With 10 logics, no blind spots⁉Portfolio-type EA "Multi-RoleGJ1_TypeA"

Realize overall drawdown reduction by operating multiple independent logics.

The on/off control of each logic and its parameters can be changed, with customization being a key feature

【Multi-Role GJ1_TypeAOverview】

Currency pair:[GBP/JPY]

Trading style: [Swing Trade] [Position Trade]

Maximum number of positions:10

Timeframe used:1Hour

Maximum stop loss:100(configurable per logic)

Take profit:300(configurable per logic)

The logic10 types are included, with one position per logic and a maximum of10 positions for GBP/JPY.

Since each logic can be toggled on/off in settings, you can operate as a portfolio even with a single EA.

10types, by using all logics you can expect drawdown reduction across the whole portfolio by responding to market changes with hedged-style behavior.

Because the trading style ranges from swing to position trading, stop loss and profit-taking ranges are relatively larger.

As for margin, rather than lot management for a single EA,10logics are operated simultaneously, so careful lot management is advisable (default setting is0.01lots, up to0.1lots).

The current win rate is not very high, but figures such as the profit factor (PF) are not bad, and it is yielding profits.

【Backtest Analysis】

There are 10 logics, so we will look at the backtest results for each logic operated individually over the most recent six years, including number of trades, max drawdown, PF, plus annual number of trades and annual profits.

Finally, we will analyze the case where all logics are operated together (default settings)(The currency symbol in the image is shown in dollars, but the figures are in yen)。

・Common conditions

Backtest period: 2013.01.01‐2019.01.01

Spread 1.0

0.01 lot fixed

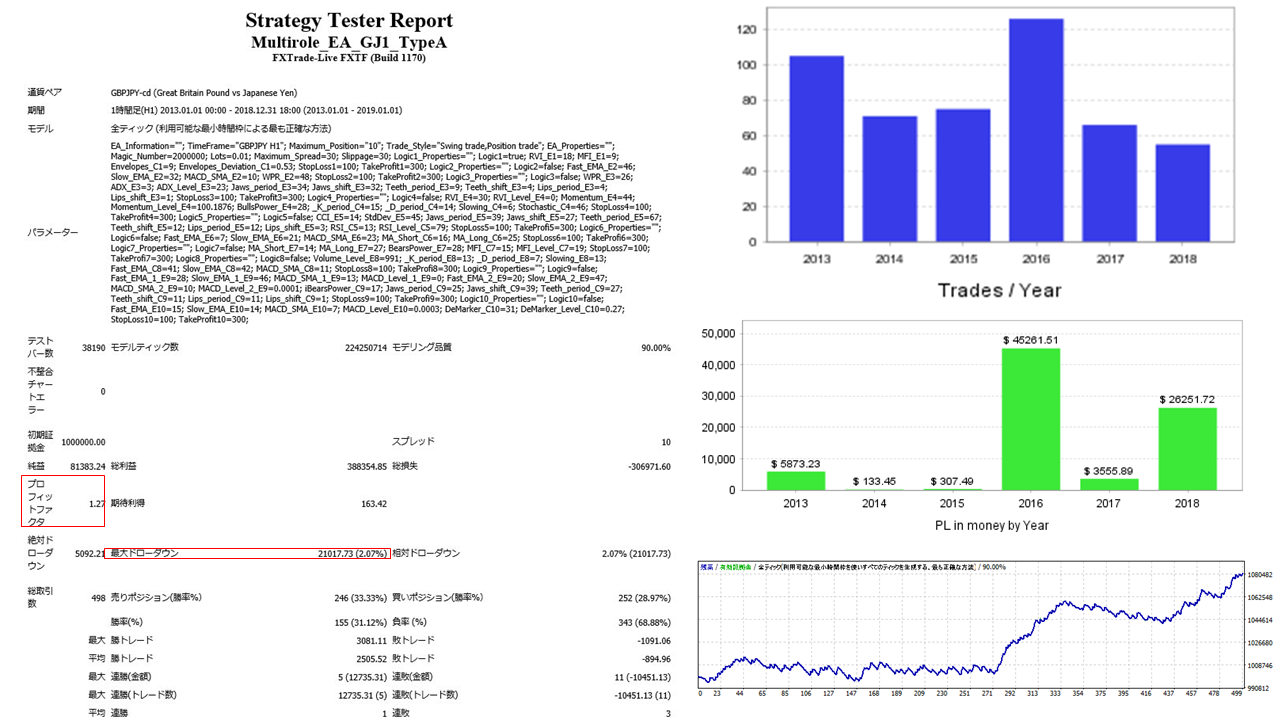

・Logic 1

Trades:498

Max drawdown:2.1ten thousand yen

PF:1.27

The number of trades is high, and accordingly the max drawdown also exceeds 20,000 yen. However, on a yearly basis there are only a few years, and profits were achieved in all years, so single-logic operation may also be feasible.

