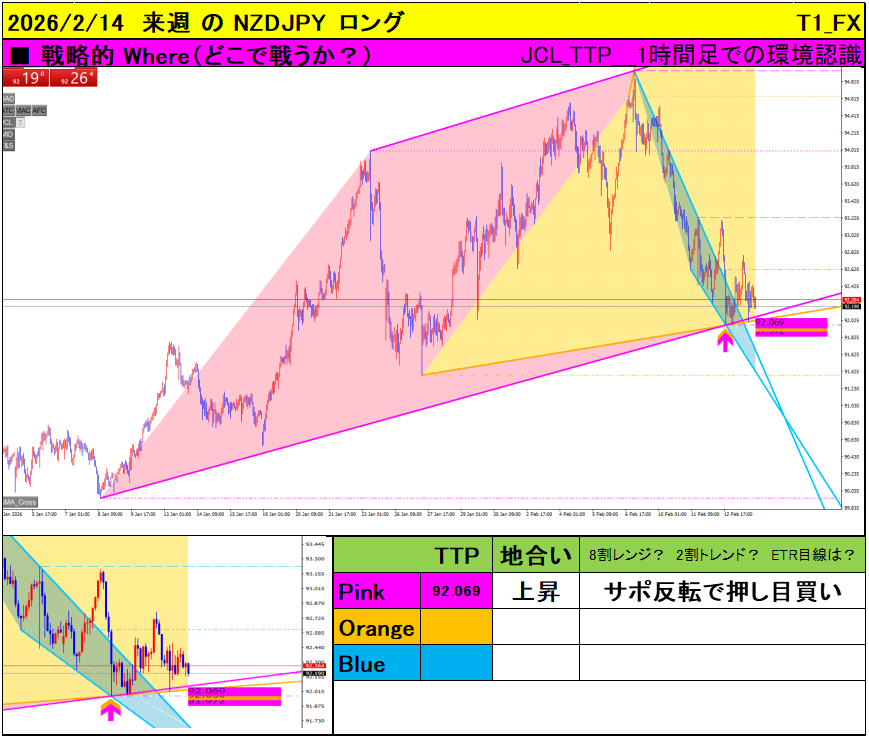

JCL Analysis 2026/2/14

- Higher highs are clearly established

- Higher lows as well, forming an ascending channel

- Short-term (blue): Breaks out above a downtrend

- Mid-term (orange): Maintains an uptrend

- Long-term (magenta): Steadily rising

- Price approaches 92.069 (pink TPP)

- When JCL’s proximity feature displays the “pink box,” be cautious

- Additionally confirm that the candlesticks reverse at this level

- Long lower wick

- Pin bar formation

- Reversal bullish candle

- Crimson cloud formation

- If upward price action is confirmed, enter long

- 1st target: near recent highs

- 2nd target: once blue or orange lines are broken sequentially, trail

- Clearly break below 92.069 (support breaks)

- As it nears 92.069, a box appears automatically

- Alerts notify you

- Touching the line thickens the line

【This Week's JCL Analysis】

The first notable pair of 2026 is NZDJPY! Long bias in the pink uptrend

Hello everyone!

With the filing deadline finally set, we start the first JCL analysis of 2026?

This year, let's use JCL to clearly identify “where in the market we are looking right now.”

This week's notable currency pair: NZDJPY

The first pick of this year is the NZD/JPY pair.

This currency pair is actually currently showing a very easy-to-understand market structure.

【Point ①】The pink uptrend is continuing

First, the big picture shows the magenta (long-term) line firmly forming an uptrend.

This is a signal to “the big trend is buy.”

Rather than aiming for counter-trend shorts, the rule of thumb is to focus on buying on dips.

【Point ②】Important TPP is “92.069”

What to pay special attention to this time is the pink (long-term) TPP (Price Proximity Point) = 92.069.

From the current price, this 92.069 is:

✅ A crucial level that has reacted multiple times in the past

✅ Near the magenta AB line

✅ A dip candidate within an uptrend

In other words, this is a prime long entry point where you’d want to buy if it comes down to this level.

【Point ③】Current outlook is “Long”

When analyzing the current market with JCL:

Overall verdict: bias toward long

【Entry Strategy】Longs on support confirmation

So, specifically, how should we trade?

Scenario

Profit-taking and risk targets

Stop loss

Wait for JCL’s “buy signal”

The key point this time is whether the price reverses at the pink TPP.

Using JCL’s proximity feature:

You can catch entry opportunities with zero misses.

Summary: The first JCL of 2026 should be approached cautiously, but decisively

|

Item |

Content |

|

Currency pair |

NZDJPY |

|

Direction |

Long (uptrend continues) |

|

Key level |

92.069 (pink TPP) |

|

Entry condition |

Confirm reversal at the same level |

|

Stop loss |

Below 92.069 |

Let’s continue to use JCL to build trades with solid rationale this year as well!

【Bonus】A thought after filing taxes

Finally, the tax filing is done...?

Keeping a trading journal makes filing easier, but the process is still a hassle.

Still, feeling good as a trader that you’re earning enough to pay taxes ✨

Let’s keep pushing steadily this year as well!

Would you like to start trading with JCL to not miss important price levels?

◆ JCL_TTP (MT4)

◆ JCL_TTP (MT5)