An annual return of 30% is expected! With a stop-loss and fast recovery, a Martingale-type EA "Martingale Impala"

Setting a stop loss to prevent account bankruptcy common in martingale-type strategies

USD/JPY EA with up to 3 positions "Martingale Inpara"

Martingale Inpara Overview

Currency pair:[USD/JPY]

Trading style:[Scalping]

Maximum number of positions: 3

Maximum lot size: 1 (depends on margin))

Timeframe used: M5

Maximum stop loss: 100

Take profit: 30

This is a martingale-type EA that trades USD/JPY by scalping.

Backtest shows an annual average354 trades and aggressive trading.

Entries are made and, if movement goes against expectations, averaging down occurs, but it holds at most 3 positions. Therefore, it seems to minimize the risk of exiting the market during large events such as unexpected surges or crashes. While averaging-down strategies often involve taking on too many positions and not allowing the market to recover, potentially leading to a forced exit, this EA is designed to reduce that risk.

※Note: On the product page, if the base lot is 0.1, it increases to 0.1, 0.2, 0.4.

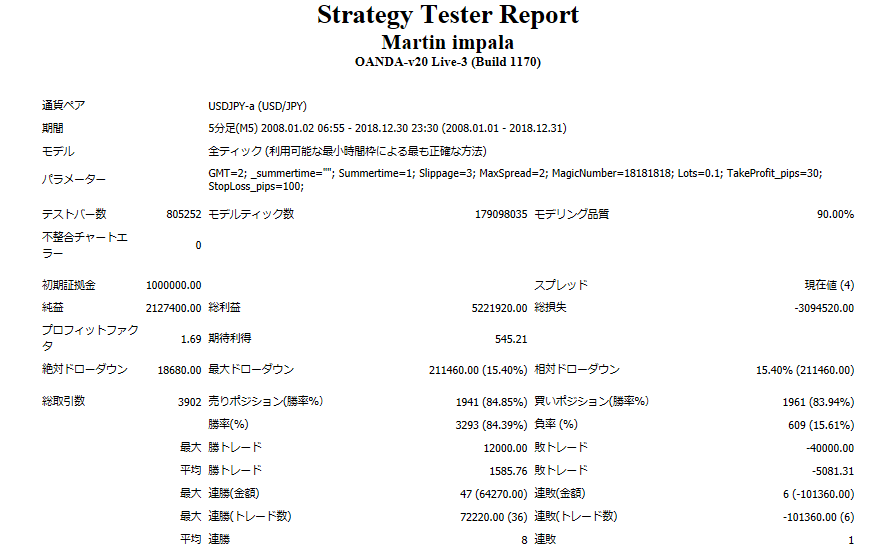

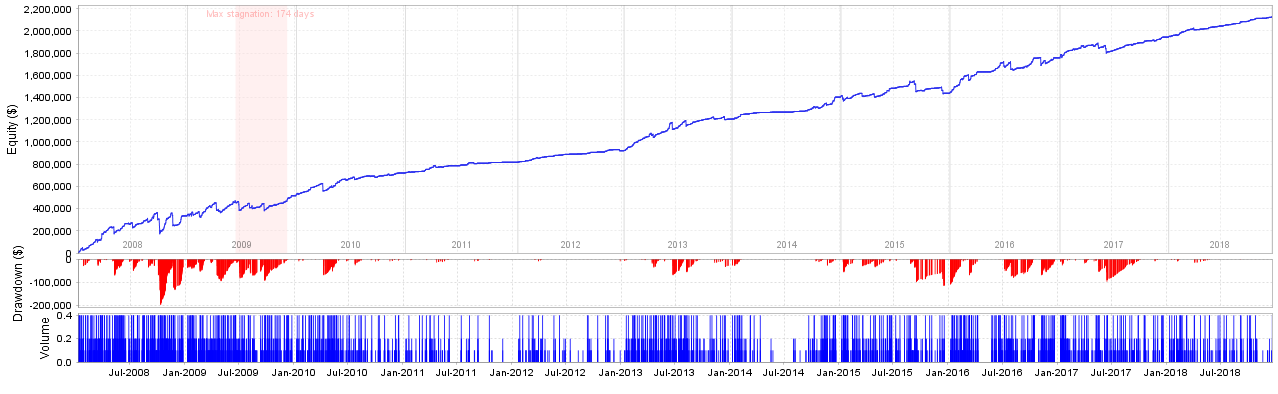

【Backtest Analysis】

2008.01.01‐2018.12.31

Spread 4(0.4 pips)

Fixed lot 0.1

Net profit +212.7万円(annual average 19.3万円)

Maximum drawdown -21.1万円

Total trades 3,902回)

Win rate 84.39%

PF1.69

This is the result.

Recommended margin is (4.5)+(21.1×3)=67.8(万円)

Therefore, about 68万円 is the safe operating guideline.

