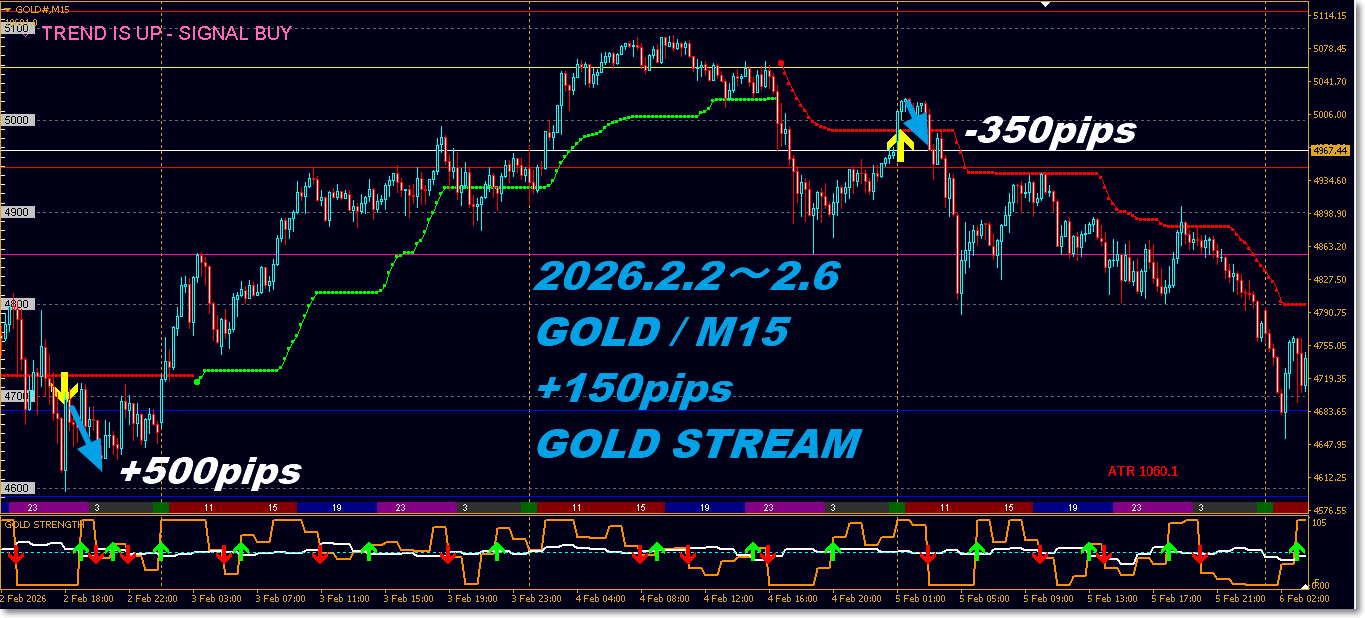

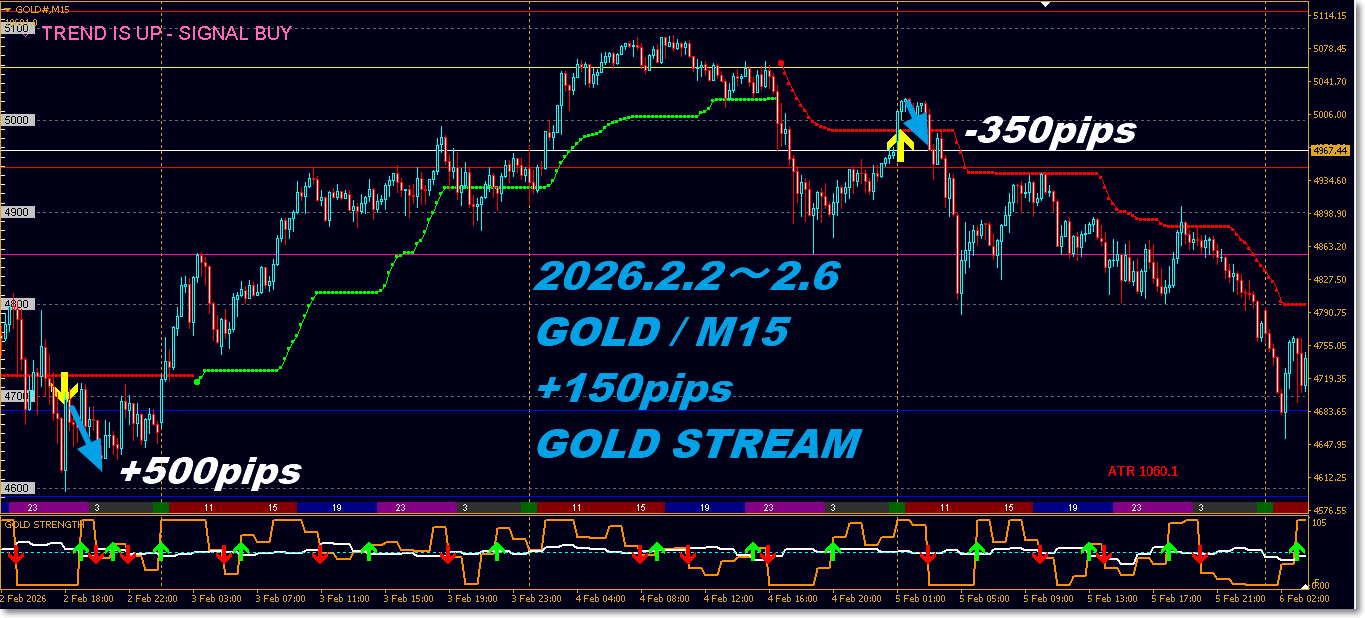

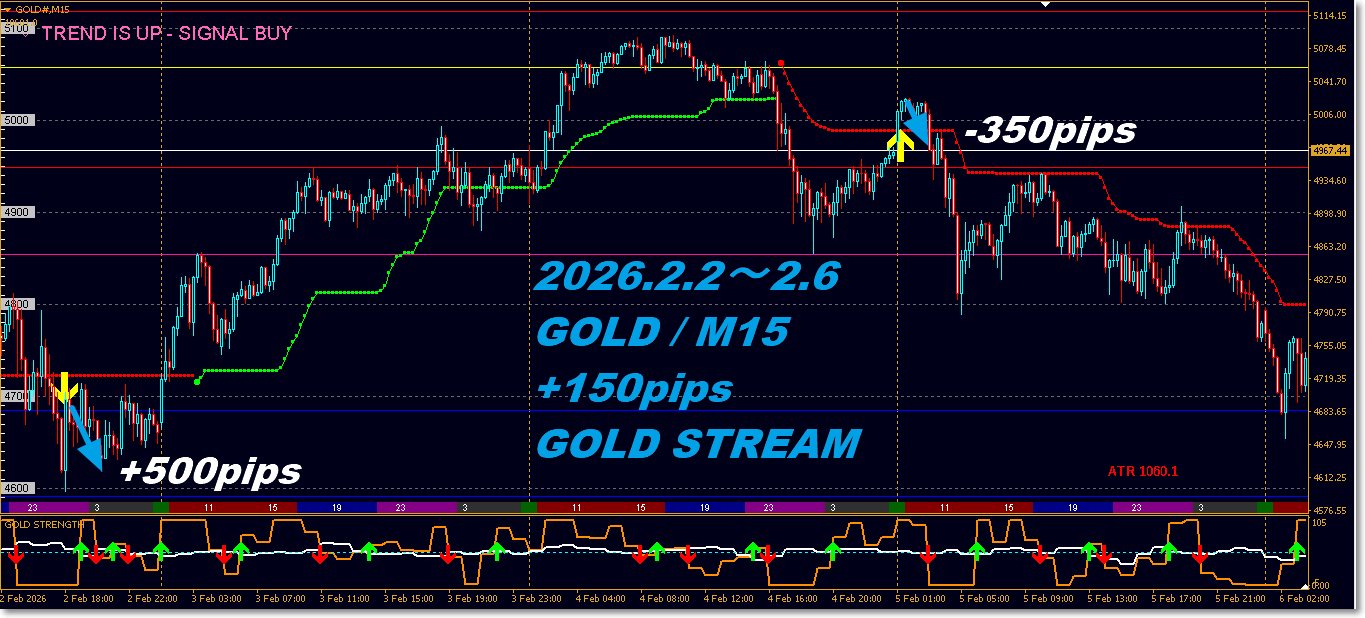

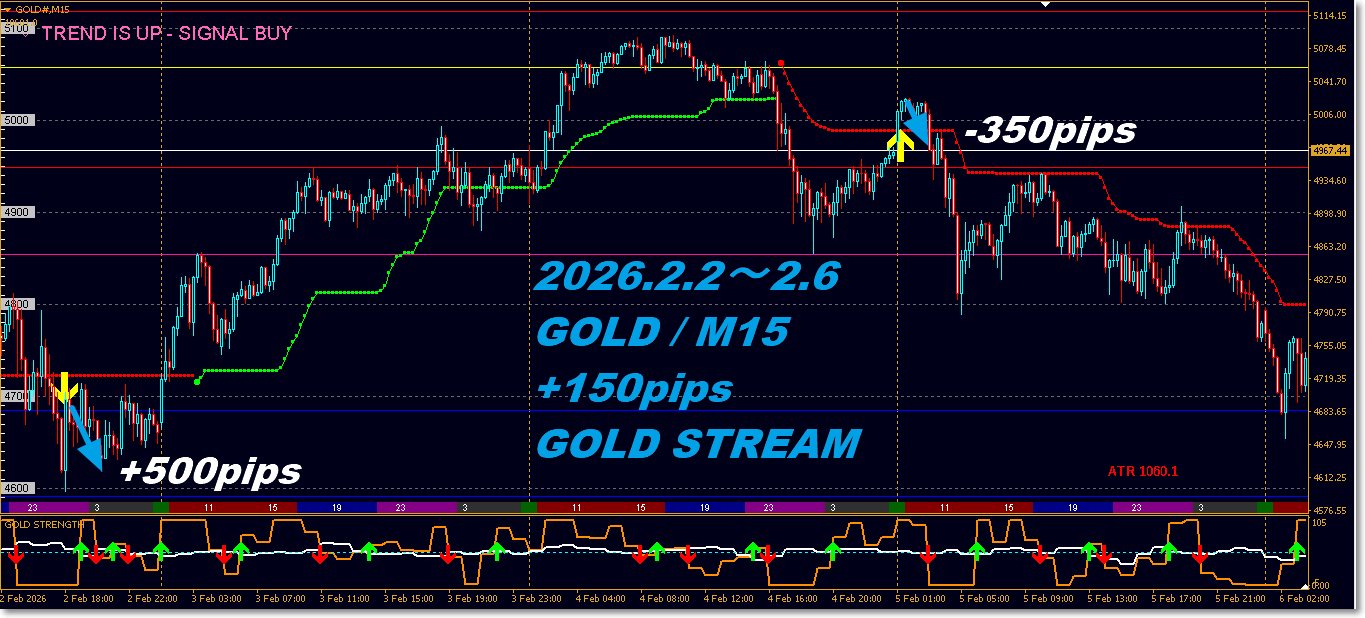

【Weekly Trade Verification】GOLD Day Trading Specialization "GOLD STREAM" 2026.2.2~2.6

▼【Weekly Trade Verification”GOLD STREAM” 2026.2.2~2.6 MAX Calculation▼

■ February 2, 2026 – February 6, 2026

GOLD (Gold) Market Summary

Price Trend

Following the sharp advance up to last week,the high-range movement around around $5,000 continues

At the start of the week buying was easier due to the lingering uptrend,

but at the higher levels profit-taking selling tends to appear,leading to a choppy up-and-down pattern

On a daily chart

Attempt to make new highs

Pullbacks and reversals

interact,the directional bias is somewhat unstable

The range magnitude is large,a week with high volatilitywas observed,

not a one-way rally,but a move with intermittent adjustments

Following the sharp advance up to last week,the high-range movement around around $5,000 continues

