Nanpin EA that floods the AUDCAD market with positions "NanpinDrug"

Rich parameters and customizable to your liking

Using the AUD/CAD market with narrow price range fluctuations

Nanpin-type EA with up to 30 positions

【NanpinDrug概要】

Currency pair:[AUD/CAD]

Trading style:[Scalping][Day trading][Swing trading]

Maximum positions: 30

Timeframe used: 15-minute chart

Maximum stop loss: 0 (settings adjustable)

Take profit: 0 (settings adjustable)

A nanpin-type strategy that distributes positions with a contrarian logic at points where a price reversal is likely.

It targets AUD/CAD with relatively small long-term price fluctuations, making it a minor currency pair; even with domestic FX brokers,

be sure to check trading conditions such as spreads.

It targets AUD/CAD with relatively small long-term price fluctuations, making it a minor currency pair; even with domestic FX brokers,

be sure to check trading conditions such as spreads.

High customization; not only stop loss and take profit, but also the nanpin lot multiplier can be changed,

and depending on settings it can operate like the Martingale method.

and depending on settings it can operate like the Martingale method.

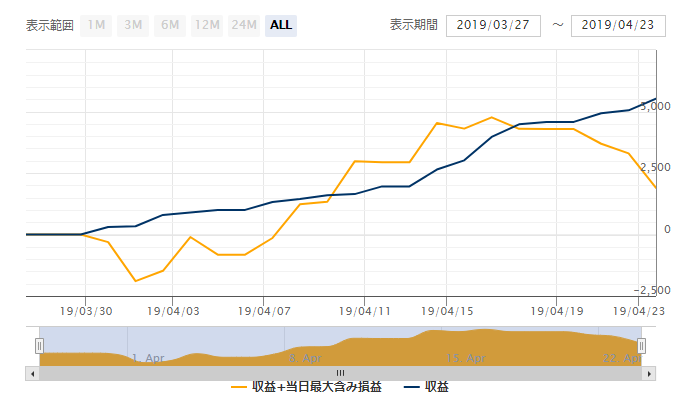

【Forward Performance】

Because it is a nanpin-type, unrealized P/L can diverge from the equity curve, but the equity curve is clearly upward.

Trades are currently performed daily with small profits.

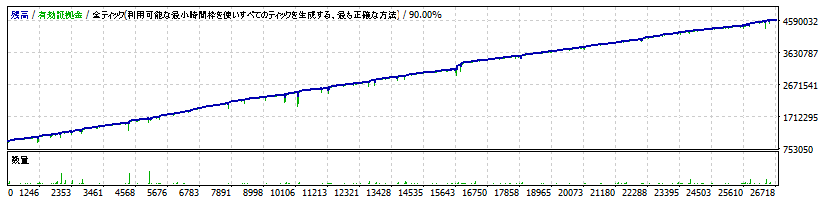

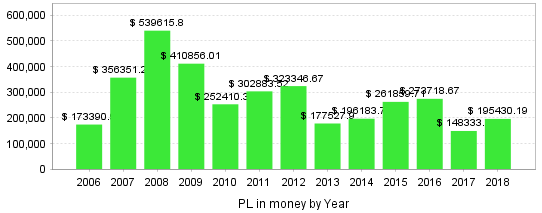

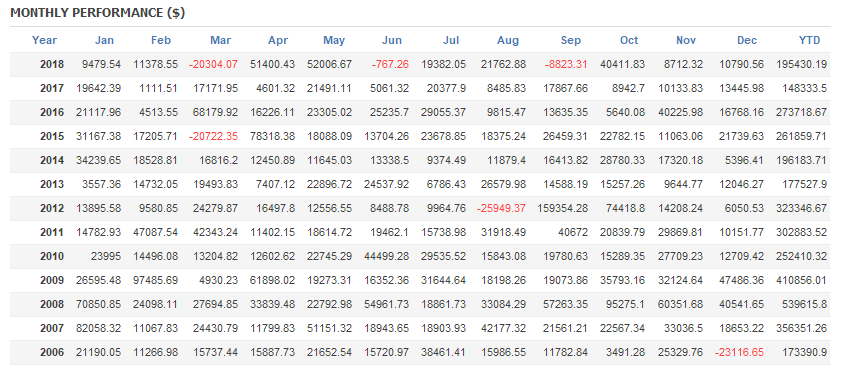

【Backtest Analysis】

13 years of backtesting results are shown. The backtest environment uses default settings and the currency unit is yen.