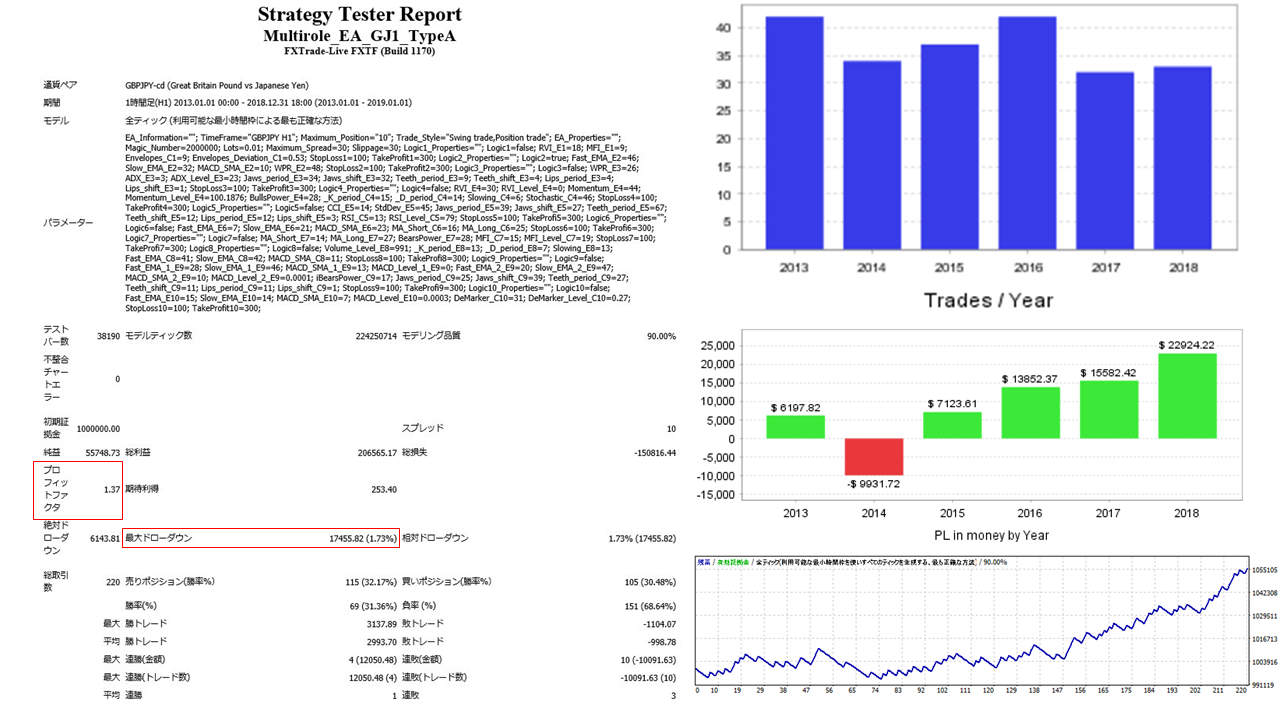

・Logic2

Trades:220

Max drawdown:1.74ten thousand yen

PF:1.37

The performance in the most recent four years is good, so if combining this logic should be a core you want to use. The max drawdown is relatively high at 1.74×10,000 yen, and losses in 2014 were not small, so if using alone, further analysis is needed.

