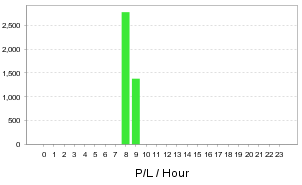

30 minutes a day is the key! An EURUSD contrarian scalping strategy that enables compounding, 'London is 7 a.m.'

Counter-trend scalping with short entry times limited to a specific time window

Fixed (simple) interest as a portion of the portfolio; with compounding, an EA that aims for long-term operation even as a standalone

Even though the entry window is narrow, there are many days with profits.

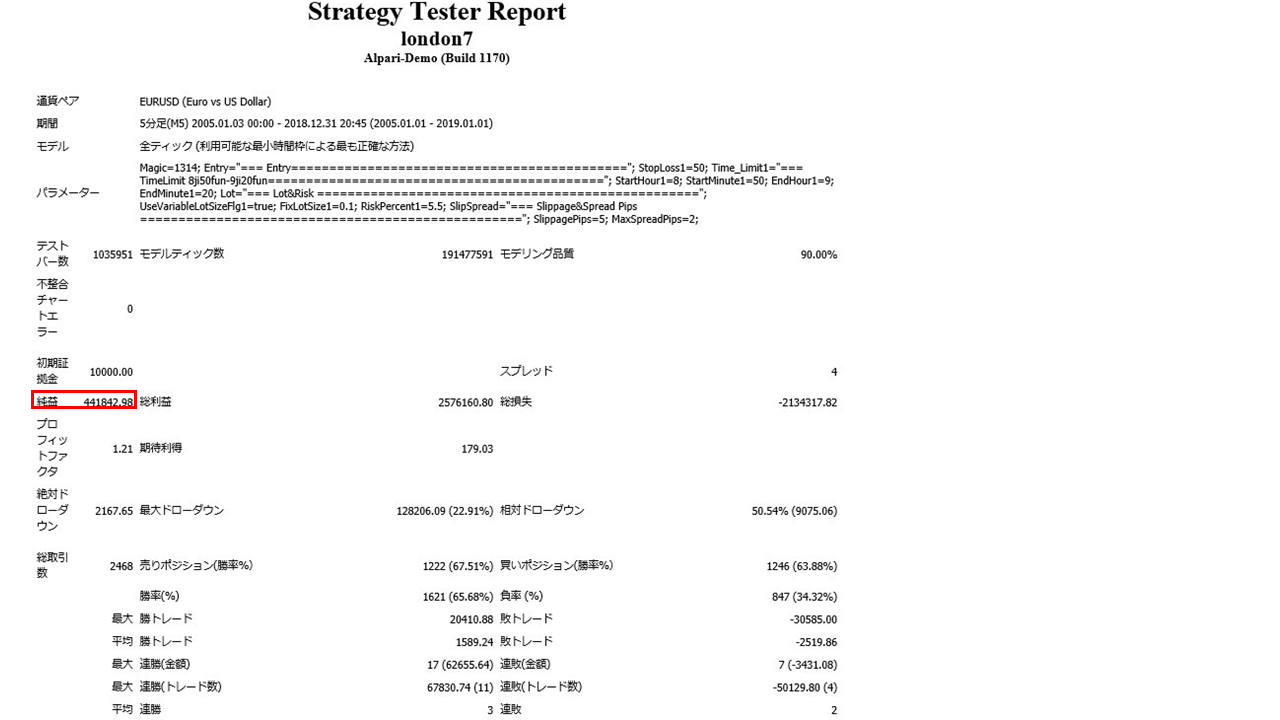

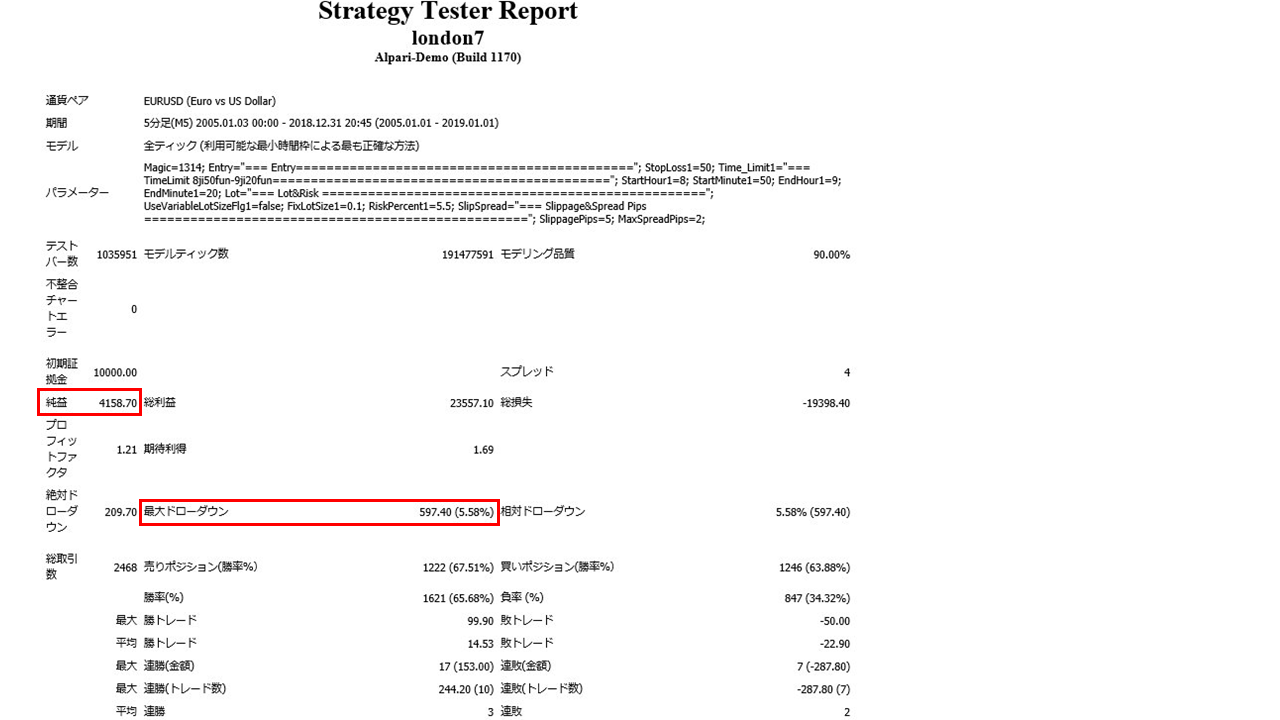

2005.01.01‐2019.01.01

Spread0.4

0.1Fixed lot

Net profit+45.7万円(Annual average3.2万円)

Maximum drawdown -6.56万円

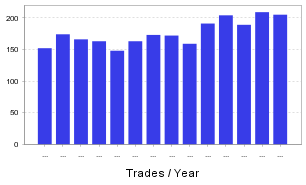

Total trades2468 trades(Annual average176 trades)

Win rate65.68%

PF1.21

Because entry times are limited, the number of trades is comparatively low.

Recommended margin is0.1 lot fixed

(5.1)+(6.56*2)=18.2(万円)

Therefore,18万円以上が安全運用の目安になります。

