From among the 29 TSE sectors excluding the four financial sectors, select notable individual companies; new column "Remember 300 Companies"

A new column has begun in the popular Investment Salon by Tetsuo Inoue, 'Market Trends'.

The new column "Remember 300 Companies" selects notable individual companies from among the 29 TSE sectors, excluding the four financial sectors.

Let's quickly take a look at Mr. Inoue's piece on the new column, "Remember 300 Companies".

About the new column "Remember 300 Companies".

Since April of last year, when this newsletter began, we have been writing about market trends with a learning-oriented tilt, focusing on supply-demand dynamics and movements in the financial and stock markets. As a new column, we will bring you "Remember 300 Companies – Research This One Company!"

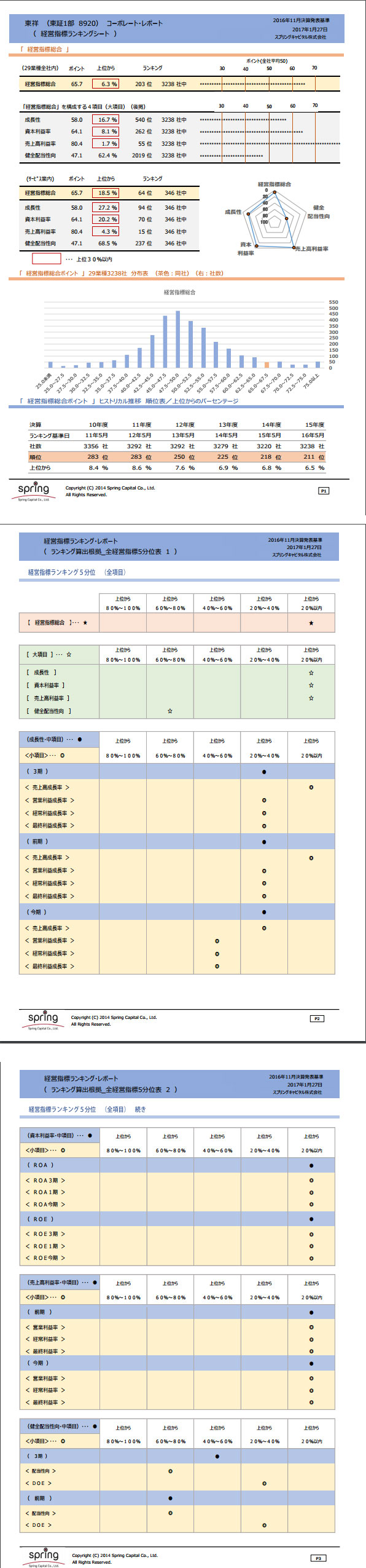

Spring Capital defines 29 sectors out of the 33 sectors on the Tokyo Stock Exchange, excluding the four financial sectors (Banking, Securities, Insurance, and Other Finance), as general operating companies, and publishes a ranking of all listed companies quarterly (see below *).

The companies excluded from consideration are: ① those for which all of the latest four-term (annual) securities reports have not been disclosed, ② those in which equity capital was zero or negative in any term during the same period, ③ those adopting IFRS but when reconciling to Japanese standards, the numbers disclosed by the company cannot be calculated with a reasonable basis, ④ those that do not comply with the Tokyo Stock Exchange's "45-day rule" and whose earnings announcements did not meet Spring Capital's calculation deadline. Excluding these, the current number of ranking-targeted companies is 3,238, and we will introduce one company per day from the top 300.

(* "Quarterly" means that the quarterly earnings announcements for March-year-end companies are compiled on an August basis, November basis, and February basis, and the rankings for the previous year are finalized after the May full-year results. Therefore, going forward, the companies featured daily in this column will be one of the top 300 ranked according to the November standard (FY2016 Q2 base); after the March completion of the February standard (FY2016 Q3 base), the top 300 under that standard will be announced.

The ranking is calculated using Spring Capital's original statistical method. Also, the "Overall Management Indicator (Rank)" is the overall ranking based on four components in management indicators: "Growth," "Return on capital," "Sales margin," and "Healthy dividend payout ratio." The quintiles are shown on the attached PDF at pages P2 and P3.

Also, going forward, we will not attach disclaimers to PDFs; this is intended solely to provide information about individual companies and is not intended as investment solicitation. Additionally, many companies use this "Management Indicator Ranking Sheet (Corporate Report)" in their websites or earnings presentation materials, but the distribution in this newsletter is strictly for providing information on individual companies as described above, and we declare that there is no conflict of interest.

What is important is to visit these companies' websites, review their business descriptions and the "IR page" or "Investor information" tabs to view earnings presentation materials, and accumulate knowledge for your own personal stock universe as one company. We would like you to build your own knowledge one company per day; that is the purpose of this delivery, and we hope you understand this as you read.

The January 31 selection for the new column "Remember 300 Companies" was 8920 Tosho.

Publication date: 2017/01/31 08:00

8920 Tosho

TSE 1st Section, March year-end

Overall ranking: 203rd / 3,238 companies

Industry ranking: 64th / 346 in the same industry

(Industry: Services)

- Operates sports facilities mainly in Nagoya; also runs hotels

- Has remained within the top 500 since FY2010

- Dividend payout ratio was 14.4% in the previous term, somewhat modest, but

other indicators are favorable

(Valuation) (1/27)

Share price: 5,340 yen

Trading unit: 100 shares

P/E: 30.72x

P/B: 4.96x

(Previous term) ROE: 17.90%

(Actual) Dividend yield: 0.39%