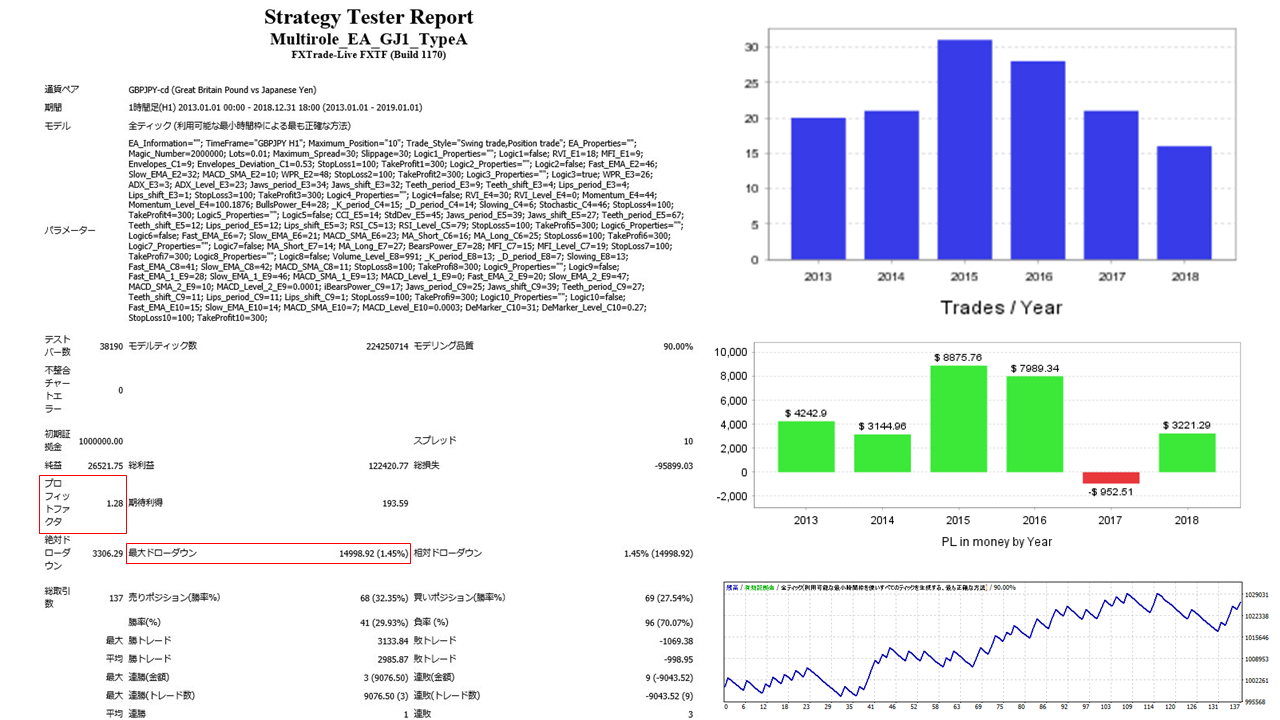

・Logic3

Trades:137

Max drawdown:1.49ten thousand yen

PF:1.28

Although the number of trades is small, profits are solid. However, because the number of trades is small, there are years with losses, so it would be prudent to operate it in conjunction with other logics to keep losses down.

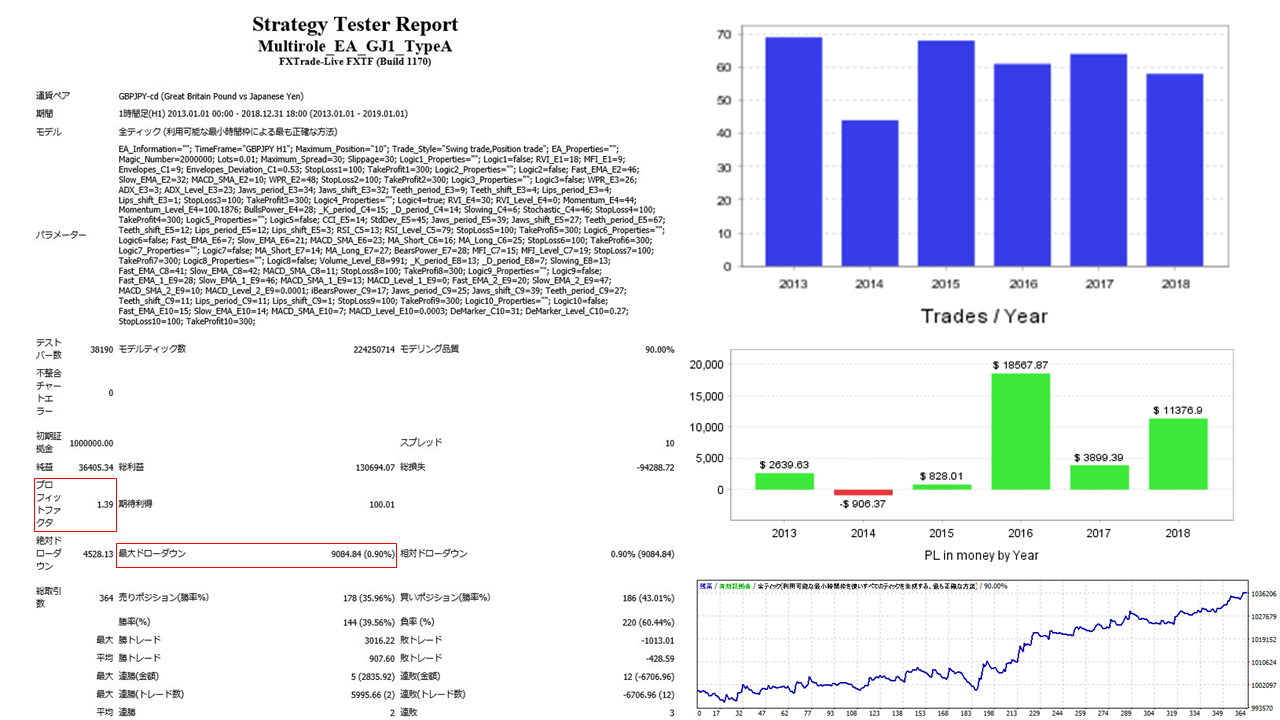

・Logic4

Trades:364

Max drawdown:0.9 ten thousand yen

PF:1.39

The number of trades is high, and the max drawdown is below 10,000 yen. Since the up and down cycles are large, it would be good to operate this logic in combination with others if possible.

