February 14, 2026, USD/JPY, Gold, SP500, and Nikkei 225 environment

The indicator in the attached image uses the indicators above.

If you are interested, please take a look.

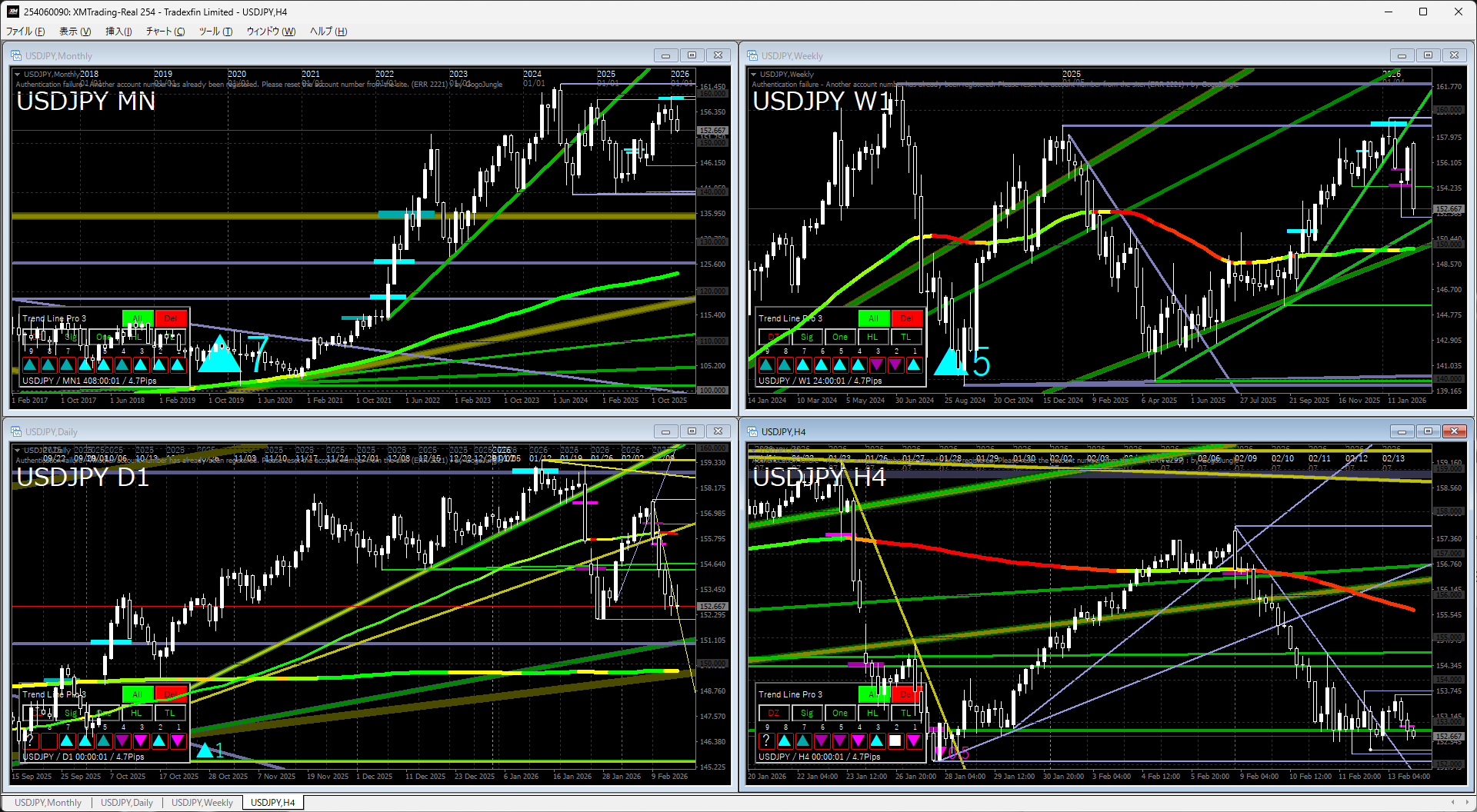

USDJPY

Monthly & WeeklyLong-term uptrend (yen depreciation) has not broken, but it seems to have entered a phase of time-wise consolidation. Since the MA is lagging, the impression is that the consolidation will continue for a while longer.

