An Expert Advisor that yields overwhelming profits through a compounding strategy — "Alpha Goldman"

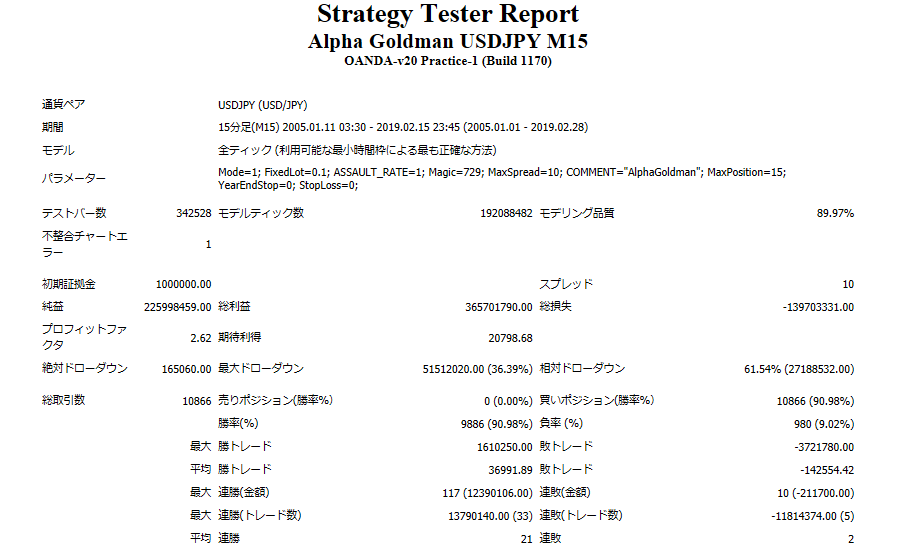

The compounded investment management system "Assault System" has accumulated profits of over 200 million in 14 years

Alpha Goldman, boasting an outstanding win rate even with simple interest

【Alpha Goldman Overview]

Currency pair: [USD/JPY]

Trading Style: [Scalping]

Maximum positions:15 (modifiable via parameters)

Used timeframe: M15

Maximum stop loss: 0(automatic close by program)

Take profit: 0(automatic close by program)

You can choose between the compounded operation "ASSAULT Mode" and the fixed-lot "Fixed Mode".

It features a "Downtrend Detection" function that targets buying on dips in uptrends and range markets, and does not enter when a downtrend occurs.

【Backtest Analysis】

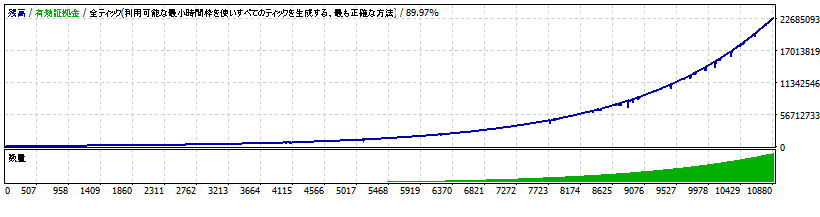

First, let's look at the compounded operation's「ASSAULTモード」

From 2005 to 2019, over 14 years, it grew from 1 million to 220 million. The power of compounding is remarkable.

However, the maximum drawdown is 36%, indicating sizable losses. If continued, you can expect corresponding returns, but you would need the calm to withstand asset declines.