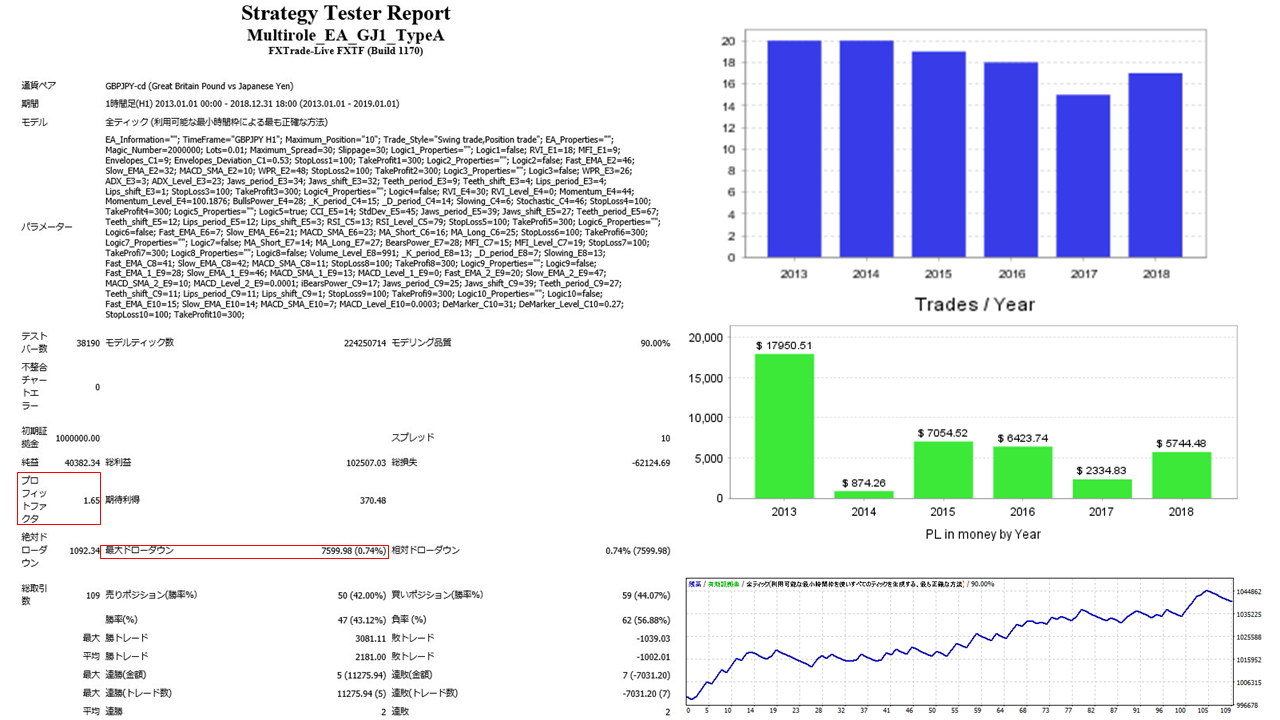

・Logic5

Trades:109

Max drawdown:0.75ten thousand yen

PF:1.65

Although the number of trades is small, PF is the highest among the logics at1.65, and the max drawdown is below1 ten thousand yen. Profits are posted in every year, so standalone operation also seems highly suitable.