The expected annual return in this case is approximately17.9%. The average gained pips are 14.5 pips (at 0.1 lots).

There is stability, but thisEAalone may feel lacking in both profitability and number of trades.

Compared with the compound operation analysis, you may want to use the option that best fits your expected profit and risk.

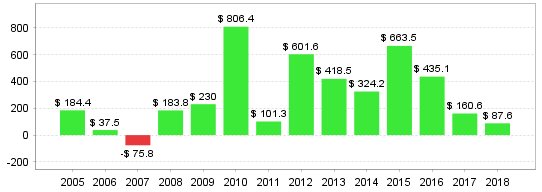

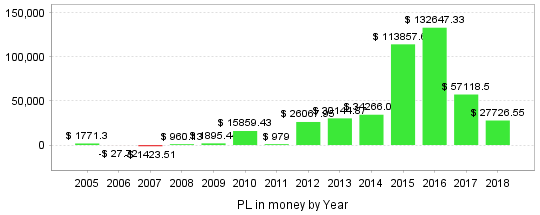

Annual earnings

Over the most recent10 years there are ups and downs, but profits are earned every year.

By year, the most recent years seem to have more trades. The timing also matches the settings.

Because this is a contrarian logic, even with many entry opportunities, gains may not materialize until profits are realized.

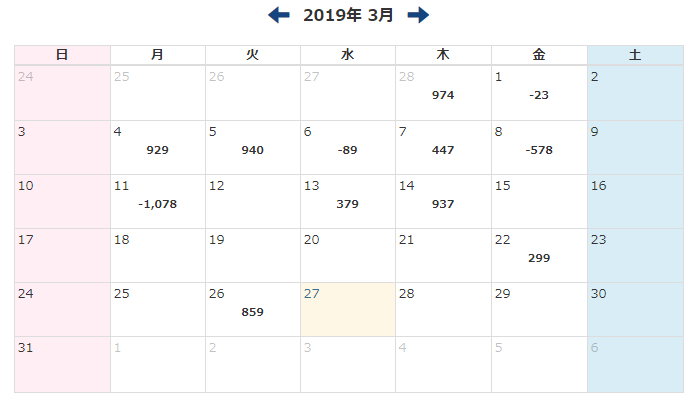

Looking at monthly data, many months show losses, butwhen summed for the year, profit is achieved.。

With a broker that has strong order execution FX company, it might be interesting to tighten the stop-loss settings further.

