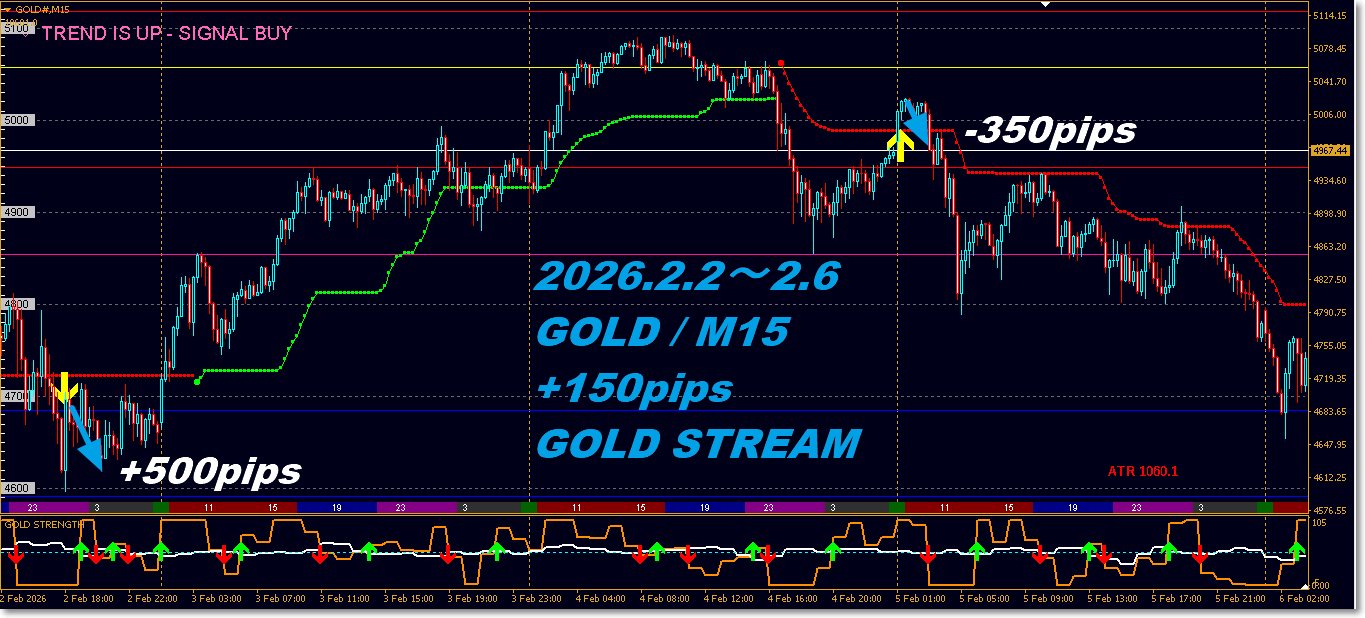

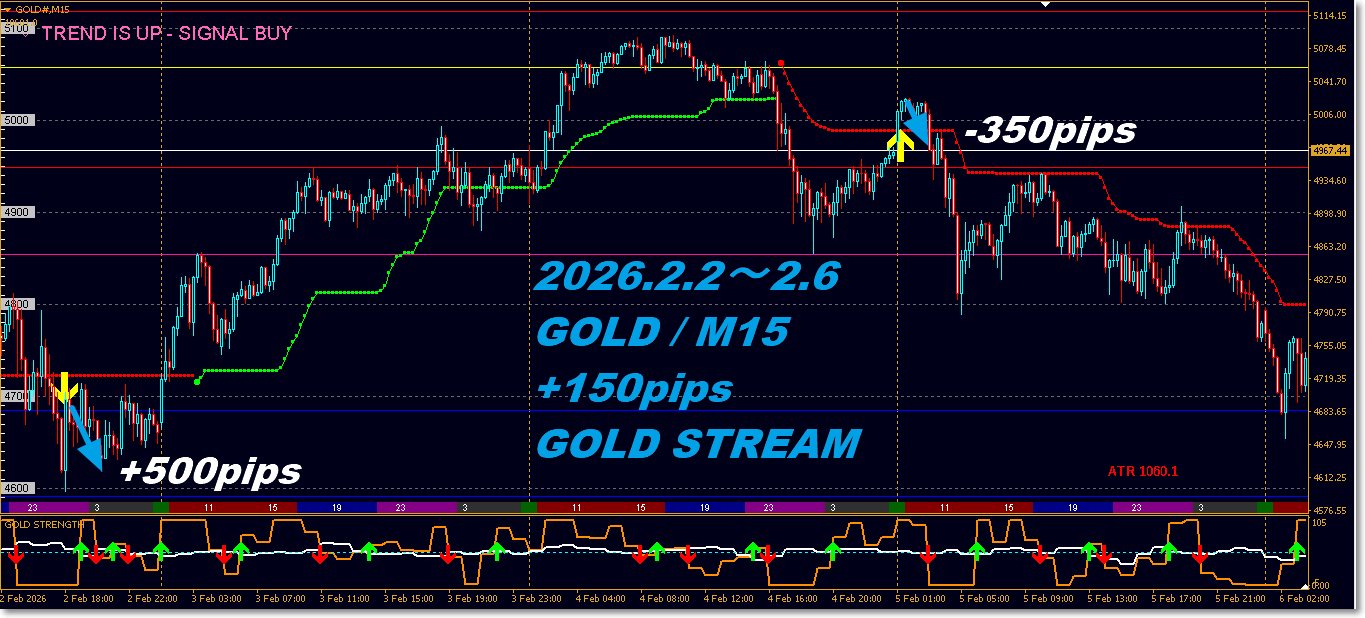

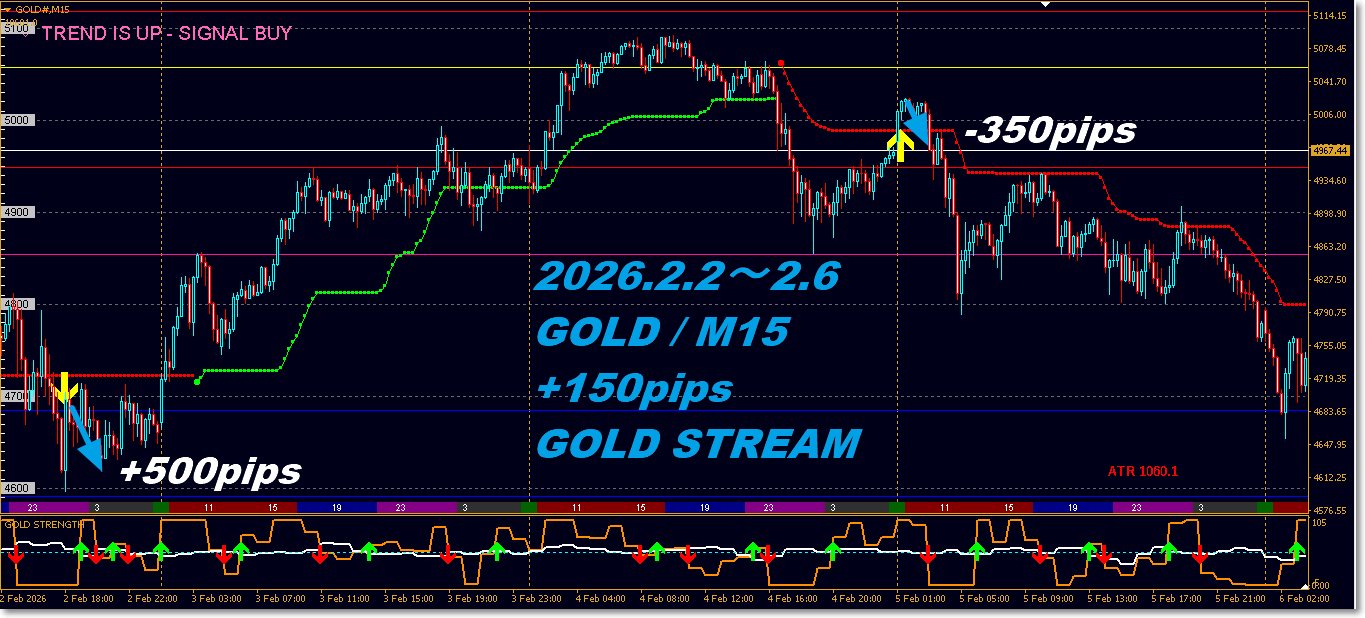

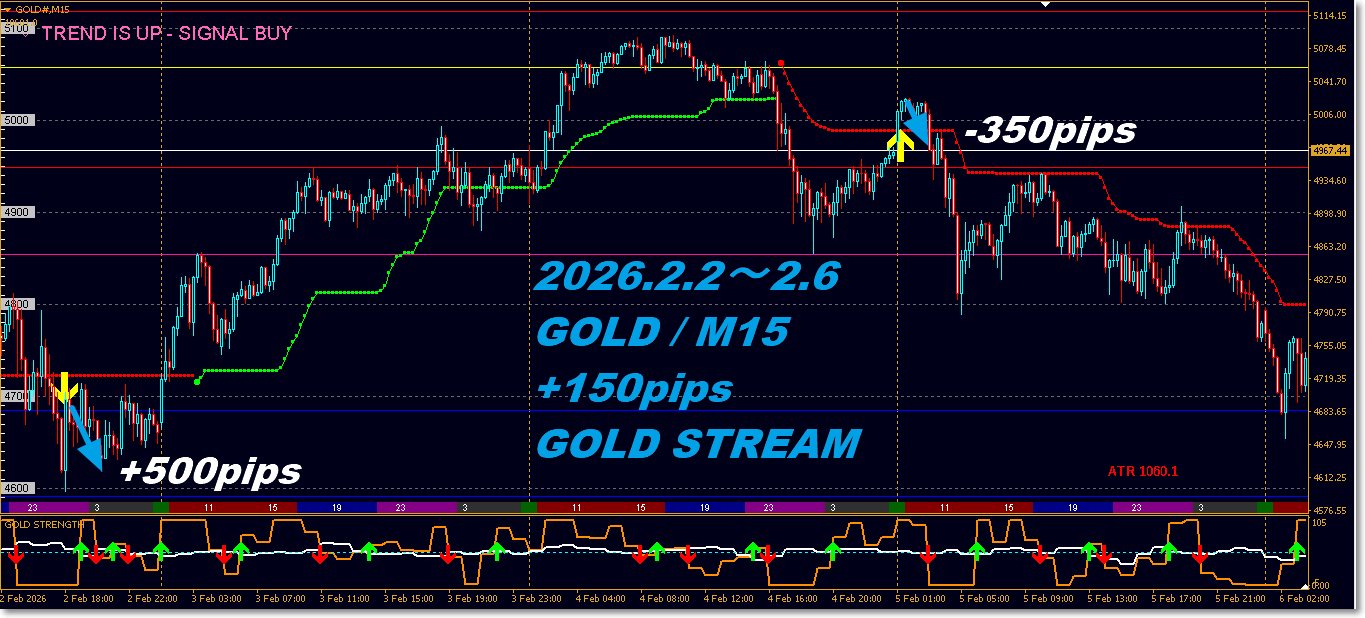

【Weekly Trade Verification】GOLD Day Trading Specialist "GOLD STREAM" 2026.2.2~2.6

▼【Weekly Trade Verification”GOLD STREAM” 2026.2.2~2.6 MAX Calculation▼

■ February 2, 2026 – February 6, 2026

GOLD (Gold) Market Summary

Price Movement

Following the sharp rally up to last week,the high-zone (around 5,000 USD) continued to hold

At the week’s start, buying was easy due to the residual uptrend,

but upper levels saw profit-taking pressure,resulting in a choppy up-and-down move

On a daily chart,

an attempt to make a new high

pullbacks and reversals

intermixed,the trend direction was somewhat unstable

The price range was large,a week of high volatilitybut not a one-way rally;

it moved with correctionsand alternating moves

Following the sharp rally up to last week,the high-zone (around 5,000 USD) continued to hold

At the week’s start, buying was easy due to the residual uptrend,

but upper levels saw profit-taking pressure,resulting in a choppy up-and-down move

