February 6 EURCAD Market Commentary

February 6 EURCAD Market Commentary

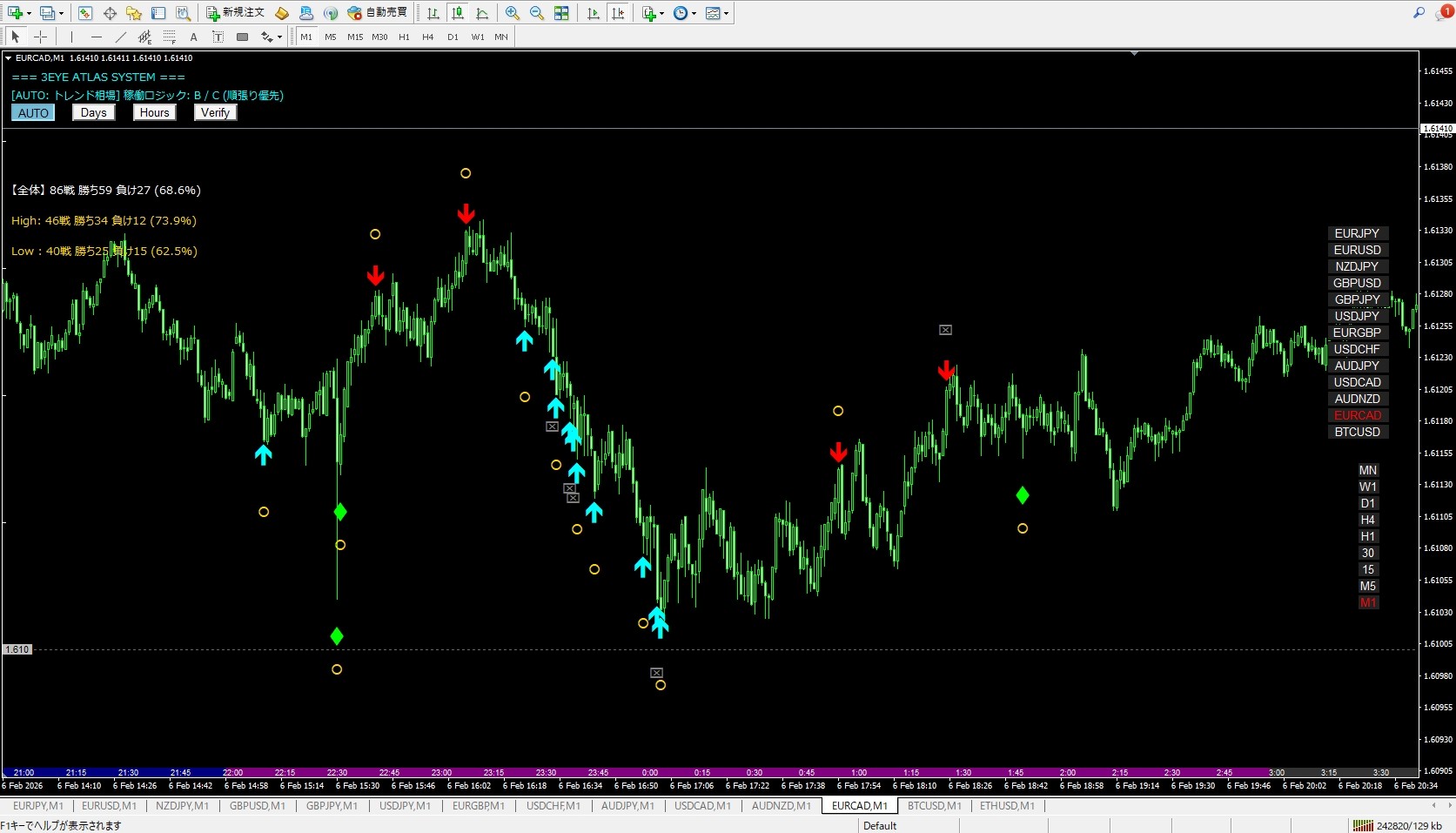

── Judgement points after the trend emerged seen on the 1-minute chart ──

Papa Trader Yuu

■ How to summarize the market of this day in one sentence

On February 6, EURCADthe price movement itself was solid, but making judgments was by no means easy.

On the 1-minute chart, there were frequent up and down moves, and many opportunities to enter appeared, but“moving = easy to capture” was not the case.

As you can see in the screenshots, the early stage lacked a clear direction,and gradually shifted toward a downside biasas the session progressed. However, it was not a one-way move from start to finish, as there were retracements and rebounds,making the point of judgment extremely important for the day.

■ Common mistakes when judging on the 1-minute chart

When looking at the 1-minute chart, one tends to focus onthe momentum of the most recent candle.

That day, there were several candles that extended rapidly in a short time,

- “Will it break out all at once from here?”

- “Maybe this is the initial move”

and situations like that were not rare.

However, in reality, most of them

- were retraced quickly

- lost momentum on the next candle

- were pulled back into a range

and developed like that.

On this day, in particular,whether you could observe “after the move” rather than the move itself greatly affected the difficulty of judging.

■ Common points seen after the trend emerged

From around the center of the screenshot onward, the downward drift becomes relatively clearer.

However, the important factor here isnot the initial drop.

After it drops once,

- where does the retrace stop

- whether the rebound momentum continues or stalls

By watching these reactions,it becomes easier to determine whether the market is still aiming downwards.

On February 6,even when a retracement occurred, there were frequent cases where it failed to push to new highs, and rebounds stalled along the way.

In this state, the sense of direction was not completely broken,and it tended to create an environment where trying the same direction again was likely.

■ How the 3EYE ATLAS SYSTEM signs appear

Looking back at the signs on this day from the 3EYE ATLAS SYSTEM,

not all price movements trigger signs.

What stood out most were the following points.

- The initial rough moves produced modest signs

- After a trend emerged, signs lit up when retraces became weak

- In phases with strong rebounds and unclear direction, reactions were sparse

This is because the 3EYE ATLAS SYSTEM is designed to focus on

“whether it is moving”

“whether the conditions are met”

rather than simply on

“is there movement?”.

■ How to view periods with no signs

That day, there were periods with no signs for a while.

But it is not that there was no opportunity; rather,

“the environment is currently difficult to judge”

is a message from the market.

- no signs = unusual

- something must be done

is a common feeling, but in reality the opposite is healthier,the more unsettled the market, the less signs appear.

■ The meaning of overlaying the 5-minute perspective

If you only look at the 1-minute chart, you can be easily swayed by the ups and downs,

but if you view the overall picture on the 5-minute chart, this day’s EURCAD shows a structure of

“downward move with retracements”

which becomes relatively easy to see.

On the 5-minute chart

- whether it is still in the middle of a trend

- or already finished moving

and then looking at the 1-minute chart helpsavoid forcing early entries and maintain judgement accuracy.

■ What February 6, 2024 EURCAD market showed

What the market on that day showed was

“movement does not equal easy”

which is a very obvious yet important fact.

Rather than increasing the number of trades,

- explain why you chose that moment

- explain why you passed on it

and keep a state where that explanation is possible is the most important thing in short-term trading.

■ Summary

On February 6, EURCAD was a market withflashy moves but required calm judgment.

Rather than reacting to the start of movement,

watch how the market behaved after the trend emerged.

And,the signs of the 3EYE ATLAS SYSTEM appeared not only in moments of signal but also in moments when there were none.

find meaning in the periods when there were no signs as well.

— Papa Trader Yuu