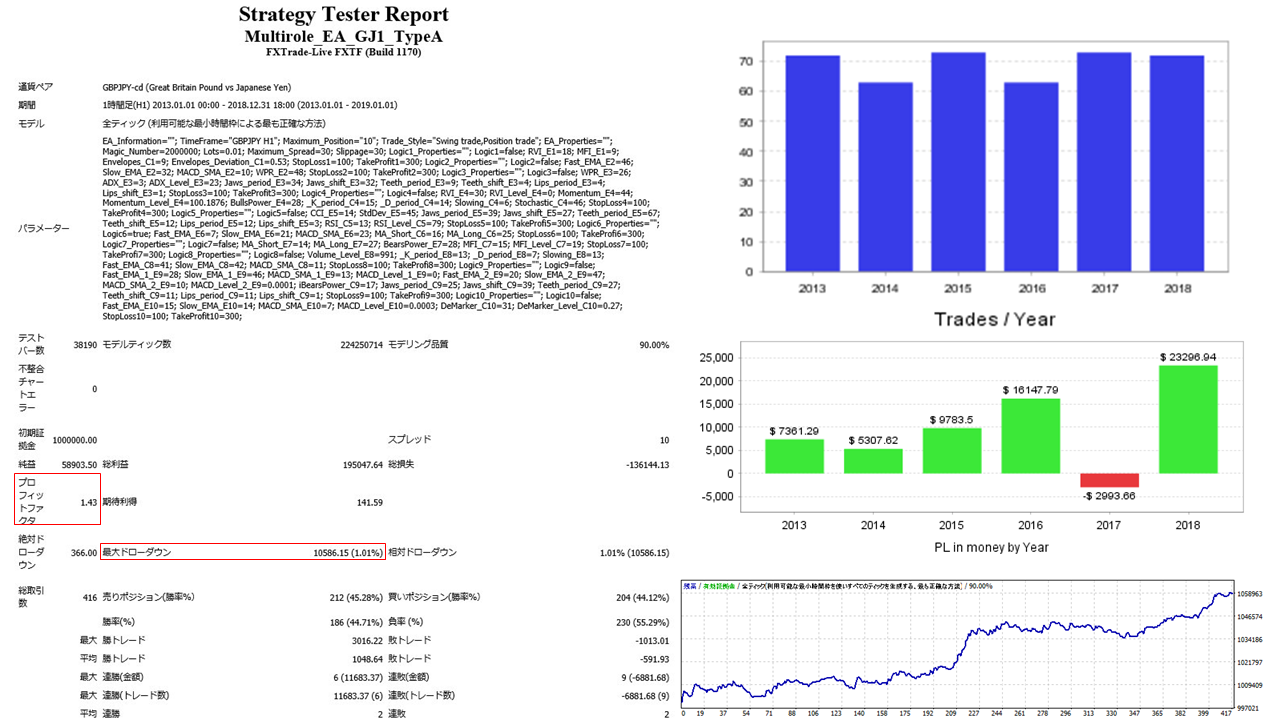

・Logic6

Trades:416

Max drawdown:1.05ten thousand yen

PF:1.43

The number of trades is relatively high and the max drawdown is low, so this logic is also worth considering as a core when operating solo or in combination.

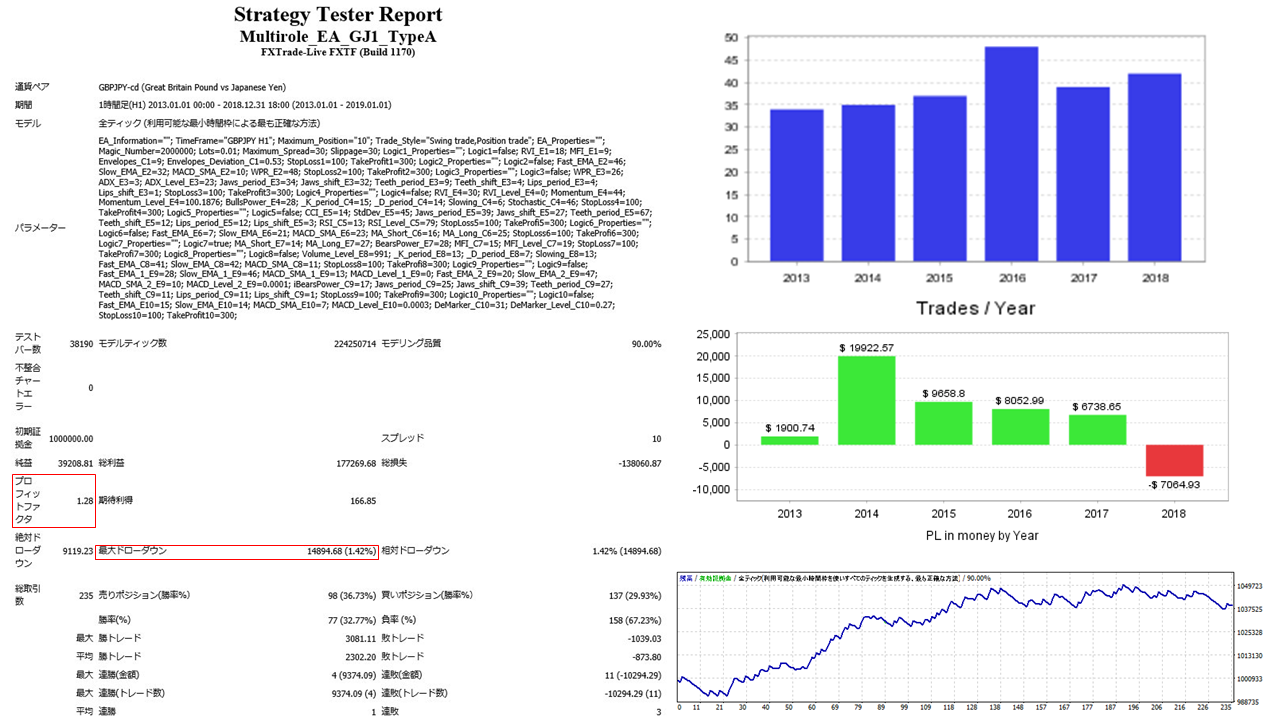

・Logic7

Trades:235

Max drawdown:1.48ten thousand yen

PF:1.28

Overall it is average, but 2018 shows a loss. However, compared with the profitability of other logics, 2014 shows substantial profit, so this logic is balanced within the overall set. Therefore simultaneous use also seems likely.