Daily & 4-hourThe monthly and daily MAs (around 150) are in focus, but first we need to see if the near-term low is broken. The market is hard to read, so price action could stay weak.

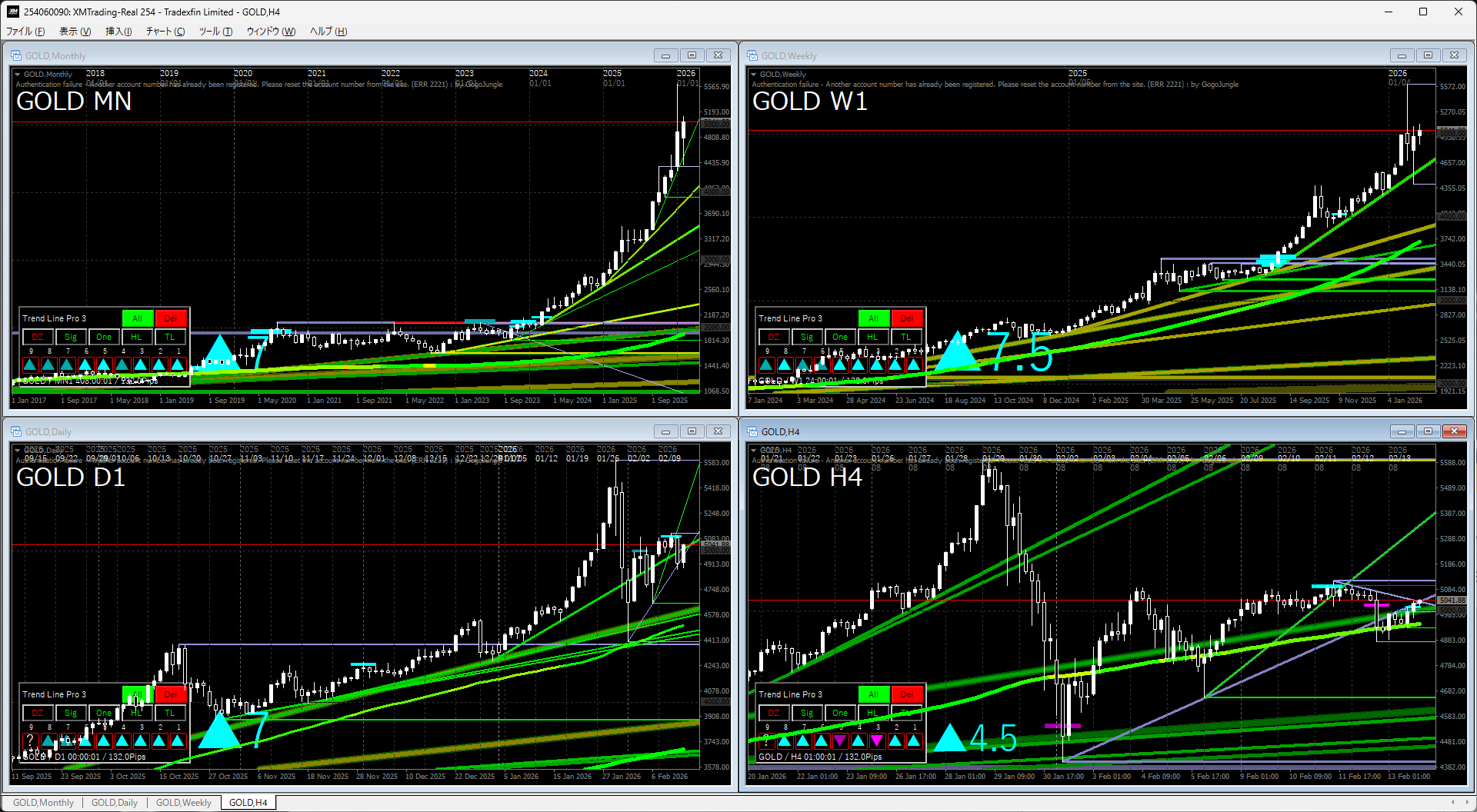

Gold

Interest in currency value declines remains, and gold continues to have a bullish bias as a primary choice.

Central banks still seem to be buying gold, and the risk of selling appears higher than price declines, so I don’t expect anyone to sell yet.

