With the new works "臥薪嘗胆" and "一本勝ち", assemble a portfolio and aim for 2000 pips per year!?

The '一本勝ち' that achieved 1000 pips in one year forward with one position,

The new set product with 『臥薪嘗胆』 will be released on February 6!

For those who already own '一本勝ち' or are considering purchasing the set product, from the two EAs' performance,

we would like to assess compatibility!

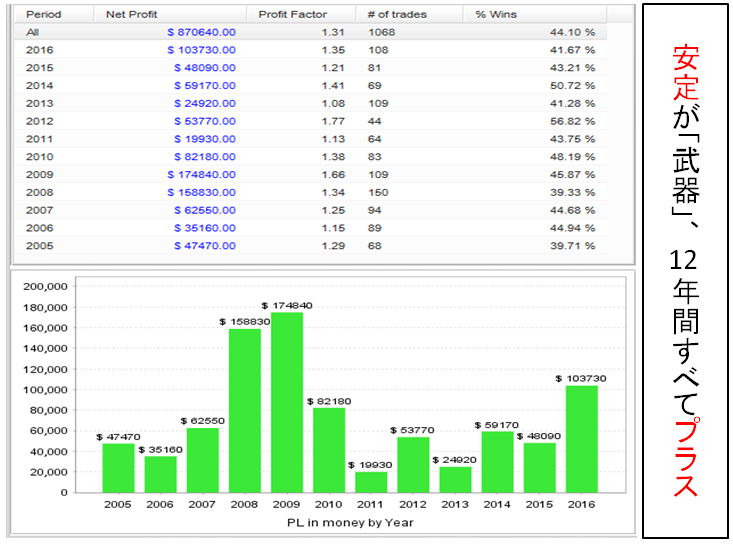

Features of the new 『臥薪嘗胆』

(From backtest data)

No losses over the ten-year period!

Annual trade count ranges from 44 to 150, not very high.

'臥薪嘗胆', as its name suggests, is an EA that patiently waits for a winning opportunity.

Indeed, alone it might feel a bit idle or wasteful, don’t you think?

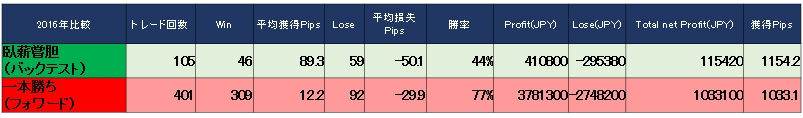

■Comparison between 『臥薪嘗胆』 and 『一本勝ち』 in 2016

So what happens when you compare the set product '一本勝ち' and what if they are run simultaneously? Let’s take a look.

The number of trades is nearly four times higher for '一本勝ち',but the annual gained pips are almost unchanged.

Gashinshōtan's win rate isn't high, but its take-profit is larger than its stop-loss, so even when it loses, there is profit left as an EA.

Conversely, '一本勝ち' has a good win rate, and with an average gain of 12 pips per trade, it wins steadily and earns by the number of trades.

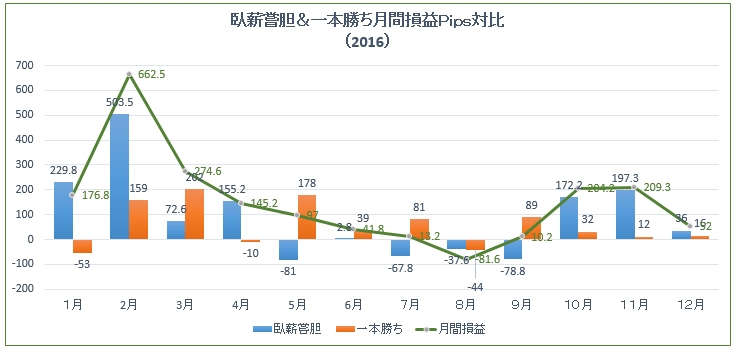

So, if operated simultaneously, what would have happened?

Let's look at 2016 as an example.

Gashinshōtan used backtest data, while '一本勝ち' used forward data.

When comparing the monthly pips gained in 2016, August is slightly negative for both, but

in the other months January, April, May, July, and September, if one is negative, the other exceeds it with higher earned pips, completely covering it.

From the 2016 results, we can determine that running '臥薪嘗胆' and '一本勝ち' simultaneously is advantageous!

The total combined annual pips exceed 2,000 pips!

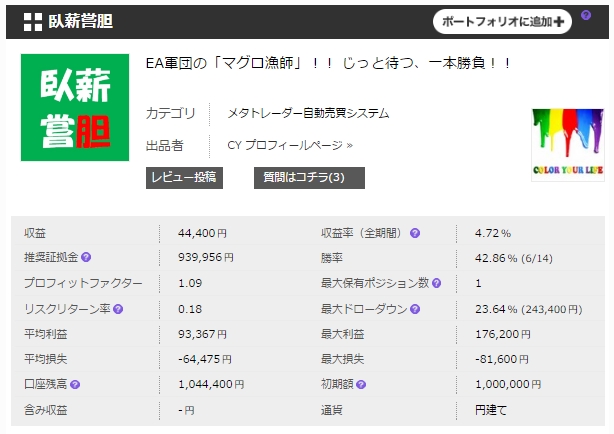

The drawdown to watch is that '一本勝ち' with 1 lot (100,000 units) is 250,100 yen,

The backtest theoretical value is 46,300 yen (463,000 yen for 100,000 units).

Gashinshōtan earned 243,400 yen during the forward testing period; the backtest theoretical value is 72,280 yen (0.1 lot), so for 100,000 units it would be 722,800 yen.

If run concurrently, you would need the account funds to cover the margin for two positions + twice the maximum drawdown + extra funds, so please calculate lot sizes carefully.

If run on a separate account, the recommended margin is listed on fx-on's forward data.

Two 1,000,000-yen accounts would be comfortable, but…

It would be wonderful if 2,000,000 yen becomes 4,000,000 yen in a year!

Written by Tera

× ![]()