20190321 (Thu) USD/JPY short-term scenario

This is a front-loaded scenario.

Free is OKSo, I tried drawing one for free. I may draw for free occasionally.

Everyone’s favorite dollar-yen, right?

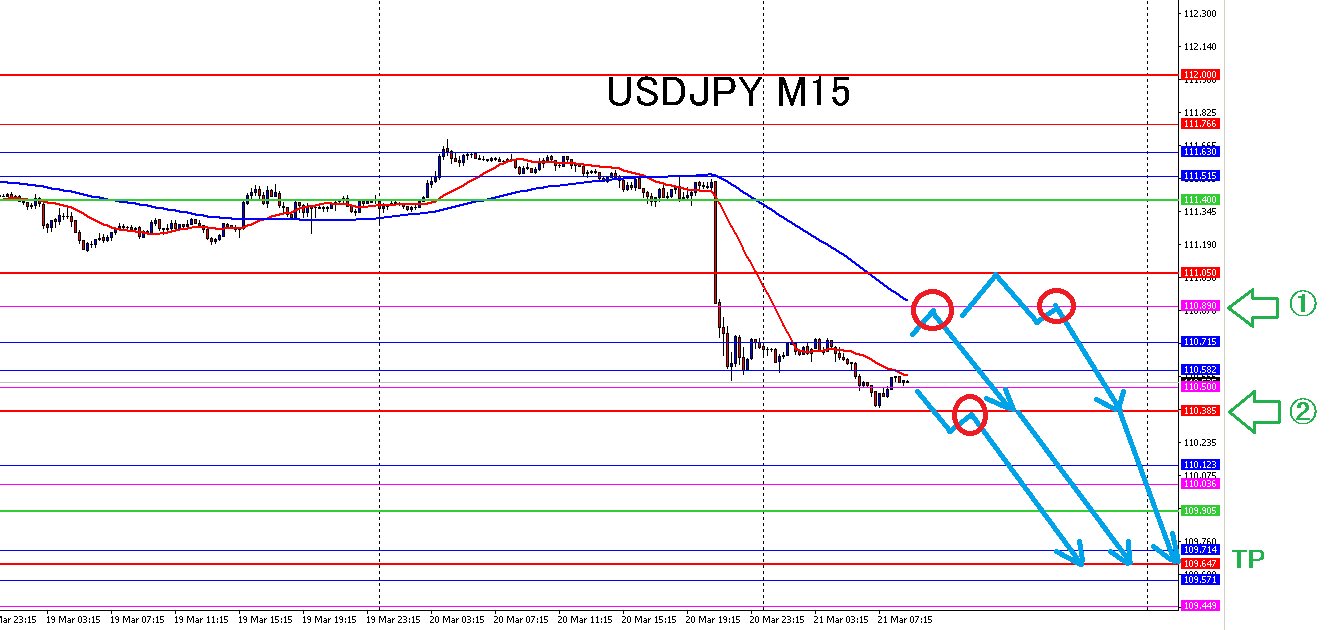

Dollar-Yen 15-Minute Chart

Line ① (110.890)

Line ② (110.385)

The plan is to look for a rebound near these two lines and aim for a selling entry.

If it moves like the blue arrows, I plan to target an entry, but I’m not predicting that it will turn out this way.

It might continue to rise, or it might move like the blue arrows and enter, which could also result in a stop loss.

No one can predict, and there’s no need to predict.

It’s a game of winning and losing, adding up to a net profit over time.

To that end, keep the stop loss small when there is a counter-move.

It is essential to decide this in advance.

The basics of stop loss are to place it above the line, and to target 1–2% of account funds.

That way you won’t sleep with a running loss, won’t face a big loss, and won’t be wiped out in one go.

To avoid big losses or a wipeout, once you enter, just place the stop loss.

This simple step can prevent it.

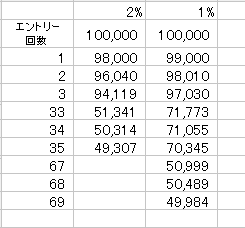

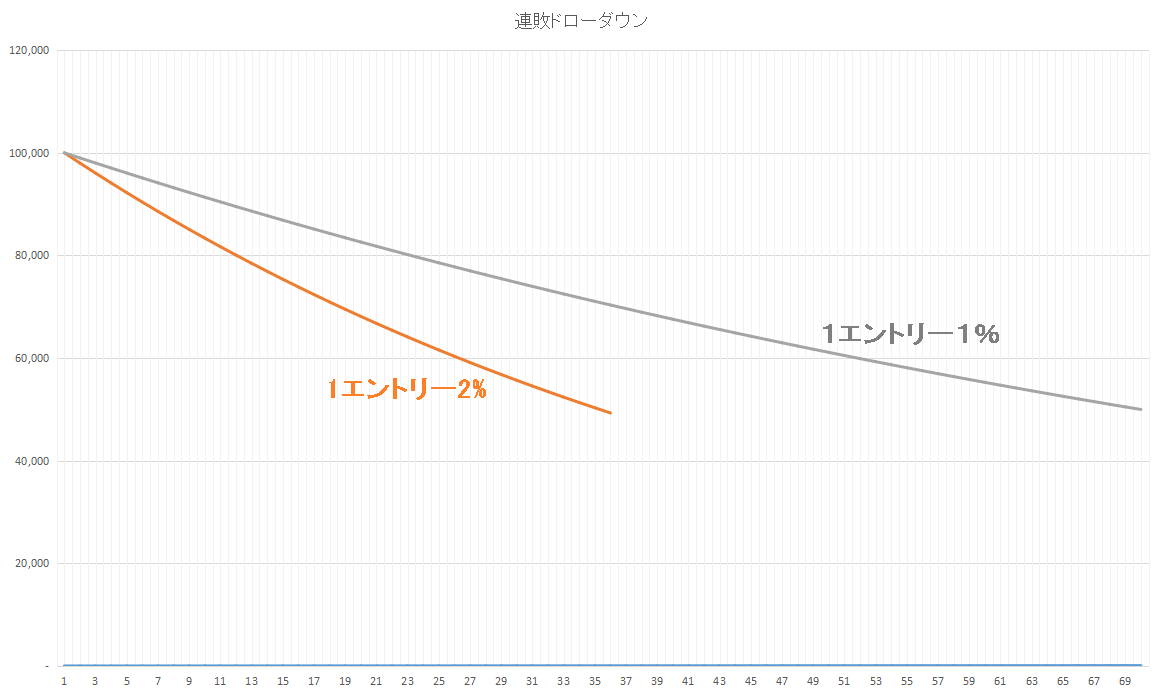

For example, starting with 100,000 yen, if you drop below 50,000 yen with a 2% stop per entry,you would need 35 consecutive lossesto reach that point.

With a 1% rule,69 consecutive lossesare required before the funds halve.

Losing half of your funds is extremely difficult.

If you manage funds properly, draining all funds seems like an impossible game.

What about profits?

If you can take from line ① to ②, that’s about 50 pips.

If you entered with a 10-pip stop and earned 50 pips, then under the 1% rule that’s 5% profit, under the 2% rule that’s 10% profit.

A single trade can yield approximately 5%–10% profit. Is that small?

On the FX member blog, the ability to publish front-loaded scenarios was restricted, but

you can learn how to draw lines and how to craft scenarios.

From situational awareness to chart analysis, etc.

By adjusting the posting time of front-loaded scenarios, we’ll publishlate-breakingscenarios.