Treat trading as gambling. Trying to guess whether it will go up or down is for amateurs. A seasoned trader aims for overall profit even with 1 win and 9 losses.

Hello!

I am Takashi, former accountant and psychological counselor, trader.

This is titled "Think of trading as gambling".

Some people say, “Trading isn’t gambling! It’s asset management!” right?

Mahjong and poker, as genres, are considered gambling, but in terms of a game where skilled players can win, I would say they are not gambling.

In the world championships of poker, the final table is always filled with capable players.

I also have experience working as an accountant at a company that runs a mahjong parlor.

In free mahjong shops, employees gamble money on mahjong as well.

Mahjong is a four-player game.

For example, if there are only three customers, one employee will join and play.

The losing amount is deducted from the salary, and the winnings are added to the salary.

I also did payroll calculations like that.

People who are weak at mahjong can end up in debt, losing more than their salary. It’s a very strict world.

Those with real skill win steadily every month. Those without skill lose steadily every month.

Even capable people can lose for one day. But over a month, they will surely come out ahead.

It’s a world of absolute skill.

The market and the world are the same. It’s a world of absolute skill.

Even complete beginners can win one trade. There may be days when you finish with a plus after a win.

You might think, “If I keep doing this, I’ll win,” but without skill, you will end up with a 100% loss overall.

If you consider it in total, those without skill will lose 100%, so it isn’t gambling in the sense of not knowing whether you’ll win or lose.

However, the title this time, “Think of trading as gambling,” means that even for someone with ability, you should expect that you will win or lose—the premise is to think in terms of outcomes.

From the book by Tetsuya Asada, who was known as the Mahjong Sage (god of mahjong), I’ll introduce gambling-related stories.Quotes are in blue text.

“Asada Tetsuya’s Gambler’s Quotations” by Saifu Mei

Here is a dice. It’s either shii, or han. There are two possible answers.

Is the next roll going to be shii or han? Which will it be? Those questions are universally asked by novices.

Novices try to predict the next roll.

This also applies to trading.

Will it go up or down? Which will it be? Those questions are universally asked by novices.

Novices try to predict whether it will go up or down.

Experts, in a extreme sense, bet so that they can win even if they lose 1 out of 9 times.

They aim for overall profit.

The same goes for trading.

To have an overall profit, the important thing is form.

Form means something you can believe in, that if you strictly adhere to it, you can always gain the favorable 6-to-4 conditions for yourself. That is what you can trust.

In trading, form refers to methods and trading rules.

Even after four straight losses, if you stick to the method and the rules, you can come out ahead in total.

Professionals, among the 6-to-4, remain calm even when the 4-to-6 disadvantage appears.

Even if 4 is bad, they are convinced that 6 will surely be good.

Even if King hits a few hits, if you can hit 3 out of 10, you can hit. That’s the power of the form.

If you change your form just because you haven’t been hitting, that’s not right.

What’s important isn’t the hits. It’s the form.

That’s how professionals think.

A common pattern among traders who continue to lose is that even after learning one method, they cannot keep using it.

After a series of losses, they look for the next method, saying, “This can’t be used.”

This will never lead to winning. Many losers fall into this pattern, don’t they?

What matters is not getting hits, but not breaking the method or trading rules even if hits (profit-taking) don’t appear.

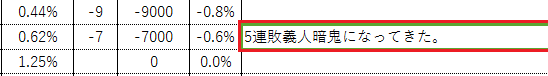

Below is part of a trading diary from a student of my methods and practices. I plan to introduce it in more detail on the members’ blog in the future.

Even with my methods, losing five in a row is not unusual.

When you’re on a losing streak, you understand how doubtful you become.

Even so, keep the form and continue. What’s important is not win/loss or losing streak. It’s about sticking to the methods and trading rules.

>What’s important isn’t hits. It’s the form.

>A professional thinks that way.

And in the end, you turn a profit in total.

Even if you cut losses strictly, and lose somewhere, it’s fine.

Even if you lose and have a losing streak, by not breaking the form (sticking to the method and rules), you eventually win, and that experience is important.

As you accumulate these experiences, even after a losing streak you won’t feel doubt and you’ll be convinced you will win in total.

>Professionals, among the 6-to-4, remain calm even when the 4-to-6 disadvantage appears.

>Even if 4 is bad, they are convinced that 6 will surely be good.

