The next-generation EA evolves even further! Rack up profits with EUR/USD "InstaFX Evolution"

AI (Deep Learning) Applied EA Returns with New Logic

Four Independently Operating Logics Deliver Outstanding Stability: The Incredible EA “InstaFX Evolution”

【InstaFX Evolution Overview】

Currency pair:[EUR/USD]

Trading style:[Scalping] [Day Trading]

Maximum positions: (logics bundled)

Maximum lot size:50(

Used timeframe:

Maximum stop loss: (Automatically calculated by the EA internal judgement, 7– 123 pips)

Take profit: (Automatically calculated by the EA internal judgement, minimum 5 pips-)

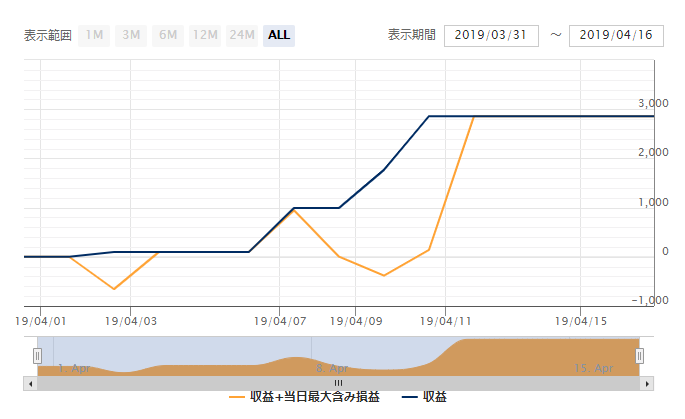

Forward results show a win rate of 83.33% and a PF of 2.59, indicating strong performance. Although the number of trades is still small, profitability when profitable looks quite favorable.

※The product page notes that holding four positions simultaneously is not common. In backtests, simultaneous holdings are typically around two positions at most.

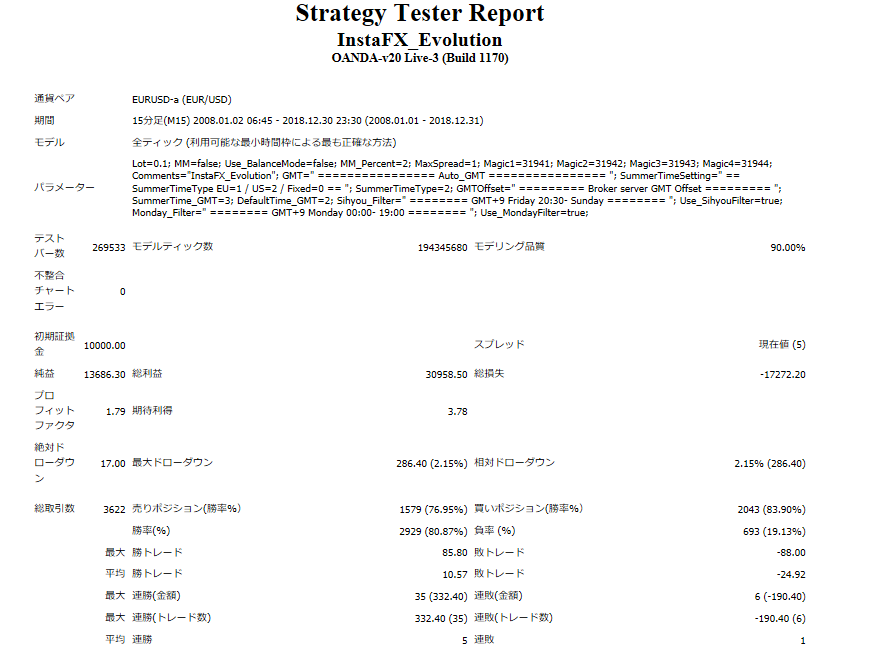

【Backtest Analysis】

2008.01.01‐2018.12.31

Spread 5(0.5 pips)

Fixed Lot 0.1

Net Profit +,000 USD(Annual average $1,400)

Maximum Drawdown –

Total Trades 3,622(Annual average 362)

Win Rate 80

PF1.79

Backtests also show a win rate of 80% with a PF of 1.79, and around 362 trades per year.

Recommended margin is fixed at 0.1 lots

(5.1×4) + (2.86×2) = 26.1 (ten-thousand yen)

With margin considered, 270,000 yen or more is a safe operating target.