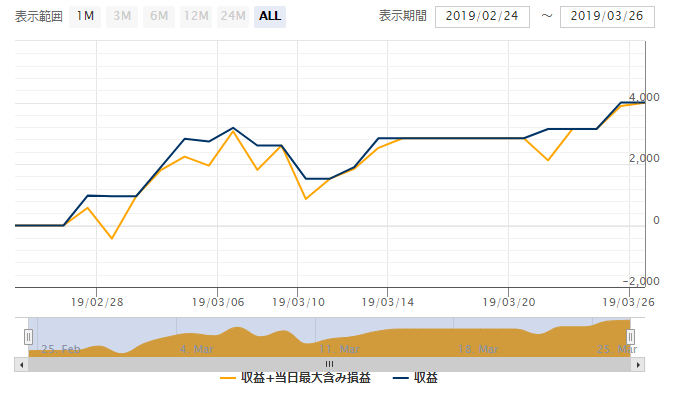

Compound operation

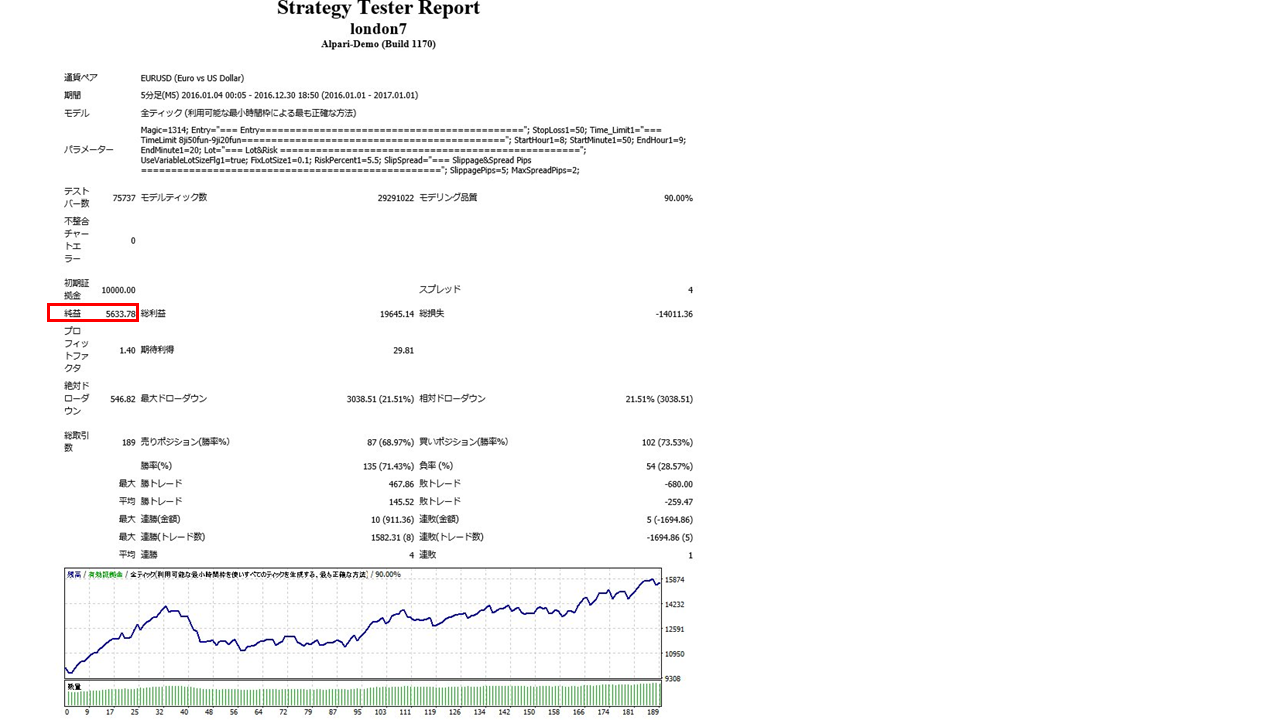

The settings are the same as before but set to compound.

14years backtest shows Net profit4860万円was reached!