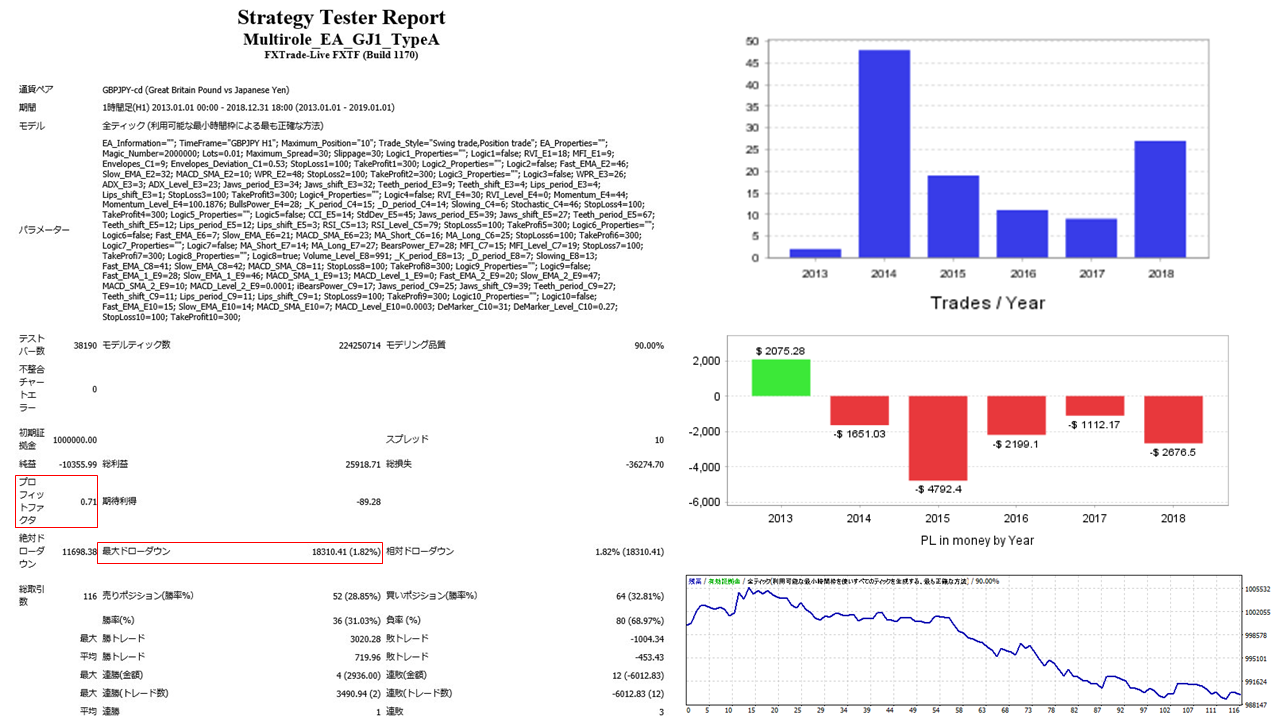

Logic8

Trades:116

Max drawdown:1.83ten thousand yen

PF:0.71

The only logics whose PF is below 1 among all logics. Since the balance of income and expenditure has declined, if you base on backtests, further verification with parameter changes or longer-term testing may be necessary. If difficult, you could disable only this logic from the default settings.

