Low-risk, no averaging-down orthodox EA "Infantry with balanced offense and defense -- USD/JPY version"

High safety and steadily building profits

A high-performance EA with compounding feature: “Infantry” -- USD/JPY version

【Infantry: Well-balanced on offense and defense -- USD/JPY version Overview】

Currency pair:[USD/JPY]

Trading style:[Scalping] [Day trading] [Swing trading]

Maximum number of positions: 1(Default setting is 1 position. Freely configurable

Maximum lot size: 1(With compounding feature. Freely configurable))

Used timeframe: M5

Maximum stop loss: 35(Freely adjustable)

Take profit: 0(Uses a stepped trailing stop, there is also a close logic)

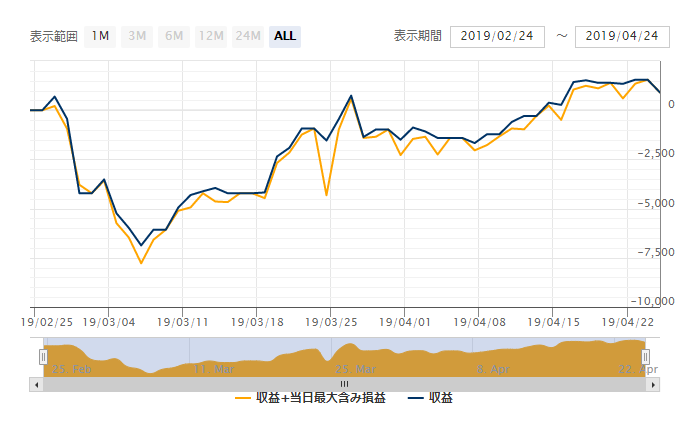

In forward testing for about two months, win rate is 61.11%, and PF is 1.06.

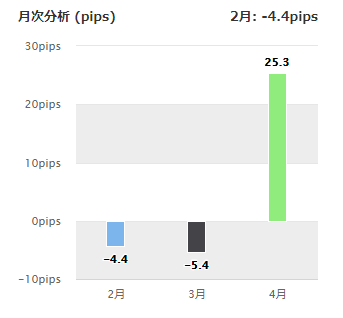

■2019 Monthly Analysis

From the monthly analysis, February and March seemed weak, but April was excellent with 25.3 pips.

Forward results also appeared to be a slow starter, so there is reason to expect better performance going forward.