In one trade, the initial maximum stop loss is50pips, but out of a total of2,468 trades,67 times, or less than5 per year, reached the max stop loss.

In compound operation, loss risk is set as a percentage of the account balance (initially 5.5% of the account balance).

Yearly view shows2016 as the highest profit; the most recent year2018also yields about 300万円in profit.

With long-term compounding, understanding expected profits is difficult, so as a sample we backtest assuming starting the year 2016 (the best year) and 2018 (the most recent year) with one year of compounding.

2016 year

Net profit+5633 dollarstherefore,61.9万円 of profit. The annual return is about approximately56.3%.

From year 1 with compounding, this rate would be ideal.

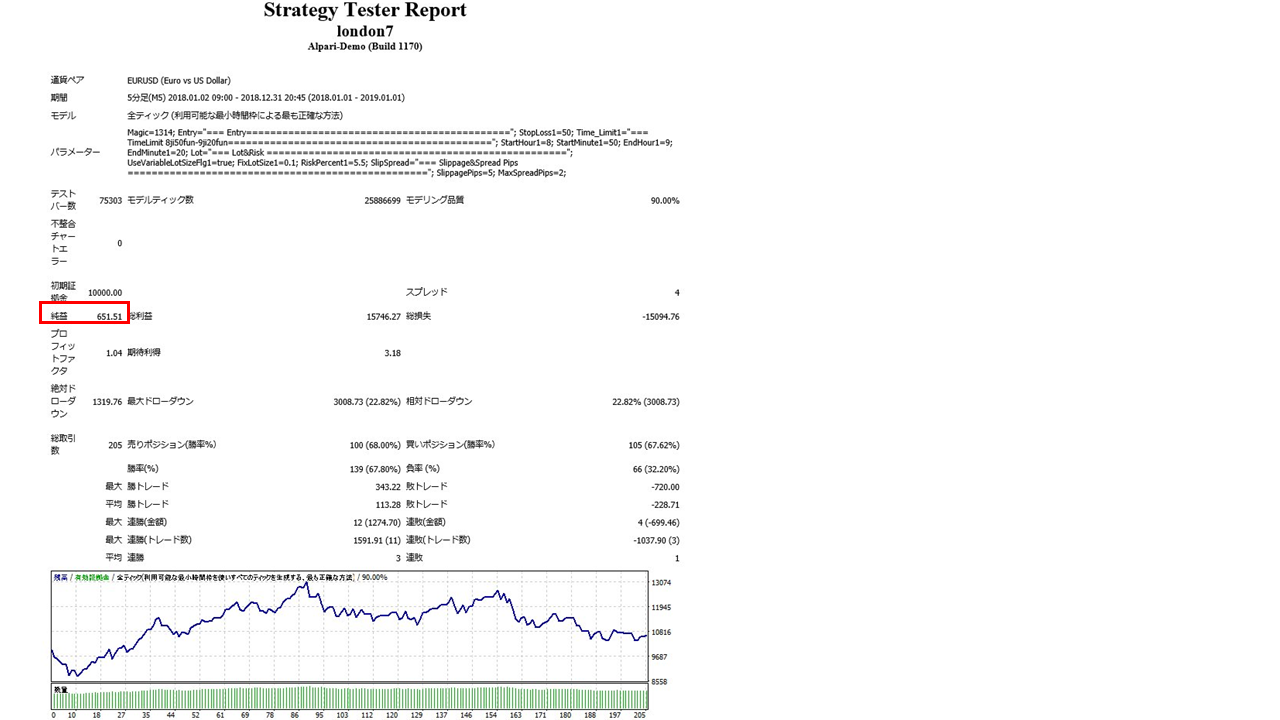

2018 year

Net profit+651 dollarsso7.1万円 of profit. The annual return is about approximately6.5%.

Compared with single-year compounding, the differences in annual returns can appear large. However, compounding increases profitability over the long term, so even if the initial annual return is small, it can still yield high profits soon after starting if the performance is strong.EA.

Since both simple and compound can be configured, there are many operational options.

With simple interest operation, the number of trades and expected annual return are a bit unsatisfactory, but stability and easier capital management with a small margin are advantages, so you may want to combine with other EAs in a portfolio.

With compound operation, this EA alone seems to offer sufficient performance to generate meaningful profits, so you should aim for long-term operation with careful capital management.

※ The portion above this line is public to everyone

If you remove this notice, everything becomes public to all, so please be careful.

Also, images can be pasted by dragging and dropping from external sources.

※ The portion below this line is for purchasers

(For purchasers: edit this part)

(For purchasers: edit this part)

(For purchasers: edit this part)