With low drawdown, an expected annual return of over 30%! A high cost-performance investment: "STARTIME EURUSD"

Long-term backtest shows virtually unchanged, low drawdown

Even with a single-position operation, the expected annual return exceeds 30% and has attractive cost performance

Current forward performance shows a win rate of75%、PF5.64、and it is on track.

With the maximum of 1 position, the maximum drawdown is not high, so it seems suitable for safe and solid operation.

【STARTIME EURUSDOverview】

Currency pair:[EUR/USD]

Trading style:[Scalping][Day trading]

Maximum positions:

Time frame used:15minutes

Maximum stop loss:50

Using 15-minute EURUSD EA, the maximum stop loss is50in place.

The default maximum positions are1, but can be changed.

MT4 trading hours appear to be from 19:00 to 09:00 the next day.

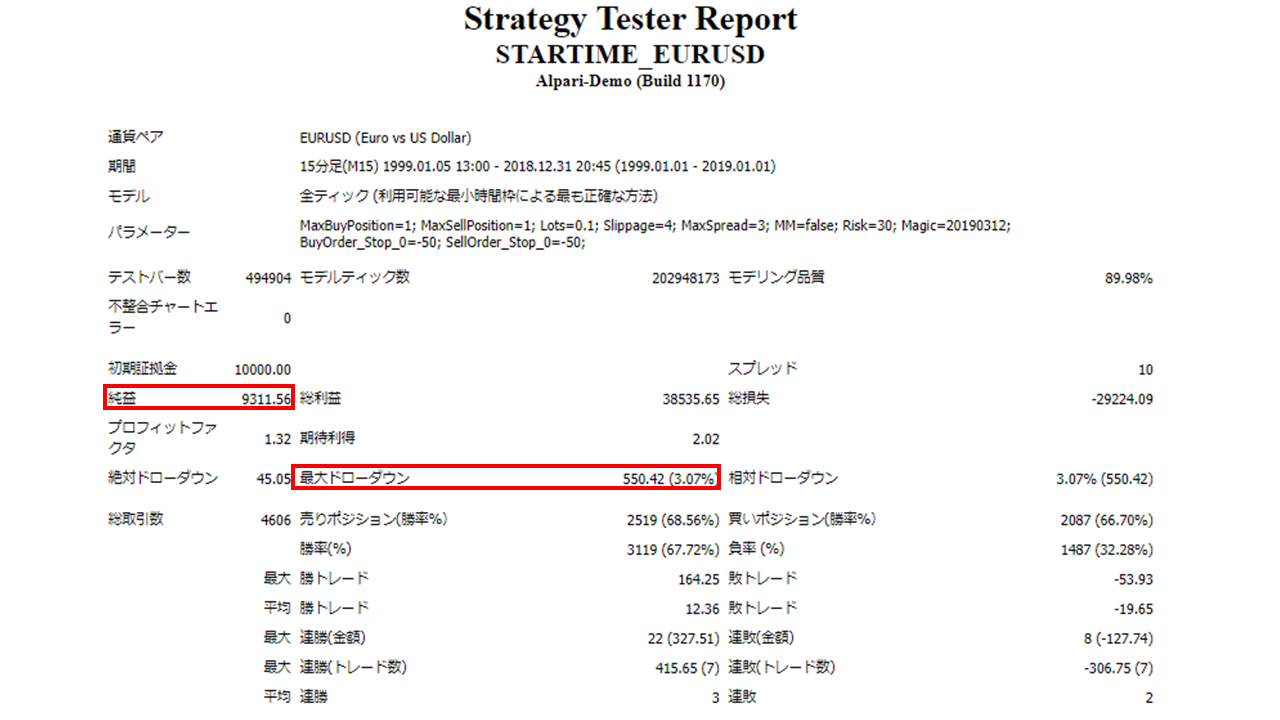

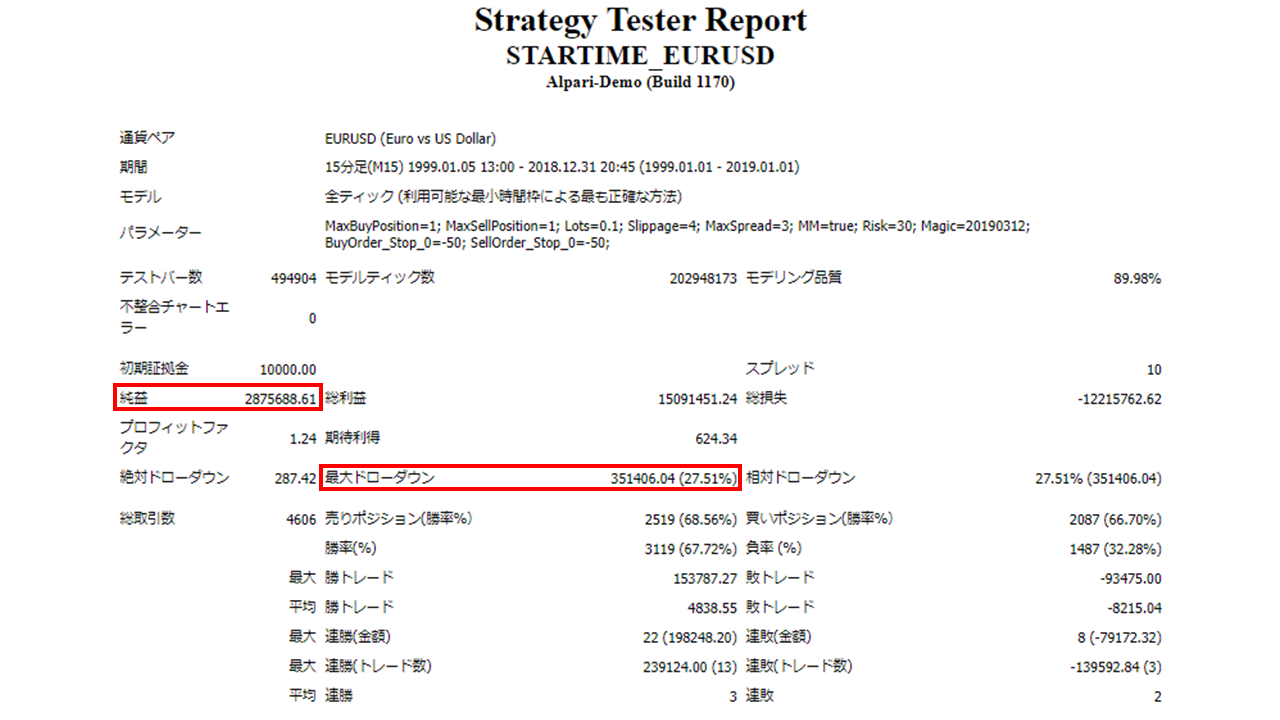

【Backtest Analysis】

ThisEA allows switching between simple interest and compound interest, so let's look at the backtest results for each.

Simple interest operation

1999.01.01‐2019.01.01

Spread 1.0

0.1 lot fixed

Net profit +1.024 million yen (annual average 51,200 yen)

Maximum drawdown −60,000 yen

Total trades 4,606 (annual average 230)

Win rate 67.72%

PF 1.32

Even in a long 20-year backtest, the maximum drawdown is only 60,000 yen, so it seems possible to operate from a small margin.

