Brings the voice of Toki's Whale Wave to the allies you have formed, 'Kujira Sukyaru'

EUR/JPY 1-Position Scalping

Low drawdown, simple logic

Testing by building a portfolio with popular EAs as partners

【Kujira Scalper Overview】

Currency pair:[EUR/JPY]

Trading style:[Scalping]

Maximum number of positions:1

Used timeframe:5-minute chart

Maximum stop loss:100

Take profit:10

This is a simple EA for a single position targeting EUR/JPY.

Forward performance is still in the early stages, but even now the win rate and PF are strong, making for a good start.

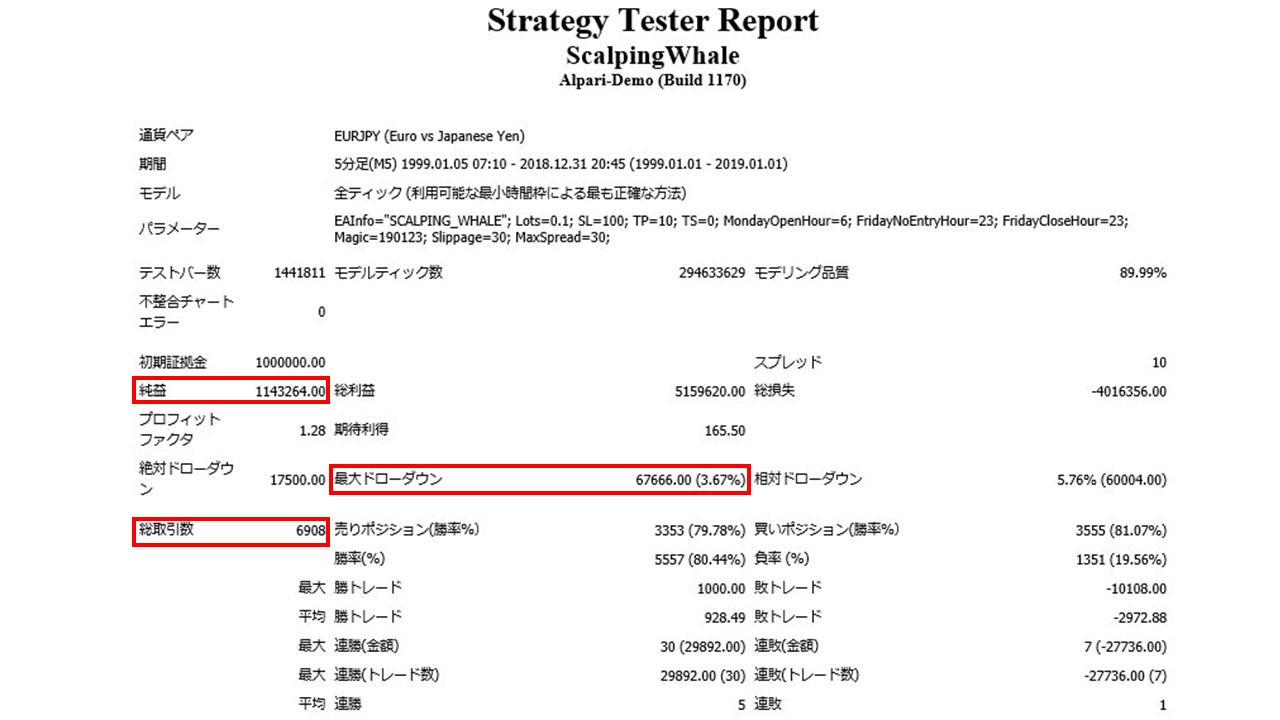

【Backtest Analysis】

Let's look at the backtest results.

1999.01.01‑2019.01.01

Spread 1.0

Fixed 0.1 lot

Net profit +1,143,000 yen (Annual average 57,000 yen)

Maximum drawdown −67,000 yen

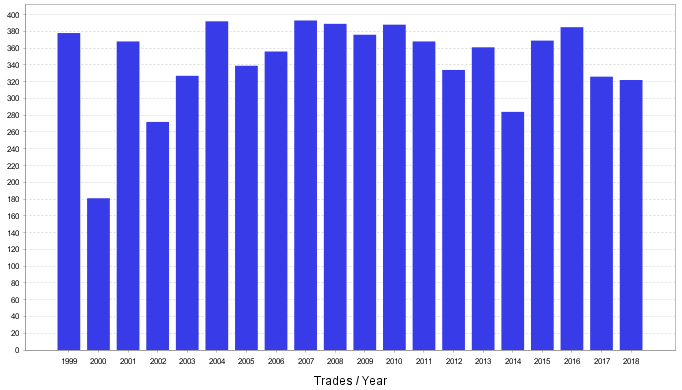

Total trades 6,909 (Annual average 345)

Win rate 80.44%

The win rate is high, and the total number of trades is relatively high.