この場合の期待年利は30%です。

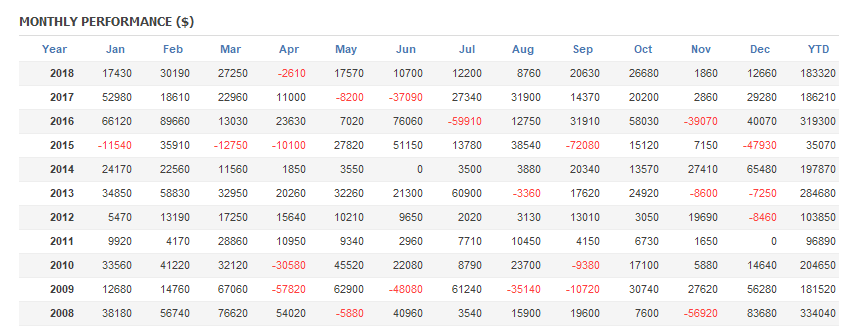

Backtest profit/loss chart shows temporary large losses from late 2008 to 2009, but profits rise even more steeply overall. From 2011 onward, profits steadily increase. From 2015 to 2017 there are drawdowns, but profits continue to grow beyond them. In 2018 there are no losses and performance is smooth.口座管理に気をつけていれば大きなリターンを期待でき、「ピンチの後にチャンスあり」だといえます。

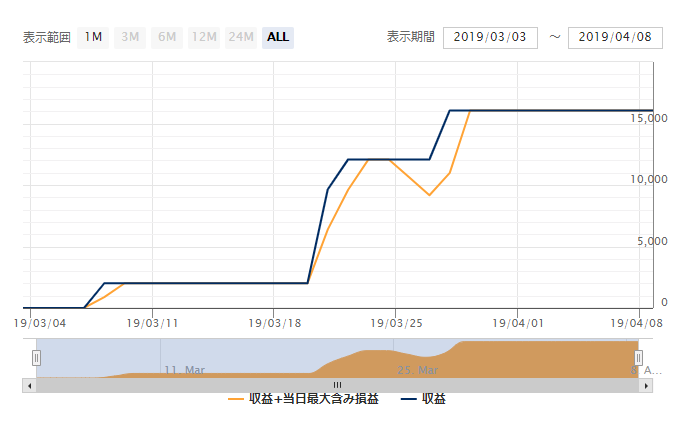

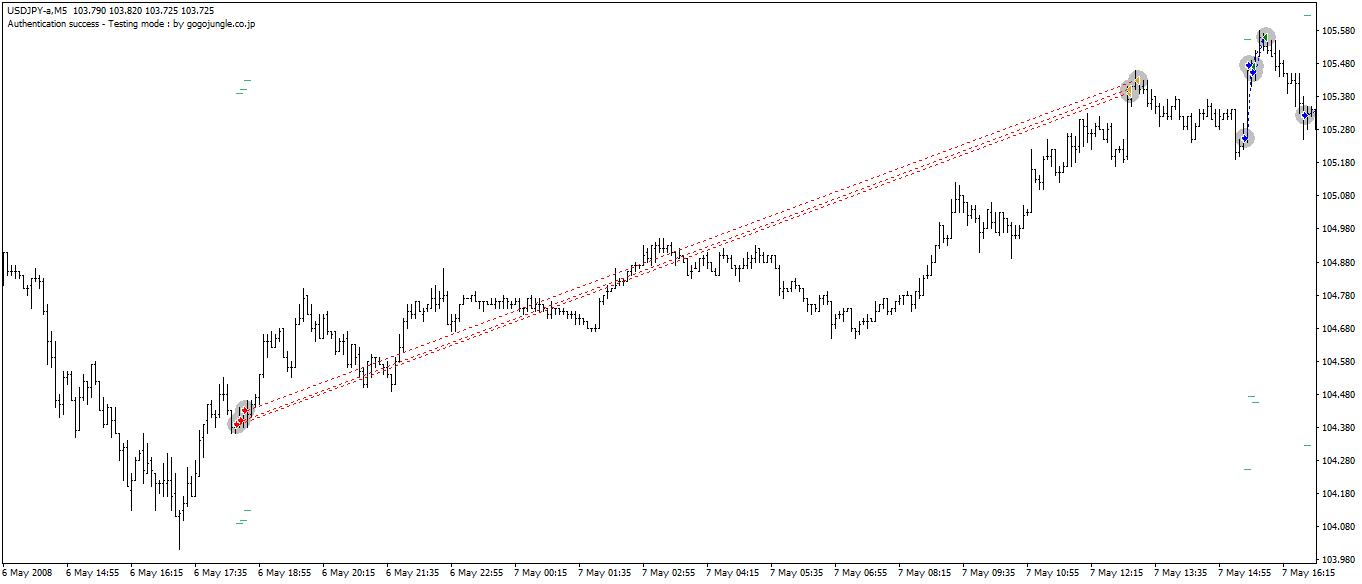

■Trading Image

It enters during range-bound markets, and if the price moves in the opposite direction from expectations, it may add up to 3 positions (averaging down). It generally closes positions shortly after opening.

This is an illustration of the stop-loss. It was averaging down on a short position and took 3 positions, but as the price continued to rise, it cut the losses.

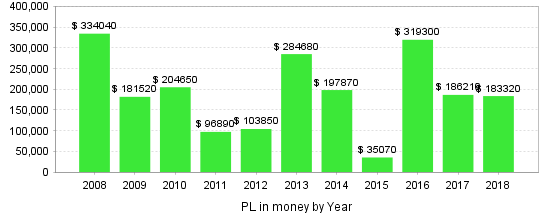

■Yearly/Monthly P/L