This person, next, has11 consecutive lossesso far.

However, they can cut losses smoothly without resistance.

And in the end they turned a total profit.

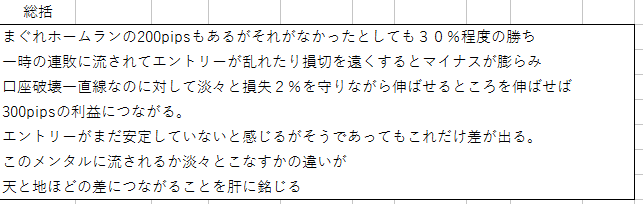

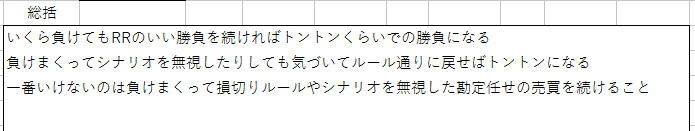

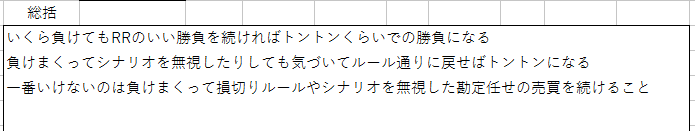

This is how they summarize it.

“The worst thing is to keep losing and ignore the cut-loss rules and scenarios, letting emotions drive trades.”

What a wonderful realization.

To put it differently,

“The worst thing is to lose repeatedly and ignore trading rules, i.e., break the form.”

That’s right, isn’t it?

“Professionals consider form the most important.

Form means, up to today, this is what I have always followed, the kernel I must protect at all costs.

The King’s one-legged stance symbolizes the Asada Tetsuya theory.

The story of Ishii White’s manager using the King’s strategy in Hiroshima.

The King’s hits mostly go to the right; so all the outfielders moved to the right.

The King is hard to hit. But if you slap a bloop, it becomes a hit.

A player of King’s caliber can place and swing so that hits are easy to accumulate.

But the King kept pulling to the left.The King’s choice may look like a loss, but it isn’t.Later, White’s manager said the following:“I didn’t mind being hit by a bloop. If you swing with a bloop, the form collapses. Once the form is disturbed, it takes time to repair.”The opponent’s “King shift” was aimed at breaking the form.The Hiroshima side was the one who failed the tactic.What an extremely high-level discussion, isn’t it?It shows how important form is. A quick hit doesn’t matter at all.In trading, the short-term wins or losses don’t matter.Even if you don’t hit, continue without breaking your form. That is “the win.”That is the path to ultimate victory.The second video shot at FX Kouhyou.com has now been released. Thank you very much.Click the link below【Video】Is everyone misunderstanding? Takashi Kirakira explains that the market is not about predictingIn this video, the following is stated,“If you are set on edge, you can call it correct (a success)!”This means that when you adhere to the form “methods and trading rules (those with an edge),” it is correct (a success) at that point.Whether it becomes a take-profit or a stop-loss, the result doesn’t matter.No matter what method or rule you use, there will always be stop-losses.Each trade may end in a win or a loss. You never know which roll will come. It’s gambling.“Think of trading as gambling.”To win in gambling, you should not try to predict each move; instead, aim to end up net positive in total.>Here is a dice. It’s either shii, or han. There are two possible answers.>Is the next roll going to be shii or han? Which will it be? Those questions are universally asked by novices.>Novices try to predict the next roll.The dice roll outcomes, and market moves, no one can predict.Novices try things they cannot do.People who think the market is something to be predicted may have trouble winning.If you believe “the market is something to predict,” you may think, “What are you talking about?”Many people believe the market can be predicted, and the stronger this belief, the harder it is to win.To win in the market, you should not predict at all.Even legendary traders like the Turtle Traders have said so.Richard Dennis, a charismatic trader, gathered people and taught them trading, but those with a strong belief in predicting could not trade consistently.Consistent trading means sticking with the form and continuing.If you predict each time and continue with rules only when you win, it becomes hard to keep following them.This is a message I received last month.In the euro-dollar short scenario, my first trade also hit a stop-loss.But the second entry condition aligned, I entered again, took profit, and ended with a total plus.The person above didn’t take the second entry because the first stop-loss affected them.I study in my members’ blog, so I understand that each trade’s result doesn’t matter, and I think in terms of probability.However, I still can’t act. I think practice and experience are the only ways to go.I didn’t start out able to do it either.↓ Here is one of my past study notes. The same euro-dollar pair. The selling conditions aligned, but I couldn’t enter selling.You can see I’m carrying over the previous trade.If you can’t follow the rules, write in your study notes why you couldn’t, review objectively, and engage in self-talk; it’s important.Educate yourself.Check the rules, review past results, redo the verification, and reach a level where it finally “clicks” and you can do it.This person introduced earlier is also like this, isn’t he?Even after losing a lot, if you keep following the method or the rules (form), you’ll break even or gain experience, and eventually reach a level where it “clicks.”Even if you learn a winning method (an edge), merely knowing it does not guarantee winning—that is also the difficulty of the market.Practice improvement method is something you experience, not just understandby Teruo HayashiSummary of this time.By saying “Think of trading as gambling,” you acknowledge that each single result is random and unpredictable, which can be considered gambling.>Here is a dice. It’s either shii, or han. There are two possible answers.>Is the next roll going to be shii or han? Which will it be? Those questions are universally asked by novices.>Novices try to predict the next roll.Each roll is unpredictable.No one can predict it.Nevertheless, to win, aim for total net positive even if you go on losing streaks or winning streaks.To aim for total net positive, form is important.Maintaining form is more important than short-term wins or losses.>What’s important isn’t hits. It’s the form.>A professional thinks that way.>Professionals remain calm even when 4-to-6 disadvantages appear among the 6-to-4.>Even if 4 is bad, they are convinced that 6 will surely be good.And to become convinced that you will ultimately win in total even after losses and losing streaks, you need to practice, verify, and gain experience.