2006.01.01‑2019.01.01

Spread 30

Net profit +3,611,000 yen (annual average 277,000 yen)

Maximum drawdown ‐495,000 yen

Total trades 26,683 (annual average 2,052)

Win rate 69.52%

PF 1.80

As this is a nanpin EA with a maximum of 30 positions, the number of trades is inevitably high.

It can be assumed that you are always holding several positions.

PF is 1.8In addition to the high PF, both maximum drawdown and relative drawdown are about 20%, keeping losses relatively low.

It can be assumed that you are always holding several positions.

PF is 1.8In addition to the high PF, both maximum drawdown and relative drawdown are about 20%, keeping losses relatively low.

Nanpin tends to accumulate unrealized losses, but due to the AUD/CAD pair's narrow price range and low volatility, even with nanpin the risk of a one-sided loss expansion is limited, and large irrecoverable losses seem to be suppressed.

Conversely, as profits increase, more positions are opened, so there is potential to realize profits before closing.

Conversely, as profits increase, more positions are opened, so there is potential to realize profits before closing.

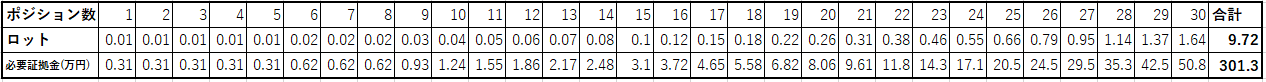

Margin required for nanpin-type EA is important,

NanpinDrug starts with 0.01 lots for the first position, but from the 3rd position onward, the nanpin lot multiplier of 1.2x applies (initial setting; truncating after the 3rd decimal), so with a maximum of 30 positions, the 30th position lot is 1.64, and the total is 9.72 lots (maximum leverage 25x).

Lot progression by nanpin lot multiplier and required margin per position

Therefore, to hold the 30th positionStarting from 0.01 lots, about 3,000,000 yen is required.

The recommended margin for safe operation considering the maximum drawdown is, with 25x leverage

4,003,000 yen

This is about 4 million yen. The expected annual return in this case is6.9%. About 276,000 yen per year on average.

・Trade Analysis

I analyzed parts of the backtest trades to illustrate the EA's behavior clearly.

Blue: Long Red: Short

On March 4, 2013, four short positions opened then incurred unrealized losses as prices rose; as prices rose further, up to 12 positions were added.

The initial four entries were 0.01 lots, but due to the nanpin multiplier, the 10th, 11th, 12th added positions were entered at 0.04, 0.05, 0.06 lots respectively. After the subsequent steep drop, closing all positions together yielded a substantial overall profit.

The initial four entries were 0.01 lots, but due to the nanpin multiplier, the 10th, 11th, 12th added positions were entered at 0.04, 0.05, 0.06 lots respectively. After the subsequent steep drop, closing all positions together yielded a substantial overall profit.

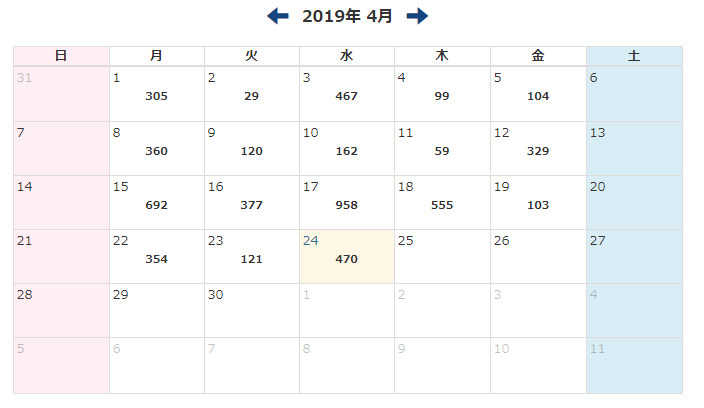

Monthly results show profits in most months as well.

Basically hold until profitable, then use nanpin to reduce drawdown and push positions to a win as far as the account funds can withstand. With high configurability, you can raise the nanpin lot multiplier to recreate nanpin-martingale behavior (requires verification).

A sufficiently large recommended margin is desirable for operation.

With that, under stable money management, a high-frequency trading combined with nanpin-type EA could generate solid profits.

With that, under stable money management, a high-frequency trading combined with nanpin-type EA could generate solid profits.

Nanpin Drug -AUDCAD-

× ![]()