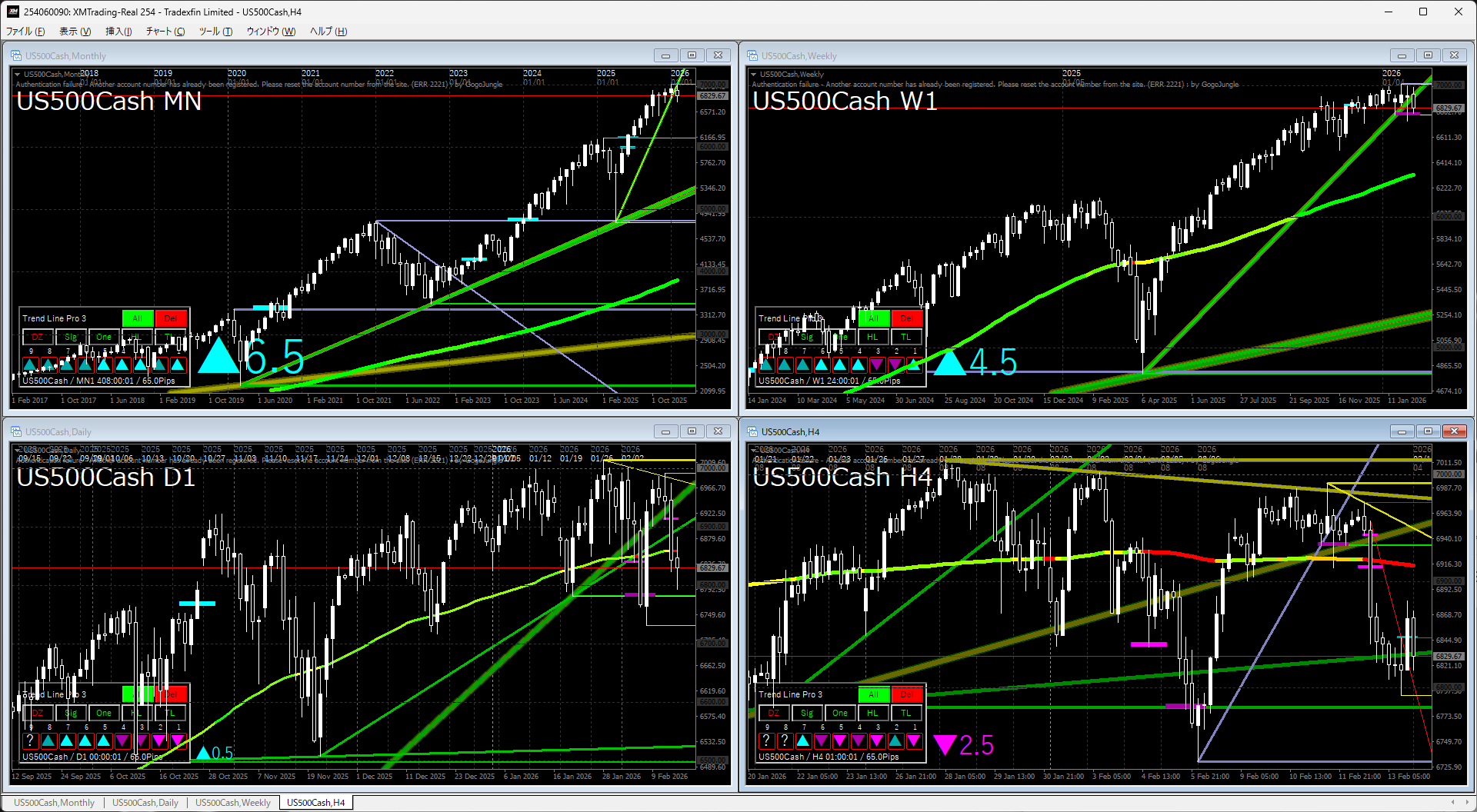

S&P 500

Monthly & WeeklyContinue to rise after a rebound from a trendline, with attention on currency depreciation; this is a favorable market for upside moves.

Daily & 4-hourThe score is near zero, and there is no clear directional bias technically. Personally, I expect sideways movement with higher highs eventually.

Nikkei 225

Monthly & WeeklyContinuing to rise after a double bottom breakout, aligned nicely with a drawn trendline.

Daily & 4-hourThe trendline is being respected, and a time-wise consolidation has begun. If nothing else happens, the consolidation is expected to continue a bit longer.

The indicator in the attached image uses the indicators below.

If you are interested, please take a look.