On a daily chart,

an attempt to make a new high

pullbacks and reversals

intermixed,the trend direction was somewhat unstable

The price range was large,a week of high volatilitybut not a one-way rally;

it moved with correctionsand alternating moves

Supply-Demand & Investment Factors

Behind the maintenance of the high zone were

Geopolitical risks

Uncertainty surrounding monetary policy

Caution regarding currency value

persisted

price levels at high terms themselves provided selling pressure

short-term speculators booking profits vs. new buyers were in opposition

Physical and long-term demand remained solid, but

short-term supply-demand tended to be tight

Behind the maintenance of the high zone were

Geopolitical risks

Uncertainty surrounding monetary policy

Caution regarding currency value

persisted

price levels at high terms themselves provided selling pressure

short-term speculators booking profits vs. new buyers were in opposition

Physical and long-term demand remained solid, but

short-term supply-demand tended to be tight

Investment Trends

Investor sentiment remained bullish, but

the dominant stance was waiting for pullbacks and consolidations rather than chasing

Short-term traders

sell into strength near resistance

buy on dips repeatedly

for short-term gains

From a medium-to-long-term perspective

continue to hold

reduce positions periodically

and focus on risk managementover directional bets

Investor sentiment remained bullish, but

the dominant stance was waiting for pullbacks and consolidations rather than chasing

Short-term traders

sell into strength near resistance

buy on dips repeatedly

for short-term gains

From a medium-to-long-term perspective

continue to hold

reduce positions periodically

and focus on risk managementover directional bets

Overall Assessment

This week's GOLD market was a typical high-price-range environment that is “strong but not entirely straightforward.”

Strong but not easily grasped in the short term

Although the broader upward trend remains intact,

in the short term

pullbacks

false breakouts

were mixed in

From a trading perspective

chasing breakouts blindly carries high risk

only when strength, weakness, and correlations line up should signals be considered valid

The week emphasized the importance of market awareness and risk management

Weekly Trade Verification AI Evaluation

This week's GOLD market was a typical high-price-range environment that is “strong but not entirely straightforward.”

Strong but not easily grasped in the short term

Although the broader upward trend remains intact,

in the short term

pullbacks

false breakouts

were mixed in

From a trading perspective

chasing breakouts blindly carries high risk

only when strength, weakness, and correlations line up should signals be considered valid

The week emphasized the importance of market awareness and risk management

Weekly Trade Verification AI Evaluation

The trades shown in this image,for 2026 February 2–6 GOLD STREAMare based on

an exceptionally high volatility environment of around 4,150 pips ADR over 5 daysand were selected through strength-correlation analysis.

Note that the displayed +500 pips is the MAX value when fully held,

and the main evaluation is not the range butsignal accuracy and design validity.

This week featured a broadly upward trend but was a highly noisy market with sharp moves from the high zone and deep pullbacks,

a highly noisy market structure.

Within that, GOLD STREAM responded only in phases where strength and correlation aligned,

and did not issue signals in unstable directional moments.

The +500 pips scenario accurately captured a moment when strength realigned after a short-term retracement,

and was not overly reactive relative to the ADR environment.

On the other hand, the recent -350 pips also holds meaning.

and if correlation breaks, exit early.

This loss occurred as volatility shifted, detecting non-fulfillment conditions and cutting risk within expectations,

and considering the 4,150 pips ADR over 5 days,

it can be considered a highly controlled loss.

Viewed overall, the trades show

limited number of entries even in high-volatility environments

capturing the momentum when it extends

exiting immediately with a fixed SL when it breaks down

and a consistent behavior pattern

as a result, the overall profit range may not appear large,

not that it couldn’t be captured, but rather that it avoided scenarios where gains were not favorable

by design.

was not swayed by ADR magnitude,

prioritized strength, correlation, and H4-based risk management,

and focused on reproducibility, and

even in very challenging market conditions, the logic remained consistent.

The trades shown in this image,for 2026 February 2–6 GOLD STREAMare based on

an exceptionally high volatility environment of around 4,150 pips ADR over 5 daysand were selected through strength-correlation analysis.