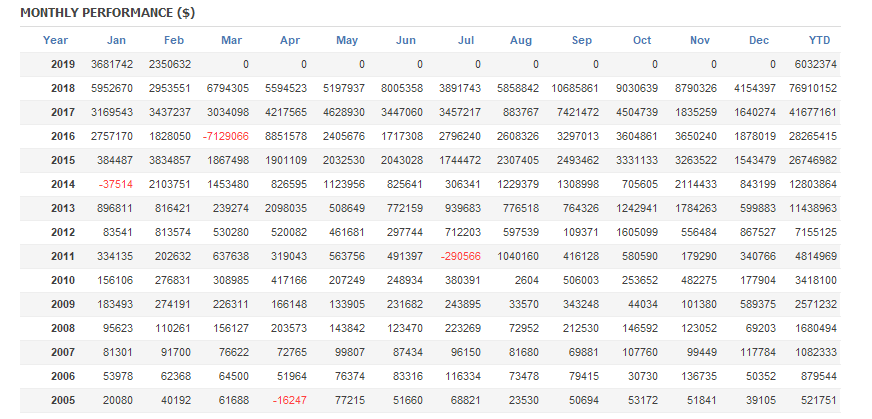

Let's look in more detail. There are negative months on a monthly basis, but overall it seems fairly stable. If continued, it could generate substantial profits.

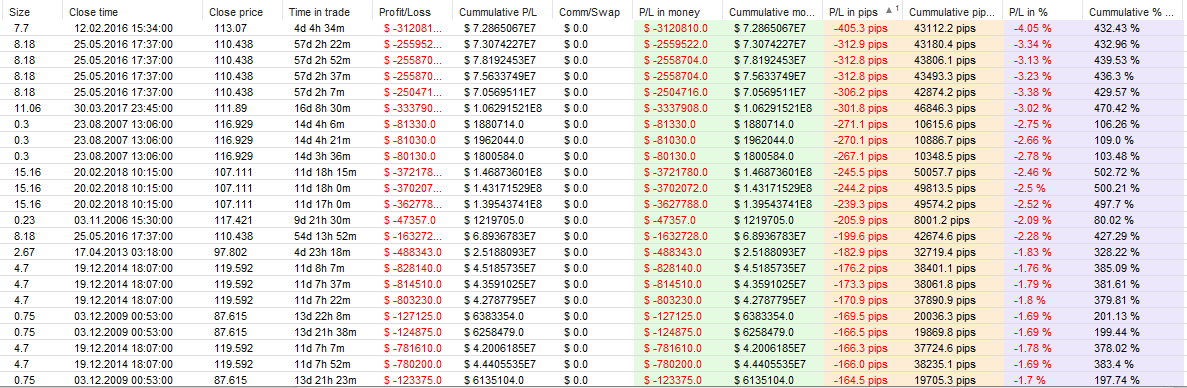

The table below shows the losses during negatives. The maximum drawdown is -405 pips, indicating considerable risk.

Enduring a drawdown while pursuing long-term operation appears to yield significant profits.

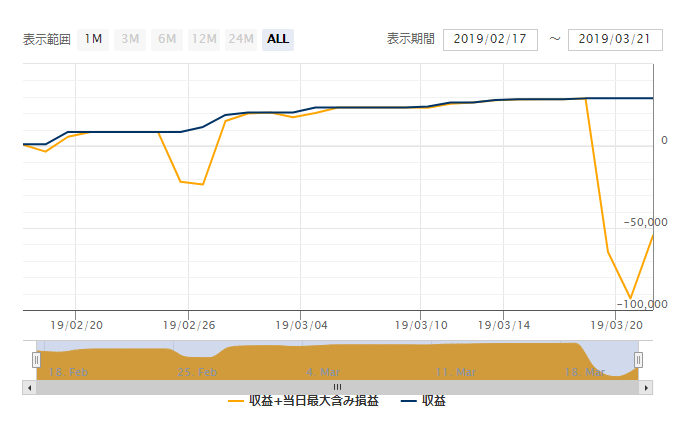

■ Past 3-year

Let's review the yearly backtest results for the past three years.