At the start of the week buying was easier due to the lingering uptrend,

but at the higher levels profit-taking selling tends to appear,leading to a choppy up-and-down pattern

On a daily chart

Attempt to make new highs

Pullbacks and reversals

interact,the directional bias is somewhat unstable

The range magnitude is large,a week with high volatilitywas observed,

not a one-way rally,but a move with intermittent adjustments

Supply-Demand / Investment Factors

Behind the maintenance of the high level

Geopolitical risks

Caution regarding currency value

continues to exist

Prices at high levels act as selling pressure

Short-term profit-taking and new buying are competing

Physical demand and long-term holding demand are solid, but

in the short term the supply-demand tends to tighten

Behind the maintenance of the high level

Geopolitical risks

Caution regarding currency value

continues to exist

Prices at high levels act as selling pressure

Short-term profit-taking and new buying are competing

Physical demand and long-term holding demand are solid, but

in the short term the supply-demand tends to tighten

Investment Trends

Investors remain bullish, but

“wait for a pullback/adjustment” tends to be favored over “chasing buying”

Short-term traders

Sell on the highs

Buy on pullbacks

repeatedly

From a medium-to-long-term view

Continue to hold

Lighten positions

and shift toward risk managementover directional bets

Investors remain bullish, but

“wait for a pullback/adjustment” tends to be favored over “chasing buying”

Short-term traders

Sell on the highs

Buy on pullbacks

repeatedly

From a medium-to-long-term view

Continue to hold

Lighten positions

and shift toward risk managementover directional bets

Overall Assessment

This week's GOLD market was a典型 high-range market: “strong but not straightforward”

The major uptrend remains intact, but in the short term

there were

pullbacks

retracements

false breaks

mixed in

From a trading perspective

Chasing breakouts carries high risk

Only in phases where strength and correlation align is effective

Environment awareness and risk management were strongly challenged this week

Weekly Trade Verification AI Evaluation

This week's GOLD market was a典型 high-range market: “strong but not straightforward”

The major uptrend remains intact, but in the short term

there were

pullbacks

retracements

false breaks

mixed in

From a trading perspective

Chasing breakouts carries high risk

Only in phases where strength and correlation align is effective

Environment awareness and risk management were strongly challenged this week

Weekly Trade Verification AI Evaluation

In this image, shown2026-02-02 to 2026-02-06 GOLD STREAMtrades are

in a highly volatile environment with about 4,150 pips 5-day ADRassumed,

entries were selectively made based on strength and correlation analysis.

The displayed +500 pips is the MAX value for full holdings,

the main evaluation is not the range butsignal accuracy and design validity.

This week, while the overall trend was upward, it was a very noisy market structure with large fluctuations from the high region and deep pullbacks.

Very noisy market structure.

reacted only when strength and correlation aligned,

and did not generate signals in unstable directional moments.

The +500 pips scenario accurately captured moments when, after a brief retracement, strength realigned,

and it did not overreact to the magnitude of environmental ADR.

This logic uses a fixed SL based on 4-hour timeframe,

and is designed to exit early if correlation breaks down.

This loss occurred as volatility swung sharply,

detecting condition failure and cutting risk as expected within the scenario,

Considering an environment with 4,150 pips ADR for the 5 days,

it can be viewed as an exceptionally well-controlled loss.

Even in high-volatility environments, entry frequency is limited

When there is growth, capturing the waves

When the market collapses, exiting immediately with fixed SL

This consistent behavior is confirmed.

As a result, the aggregate range may not look large,

not that it was “unprofitable,” but rather

it avoided taking trades in scenes where it should not.

was not driven by ADR magnitude,

prioritized strength/correlation and H4 risk management,

and focused on repeatability,

even in high-difficulty market environments,

In this image, shown2026-02-02 to 2026-02-06 GOLD STREAMtrades are

in a highly volatile environment with about 4,150 pips 5-day ADRassumed,

entries were selectively made based on strength and correlation analysis.