Recommended margin amount is 0.1 lot fixed, assuming 50,000 yen

5+(6*2)=17(万円)

Therefore, safe operation from as little as 170,000 yen is possible.

The expected annual return in this case is30.1%.

Average gained pips are2.1pips.Maximum stop-loss occurrences were 289 times, making up 6.2% of total..

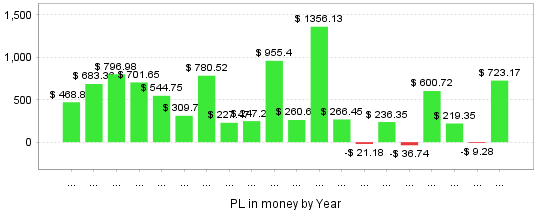

Annual profit/loss

In recent years there were years with losses, and performance fluctuates, but it delivered high profits in 2015 and 2018.

【If you change the number of positions】

Because the maximum number of open positions can be adjusted, consider multi-position scenarios as well.

・Maximum open positions2

Net profit146.1万円

Maximum drawdown7.1万円

Trades6374

Recommended required margin)

Expected annual return30.1%

Even as the number of positions increases, maximum drawdown does not grow much.

As the number of positions increases, profits also rise, but considering the recommended required margin and expected annual return, increasing the number of positions does not necessarily improve cost performance.

With a maximum open positions3, there is no drastic rise in number of trades or net profit as in the change from 1 to 2, and the expected annual return slightly falls. The default maximum positions should be 1, with 2 around the upper limit.