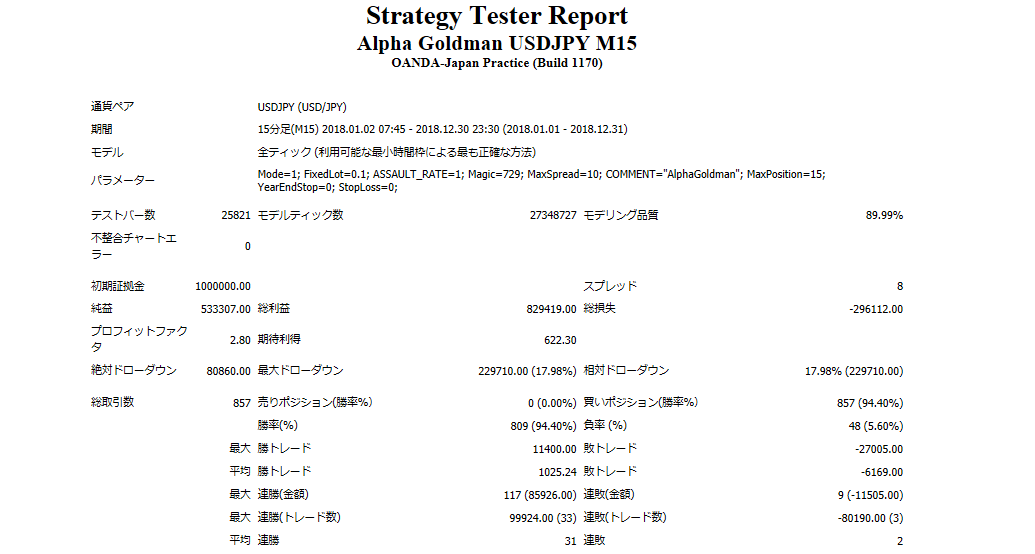

First, the results for 2018.

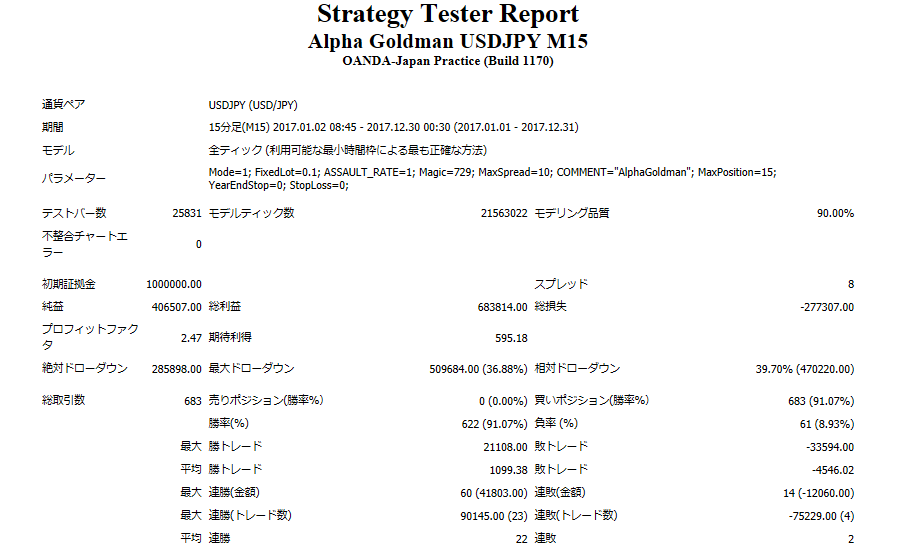

Next the 2017 performance.

