2026/2/7 Dollar-Yen, Gold, SP500, and Nikkei 225 Environment

The indicator in the attached image uses the indicators listed above.

If you are interested, please take a look.

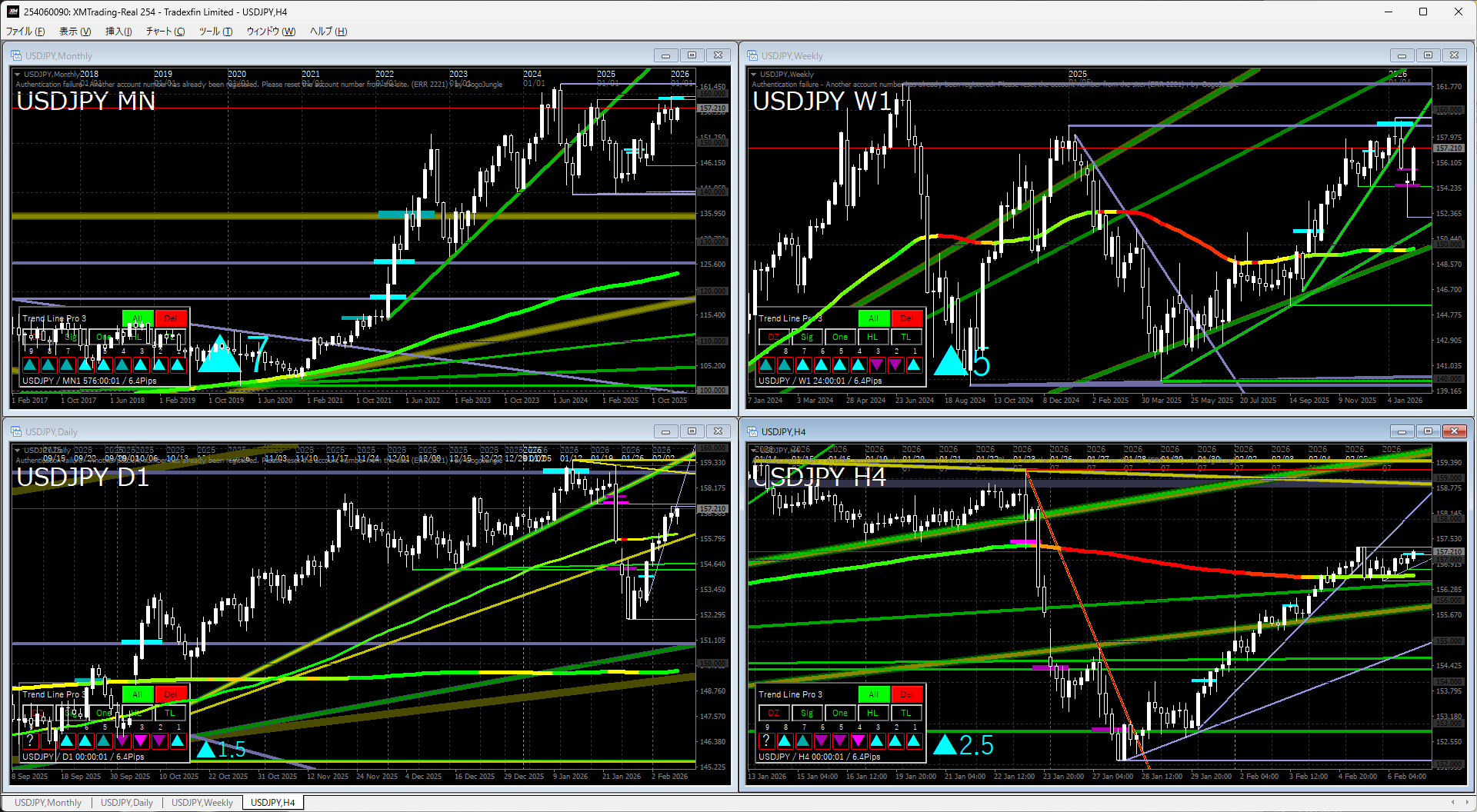

Dollar/Yen

Monthly & WeeklyLong-term, the pattern of a rise (yen depreciation) has not broken, but it seems to have entered a phase of price-range correction. Since the MA is lagging, the impression is that the correction will continue for a while.

