Isn’t it unsatisfying to go from 100,000 to 500,000 in 30 days?

Hello, how much is it.

Recently, I was interviewed by Representative Hayakawa, and I reminisced about the old days after a long time.

From my perspective back then, when I had a grasp of the winning method, 100,000 to 500,000 over 30 days was far from enough, I think.

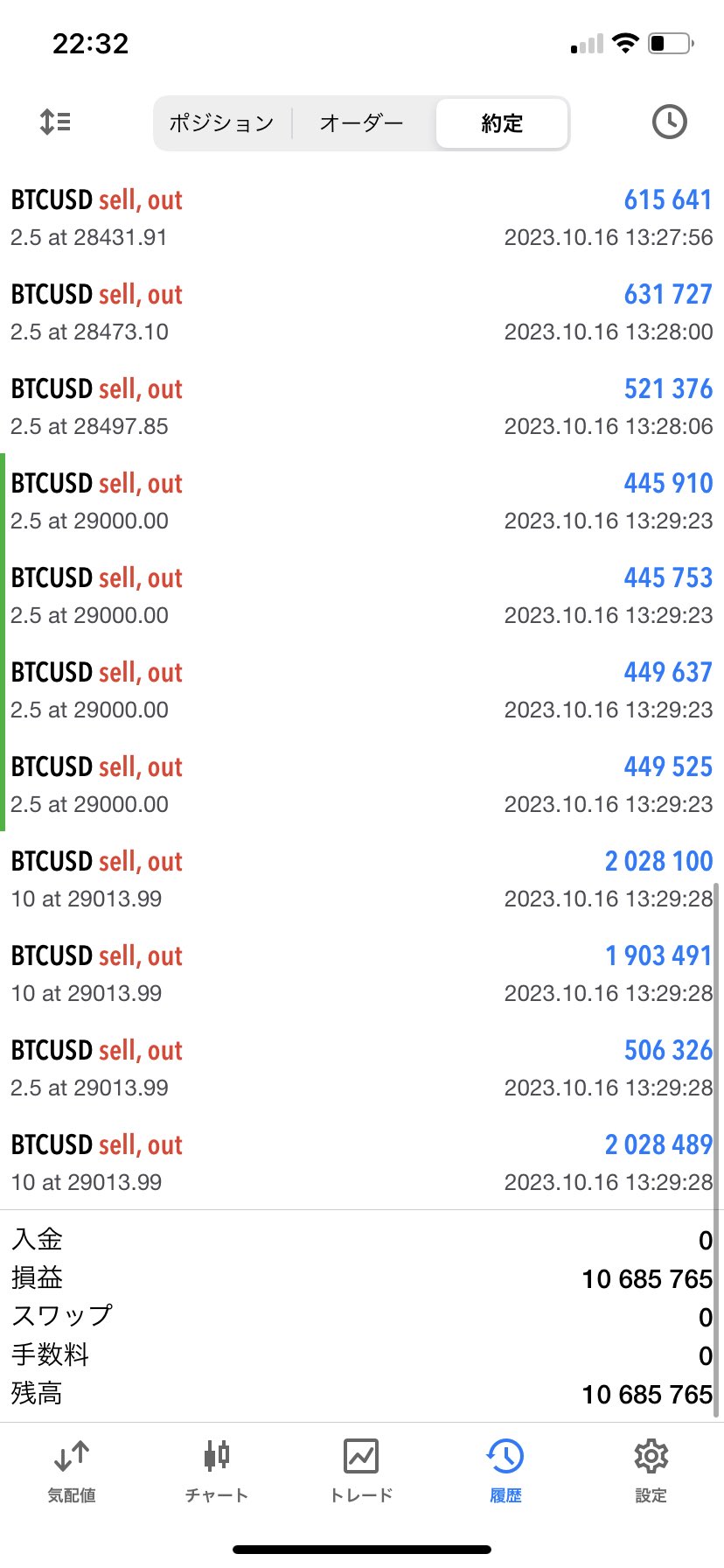

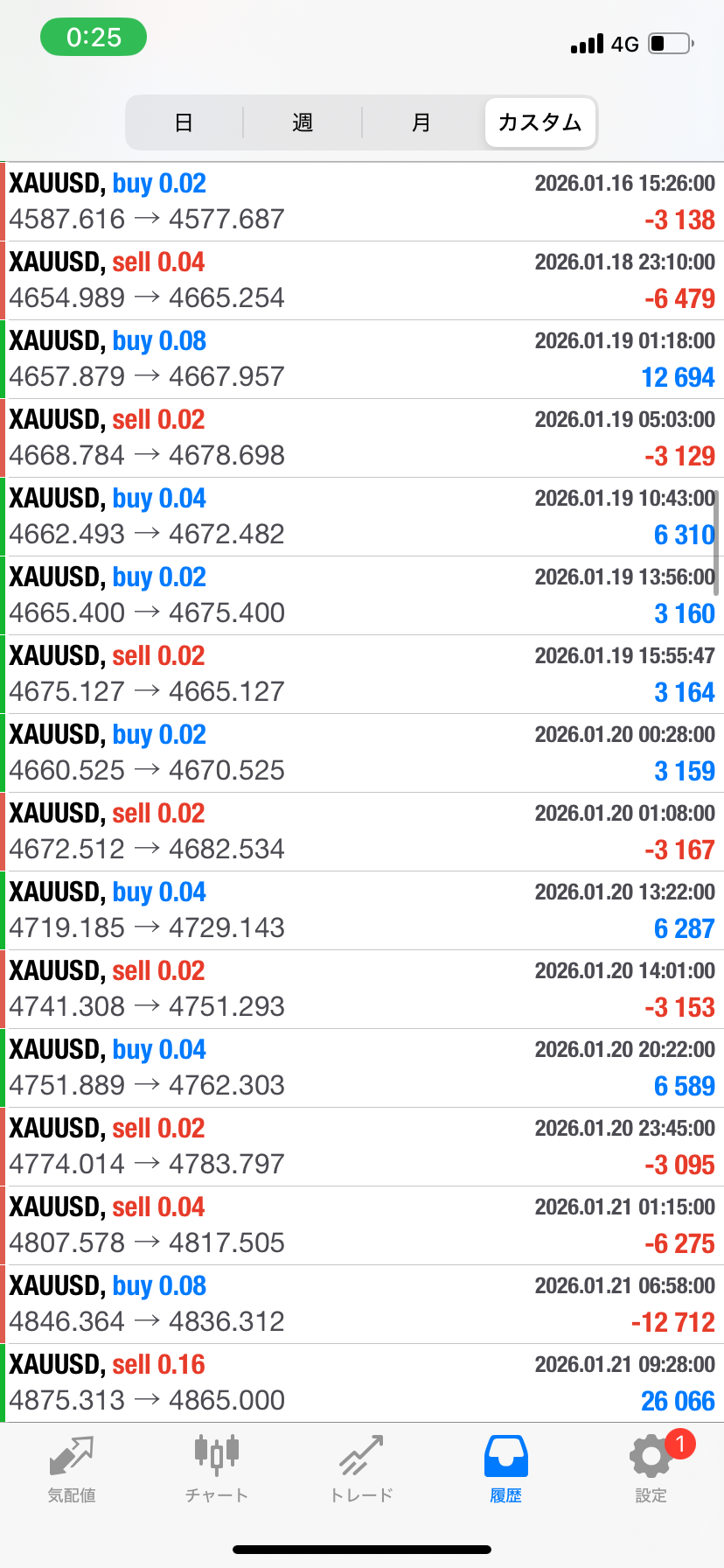

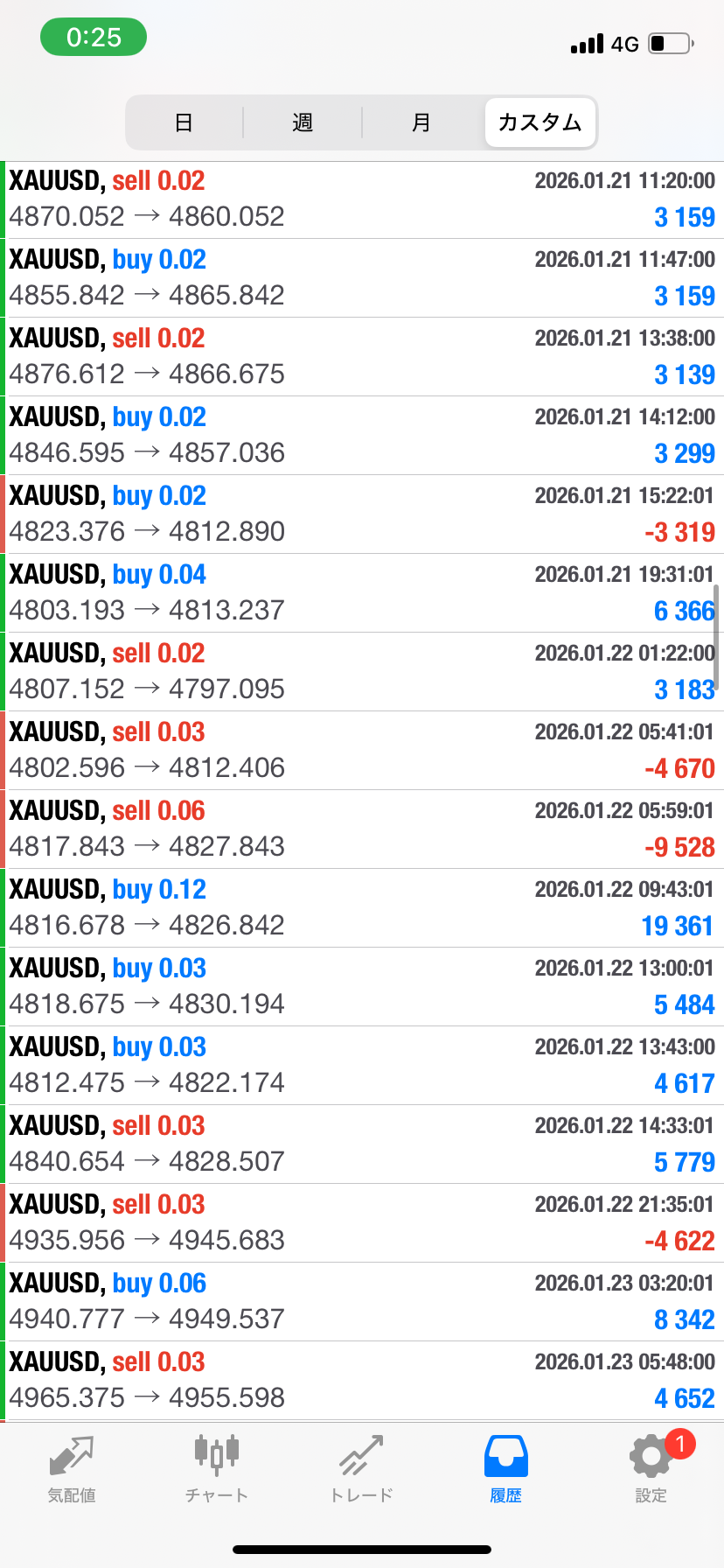

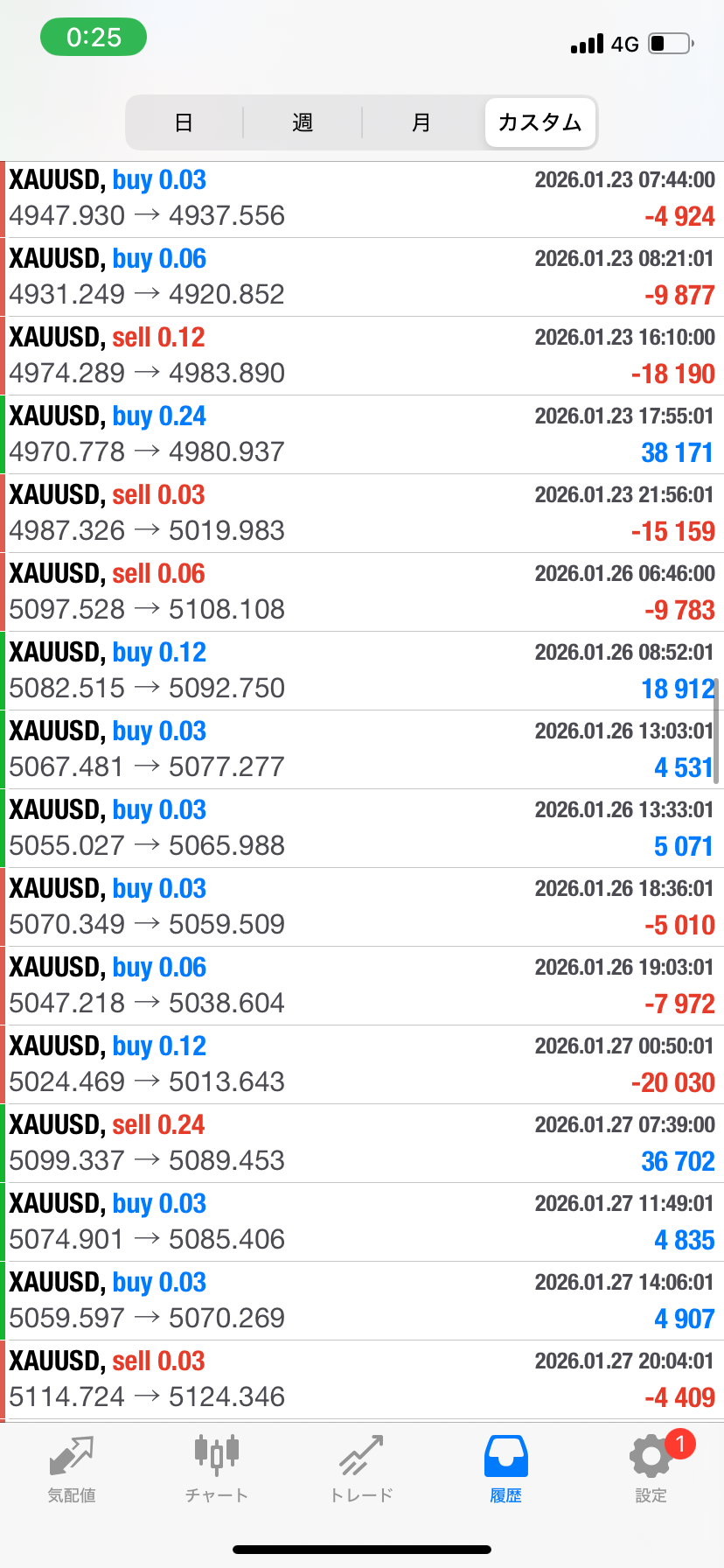

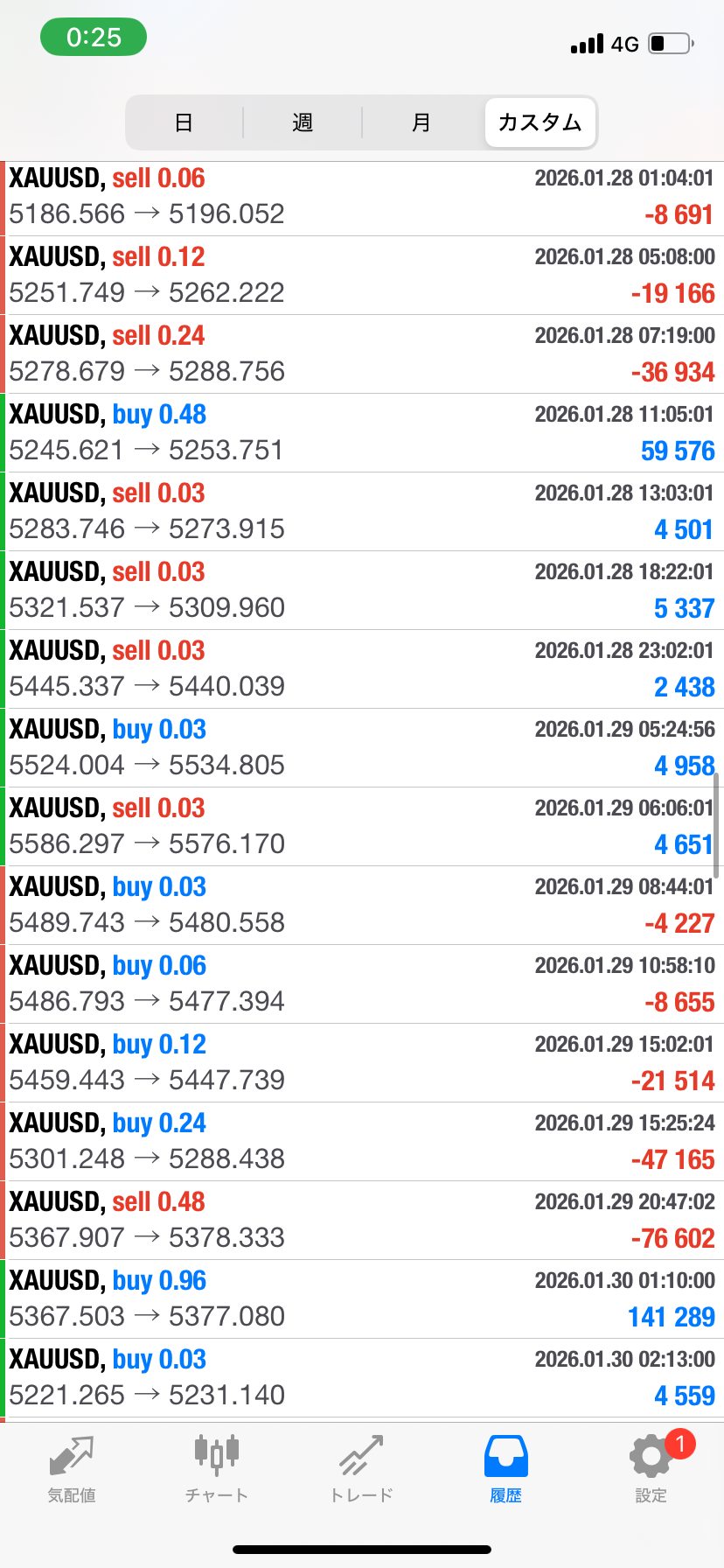

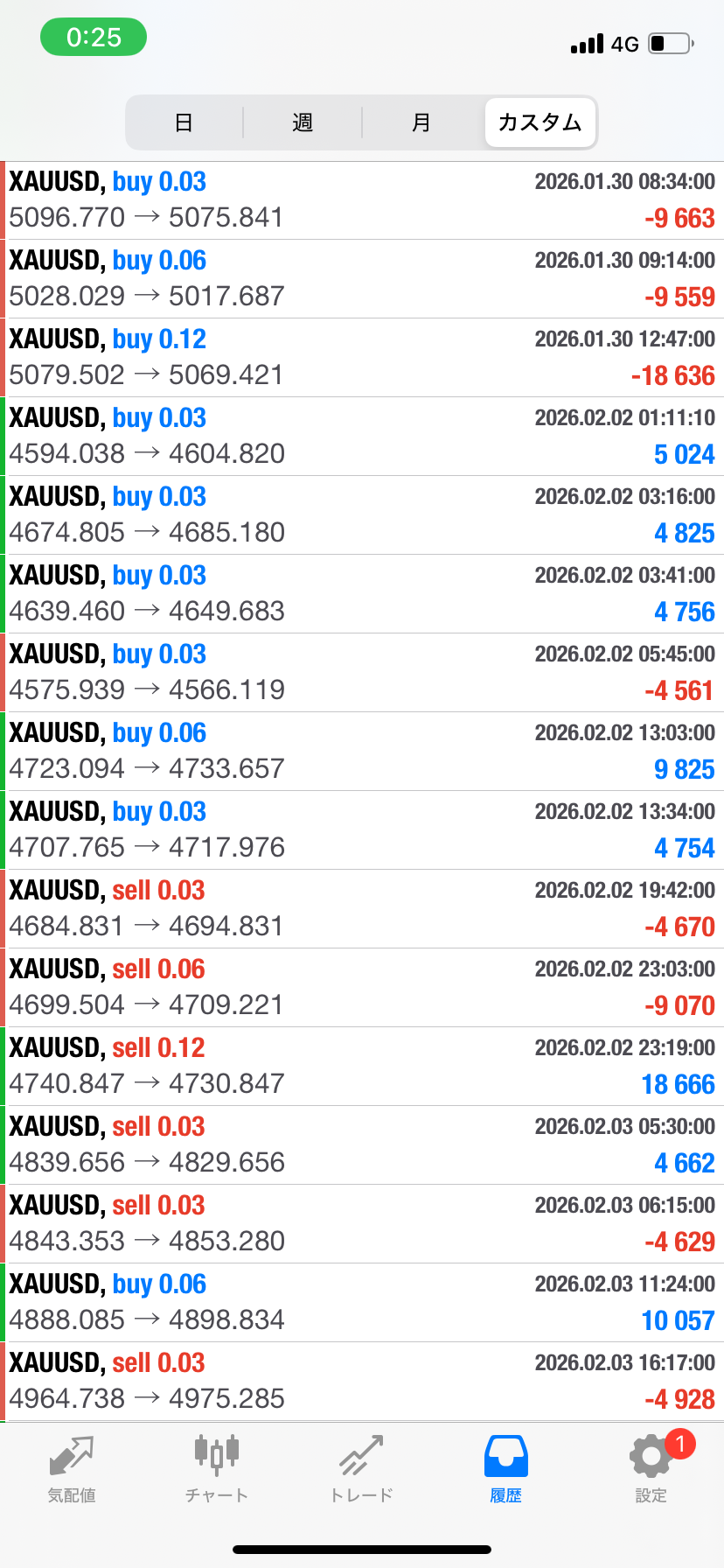

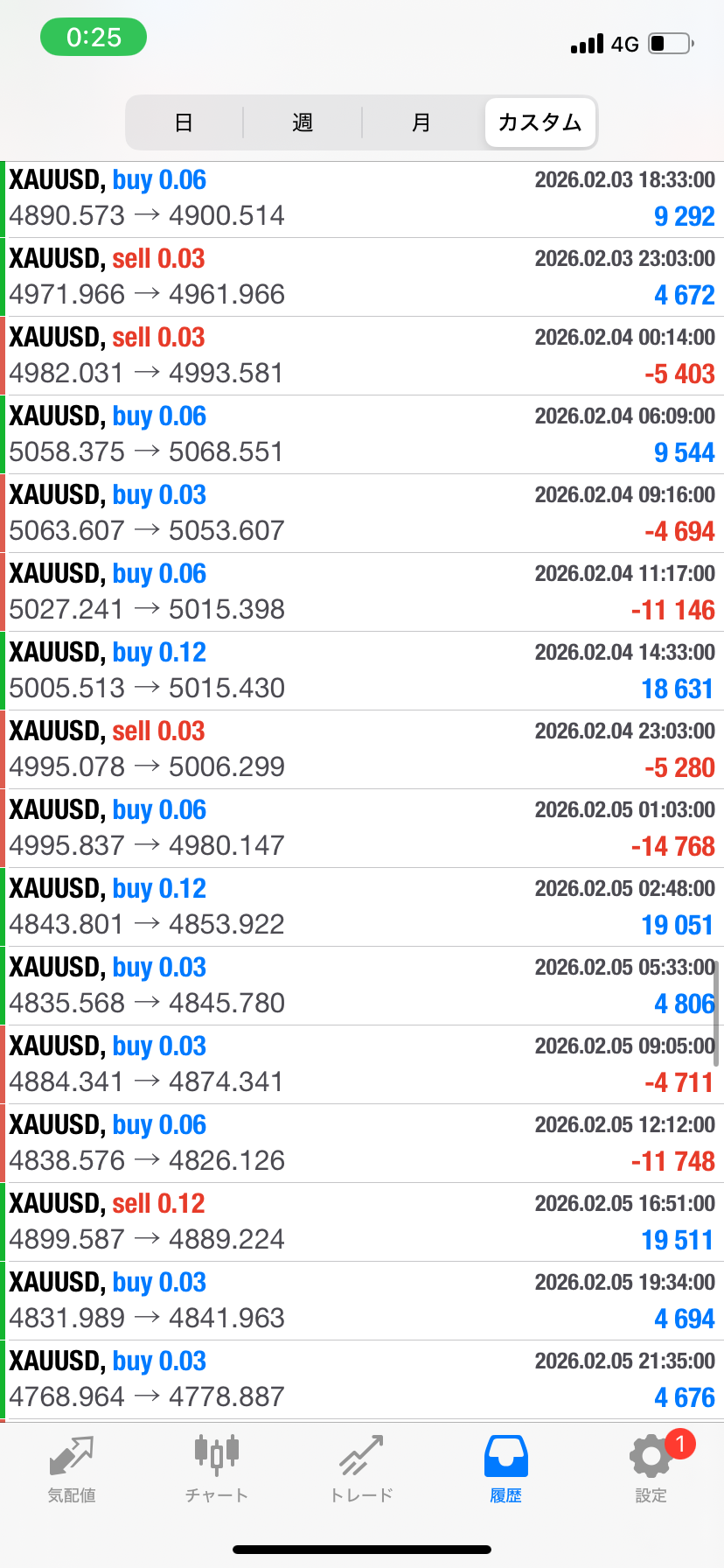

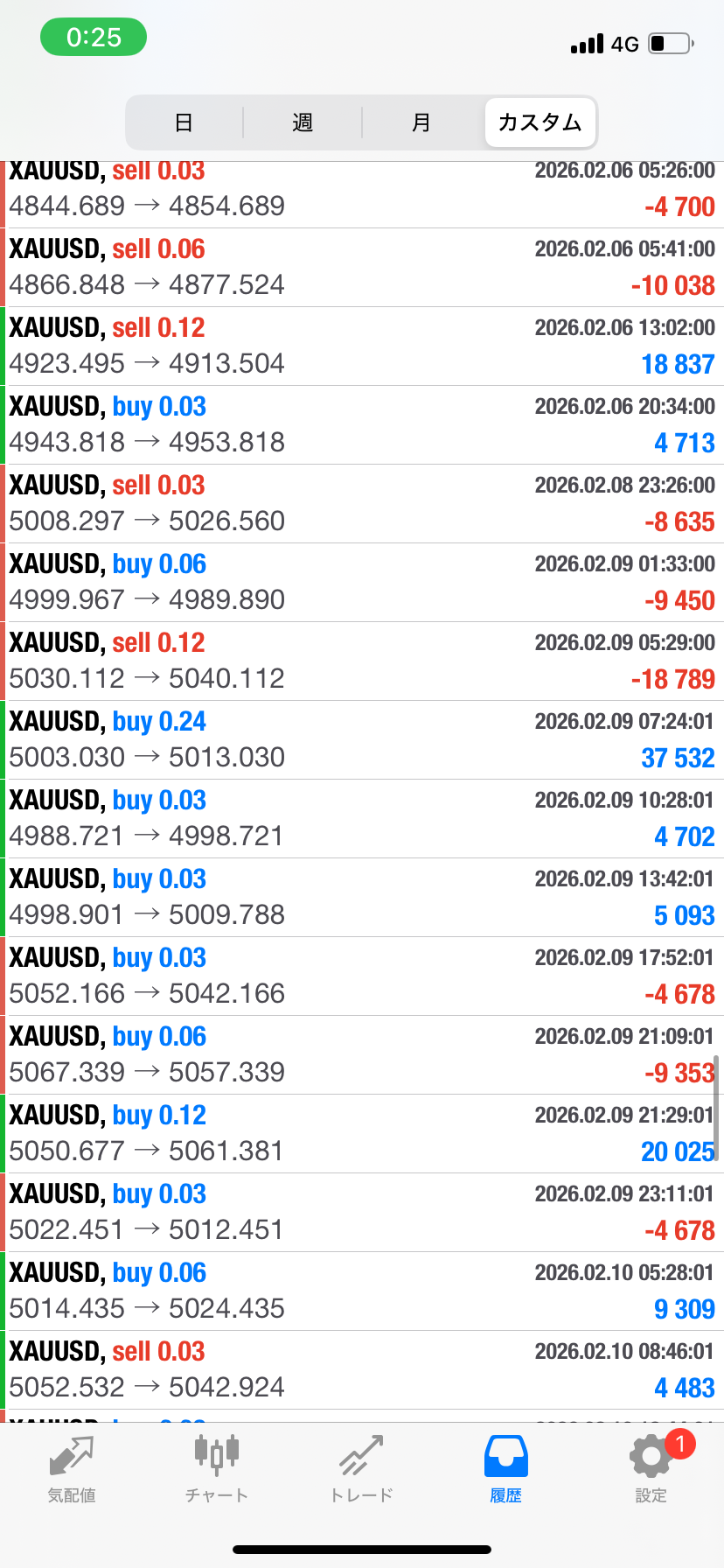

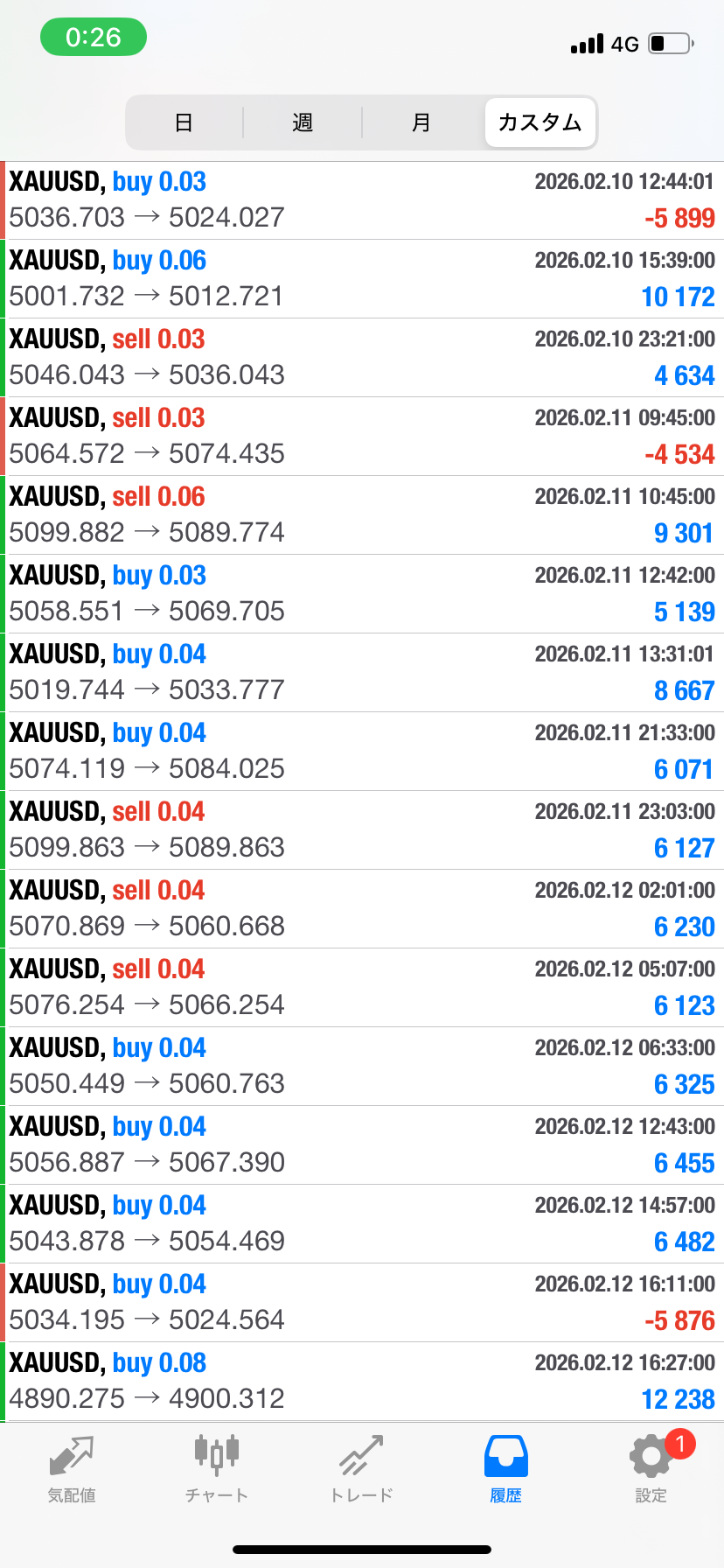