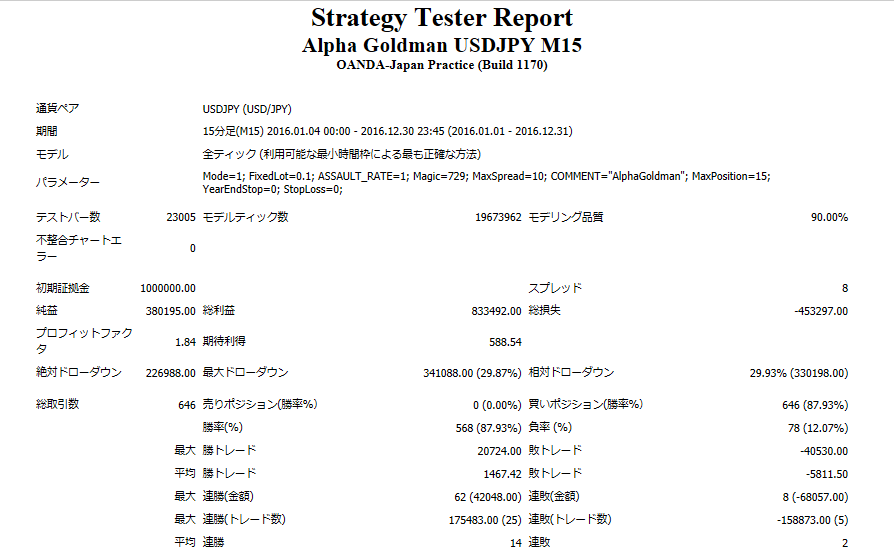

Finally, 2016.

The annual net profits were: 2018 530,000 yen, 2017 400,000 yen, 2016 380,000 yen, and the yearly return is 30–50% depending on account size.

An annual rate of 30% compounded for 3 years would yield a 210% increase on the original amount.

If a 50% annual rate continued for 3 years, you could expect a 330% increase—a very large return.

■

Next, let's look at simple interest operation

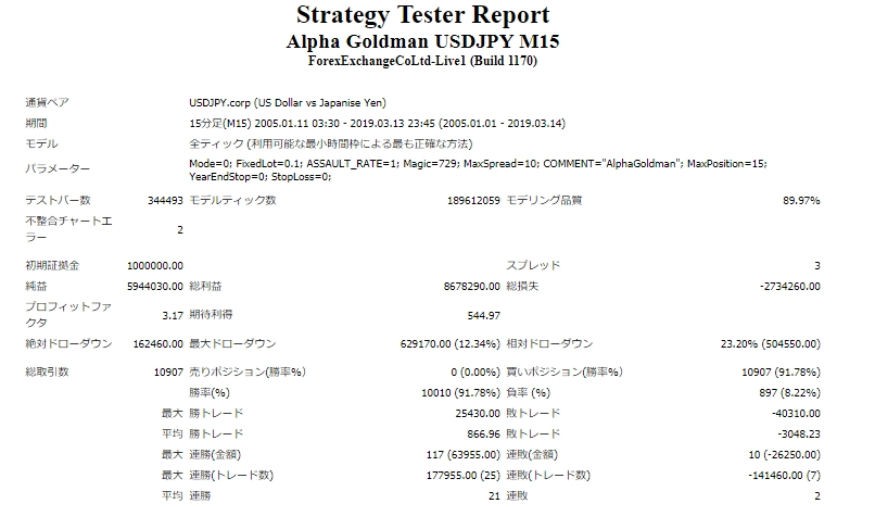

2005.01.01‐2019.03.14

Net profit +5.944 million yen (average annual 420,000 yen))

Maximum drawdown 62.9万円(12.34%)

Total trades: 10,907 (annual average 779)

Win rate91.78%

PF3.17

The recommended margin is for 0.1 lot,

(4.5×15)+(62.9×2)=193.3(万円)

The expected annual return is 21%.

Position count can be changed via parameters, so let's consider 1 position.

In that case, the recommended margin is (4.5) + (62.9×2) = 67.4(万円), and the expected annual return is 62%.

The number of trades per year is about 779, so it should not be overly frustrating.