The expected annual yield in this scenario is 52%, a figure worth looking forward to.

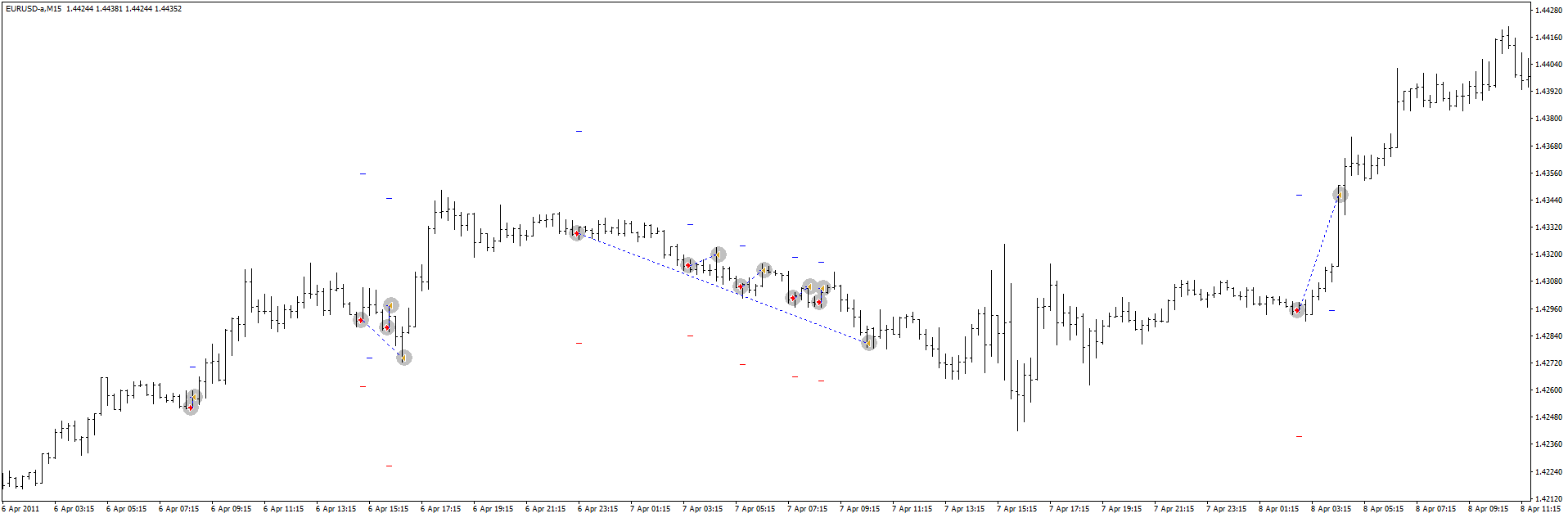

■Trading Image

Entries appear to follow a traditional trend-following approach. While up to four positions can be held, this chart suggests holding multiple positions is uncommon.

This chart shows holding multiple positions. Generally, trading with one or two positions, but if larger profits seem possible, they may go for more than two positions. However, holding four positions is rarely done.

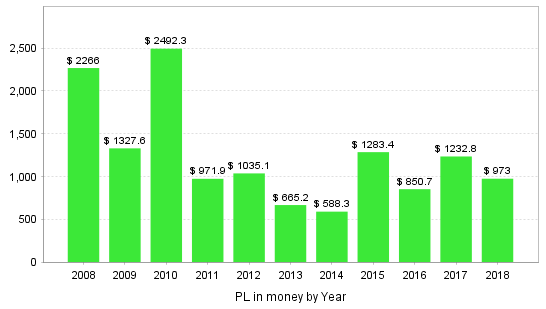

■Yearly and Monthly Profit/Loss

Looking at yearly results, there are no negative years, and profits are steadily earned. Large profits may occur, but major declines are unlikely, which is attractive.

Even monthly, there are few months with large losses. Even when losses occur, they recover quickly, contributing to stable earnings. The lack of strong up/down cycles is likely due to the balance of settings and the EA's logic.

Indeed, the 52% expected annual yield is a major attraction. The currency is EUR/USD, and since the required margin isn't high, it should be approachable for EA beginners to use.

Next, let's focus on the forward results after one year.