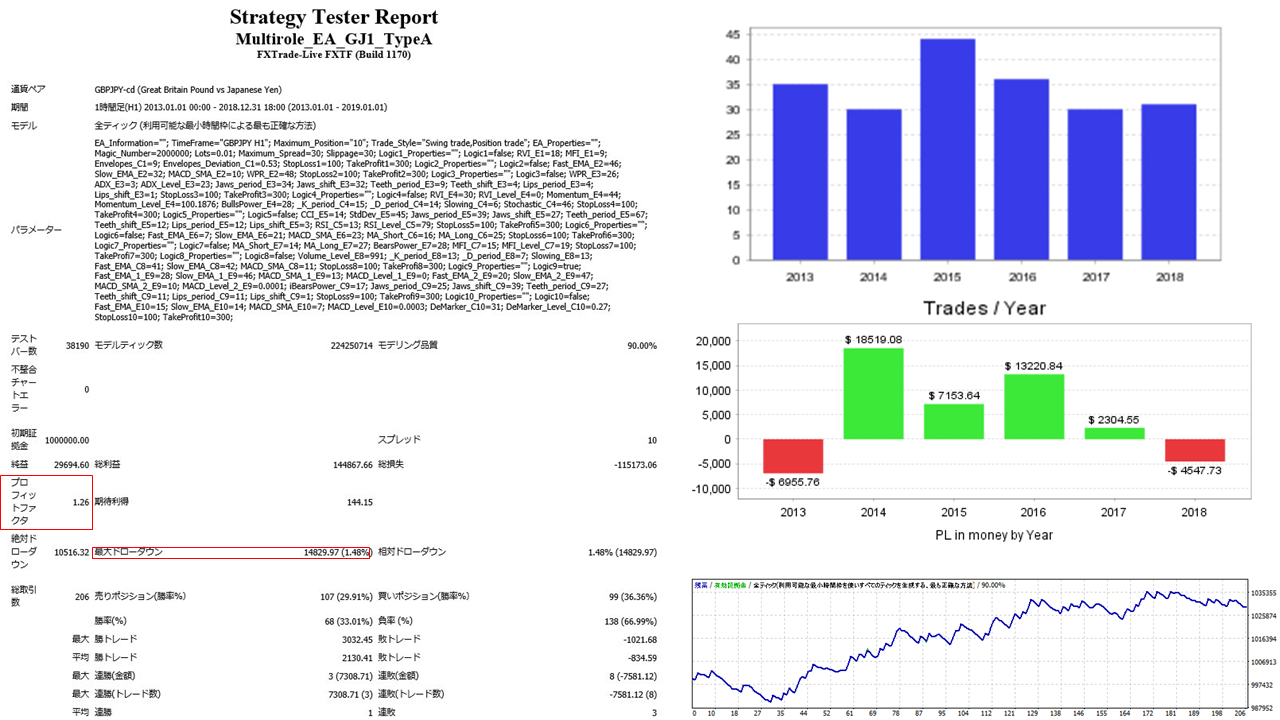

・Logic9

Trades:206

Max drawdown:1.48ten thousand yen

PF:1.26

Trade count is modest.2013 and2018 saw losses, but profits in other years keep PF at1.26. The behavior is similar to Logic 7, so you may want to combine it with others to gain profits where they are weaker.

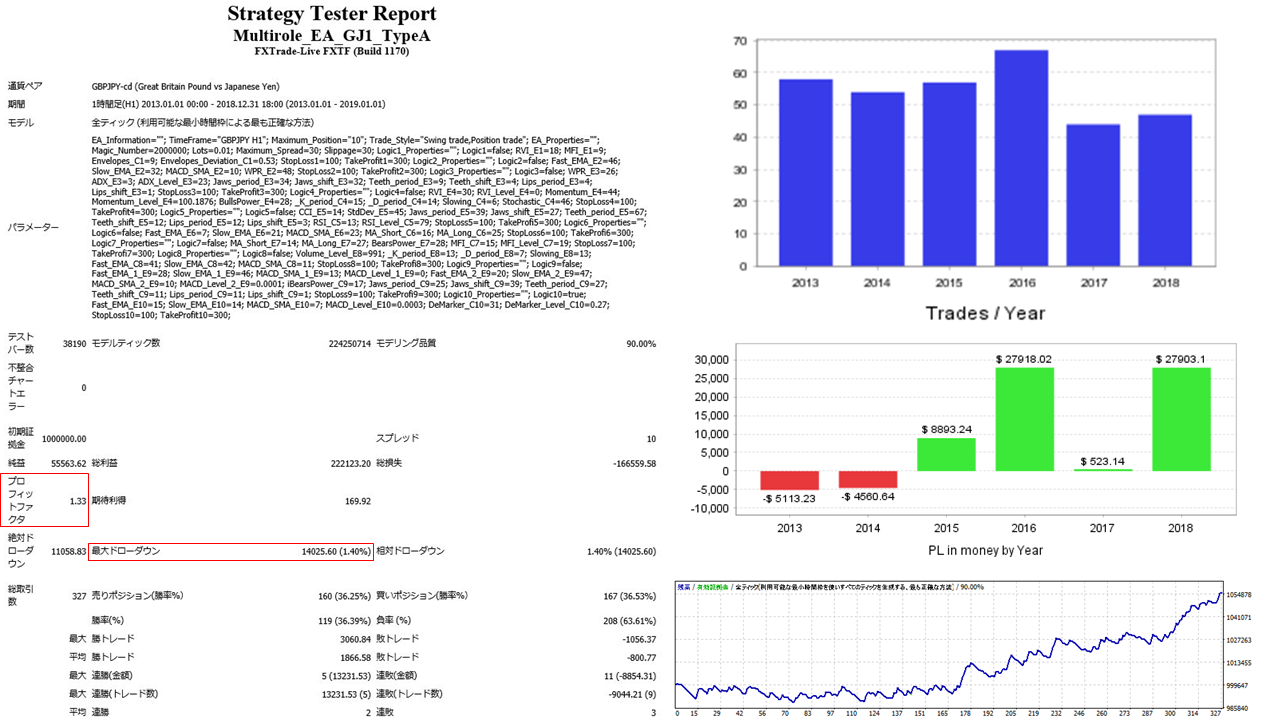

・Logic10

Trades:327

Max drawdown:1.4ten thousand yen

PF:1.33

Trade count is relatively high among the logics. Since the profit per trade can be wide, if you operate multiple logics simultaneously you should also run this one to increase average profit.

