Feeling pathetic

I am a candlestick FX trader.

Recently, I received a wonderful review.

This is a review about

“Ultra-High Win Rate FX Logic”, and

first of all, I am relieved to hear that it helped you to win.

“Ultra-High Win Rate FX Logic”iscandlestickbased and can be traded using only

without discretionary input, allowing you to trade without discretion.

And what I found wonderful is that

you have found a time framethat suits youand are using it yourself.

In the text, it mentions feeling “pitiful,” but

the trading style and the time frame that suits you

vary from person to person, of course.

Therefore, even if you trade on a shorter time frame and feel restless,

there is no need to worry at all.

There is no need to feel ashamed in the slightest.

Rather, like this person, find a time frame that suits you and

trade without stress.

And my logic can be used on any time frame.

Often there are logics or signal tools that are effective on a certain time frame

but do not work on others,

which I consider curve-fitting at that point.

Just as with indicator selection, the performance varies with the time frame you choose,

as it is a formalization of past market conditions.

Therefore, all of my logic is

effective from 1-minute to even monthly charts.

And I can provide the logic, but

which time frame you trade on

is something you must determine yourself physically.

Personally, I trade mainly on the 15-minute chart,

because I want to trade on my phone while out,

so I chose something that allows fairly relaxed trading,

and also provides enough entry opportunities,

which led me to settle on the 15-minute chart.

Of course, when I am at home or have enough time,

or when the market is moving significantly,

I may trade more actively on the 1-minute or 5-minute charts.

So, roughly, the main focus is on the 1-minute to 15-minute range.

However, this is simply a reflection of my lifestyle and trading preferences,

and not everyone may fit this mold.

I have exchanged messages with many people, and some want to scalp on the 1-minute chart,

while others prefer to trade more slowly on the 4-hour or daily chart.

There is no universal good or bad time frame or recommendations.

Ultimately, the best time frame depends on your lifestyle and goals.

And surprisingly, this choice of time frame is as important as the choice of logic.

If you choose a logic or strategy that doesn’t suit you, you will not be able to sustain it.

If you cannot sustain it, trading becomes stressful daily and leads to losses.

Whether you win or lose, you must avoid ongoing stress;

or you will lose overall due to lifestyle strain.

The goal is to profit overall, so you must choose something you can keep doing consistently.

what matters is whether it suits you or not.

It is not about which logic is good or bad;For example, in my case, EAs and signal tools are not suitable for me.

However, there are many people who profit from EAs and signal tools in the world.

My friend operates with EAs for a living,

he keeps stock of more than 100 EAs,

and continuously asks which EA suits the current market,

then selects a few to run and operates them.

If needed, he tunes them as necessary and adjusts parameters as appropriate.

So, even with EAs, he doesn’t just leave them running; he constantly monitors the market, replacing EAs,

turning them on and off, and tuning them as he goes.

The market is always changing,

so there is no EA that can profit indefinitely without attention,

and he understands this very well.

That is why his approach is to continuously monitor the market and operate accordingly.

On the other hand, I am not comfortable with that style of operation.

I am not good at watching the market in front of my computer all the time,

and I prefer to stay away from charts as much as possible.

A trader who cannot stand it, indeed (laugh).

Moreover, I have long hoped to travel while trading on a smartphone,

and thus developed and operate a candlestick-only logic that can be traded easily on a smartphone.

To ensure it can be used even when the market changes,

I arrived at a logic that captures the essence of the market.

However, this is just my perspective,

and there are friends who want to monitor the market at home and conduct EA research for example.

He treats EAs almost as his own children,

and cherishes them (laugh).

When talking, he often says things like,

“This child has been acting up lately,”

“This one is a little wild,”

“This one has become very quiet recently.”

And he talks about his EAs like that (laugh).

Calling an EA “this child”!

I was impressed.

He loves and operates the EAs he created.

Thus, the way people handle logic and strategies differs vastly.

It is not about which strategy is better or worse;

the more important question is choosing a strategy that suits you and being able to keep using it.

Similarly, this applies to time frame selection as well.

If you choose a time frame that does not suit your lifestyle,

it will cause stress and you will not be able to continue.

Therefore, the selection of the time frame is as important as the selection of logic or strategy.

And the person who wrote this review is exactly someone who found a time frame that suits them

and is operating it well.

This is extremely important.

I myself have struggled quite a bit with time frame selection.

There were times I scalped on 1 minute,

and times I switched to swing in the middle.

In that process, I found a time frame and trading style that suited me.

However, for beginners,

it can be very difficult to determine their trading style or a time frame that fits.

A suitable time frame is something you truly understand only after you actually trade.

Therefore, at first, it is okay to demo-trade,

trade on around 15-minute charts,

and then decide whether you want faster trading or slower trading.

Regarding the logic, we often receive questions,

and eventually you will need to choose a logic that suits you.

But beginners may not even know what suits them.

So, start with“Ultra-High Win Rate FX Logic”.

This logic currently has seven logics published,

and it is the simplest among them.

Whether in trends or ranges,

or any market condition,

it is designed to steadily target profits, making it easy to operate.

