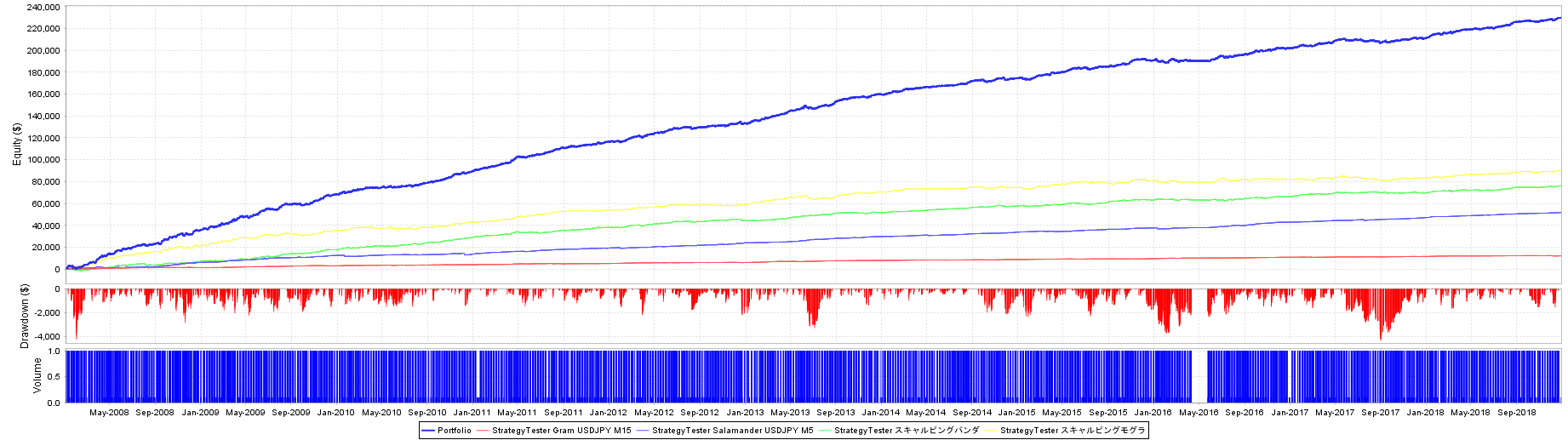

This EA set is scheduled for release on May 13. Let's look at the forward and backtest analyses.