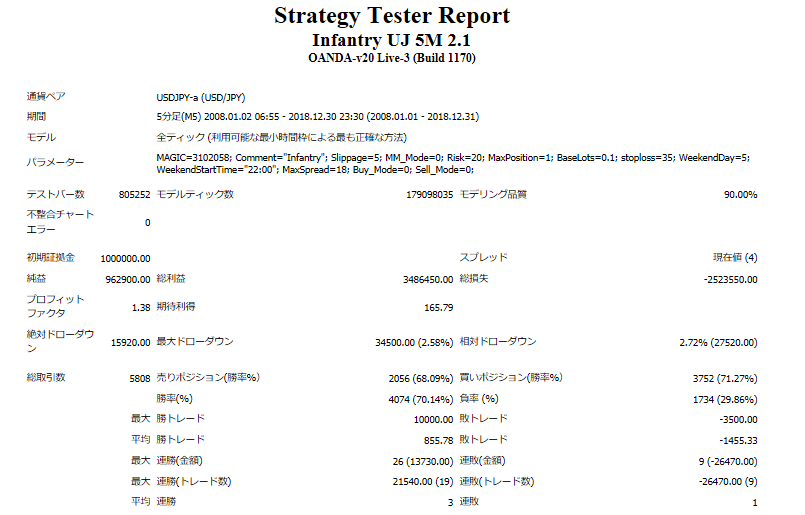

【Backtest Analysis】

■Simple Interest Operation

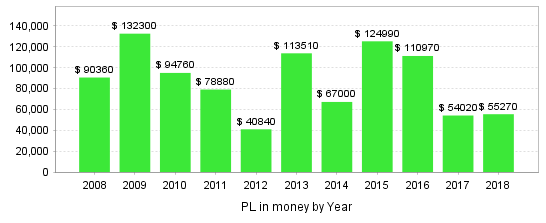

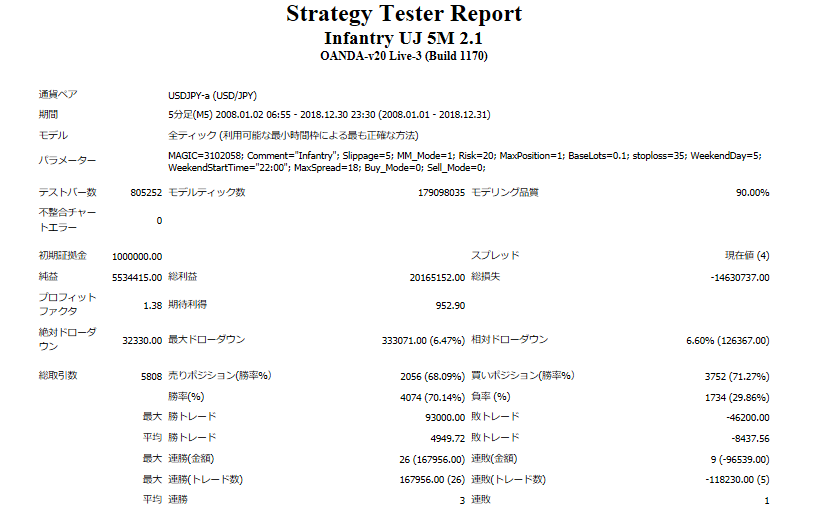

2008.01.01‑2018.12.31

Spread 4

0.1 Lot fixed

Net profit: +963,000 JPY (Annual average 87,000 JPY)

Maximum drawdown: -35,000JPY

Total trades: 5,808 (annual average 528) trades)

Win rate: 70.14%

PF1.38

Trading frequency averages 528 trades per year, and it trades quite frequently, so you won't be frustrated by not taking a position.

Safe operation margin is

4.5(3.5×2).

■

Yearly results show all positive for 11 years. Large drawdowns are rare, and it is very stable.

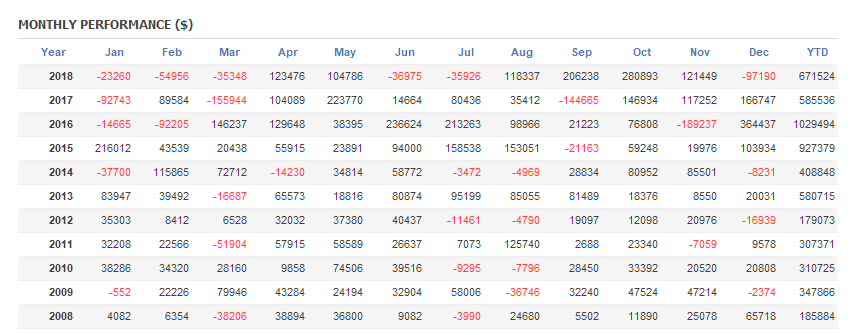

Monthly results show many months with large profits. Notably, May and October have been profitable in all 11 years.

However, there are times when losses can be large, so keep ample margin. Since recoveries happen quickly, you shouldn’t worry unless you hit a margin call.

■

It aims to profit from trend-following in the direction of the trend and contrarian trading in range-bound markets, so let's look at trading examples.

▲ Range market. Red indicates buy and yellow indicates sell. Contrarian entries can be seen.

In an uptrend. Red indicates buy, but trades are conducted in a trend-following manner.

■

Because it includes compounding, I also ran a backtest. It has accumulated about ¥5.5 million in profits over 11 years.

Drawdown is 6.47%, with relatively small losses.

Looking at the monthly view, there are months with large negatives, but it properly recovers and builds profits.

Compounding to aim for rapid profits could also be good.

【Summary】

The maximum stop loss is 35 pips, which keeps risk low. The annual average number of trades is about 600, so using compounding to accumulate profits is recommended. Also, the compounding parameter is the Risk value that determines what percentage of the margin is allocated to holding positions. With 20% in backtests, relative drawdown stays within 10%, leaving room to adjust for potentially higher profits.

It does use counter-trend trading, but it does not employ averaging down, so it is beginner-friendly.

Since the price is affordable, why not try for big profits with low risk?

![[トレンドフォロー]と[レンジ相場スキャルピング]、両方の戦略を兼ね備えた低ドローダウンの1ポジ運用EAーー初売りお試し価格提供中!](https://img.gogojungle.co.jp/products/17029/banners/1/4)