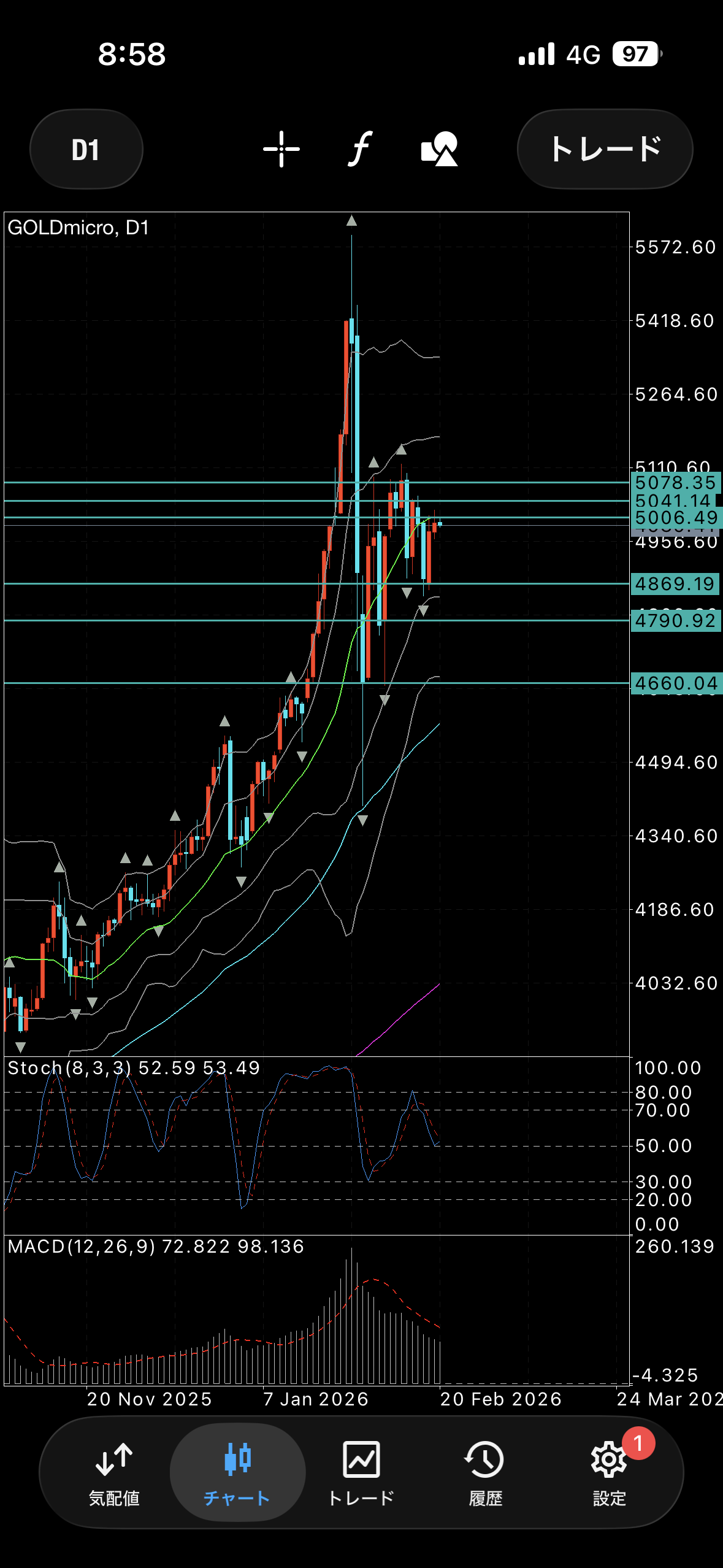

Gold Analysis on 2026/02/20

Using Indicators

BB Period 20

75,200 EMA

Yesterday's gold daily was a bullish candle.

There is a slight upper wick near the middle, but it is becoming relatively flat; overall it remains bullish, but it is not yet clear whether it will rise.

