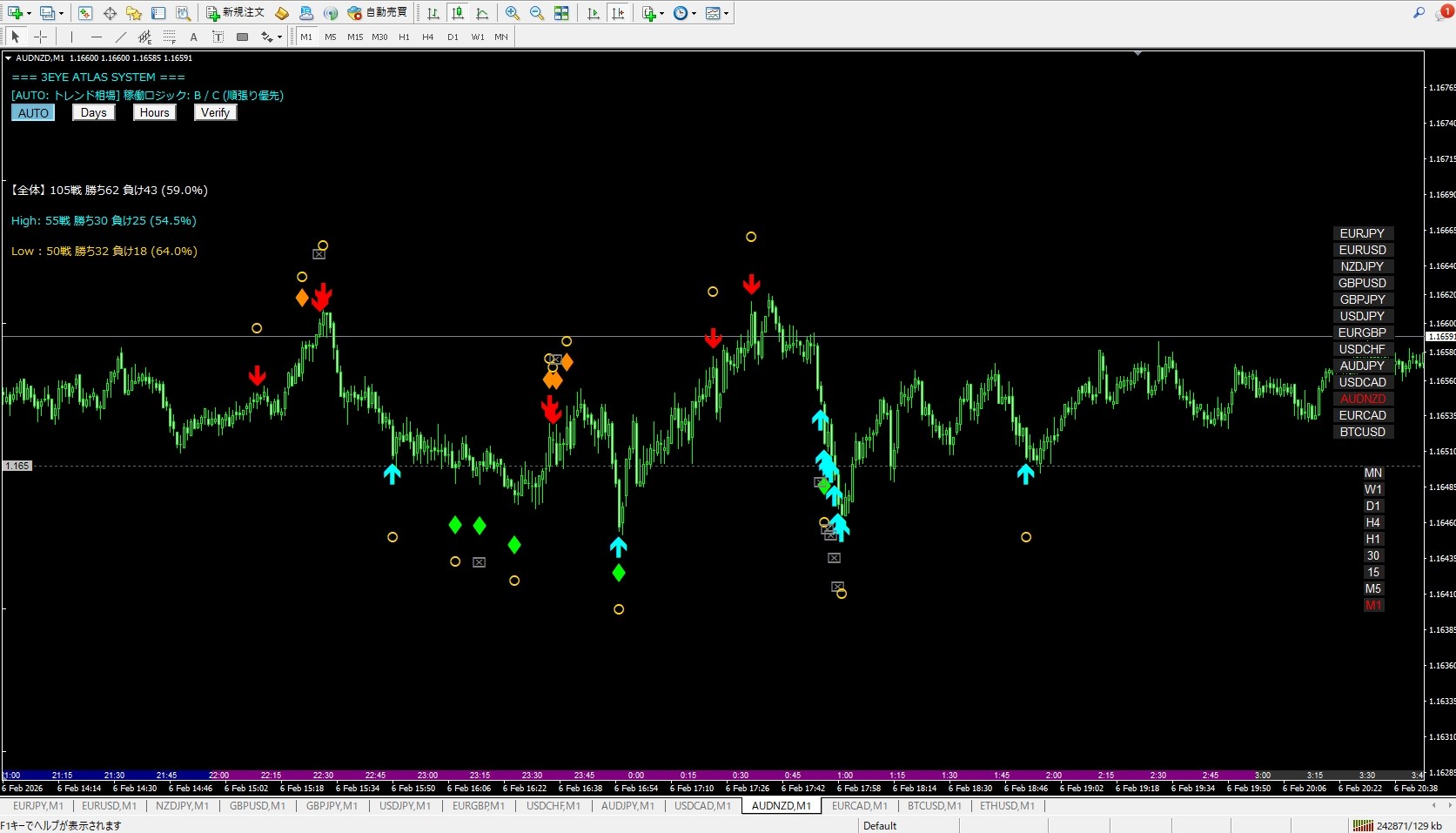

Both Upward and Downward are “easy to deceive” a day | February 6 AUDNZD 1-minute view

── In a market where ranges and short-term trends cross, the 3EYE ATLAS SYSTEM's “selectivity” was tested —

Papa Trader Yuu

■ A one-liner for this day's AUDNZD

On February 6, AUDNZD did not move in a clearly one-directional trend,but rather traded in a range with alternating rises and falls.

On the 1-minute chart, there were moves up and down,“it could go either way, but it doesn’t continue in either direction”in many scenes.

As the screenshots show, in the high price area momentum stalls, and in the low price area reversals recur,making it a day with unclear directional bias.

■ First half: mixed small trends and whipsaws

In the early phase, AUDNZD shows short-lived moves upward and downward,

- the moves do not extend

- soon reverse to the opposite direction

- previous highs and lows are not well respected

as characteristics.

At first glance it looks like a range with potential gains, but in reality there are many false moves

During this period, more important than the direction of price movementis the stance of waiting for the market to settle.

■ Middle phase: temporary momentum but not sustained

In the middle phase, there are temporarydownward movesandrebound rallies.

However, neither move continues

- to push new highs or lows

- to maintain momentum

therefore,short-term momentum tends to stop easily.

This phase is also a time when the trend “appears” to have a direction only on the surface.is essentially a time when a direction looks like it exists.

■ How the 3EYE ATLAS SYSTEM signals appear

On this day,3EYE ATLAS SYSTEMsignals showed the following characteristics:

- In the initial moves or momentum-only scenesthe signals are subdued

- Only after a consolidationdo they respond

- As the range becomes clearerthe intervals between signals widen

These features are clearly evident.

3EYE ATLAS SYSTEM

is designed to emphasize whether the market is orderly rather than the direction of movement

Therefore, in markets like AUDNZD with many whipsaws,not reacting to every move itself is of great value.

■ Second half: range becomes clear, and deciding not to trade is effective

Toward the latter half, the price range narrows further,sharply turning into a clear range market.

- makes it hard to expect a one-way breakout

- reactions tend to be short-lived

therefore, judging on a 1-minute chart becomes very difficult.

Seeing fewer signals doesn’t mean there are no opportunities; rather,

it’s time to refrain from forcing trades

which helps avoid unnecessary trades.

■ Position on higher timeframes (5-minute)

While the 1-minute chart is choppy, on the 5-minute chart it is

a range that is accumulating energy

and can be interpreted as such.

With this perspective,

- you can avoid getting caught in short-term whipsaws

- you can wait for the momentum to develop

which makes judgments easier.

■ What AUDNZD on February 6 taught

What the market showed that day was

“In a moving market, caution is actually more necessary”

.

Even if short-term charts show many opportunities,

in a market without sustainability, the value of “choosing not to trade” rises.

3EYE ATLAS SYSTEMis a tool that can visually organize this kind of market,

“whether to attack now or wait”

.

■ Summary

On February 6, AUDNZD was a difficult market where direction seemed to be possible but not actualized, a day that was hard to judge.

On days like this,

- don’t chase the number of signals

- do not be swayed by flashy price action

which leads to more stable results.

3EYE ATLAS SYSTEMis,

even in short-term charts, useful for not being swayed by the market andserves as a supplementary line to keep your judgments flat, especially in such range markets, and today felt like it truly shined.

— Papa Trader Yuu