Recommended margin amount is fixed at 0.1 lots

5+(6.7×2)=18.4(十万円)

Even with 20 years of backtesting, the drawdown is low and excellent, but for conservative operation, starting around 190,000 yen is recommended.

The expected annual return in this case isapproximately31%.Average gained pips are1.7 pips.

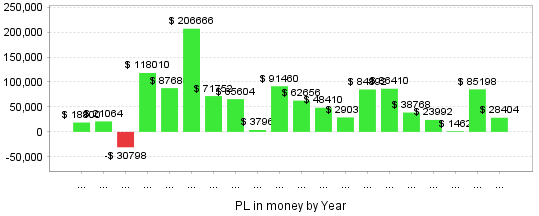

Yearly earnings.

There was only one year (2001) with a loss in earnings over the years.Looking at annual trade counts, the last 10 years show fewer fluctuations, and the average appears high and stable.

There are years with lower profits, but as it is a single-method strategy, misfits occur roughly once every ten years.

In such cases, we'd like to compensate by constructing a portfolio with other EAs.

Annual trades.

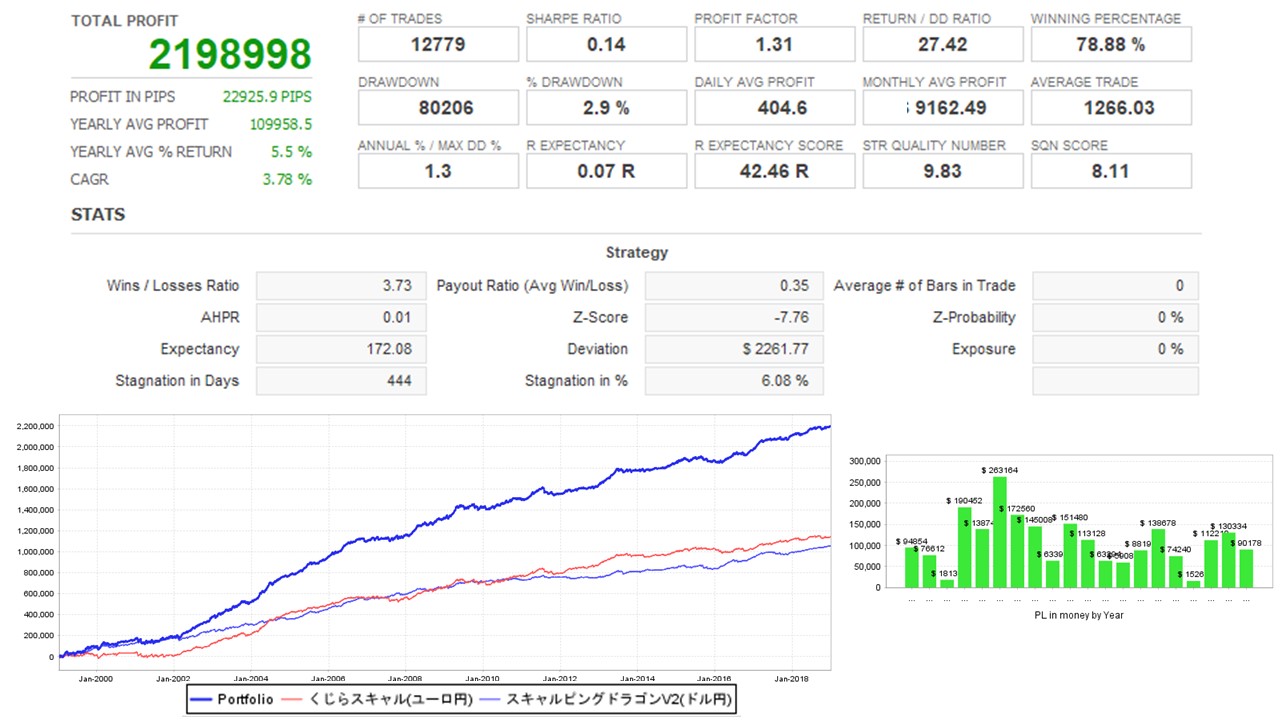

Portfolio Analysis

Using other EAs from the seller FX Noble, we'll build and analyze a portfolio with different currency pairs.We will use 'Scalping Zeus' for GBP/USD and 'Scalping Dragon V2' for USD/JPY.Both are scalping EAs of the same type as Kujira Scalper and use a 5-minute timeframe for their combinations.The analysis environment for both EAs is yen-denominated, fixed at 0.1 lot, spread 10, and a 20-year period.(1)&Scalping ZeusScalping ZeusZeus supports multiple currency pairs, and the advantage is more options for combinations with major currencies.This time Kujira Scalper targets EUR/JPY, so we built a portfolio with GBP/USD to avoid overlapping currency pairs.Kujira Scalper on its own yielded about 500,000 yen more net profit.A notable point is that the maximum drawdown was 74,000 yen, and it barely increased from Zeus alone.Because the currency pairs do not overlap, they are less affected by common market swings and function as a risk hedge.Kujira Scalper’s extremely low maximum drawdown is a strength, so if drawdown impact is small, forming a portfolio to seek higher profits is a better option.(2)&Scalping Dragon V2Scalping Dragon V2A high-frequency USD/JPY popular EA with excellent performance.With this combination, you can consolidate the settlement currency in yen, simplifying money management.In terms of net profit, it nearly doubles the profit of Kujira Scalper alone.As the charts of both EAs overlap on the bottom-left, since both involve yen, the profit/loss waves where the logic works are amplified.The year 2001, which was a loss for Kujira Scalper alone, turned positive here (bottom-right).On the other hand, the maximum drawdown also increased by about 1.2–2 times. If the points