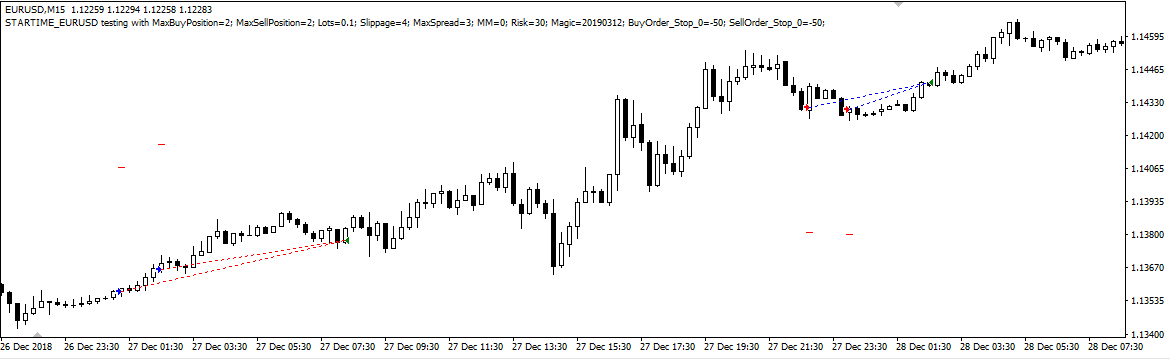

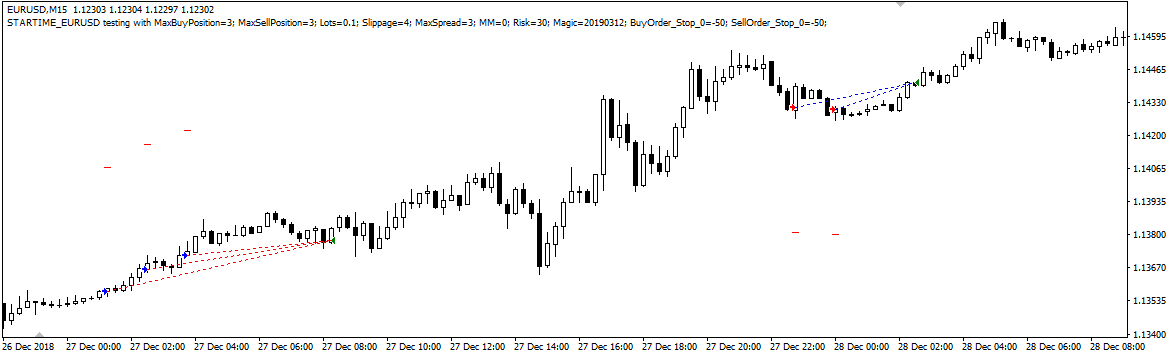

Also, when comparing charts with different maximum open positions at the same time,

・Maximum open positions2

・Maximum open positions3

Because they follow the same logic, entry timing is relatively close even with multiple positions, and settlements often close all positions held at that stage(Left red line: short stop loss, right blue line: long take profit)

From this, in terms of capital efficiency, the number of positions1~2 appears to be optimal.

If you are considering a portfolio with other EAs, operate with a cost-efficient 1-position setup. If you plan to run “STARTIME EURUSD” alone, adjust the number of positions to fit your funds and set accordingly.

Compound interest operation

Now we will look at backtests for compound operation.

Risk settings are up to 30% of the initial capital.30 up to this value.

As expected, compound operation also features low drawdown. With a win rate of67%, you cannot rely on this alone, but with a maximum position count1, compounding trades can be feasibleEA.