Daily & 4-hourHas come back to the MA after a pullback. Since it’s hard to discern a clear direction, we will wait and see until it settles.

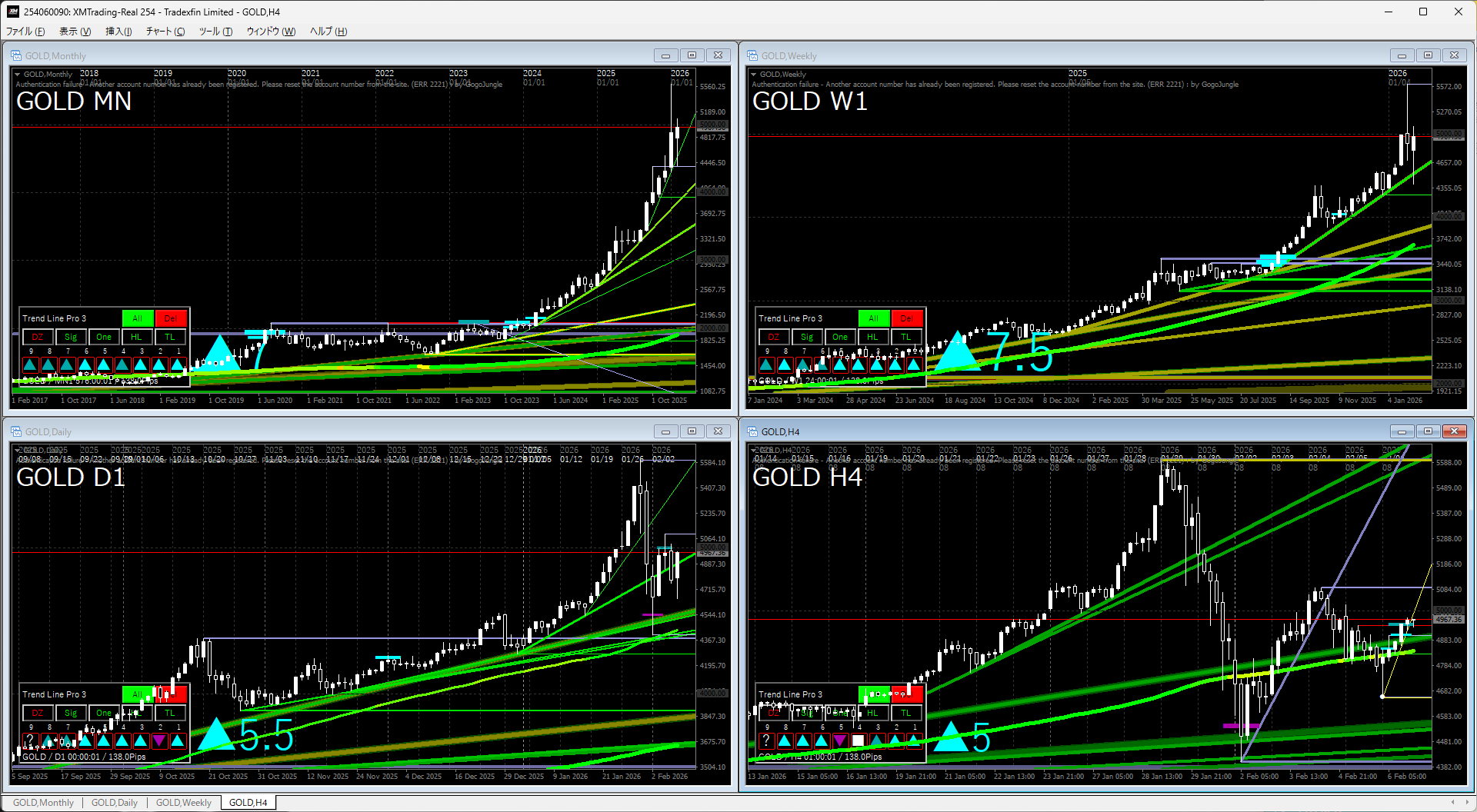

Gold

The general view is that currency value is falling, and gold remains the clear buy option.

Watching for a move that corrects the divergence between currency value decline and gold price rise, but the MA is likely to attract pullbacks, creating an environment favorable for buying on dips.