The displayed +500 pips is the MAX value for full holdings,

the main evaluation is not the range butsignal accuracy and design validity.

This week, while the overall trend was upward, it was a very noisy market structure with large fluctuations from the high region and deep pullbacks.

Very noisy market structure.

reacted only when strength and correlation aligned,

and did not generate signals in unstable directional moments.

The +500 pips scenario accurately captured moments when, after a brief retracement, strength realigned,

and it did not overreact to the magnitude of environmental ADR.

This logic uses a fixed SL based on 4-hour timeframe,

and is designed to exit early if correlation breaks down.

This loss occurred as volatility swung sharply,

detecting condition failure and cutting risk as expected within the scenario,

Considering an environment with 4,150 pips ADR for the 5 days,

it can be viewed as an exceptionally well-controlled loss.

Even in high-volatility environments, entry frequency is limited

When there is growth, capturing the waves

When the market collapses, exiting immediately with fixed SL

This consistent behavior is confirmed.

As a result, the aggregate range may not look large,

not that it was “unprofitable,” but rather

it avoided taking trades in scenes where it should not.

was not driven by ADR magnitude,

prioritized strength/correlation and H4 risk management,

and focused on repeatability,

even in high-difficulty market environments,

■ SILVER (Silver) Market Summary

Silver prices moved in line with gold’s high-range, but price action was more volatile, with wider swings. Supported by expected industrial demand and inflows of speculative funds, but dampened by high-price caution triggering profit-taking, directional clarity remained limited. In the short term, volatility management took precedence over trend following.

▼【Weekly Trade Verification】”GOLD STREAM” 2026.2.2~2.6 MAX Calculation▼

GOLD / M15 Day Trade Focused

What is GOLD STREAM?

For GOLD short-term day trading

“No hesitation, no delays, no deviations”

A dedicated system.

Even in markets driven by volatility, designed to enter after aligning grounds,

supports highly repeatable trading.

◆ The 7 Strengths of GOLD STREAM

1. Gold (XAUUSD) Fully Specialized Design

Optimized for Gold’s specific volatility and correlation structureShort-term day-trading logic.

Prioritizes immediacy and consistency that generic indicators struggle with, and is tailored for the M15 timeframe.

2. Ready → Signal 2-Stage Notification

Ready: Early notice that conditions are starting to align

Signal: Fully matched trigger for entry decision

➡ Eliminate misses, chasing, and haste,

and build the habit of entering after preparation.

3. Judgment of Strength and Correlation on One Screen

Essential for GOLD mastery

Relative strength

Correlation direction

Signal strength

displayed in a sub-windowwithout repainting.

No need to switch between multiple tools anymore.

4. Visualize Realistic Profit Targets with GOLD PIVOT LINE

Day Trading: Daily Pivot

Profit Targeting: Weekly Pivot

Understand at a glance achievable profits aligned with GOLD movements.

5. ATR-Based Auto-Settlement (Trailing EA Included)

Basic RR 1:2 or better automatically targeted

Non-trending markets are preserved with trailing

Eliminate emotional exits

➡Settlement fluctuation is eliminated as the biggest cause of lossby design.

6. Hybrid Operation of Smartphone × EA

Entry can be done on smartphone

Settlement trailing EA handles TP/SL/trailing automatically

Even on busy days, steady operation is possible.

7. Design to Cultivate the Skill to Keep Winning

Identify advantageous market phases

Correct RR sense

Minimize wasted entries

➡A system that helps traders grow themselves.

For Those Who Want to End These Worries Now

Direction aligns but you get shaken out

Always entering too late

Every exit is inconsistent

GOLD is scary and unreproducible

→ Most of the cause lies in the order of judgment.

Prepare → Correlate → Confirm → Execute → EA Settlement

Just following this flow stabilizes trading immediately.

Now, from “feeling” of GOLD to “reproducibility”

GOLD STREAM is

not just a signaling tool, but

a decision-making OS to win with GOLD.

First, please review the concept and verification on the page.

Elevate your GOLD trading to a different level starting today.