Note that the displayed +500 pips is the MAX value when fully held,

and the main evaluation is not the range butsignal accuracy and design validity.

This week featured a broadly upward trend but was a highly noisy market with sharp moves from the high zone and deep pullbacks,

a highly noisy market structure.

Within that, GOLD STREAM responded only in phases where strength and correlation aligned,

and did not issue signals in unstable directional moments.

The +500 pips scenario accurately captured a moment when strength realigned after a short-term retracement,

and was not overly reactive relative to the ADR environment.

On the other hand, the recent -350 pips also holds meaning.

and if correlation breaks, exit early.

This loss occurred as volatility shifted, detecting non-fulfillment conditions and cutting risk within expectations,

and considering the 4,150 pips ADR over 5 days,

it can be considered a highly controlled loss.

Viewed overall, the trades show

limited number of entries even in high-volatility environments

capturing the momentum when it extends

exiting immediately with a fixed SL when it breaks down

and a consistent behavior pattern

as a result, the overall profit range may not appear large,

not that it couldn’t be captured, but rather that it avoided scenarios where gains were not favorable

by design.

was not swayed by ADR magnitude,

prioritized strength, correlation, and H4-based risk management,

and focused on reproducibility, and

even in very challenging market conditions, the logic remained consistent.

■ SILVER (Silver) Market Summary

Silver moved in tandem with Gold’s high-range levels but with more volatile price action, wider intraday swings. Industrial demand expectations and speculative capital supported the upside, while profit-taking selling occurred amid high-price caution, resulting in limited directional clarity. In the short term, volatility management took precedence over trend chasing.

▼【Weekly Trade Verification】”GOLD STREAM” 2026.2.2~2.6 MAX Calculation▼

GOLD / M15 Day Trading Focus

What is GOLD STREAM?

For short-term GOLD day trading

“Be decisive, timely, and unwavering”

A dedicated system.

Even in volatile markets, it is designed to enter after aligning the rationale,

and supports highly reproducible trading.

◆ Seven strengths of GOLD STREAM

1. GOLD (XAUUSD) Fully Specialized Design

Optimized for GOLD’s unique volatility and correlation structureShort-term day-trading logic.

Emphasizes immediacy and consistency beyond generic indicators, tuned for M15 as the primary arena.

2. Ready → Signal Two-Stage Notification

Ready: early notification that conditions are starting to form

Signal: notification of a complete, actionable entry decision

➡ Eliminates misses, chasing, and haste,

and habits you to enter after preparation, a winning procedure.

3. Instant Judgment of Strength & Correlation on One Screen

Essential for GOLD攻略

Relative strength

Correlation direction

Signal strength

displayed in a sub-windowwithout repainting.

No need to switch between multiple tools anymore.

4. Visualize Realistic Profit Targets with GOLD PIVOT LINE

Day trading: Daily Pivot

Targeting price ranges: Weekly Pivot

See at a glance the attainable profit aligned with GOLD’s movements.

5. ATR-Based Auto-Settlement (Trailing EA Included)

Basic risk-reward target auto-set to 1:2 or better

In non-trending markets, trailing protects gains

Eliminates emotional exits

➡Fixing slippage = major cause of lossesis addressed by the system.

6. Hybrid Mobile x EA Operation

Entry on mobile is OK

Auto processing of TP/SL/Trail by the EA

Even on busy days, you can operate steadily.

7. Designed to Cultivate Winning Techniques

GOLD STREAM is more than a tool.

Identify advantageous market moments

Correct sense of risk-reward

Limit unnecessary trades

➡A system that helps traders grow themselves.

For those who want to end these struggles now

Direction is correct but gets knocked out

Entering is always late

Profit exits keep fluctuating

GOLD is scary with no reproducibility

→ Most of the cause lies in the order of judgment.

Prepare → Correlation Alignment → Confirm → Execute → EA Settlement

Just follow this flow and trading becomes suddenly stable.

Now, Move GOLD from “feel” to “reproducibility”

GOLD STREAM is

not just a signaling tool,

but an operating system for winning GOLD trades.

First, check the concept and verification on the page.

Elevate your GOLD trading to a new level today.