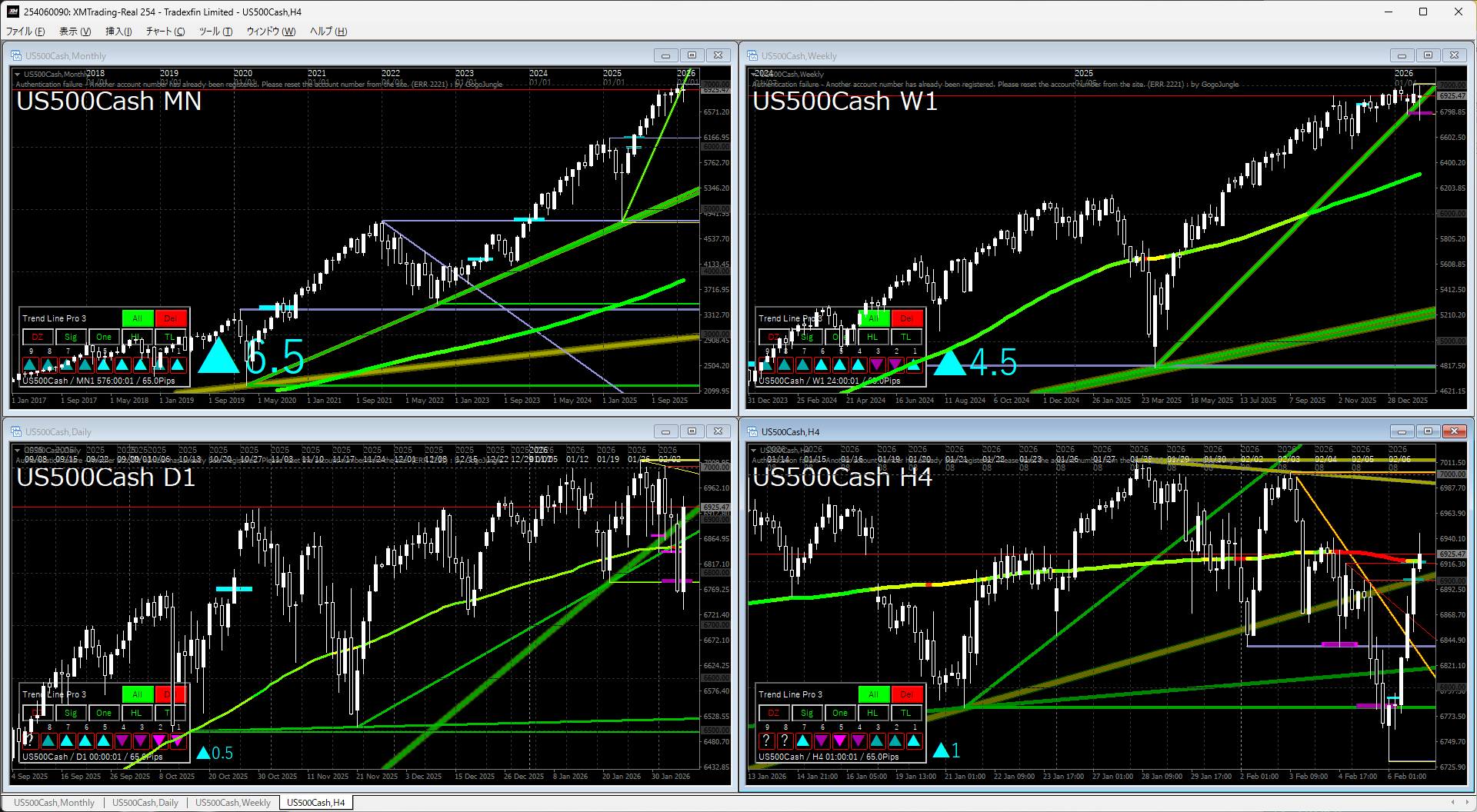

S&P 500

Monthly & WeeklyAfter a rebound from the trendline, the uptrend continues, with a market that tends to rise as currency value falls.

Daily & 4-hourThe score is near zero and there is no clear directional signal technically. Personally, I expect a sideways trend with potential new highs.

Nikkei 225

Monthly & WeeklyContinuing to rise after a double bottom break, aligned with a nicely drawn trendline.

Daily & 4-hourThe trendline is guiding the ascent. If the same momentum continues, next week is expected to enter a price-range consolidation.

The indicator in the attached image uses the indicators listed below.

If you are interested, please take a look.