A quick way to become a winning trader

Here I wrote about how to practice. ⇒How to practice trading

First, the way to think about the path to winning in trading differs from person to person.

If so, the method of practice will be completely different.

I think there are two main types.

① Hypothesize and verify to create your own unique method.

② Make an already-existing method your own.

Last time, I talked about ②.

Regarding ①, I personally do not recommend it.

Doing this is an extremely high hurdle.

② Make an already-existing method your own.

Practicing this for 100 trades in backtesting software is quite tough too.

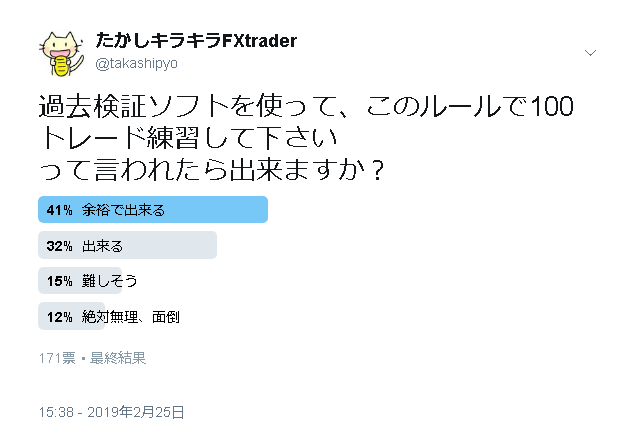

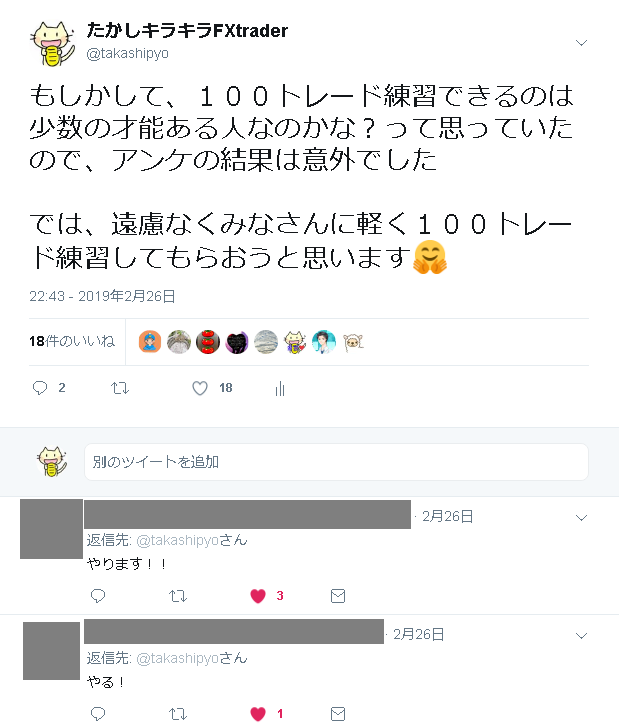

I once conducted a poll on Twitter.

This was surprising.

When I teach trading, few people can do 100 trades comfortably.

Even with a fixed method or rules, repeating them is not something everyone can do easily.

Yet to trade hundreds or thousands of trades with something whose edge is unknown is an enormous undertaking.

Form a hypothesis → run it in backtesting software to test → No good

Form a hypothesis → run it in backtesting software to test → No good

Form a hypothesis → run it in backtesting software to test → No good

....................................................

You must endure a tremendous number of failures.

There was someone who watched charts for 10,000 hours.

They were keen to find an edge through diligent study.

As a result, they concluded “there was no edge.”

Speaking of 10,000 hours, there is the so-called 10,000-hour rule.

In any field, if you work hard for 10,000 hours you can become a pro.

However, when you hypothesize and build an edge, you are discovering something, so unlike simply piling up time, you may not discover anything no matter how much time you spend.

Therefore, it seems more reliable to use something that already exists.

[Day Trading Oliver Velas, Nikkei BP]

Find a winner to imitate, then surpass them

If you seriously aim to make trading a living, start by finding the “winner” you should imitate.

Why must you find a winner?

Because in day trading, there is no quicker way to learn what to do and what not to do.

Imitating that winner becomes your job.

And you surpass them.

The goal is to surpass the mentor.

That’s all.

“The Quick Way to Become a Winning Trader”

Imitating the winner is the quickest method.

I am not denying the value of hypothesizing and building from scratch.

Such discoveries exist, so it is very valuable to imitate them.

However, if you want to win quickly, it’s faster to imitate something already discovered and used by winners, rather than discovering anew.

Then, as written previously, the topic becomes about practicing by imitation.This last point is also important.Imitating that winner becomes your job.And you surpass them.The goal is to surpass the mentor.Last year, some thought they could keep winning and drifted away from me.>Trying to learn from someone else may not become your own thing, after all.>But the fact that they were winning a lot at that time.For the above reason, there was also a rebellious period, and they drifted away from me.Indeed, they were winning last year.They reported well with decent profits in 10 lots (100,000 units).Then they drifted away to do it on their own and wandered, becoming unsure if it was right.Recently they returned and are now solidifying again.>Trying to learn from someone else may not become your ownThis is not the case.I learned from people and made it my own, and the teachers I learned from likewise had teachers above them, and they learned and made it their own.In particular, my method can be taught largely through reasoning, so I think it is easy to imitate and highly reproducible.First, it is important to imitate as is. The power of being receptive.Then there is a stage of making it your own, surpassing the master.Even while imitating, your own individuality will naturally emerge.That will become your own unique trading, your own thing.“The Quick Way to Become a Winning Trader”There are people who became full-time professionals in half a year even as total beginners.Probably because they imitated and practiced diligently.Trading videos are up:Trading from 100,000 yen to 1,000,000 yenI’m on Twitter:https://twitter.com/takashipyo:FX members blog series※ FX members blog subscriptions are only via credit card.If you prefer other than credit card payment, please contact me by email or Twitter DM.takashipsychology@yahoo.co.jp

This last point is also important.

Imitating that winner becomes your job.

And you surpass them.

The goal is to surpass the mentor.

Last year, some thought they could keep winning and drifted away from me.

>Trying to learn from someone else may not become your own thing, after all.

>But the fact that they were winning a lot at that time.

For the above reason, there was also a rebellious period, and they drifted away from me.

Indeed, they were winning last year.

They reported well with decent profits in 10 lots (100,000 units).

Then they drifted away to do it on their own and wandered, becoming unsure if it was right.

Recently they returned and are now solidifying again.

>Trying to learn from someone else may not become your own

This is not the case.

I learned from people and made it my own, and the teachers I learned from likewise had teachers above them, and they learned and made it their own.

In particular, my method can be taught largely through reasoning, so I think it is easy to imitate and highly reproducible.

First, it is important to imitate as is. The power of being receptive.

Then there is a stage of making it your own, surpassing the master.

Even while imitating, your own individuality will naturally emerge.

That will become your own unique trading, your own thing.

“The Quick Way to Become a Winning Trader”

There are people who became full-time professionals in half a year even as total beginners.

Probably because they imitated and practiced diligently.

Trading videos are up:Trading from 100,000 yen to 1,000,000 yen

I’m on Twitter:https://twitter.com/takashipyo

※ FX members blog subscriptions are only via credit card.

If you prefer other than credit card payment, please contact me by email or Twitter DM.