Overall view of winning methods and the fundamental way of thinking

Hello!

I’m a former accountant, psychological counselor, trader Takashi.

“If I’ve cut losses, it means my analysis or method was probably wrong.”

Don’t you think so?

If you’re thinking that way, before the analysis or method, perhaps the fundamental way of thinking itself is wrong.

What does it mean to win in trading?

In the first place, many people don’t know how to win.

Winning isn’t about a method or analysis technique.

The overall picture of winning and the foundation of thinkingis what it is.

First, I’d like you to read this past article.

↓

The win in Pachinko (slot) and trading are the same

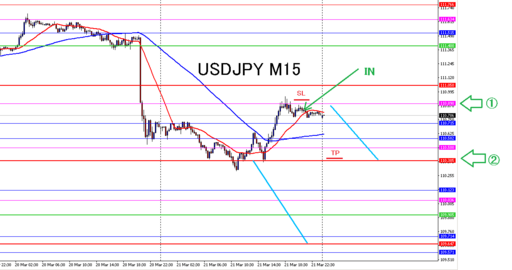

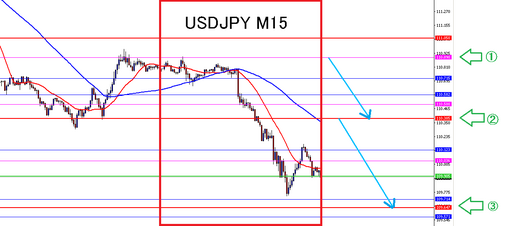

Recently, I released the USD/JPY using a free preview scenario.

I talked about thinking in terms of risk-reward and repeatedly taking favorable trades to end up winning overall.

On the day of the free preview, it was a selling scenario, and from line ② to line ① it moved up, so there were no trades.

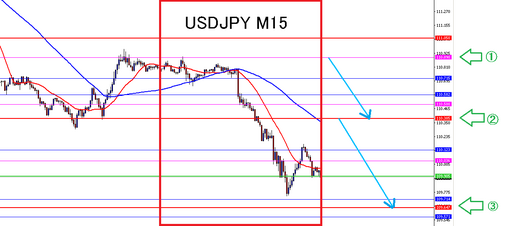

The next day, the movement was in the red-box area.

From line ① to line ② movement and from line ② to line ③ (slightly short) movement.

It didn’t reach line ③, but it largely followed the scenario.

I was able to take a small profit between line ① and line ②.

I don’t usually trade USD/JPY in the first place.

Reason: low volatility, so the reward (potential move) is small.

The USD/JPY recently was a high-volatility scenario, so there were opportunities.

The move from line ① to line ② was 50.5 pips

From line ② to line ③ was 73.8 pips

Stops (risk) are often set around 10 to 15 pips, so

you can have a favorable risk-reward ratio of 1:3 (loss 1 to gain 3).

and make a favorable bet.

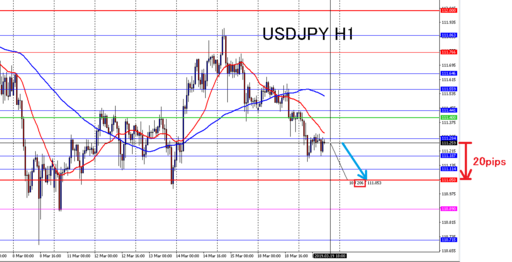

USD/JPY 1-hour chart on March 19

I was aiming for a short scenario, but the available move width was only 20 pips.

Even on the 1-hour chart, that's not tasty at all, right?

Taking only 20 pips is not worth it.

Even if you draft a USD/JPY scenario, it often gets scrapped.

In this way, even if you can draft a scenario, you shouldn’t take a poor-return bet or miss it; that is important.

In Pachinko, you target high expected value machines; choosing the right machine is important.

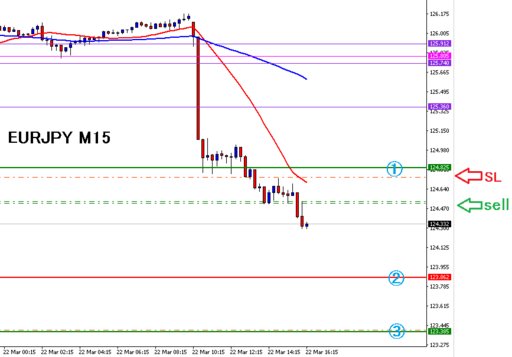

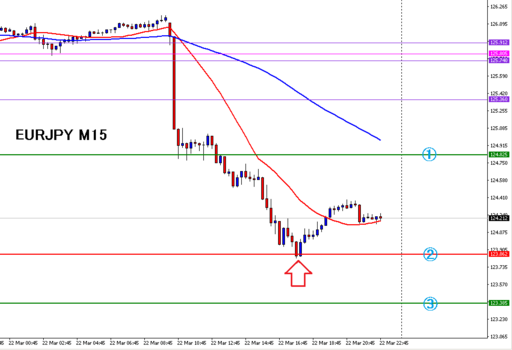

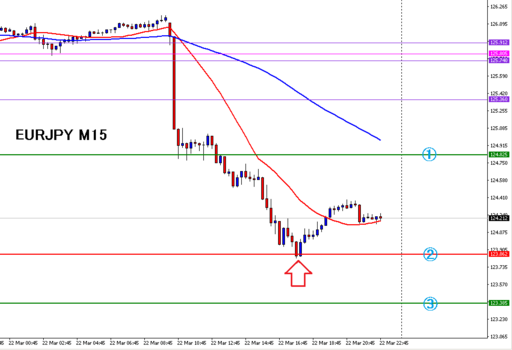

Yesterday’s EUR/JPY sell. 15-minute chart.

From line ① to ② is 96.3 pips

From line ① to ③ is 144 pips

Even if you don’t take all the way from line to line, there was plenty of movement to target.

This EUR/JPY trade is uploaded as a video on YouTube.

As a result, it fell to line ②.

It’s important to make a favorable bet considering risk-reward.

Whether you take profit or stop out is unknown.

However, if you repeatedly take favorable bets, you can win overall.

Therefore, at the point you can make a favorable bet, that is the right answer. It may be called a win.

I had a free preview scenario, and I also showed the stop loss as is.

At the point you can make a favorable bet, it is the correct answerso even if the result is a stop loss, there is meaning in presenting it as a model, and it is not a failure or something to be ashamed of.

The overall picture of winning and the foundation of thinking

Even if you only post winning trades, you won’t see the whole picture, right?

Forecasts cannot be made by anyone, so in trading, winning means making a total profit by winning and losing trades.

Let’s have favorable bets.

To achieve that, you need to be able to draw lines and scenarios.

Without lines, you can’t measure risk-reward, can you?

For example, USD/JPY

To aim from line ① to ② and from ② to ③, you need lines and scenarios.

For EUR/JPY, you must be able to anticipate aiming from ① to ② and from ① to ③ in advance.

Because you can draw lines and scenarios in advance, you can calculate risk and reward from there.

Then you can selectively choose only those with high expected value and favorable bets.

If you repeatedly make favorable bets, you will surely win the game.

Keep playing only on machines with positive expected value

Even if you play high-EV machines and lose sometimes

Even if you lose (stop out), it isn’t a failure or mistake

If you had chosen and played properly, it’s correct

Whether it is correct or incorrect does not depend on win or loss (the result of take-profit or stop loss)

We’re running a project to help everyone draw lines and scenarios together.

↓Link

Let’s draw lines and scenarios together