Zaif begins Bitcoin margin trading with up to 7.77x leverage and no maintenance margin requirement

Bitcoin Exchange “Zaif” has started offering “margin trading” that allows trading even when you do not hold cryptocurrency (digital currencies) in your account.

What is Zaif's margin trading?

Zaif's margin trading is a cryptocurrency trading that allows leverage up to 7.77x by depositing Japanese yen as well as BTC, XEM, and MONA as collateral.

● Trade using leverage with a fixed amount of collateral

● Leverage can be chosen from multiple levels

Leverage up to 7.77x

When leverage is 7.77x, you can trade up to 1,000,000 JPY worth starting from a 130,000 JPY margin.Using leverage can amplify investment effects, but losses can also be larger if the market moves against you, so proper capital management is required.

Leverage can be selected as 1x / 2.5x / 5x / 7.77x to suit your trading style.

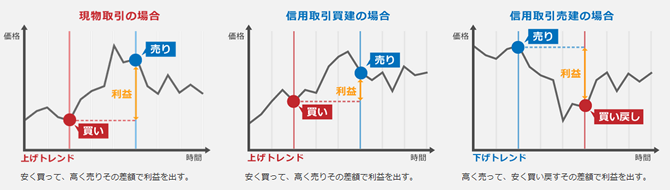

Comparison of Spot Trading and Margin Trading

You can start with a “sell (short)”

In spot trading, you buy when market price is low and sell when it rises to gain profit.

In margin trading, you can trade not only by “buy (long)” but also by “sell (short)”; you can profit by selling cryptocurrency you do not hold when the price is high and buying back when it drops.

No additional margin call

In Zaif's margin trading,there is no request for additional collateral (so-called margin call), and users will not be required to bear more than their deposited balance (JPY BTC XEM MONA) in their account.Zaif charges a fee equivalent to 0.7% only when users realize profits at settlement in margin trading (※ not required when leverage is 1x).

Even in cases where losses at settlement exceed the deposited funds due to sudden market moves, this fee collection enables a no-margin-call service, so users can trade with peace of mind within their account balance.

Limit and stop orders

Limit orders to take profitandStop orders to limit lossescan be placed as desired. Margin trading offers high returns but also higher risks, so it is advisable to set stop orders when possible.

× ![]()