The King’s choice may look like a loss, but it isn’t.

Later, White’s manager said the following:

“I didn’t mind being hit by a bloop. If you swing with a bloop, the form collapses. Once the form is disturbed, it takes time to repair.”

The opponent’s “King shift” was aimed at breaking the form.The Hiroshima side was the one who failed the tactic.What an extremely high-level discussion, isn’t it?It shows how important form is. A quick hit doesn’t matter at all.In trading, the short-term wins or losses don’t matter.Even if you don’t hit, continue without breaking your form. That is “the win.”That is the path to ultimate victory.The second video shot at FX Kouhyou.com has now been released. Thank you very much.Click the link below【Video】Is everyone misunderstanding? Takashi Kirakira explains that the market is not about predictingIn this video, the following is stated,“If you are set on edge, you can call it correct (a success)!”This means that when you adhere to the form “methods and trading rules (those with an edge),” it is correct (a success) at that point.Whether it becomes a take-profit or a stop-loss, the result doesn’t matter.No matter what method or rule you use, there will always be stop-losses.Each trade may end in a win or a loss. You never know which roll will come. It’s gambling.“Think of trading as gambling.”To win in gambling, you should not try to predict each move; instead, aim to end up net positive in total.>Here is a dice. It’s either shii, or han. There are two possible answers.>Is the next roll going to be shii or han? Which will it be? Those questions are universally asked by novices.>Novices try to predict the next roll.The dice roll outcomes, and market moves, no one can predict.Novices try things they cannot do.People who think the market is something to be predicted may have trouble winning.If you believe “the market is something to predict,” you may think, “What are you talking about?”Many people believe the market can be predicted, and the stronger this belief, the harder it is to win.To win in the market, you should not predict at all.Even legendary traders like the Turtle Traders have said so.Richard Dennis, a charismatic trader, gathered people and taught them trading, but those with a strong belief in predicting could not trade consistently.Consistent trading means sticking with the form and continuing.If you predict each time and continue with rules only when you win, it becomes hard to keep following them.This is a message I received last month.In the euro-dollar short scenario, my first trade also hit a stop-loss.But the second entry condition aligned, I entered again, took profit, and ended with a total plus.The person above didn’t take the second entry because the first stop-loss affected them.I study in my members’ blog, so I understand that each trade’s result doesn’t matter, and I think in terms of probability.However, I still can’t act. I think practice and experience are the only ways to go.I didn’t start out able to do it either.↓ Here is one of my past study notes. The same euro-dollar pair. The selling conditions aligned, but I couldn’t enter selling.You can see I’m carrying over the previous trade.If you can’t follow the rules, write in your study notes why you couldn’t, review objectively, and engage in self-talk; it’s important.Educate yourself.Check the rules, review past results, redo the verification, and reach a level where it finally “clicks” and you can do it.This person introduced earlier is also like this, isn’t he?Even after losing a lot, if you keep following the method or the rules (form), you’ll break even or gain experience, and eventually reach a level where it “clicks.”Even if you learn a winning method (an edge), merely knowing it does not guarantee winning—that is also the difficulty of the market.Practice improvement method is something you experience, not just understandby Teruo HayashiSummary of this time.By saying “Think of trading as gambling,” you acknowledge that each single result is random and unpredictable, which can be considered gambling.>Here is a dice. It’s either shii, or han. There are two possible answers.>Is the next roll going to be shii or han? Which will it be? Those questions are universally asked by novices.>Novices try to predict the next roll.Each roll is unpredictable.No one can predict it.Nevertheless, to win, aim for total net positive even if you go on losing streaks or winning streaks.To aim for total net positive, form is important.Maintaining form is more important than short-term wins or losses.>What’s important isn’t hits. It’s the form.>A professional thinks that way.>Professionals remain calm even when 4-to-6 disadvantages appear among the 6-to-4.