where profits grow overlap, the points where losses occur can overlap too, so be careful with the total number of positions and money management for the EAs you run together.Roughly speaking, both portfolios turn out quite well.I think you can also confirm the differences depending on the EAs you combine. Both of the two partners here are popular EAs, so many may have already purchased them. Consider adding Kujira Scalper as well to strengthen your portfolio.Kujira Scalper

We will use 'Scalping Zeus' for GBP/USD and 'Scalping Dragon V2' for USD/JPY.

Both are scalping EAs of the same type as Kujira Scalper and use a 5-minute timeframe for their combinations.The analysis environment for both EAs is yen-denominated, fixed at 0.1 lot, spread 10, and a 20-year period.

(1)&Scalping Zeus

Zeus supports multiple currency pairs, and the advantage is more options for combinations with major currencies.

This time Kujira Scalper targets EUR/JPY, so we built a portfolio with GBP/USD to avoid overlapping currency pairs.

Kujira Scalper on its own yielded about 500,000 yen more net profit.

A notable point is that the maximum drawdown was 74,000 yen, and it barely increased from Zeus alone.Because the currency pairs do not overlap, they are less affected by common market swings and function as a risk hedge.

Kujira Scalper’s extremely low maximum drawdown is a strength, so if drawdown impact is small, forming a portfolio to seek higher profits is a better option.

(2)&Scalping Dragon V2

A high-frequency USD/JPY popular EA with excellent performance.

With this combination, you can consolidate the settlement currency in yen, simplifying money management.

In terms of net profit, it nearly doubles the profit of Kujira Scalper alone.

As the charts of both EAs overlap on the bottom-left, since both involve yen, the profit/loss waves where the logic works are amplified.The year 2001, which was a loss for Kujira Scalper alone, turned positive here (bottom-right).

On the other hand, the maximum drawdown also increased by about 1.2–2 times. If the points where profits grow overlap, the points where losses occur can overlap too, so be careful with the total number of positions and money management for the EAs you run together.

Roughly speaking, both portfolios turn out quite well.

I think you can also confirm the differences depending on the EAs you combine. Both of the two partners here are popular EAs, so many may have already purchased them. Consider adding Kujira Scalper as well to strengthen your portfolio.