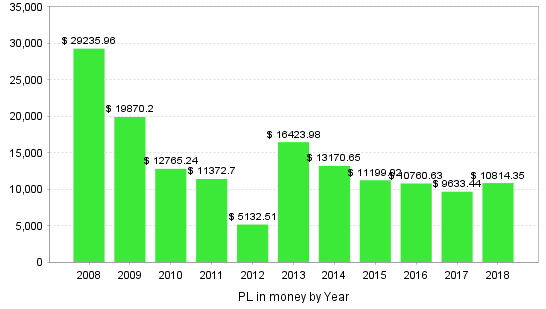

●Forward Analysis

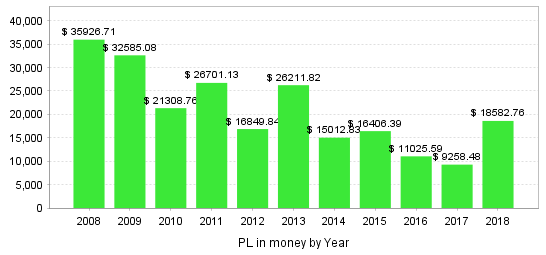

●Backtest Analysis

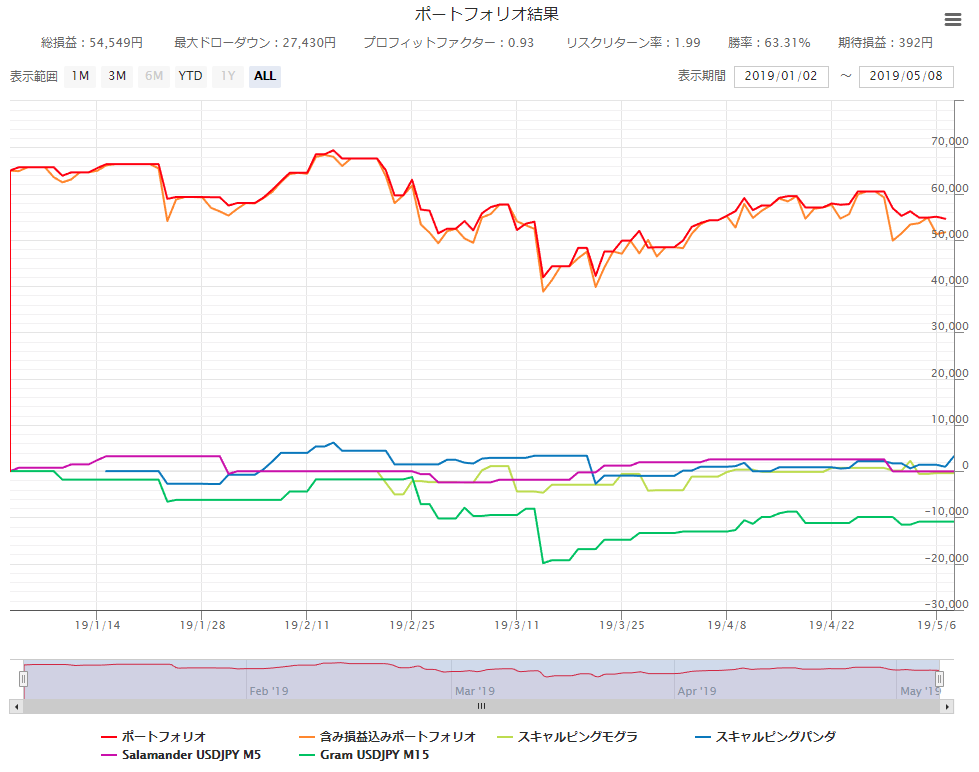

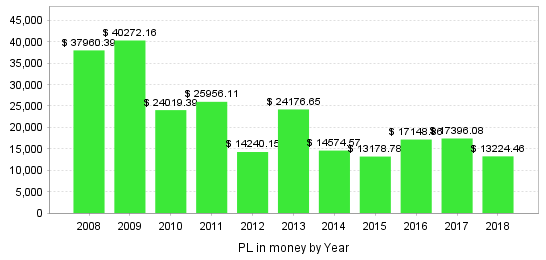

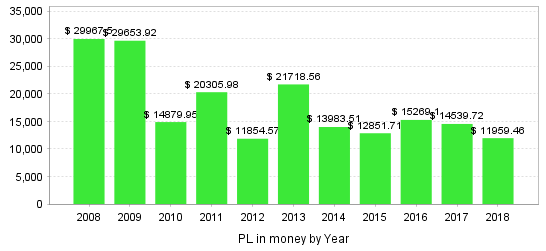

Annual P/L

Forward is fixed at 0.1 lots, with a maximum drawdown of 27,430 yen and a net profit of 54,549 yen.

The backtest shows no losses since 2008. The forward performance is currently not favorable, but based on the backtest results, a swift recovery is expected.