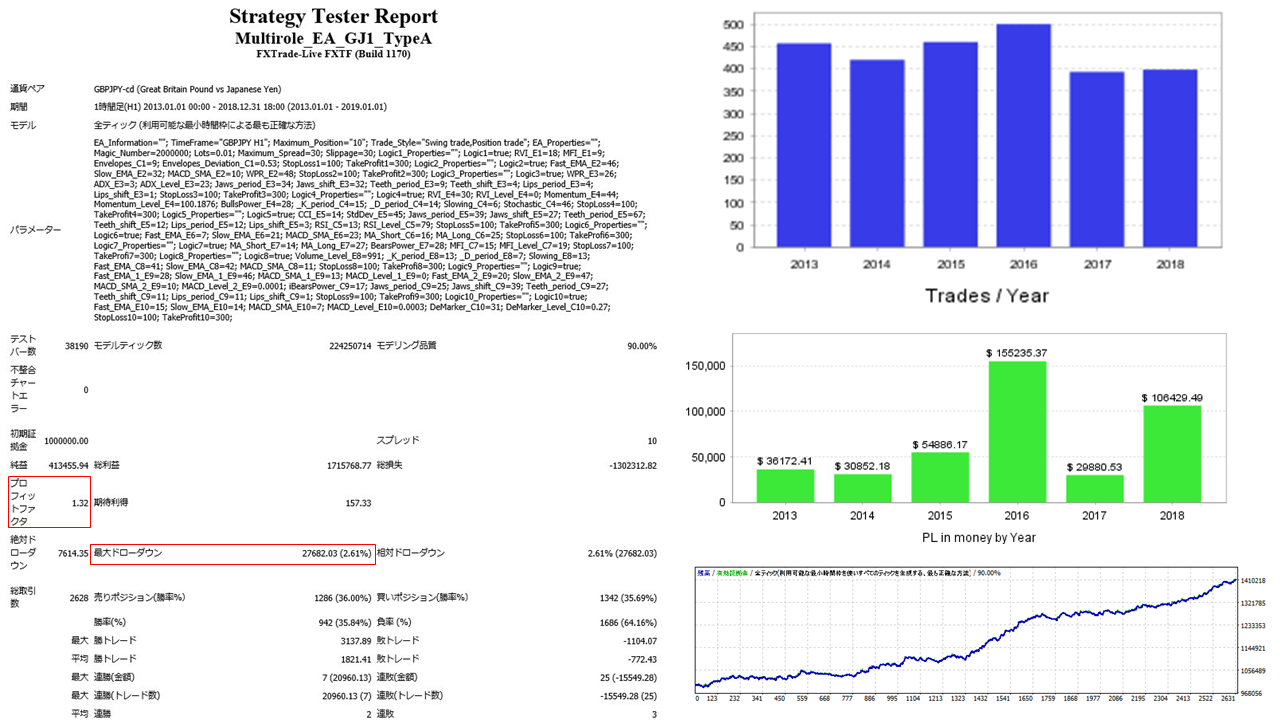

・Logic10 (default settings)

Trades:2628

Max drawdown:2.76ten thousand yen

PF:1.32

Under the same test conditions all Logic 1–10 with default settings were run.10Single-logic runs show a smoother upward trend and profitability every year.

When running all logics together, the result is a steady growth and profits each year.

With multiple logics, the maximum number of positions is 10, so the maximum drawdown increased to10,000 yen, which is large. Nevertheless, since they are independent logics, compared with single-logic operation, even with the tenfold increase in positions, the drawdown amount stays within about 2–3 times.10times the positions2–3times.

Trading frequency averages about438 trades per year (assuming 250 trading days per year, about 1.75 trades per day).

Recommended margin amount is0.01

(0.74*10)2.76*212.92(ten thousand yen)

So, if operating with the default settings, you should have at least130,000 yen.

The expected annual return in this case is53.2%.

Because the GBP is highly liquid and volatile, this long-term holding strategy makes the maximum drawdown and number of trades more important. In that context, the drawdown-reduction effect afforded by the characteristic of the “Multi-Role GJ1_TypeA”—many independent logics—should function effectively against large swings. While no individual logic is weak, relying on a single logic tends to show volatility in performance, losses, or low trade frequency.It seems the real value will be realized by combining and running multiple logics simultaneously.

As with portfolio EA compositions, you should analyze each logic, adjust combinations and parameter settings, but this EA has the potential to exceed published forward results with a single package.

Not only for immediate use, but for those who want to thoroughly analyze and adjust parameters, this is an EA that comes recommended.