USD/JPY, already facing the year's biggest hurdle?! Will it become the X-date? Japan-U.S. summit

Finally, this weekend’s US-J Japan summit is shaping up to be a big event for the dollar-yen.

Honestly, at this stage it’s unclear what might come out of it; the materials are mostly opaque.

For us investors, there is a strong interest and caution that the US-Japan trade issue may be brought to the forefront.

There is a sense of keen interest and vigilance.

In 1993, after the summit between Prime Minister Miyazawa and President Clinton, the yen market was shaken violently!

I was looking at old articles, and from February 9, many sites began to post articles from that time.

I will introduce them since they were uploaded.

From the articles on 2017/02/09

☆ Yen appreciation accelerates at US-Japan summit; market fears a “93 nightmare” returns

The game was, after all, to shrink the trade deficit with a stronger yen against the yen, which was the easy method at the time.

Back then, the USD/JPY fell below 100, entering a historic strong-yen phase, and the trade deficit issue still has a gash not yet closed.

With the deficit-target countries led by China as the second, and with Aso’s movements planned this time as well, the situation makes it more likely that some talks will surface.

It’s increasingly possible that some discussions will emerge.

At this point, there’s little use dredging up events from Miyazawa’s era, but market participants tend to look back and try to reference those moves.

Honestly, will the financial markets (the yen) move sharply or change trend as a result of this summit?

If the yen trend becomes one-sided, there are rails of a trend, and even if it deviates once, it might return to the original trend.

On the other hand, Prime Minister Abe appears to have prepared multiple souvenirs; the question is whether these will be acceptable to the US side, and there is some expectation that the final decision could come as early as in the early Japan time

early on the 11th, the dollar-yen might move.

Domestically, it’s a big event, but...

Trump cabinet members are said to have assets totaling about $30 billion, and in a sense,

they may be a professional group capable of moving financial markets.

This time, the yen is drawing attention at the US-Japan summit, but going forward against world currencies, the dollar may also begin to move significantly.

Of course, they won’t miss the chance in this money game.

For them, it may be a situation where either outcome could be acceptable...

This may highlight the difference between politicians and investors.

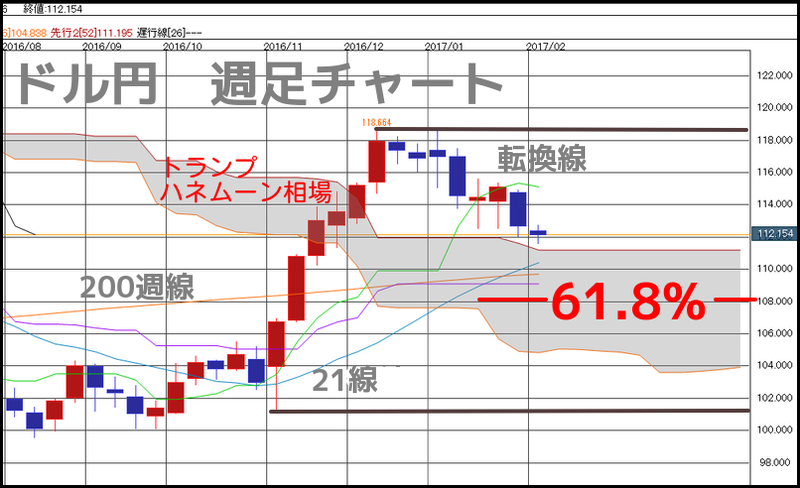

Already on the USD/JPY daily chart, we’ve entered Ichimoku cloud; I opened the weekly chart.

Already on the USD/JPY daily chart, we’ve entered Ichimoku cloud; I opened the weekly chart.

The focus is on the high posted from Trump’s election through year-end; currently it’s a pullback move,

and I’d like to watch whether it can be supported as we head into this weekend.

For now, the upper cloud acts as support, but if it breaks through, the resistance lines will come into play, and

from Trump’s presidency, the dollar-buying rally’s 61.8% retracement point and other key points will come into focus.

If the market breaks down from here, the USD/JPY could again face the 100 yen level.

In 2015, around the 125 yen level, a cyclic top may have formed, indicating that the yen’s weakness could continue, so

the yen-depreciation trend may continue, but a period of yen weakness could pause for a while.

Whether the downside can hold the 100 yen barrier will shape future developments.

If the USD also cools down,

☆ Reasons why 2017 is expected for a weaker dollar

Yen-summit material will become clearer after the weekend, but a positive move can outline the next phase as well.

☆ Reasons for a rebound in USD/JPY are forming

☆ The 100-yen defense is within expectations! If supported, another bullish wave could return

Long-term trend indicators are strong

The big crash of the Pound/yen also started from this signal!

They can sense a market turnaround and guide you to an optimal exit timing!

You can view articles ranked by Investment Navigator!

by Kawa-serigui