■4th Week Set

【Scalping Capybara】

【Undine EURUSD M5】

【Martingale Owl】

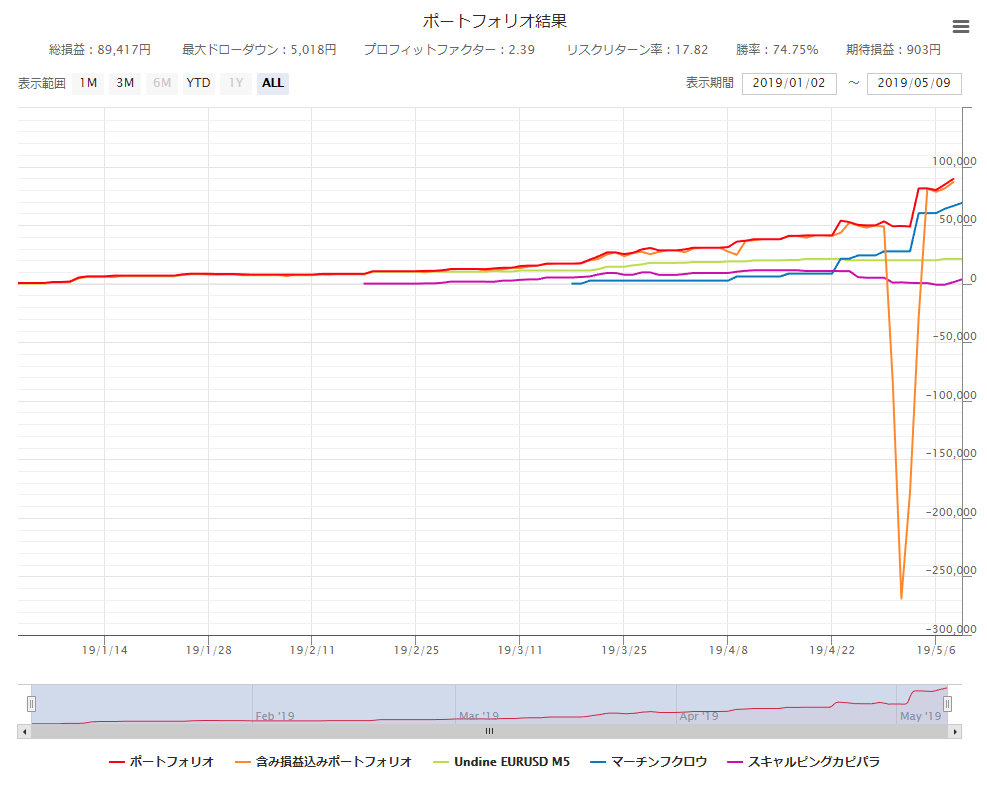

This EA set is scheduled for release from May 20. Let’s quickly review the forward and backtest.

●Forward Analysis

●Backtest Analysis

Annual P/L

Forward is fixed at 0.1 lots, with a maximum drawdown of 5,018 yen and a net profit of 89,417 yen. The profit factor is 2.39 and the risk-reward ratio is an impressive 17.82. The win rate is around 75%, which is high.

The backtest shows occasional steep drawdowns, but profits are taken accordingly. The annual results are stable and show substantial profits, which is appealing.

Compared with forward and backtest results, this seems to be an ideal portfolio.

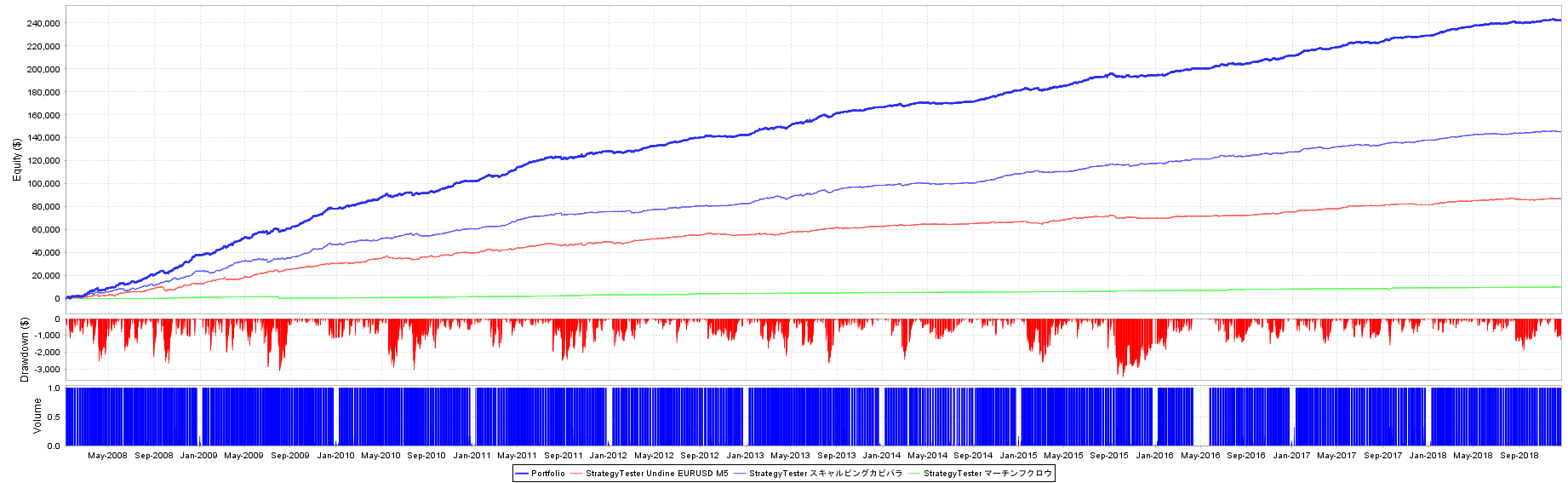

■5th Week Set

【Salamander USDJPY M5】

【Scalping Capybara】

Finally, the last week of May, an EA set scheduled for release from May 27. How will the forward and backtest results look?