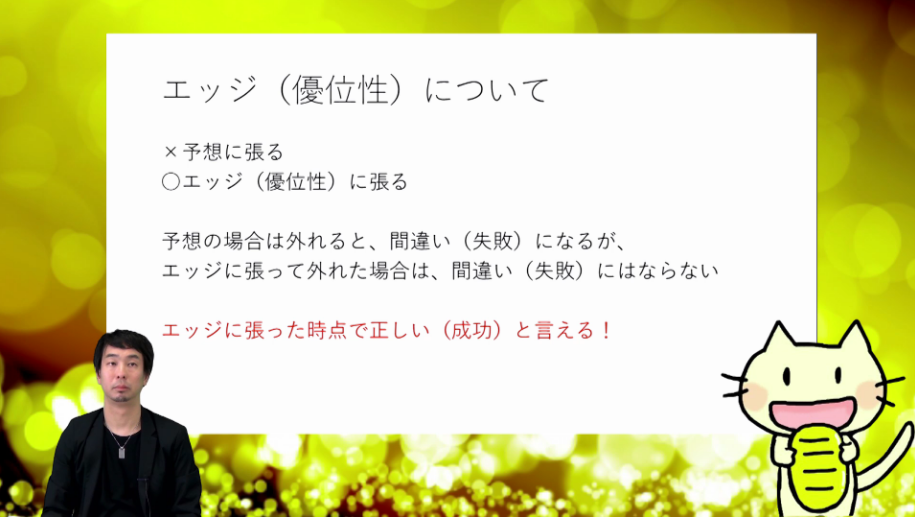

The second video shot at FX Kouhyou.com has now been released. Thank you very much.

Click the link below

In this video, the following is stated,

“If you are set on edge, you can call it correct (a success)!”

This means that when you adhere to the form “methods and trading rules (those with an edge),” it is correct (a success) at that point.

Whether it becomes a take-profit or a stop-loss, the result doesn’t matter.

No matter what method or rule you use, there will always be stop-losses.

Each trade may end in a win or a loss. You never know which roll will come. It’s gambling.

“Think of trading as gambling.”

>Here is a dice. It’s either shii, or han. There are two possible answers.

>Is the next roll going to be shii or han? Which will it be? Those questions are universally asked by novices.

>Novices try to predict the next roll.

The dice roll outcomes, and market moves, no one can predict.

People who think the market is something to be predicted may have trouble winning.

If you believe “the market is something to predict,” you may think, “What are you talking about?”

Many people believe the market can be predicted, and the stronger this belief, the harder it is to win.

To win in the market, you should not predict at all.

Even legendary traders like the Turtle Traders have said so.

Richard Dennis, a charismatic trader, gathered people and taught them trading, but those with a strong belief in predicting could not trade consistently.

Consistent trading means sticking with the form and continuing.

If you predict each time and continue with rules only when you win, it becomes hard to keep following them.

This is a message I received last month.

In the euro-dollar short scenario, my first trade also hit a stop-loss.

But the second entry condition aligned, I entered again, took profit, and ended with a total plus.

The person above didn’t take the second entry because the first stop-loss affected them.