Moreover, it is a logic that emphasizes win rate above all, so you can enjoy the thrill of profits and build a winning habit,

which is another reason I recommend you start with it.

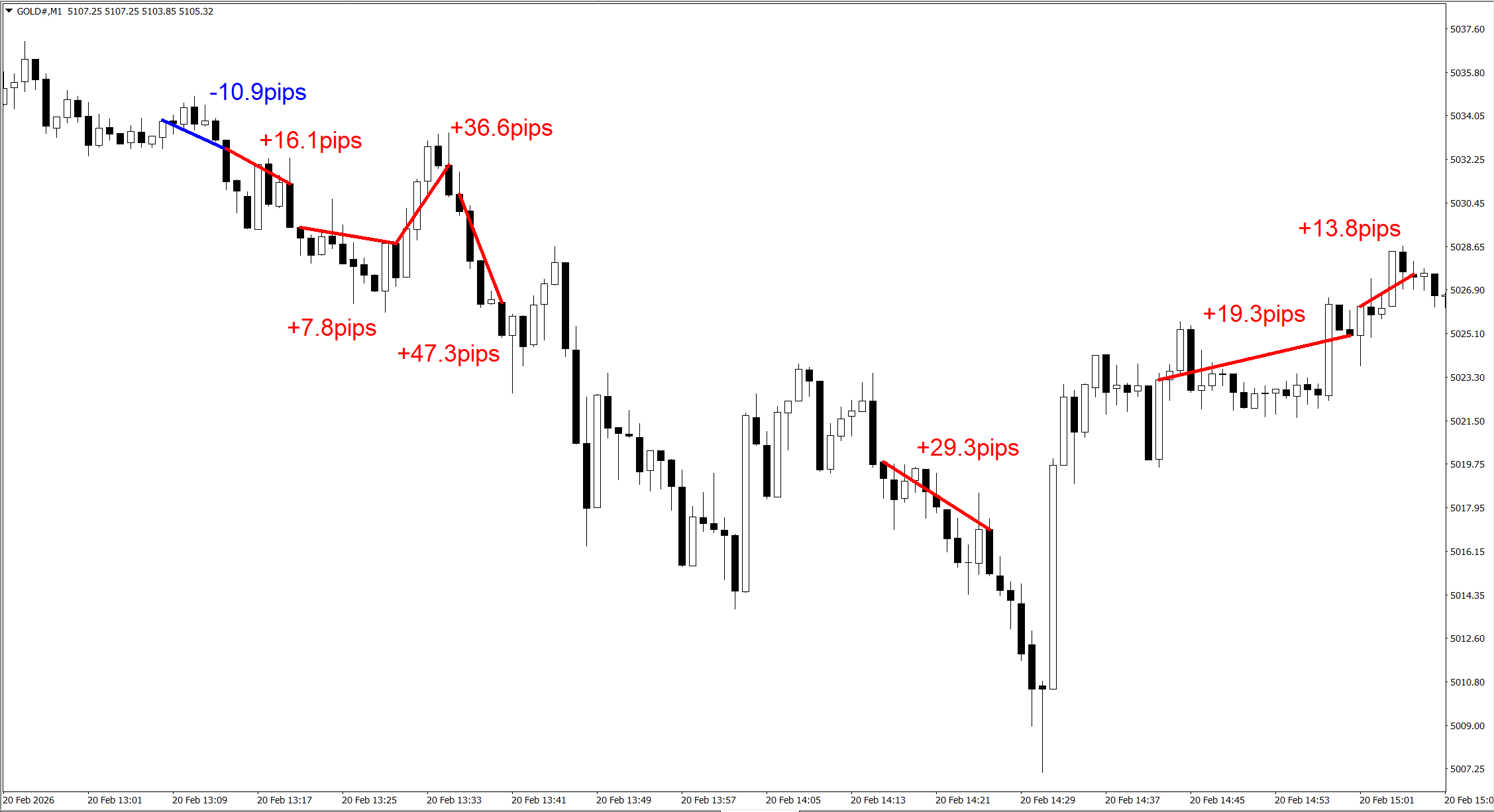

Now, when actually trading with“Ultra-High Win Rate FX Logic”,

let us see what kind of profits you would get.

This is on the 1-minute chart.

If you look at the overall chart, you will notice that

there are trends, ranges, and a mixture of both in the market.

Even in such market conditions, you can clearly see that the win rate is high and profits are reliably earned.

You can understand that this holds true for any time frame.

The key is to choose a time frame that suits you to trade even more efficiently.

And in this logic,

the entry is judged usingtwo candlesticks

No indicators are used,

nor do we look at large time frames, directional cues, or situational awareness.

It is all based on just two candlesticks.

By the way, even the exit is completely discretionary-free, and

it is, remarkably,exited with just one candlestick.

We do not consider market momentum or approaching tops,

nor anything of that kind.

We simply close the position based on the single candlestick pattern.

・Entry is 2 candlesticks

・Exit is 1 candlestick

That is all.

The above chart results are also from trading only with candlesticks,

so anyone, including beginners, can achieve similar profits.

And we have actually received feedback from people who have already used this logic.