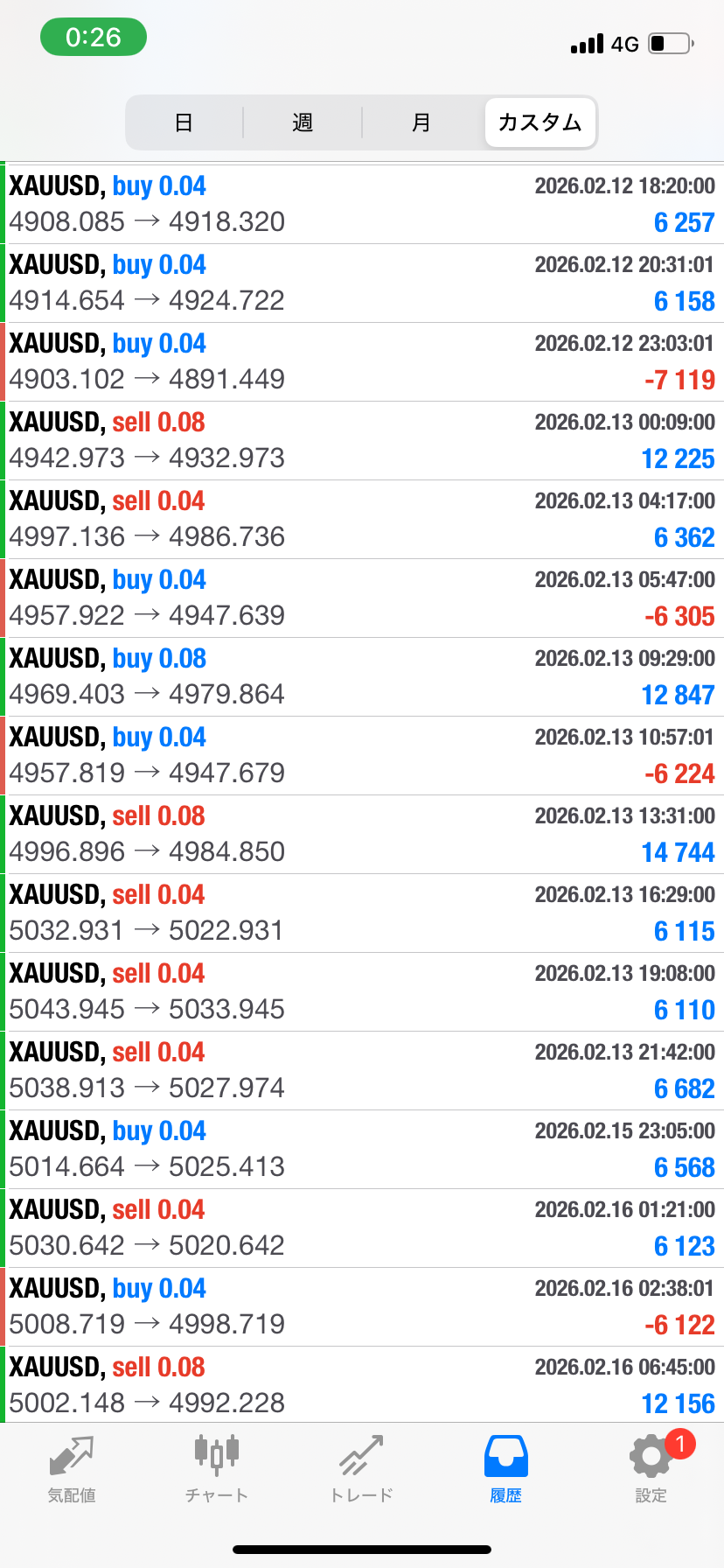

Past discretionary trading was swung around like this

However, again, for those without a sense of discretion, those who don’t like trading, those who don’t know how to study, those who don’t want to look at charts,

even beginners, if you set the same parameters from January 7th, it’s not absolutely guaranteed, but you could expect roughly similar results

It seems reasonable to think so, and it’s quite an impressive logic.

Japanese financial products are

Bank deposits (annual 0.001%〜)

→ 100,000 yen will almost be 100,000 yen after one year

・Investment trusts (5–8% per year are considered excellent)

→ 100,000 yen becomes 105,000–108,000 yen after one year

・Stock market averages (long-term average of TOPIX and Nikkei around 5–7%)

In other words,

Under normal financial products

It’s unlikely to gain +400,000 yen in 40 days.

Conversely, losses probably won’t be very large either.

If you think about it

Something where 100,000 grows by 8,000 yen in a year, or decreases by 8,000 yen

and

Something where 100,000 becomes +400,000 in 30 days, or becomes −100,000

which you prefer depends on the person, but when you think about it normally, … right?

How to react in this year’s market, of course, I don’t know, but

Ultimately, chart patterns, RSI, Stochastics, MA, are also derived from past events

to pull out numbers and identify an edge.