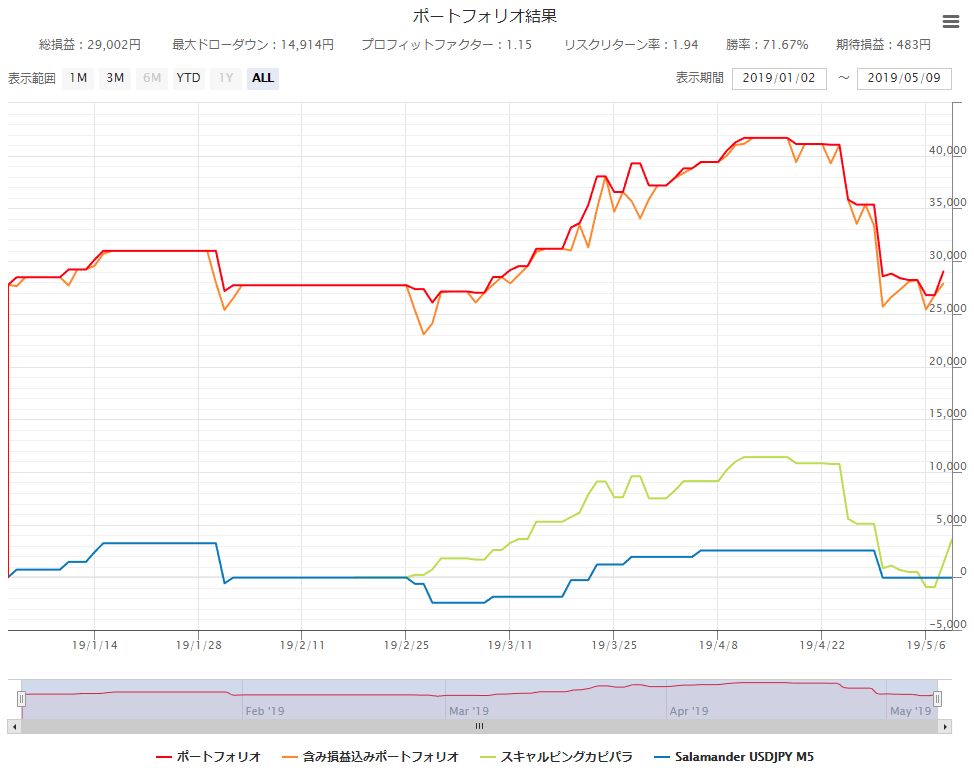

●Forward Analysis

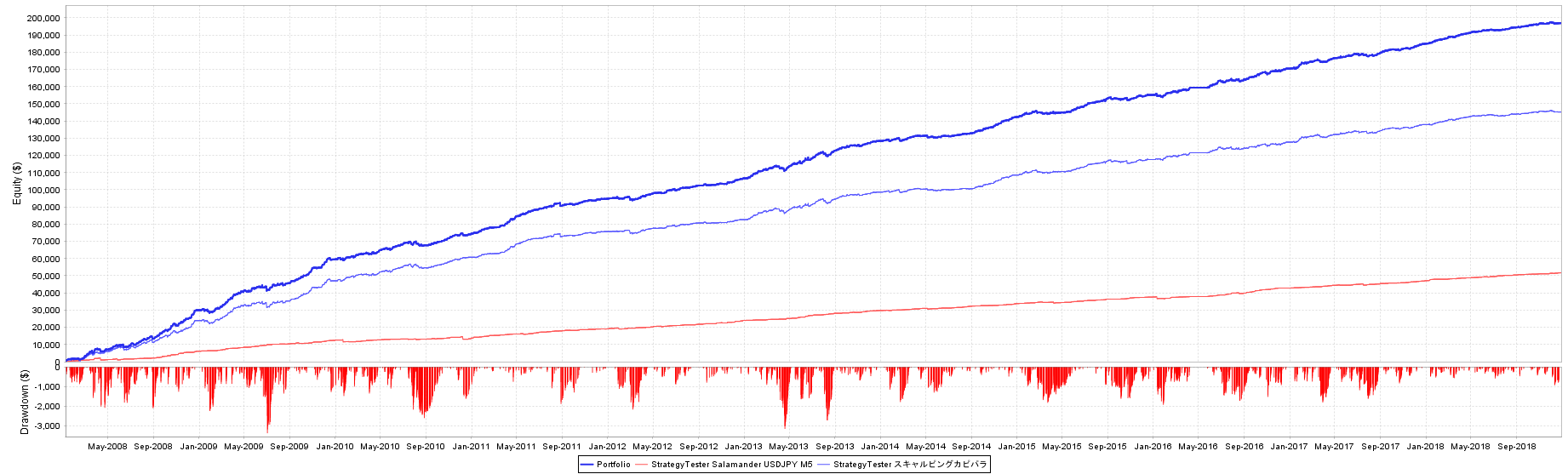

●Backtest Analysis

Annual P/L

Forward is fixed at 0.1 lots, with a maximum drawdown of 14,914 yen and a net profit of 29,002 yen. The win rate is about 71%, which is favorable.

Looking at the backtest, the annual results remain stable as well.

【Summary】

All portfolio sets appear to be able to generate stable profits.

The reason is that KML's EAs are reliably stable, after all.

Since there are many excellent EAs even on their own, why not consider using them as part of this campaign?

KML Portfolio – Part 3!!