.

As these people say,

no complicated and time-consuming analysis is required.

It really can be traded with just two candlesticks.

And because of this kind of logic, beginners can quickly aim for profits,

and we have received many more positive testimonials.

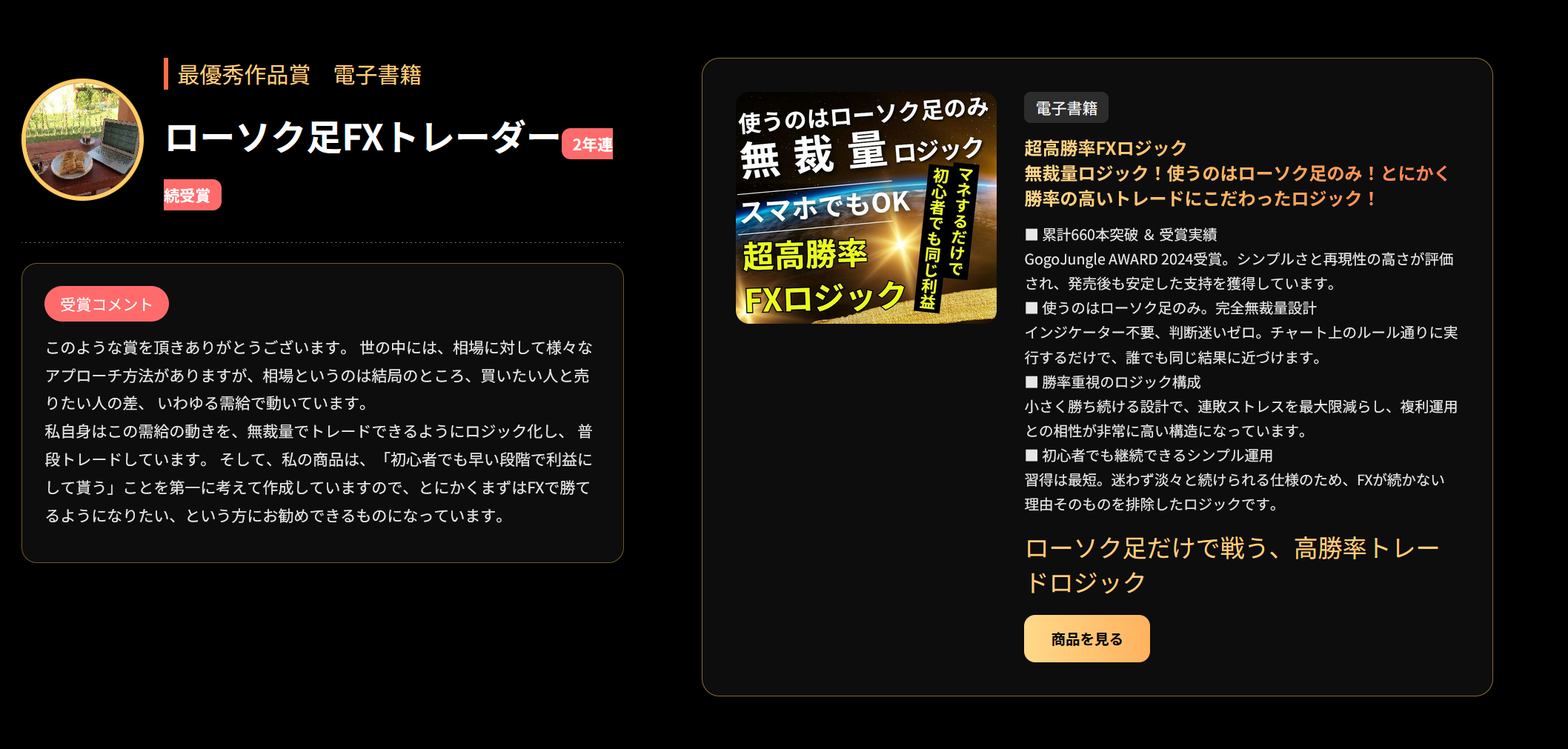

And furthermore,“GogoJungle AWARD 2025”awarded

Best Original Work

Also, this logic won theBest Original Workaward in 2024 as well,

making it a two-year consecutive win.

For people with FX experience,

they tend to think of the market as more complicated.

They try various indicators and signal tools,

or incorporate discretionary aspects like situational awareness.

They may even automate via EA to make it more complex.

Price ultimately moves according to the following equation.

When there are more buyers than sellers, price rises, and

when there are more sellers than buyers, price falls.

This is calledsupply and demand

Just by being conscious of this, you can keep up with the market.

In fact, doing extra things tends to make things worse.

And to reduce this to a discretionary-free form is

the current“Ultra-High Win Rate FX Logic”.

“Ultra-High Win Rate FX Logic”For those who want to know more

please see the following video and free bonus.

In particular, using the power of compounding is extremely important,

whether you obtain this logic or not,

so please watch it!

You will discover surprising facts!

Interview video

https://www.gogojungle.co.jp/info/21975

https://www.gogojungle.co.jp/finance/navi/articles/71349

(Password is provided inside the interview video.)