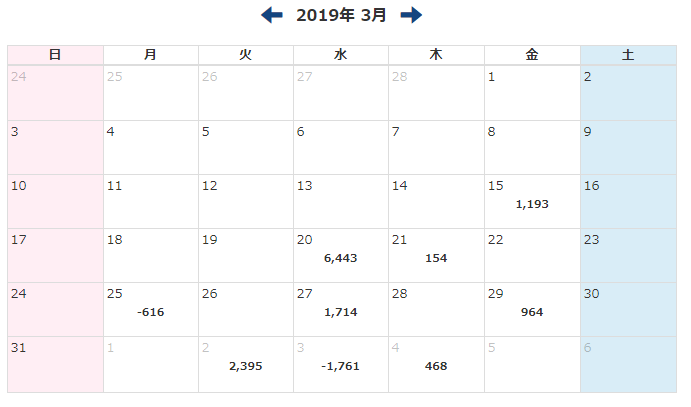

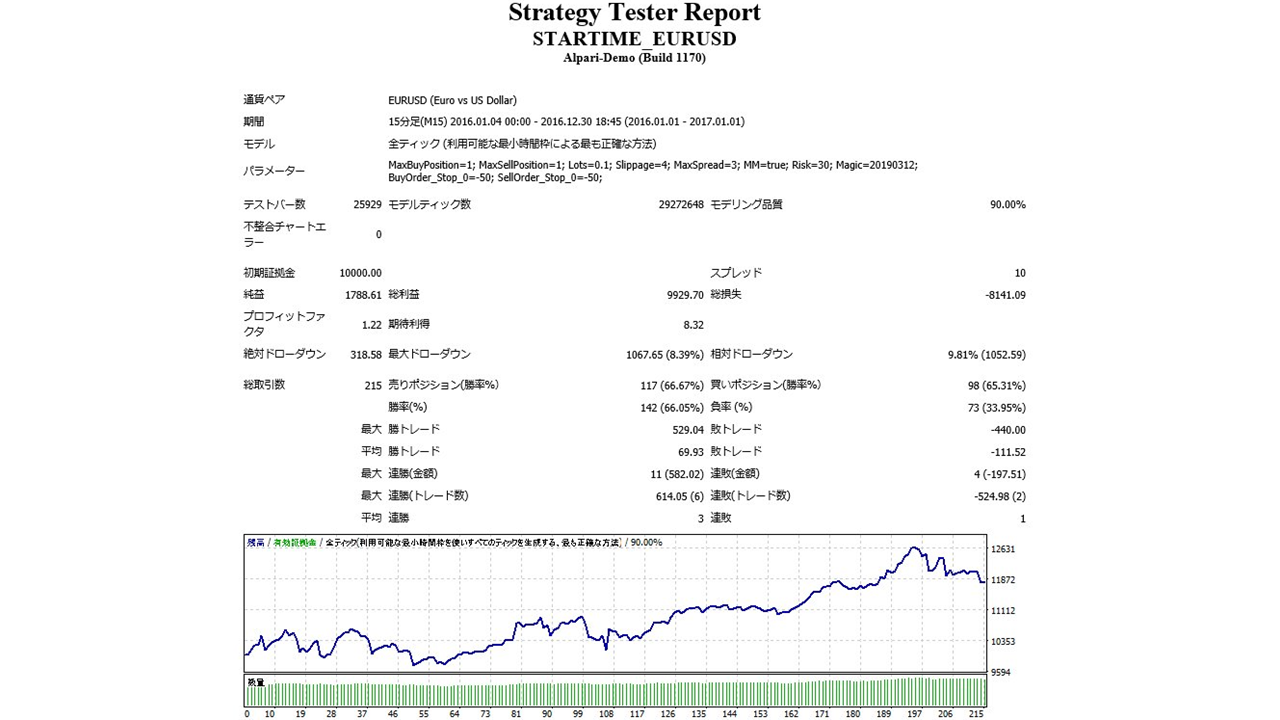

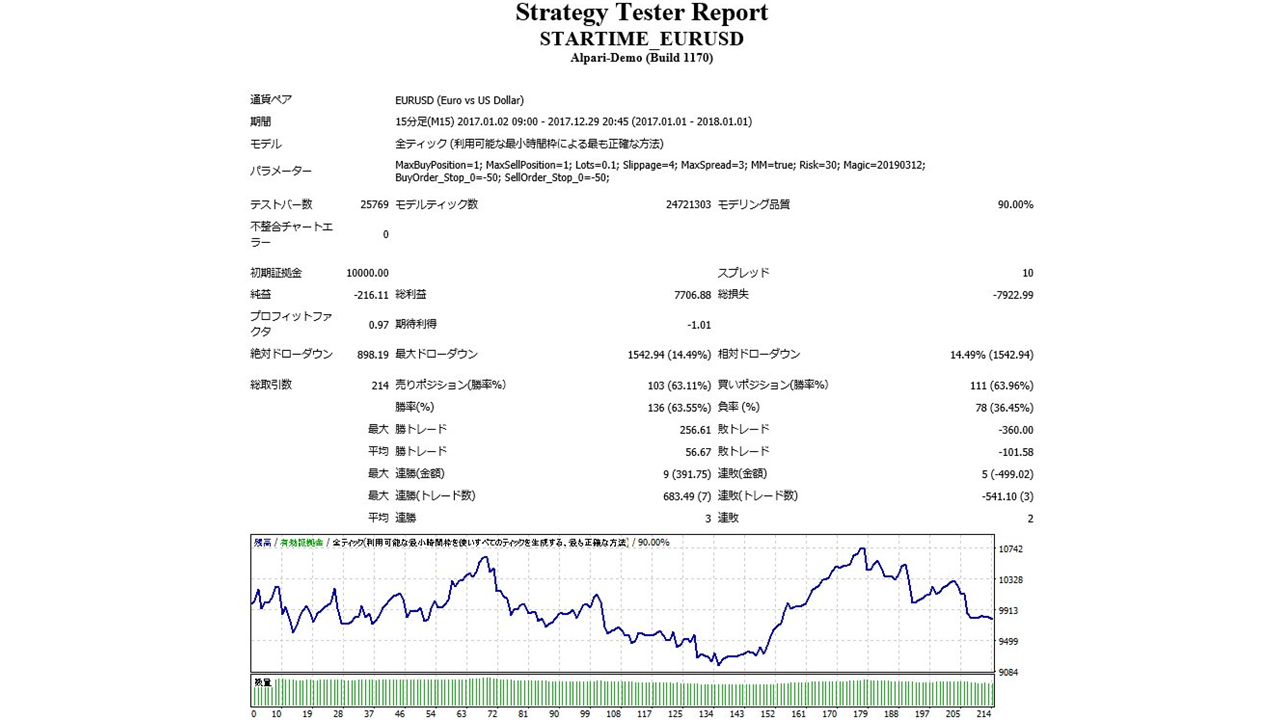

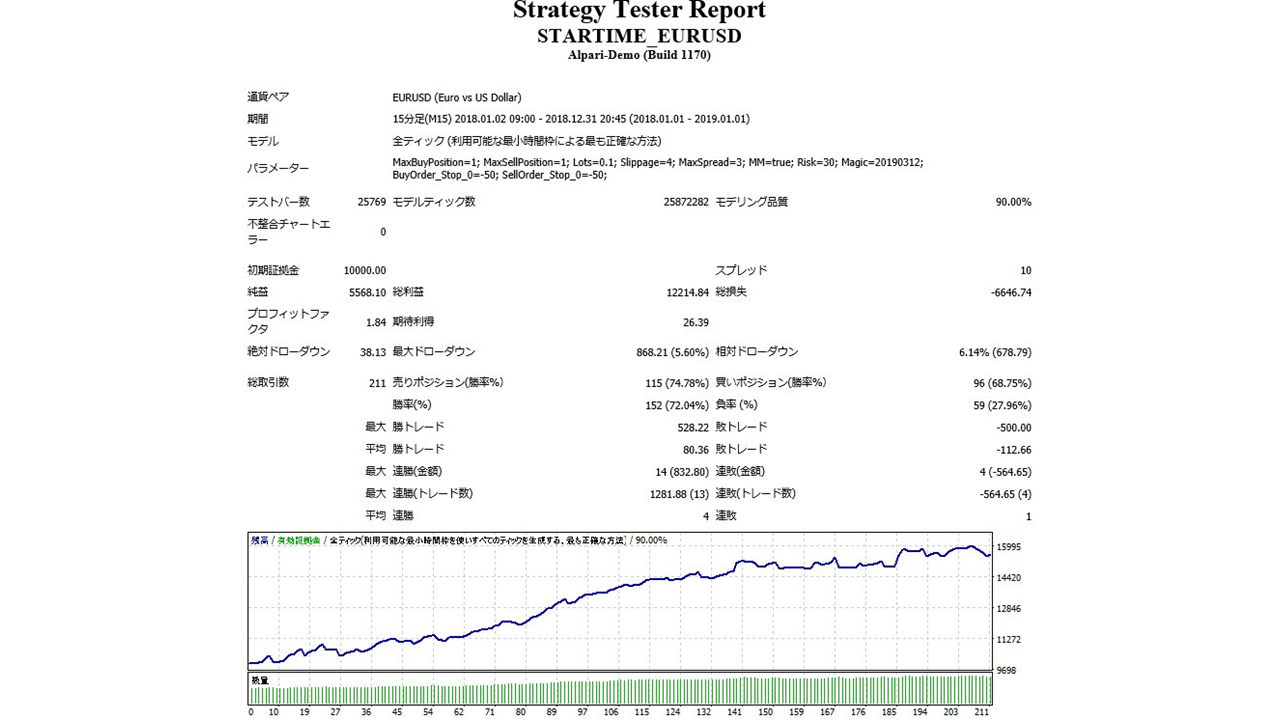

Results over the latest 3 years on a yearly basis.

2016

2017

2018

In 2016 net profit was +¥196,000, in 2017 net profit was −¥23,000, and in 2018 net profit was +¥612,000.

Although a year with a loss is disappointing, even with 1 position and low drawdown, there is potential to earn more than 50% annually, making it a solid option.

From what we have seen, overall, this EA is characterized by low drawdown. Since the basic position count is 1, beginners with small funds can operate comfortably, and those holding multiple EAs or building a portfolio should also see high cost performance.