I study in my members’ blog, so I understand that each trade’s result doesn’t matter, and I think in terms of probability.

However, I still can’t act. I think practice and experience are the only ways to go.

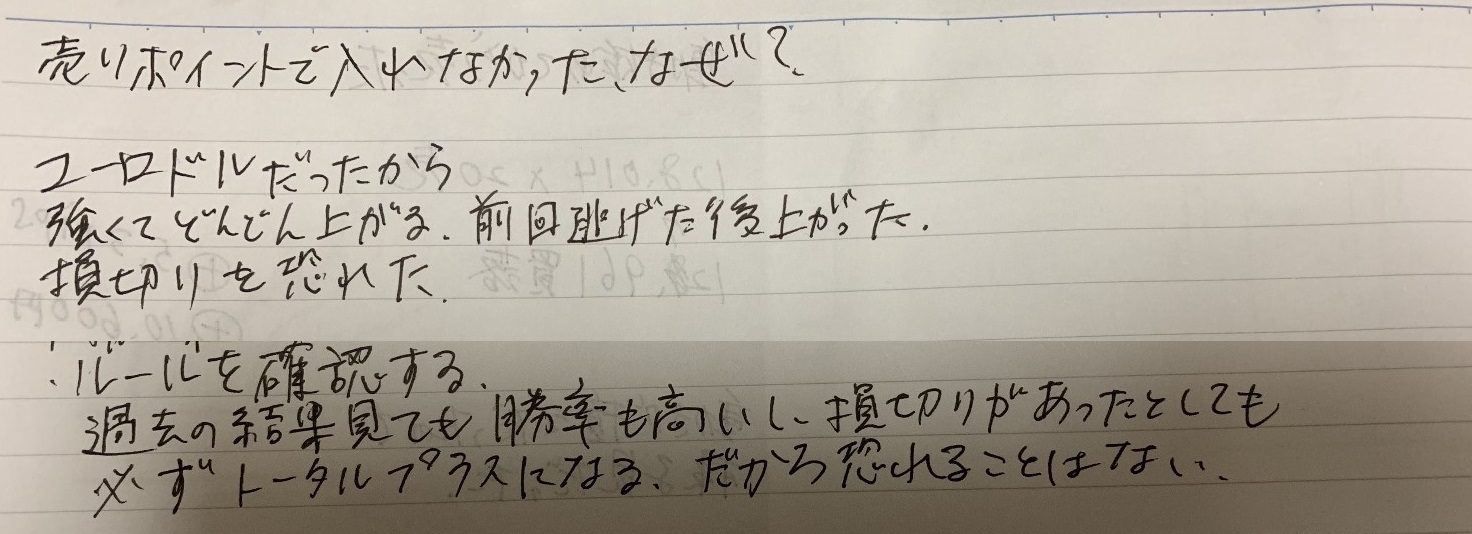

I didn’t start out able to do it either.

↓ Here is one of my past study notes. The same euro-dollar pair. The selling conditions aligned, but I couldn’t enter selling.

You can see I’m carrying over the previous trade.

If you can’t follow the rules, write in your study notes why you couldn’t, review objectively, and engage in self-talk; it’s important.

Educate yourself.

Check the rules, review past results, redo the verification, and reach a level where it finally “clicks” and you can do it.

This person introduced earlier is also like this, isn’t he?

Even after losing a lot, if you keep following the method or the rules (form), you’ll break even or gain experience, and eventually reach a level where it “clicks.”

Even if you learn a winning method (an edge), merely knowing it does not guarantee winning—that is also the difficulty of the market.

Practice improvement method is something you experience, not just understand

by Teruo Hayashi

Summary of this time.

By saying “Think of trading as gambling,” you acknowledge that each single result is random and unpredictable, which can be considered gambling.

>Here is a dice. It’s either shii, or han. There are two possible answers.

>Is the next roll going to be shii or han? Which will it be? Those questions are universally asked by novices.

>Novices try to predict the next roll.

To aim for total net positive, form is important.

Maintaining form is more important than short-term wins or losses.

>What’s important isn’t hits. It’s the form.

>A professional thinks that way.

>Professionals remain calm even when 4-to-6 disadvantages appear among the 6-to-4.

>Even if 4 is bad, they are convinced that 6 will surely be good.

And to become convinced that you will ultimately win in total even after losses and losing streaks, you need to practice, verify, and gain experience.