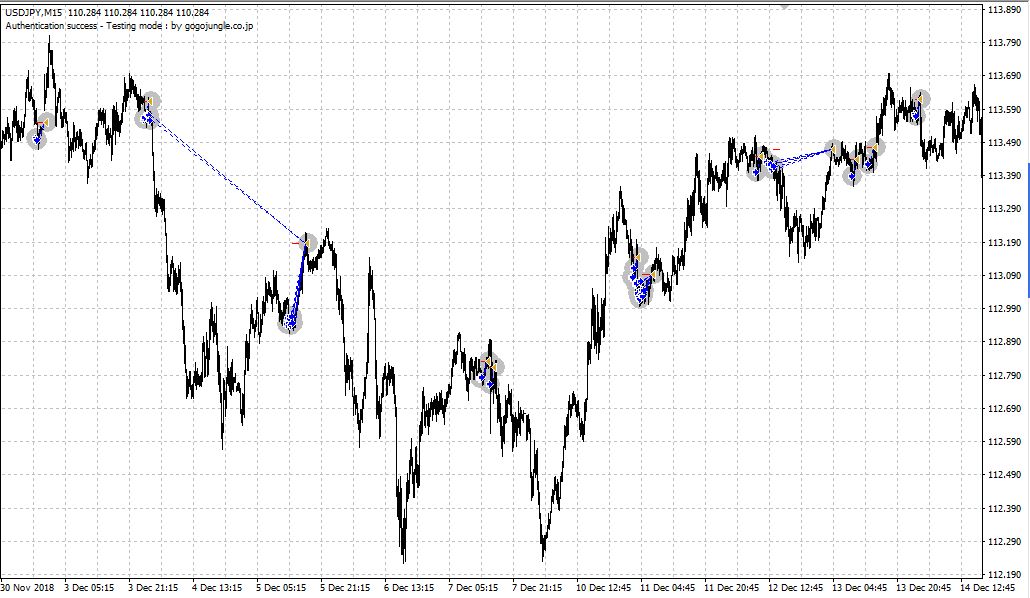

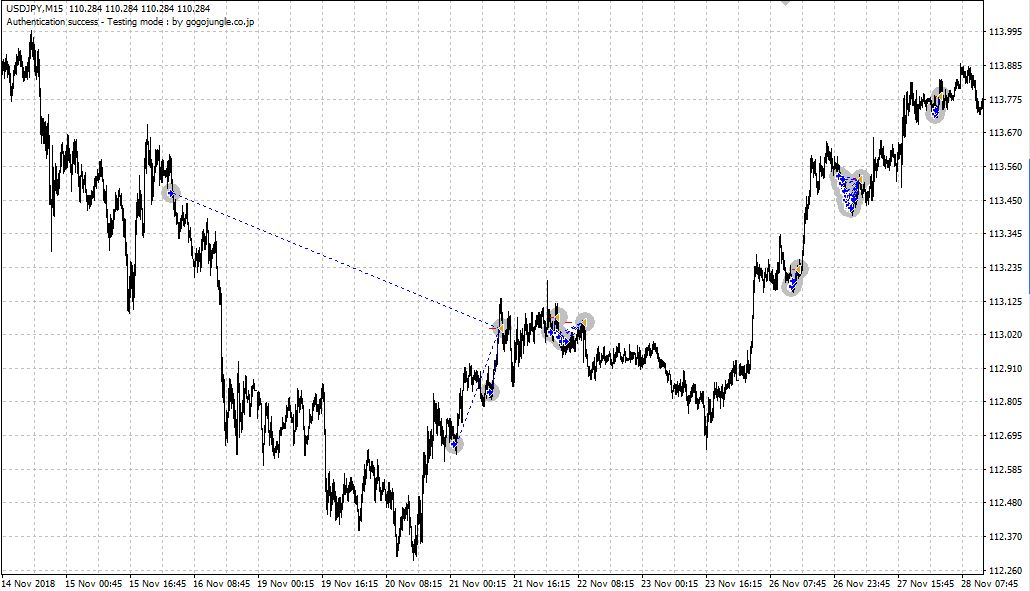

■Backtest ResultsEntry Points

The EA logic only buys.It has a "Downtrend Detection" feature, butas the image shows, entry frequency decreases when a downtrend persists.

■Summary

The main attraction, undoubtedly, is the compounded operation「ASSAULTモード」. Even if you incur unexpected losses, profits accumulate beyond them. In the past three years of backtests, continued compounding yields annual returns of 210%–330%, which could be highly valuable for investors seeking bigger profits.

There are drawdowns as well, but it might be worth trying with a strategy of tolerating losses to achieve greater gains.