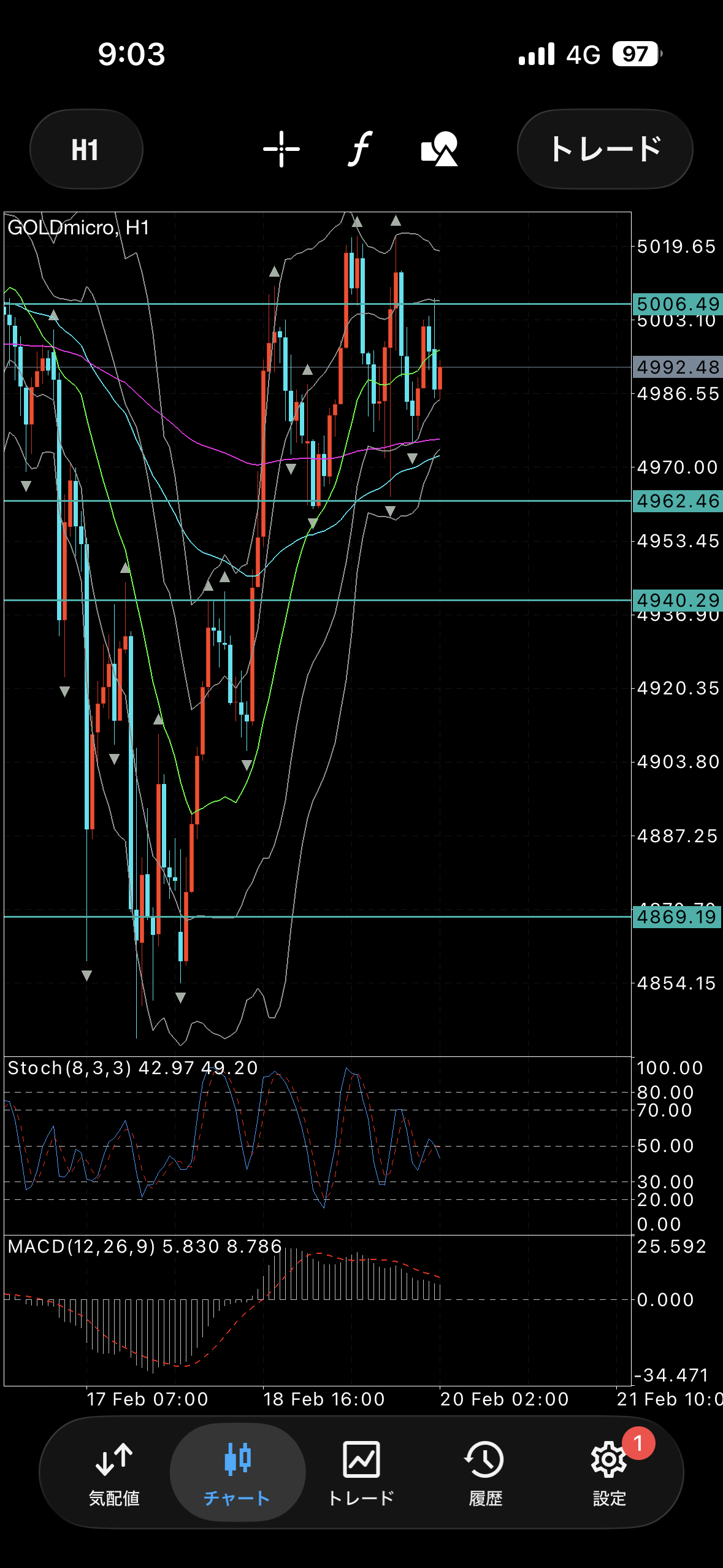

Gold 4-hour is in a range.

From around the low near the 200 EMA, buying and selling around the high is effective, but given the EMA position, advancing with a buy may be reasonable.

The 1-hour chart rose from an inverted head and shoulders but ended in a range.

Because it is also forming a range above the higher moving average, buying from the bottom has higher edge.

However, if you break even, it is safer to exit quickly (though there is still a possibility of profit if you are still long).

Buy defensive lines

4869

4940

4962

Sell defensive lines

5006

5041

5078