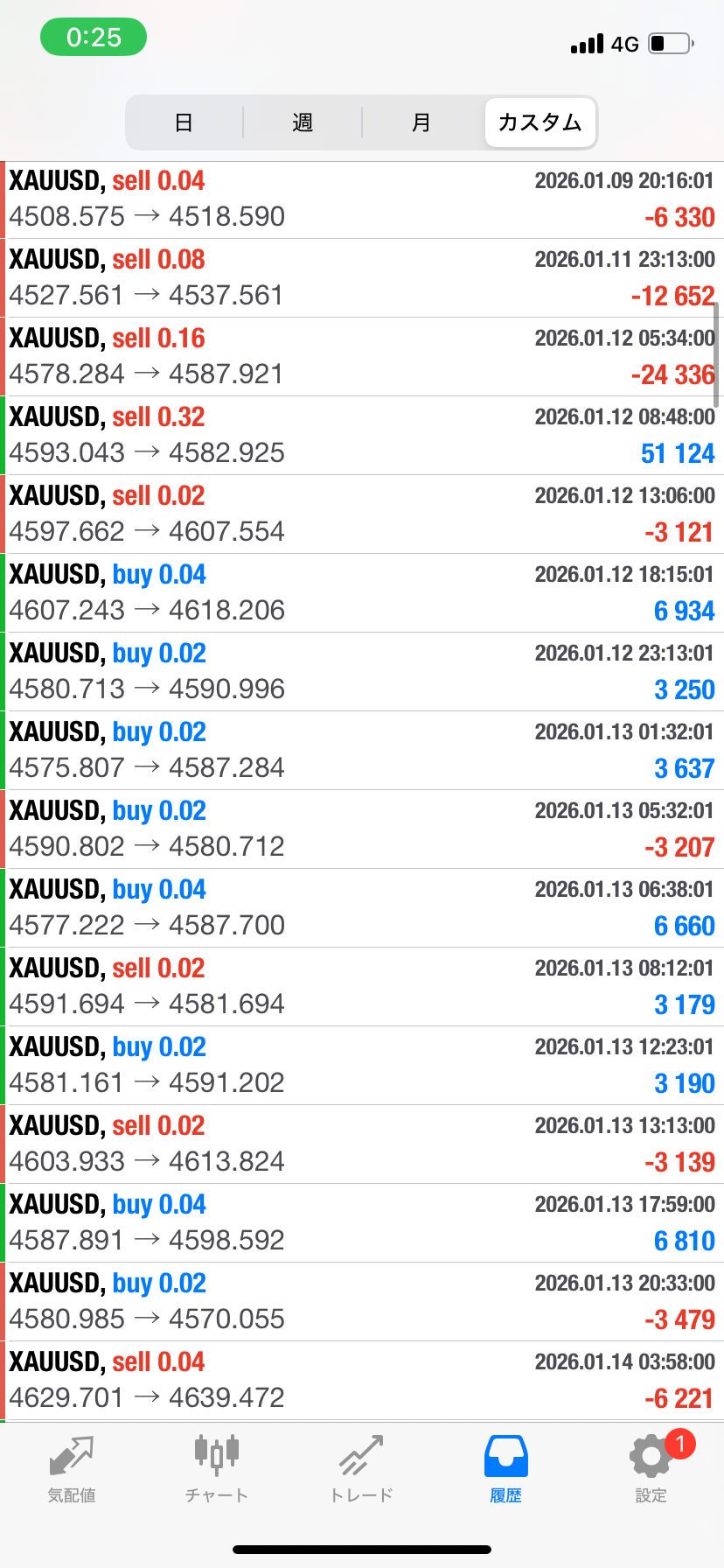

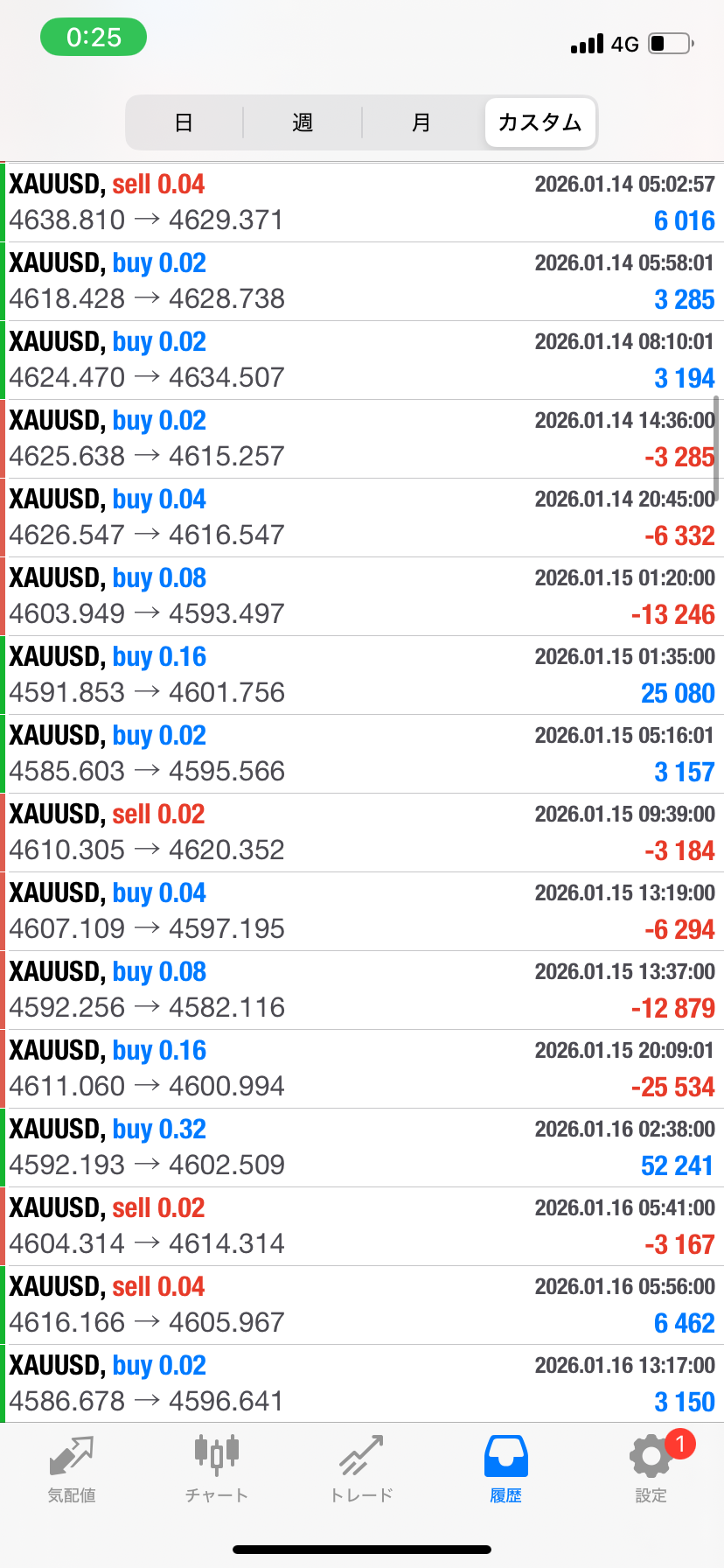

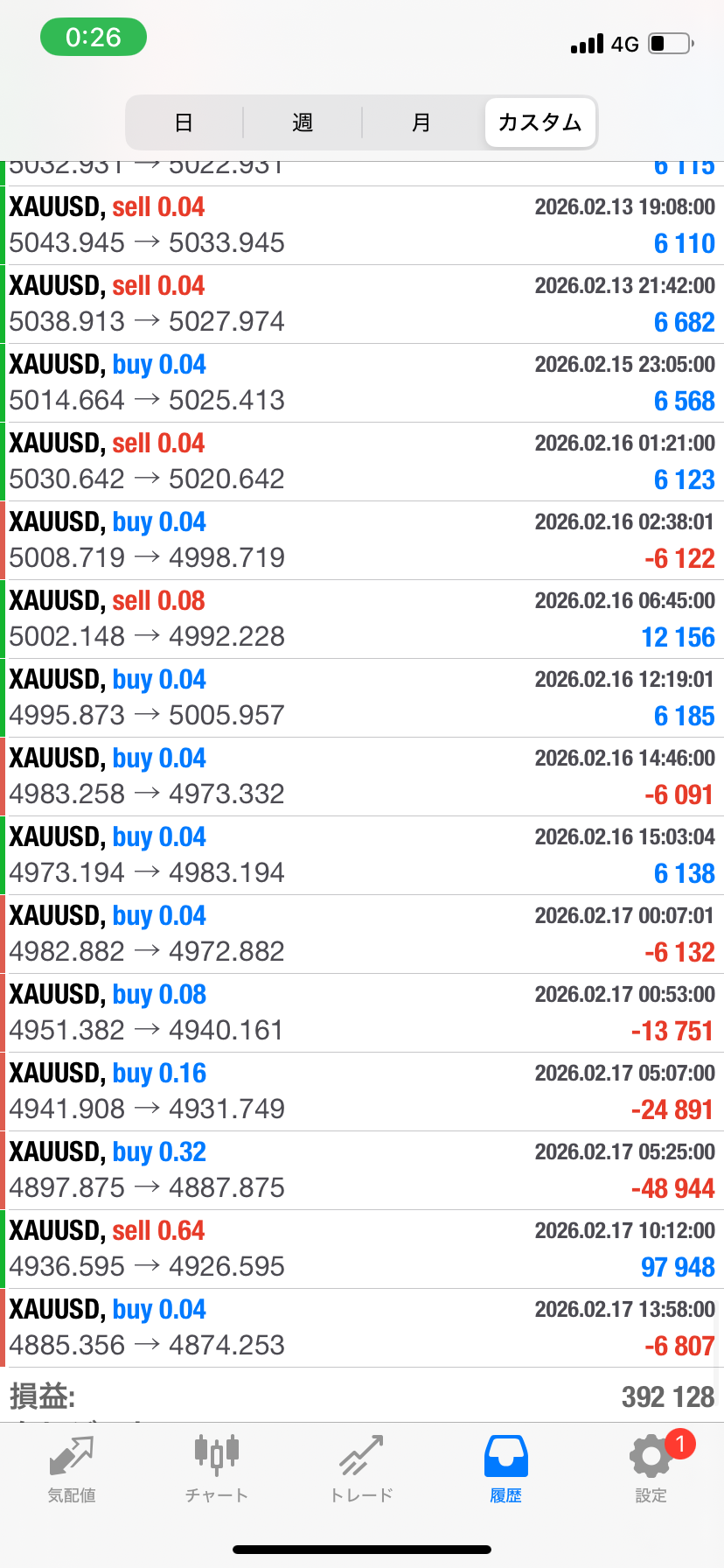

In last year’s backtest using the parameter values currently employed, among about 1,500 trades

there were two instances of five consecutive losses or more. By aligning the risk control with real trading and adjusting the Lot size

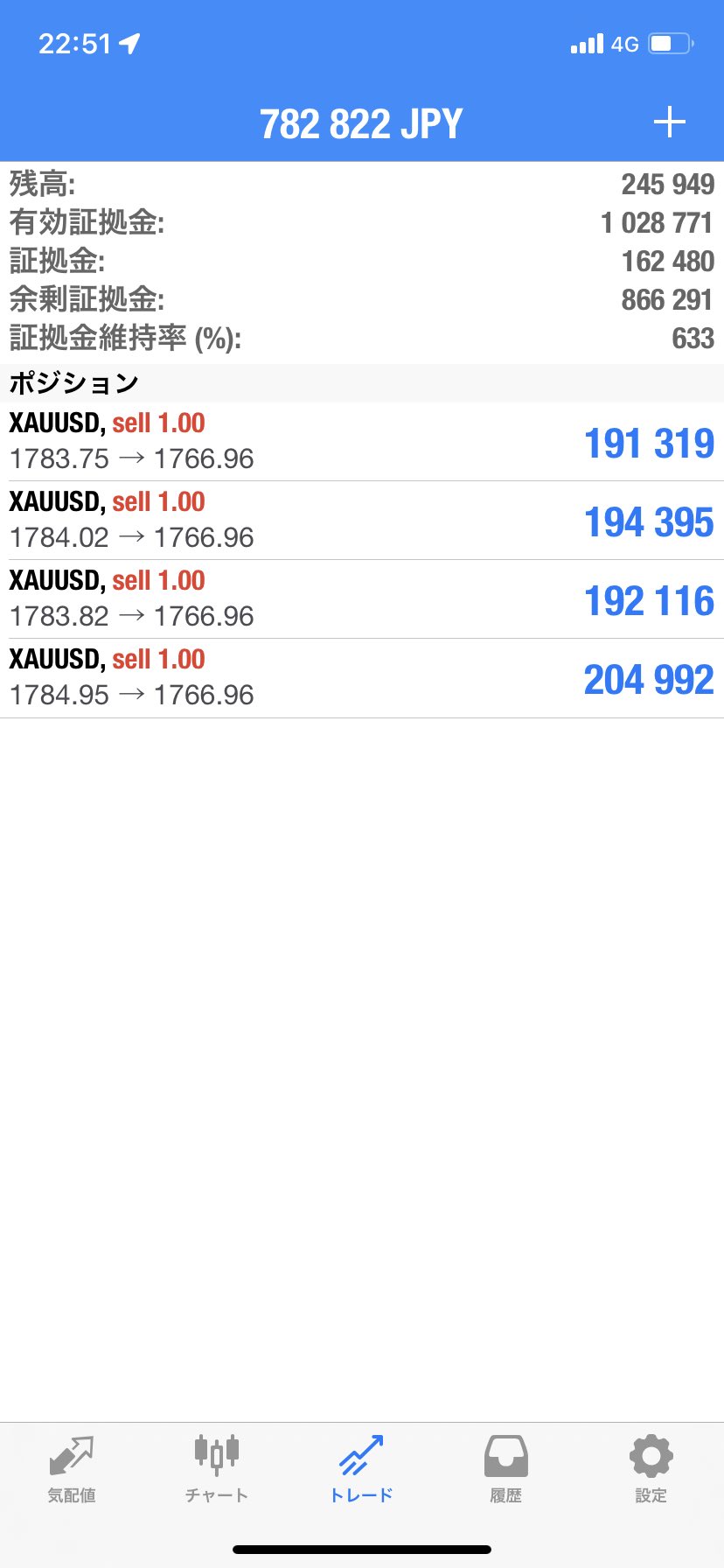

the history below is what happened. And I didn’t change anything except the Lot size. Only the two times were increased with margin.

In my case I use compound interest, but if you reset the margin once a month, you can operate with even higher safety.

From 100,000 to 500,000 in 30 days, or if you want to prioritize safety and be satisfied with that lower amount, please give it a try.

Of course, for those who fear martingale, the following results are also possible with the off setting. Please use as reference.

From January 7 to February 16 (0.05 Lot fixed)

If you have trading experience or can aim for entries near the provided line,

there are also methods to increase profitability, so please check past Investment Navi as well.

https://www.gogojungle.co.jp/tools/indicators/64612