Isn't that indicator merely a fortunate accident that happened to fit the environment?

● Overwhelming validation proves unparalleled reproducibility

When talking about the reliability of a trading logic,

“verification period” and “number of verifications (sample size)” are the most important metrics.

Because the foreign exchange market is constantly changing due to seasonal factors, interest rate policies, geopolitical risks, and volatility fluctuations,

it is a non-stationary environment with no uniform market conditions.

Therefore──

If you verify for only the most recent 1–2 months and a few dozen to a few hundred cases,

you cannot see through incidental bargains that merely fit the environment or overfitting to past data.

You cannot claim statistical significance or edge from such short verifications.

That is why you cannot call it statistically meaningful superiority.

① A trustworthy logic satisfies the following conditions.

✓Sufficient long-term verification (spanning at least several years to over a decade)

✓A number of verifications in the thousands to tens of thousands (a statistically meaningful population)

Verification is the process of confirming whether, in any market condition, the rule works consistently.Verification period that is short and sample size that is small cannot claim reproducibility and reliability.

② For statistically based trading to be valid, the following three elements are essential.

✓Long-term, continuous verification

✓Statistical backing from a sufficient sample size

✓Consistent “perfect non-repaint” between past and present

Only when all three conditions are met can you speak of the logic’s reproducibility, expectancy, and edge as a basis for investment decisions.

And──

All of these conditions are fulfilled by our Sign Indicator.

The consistent edge backed by an enormous amount of verification data is

the greatest strength of our Sign Indicator and the genuine proof you won’t find elsewhere.

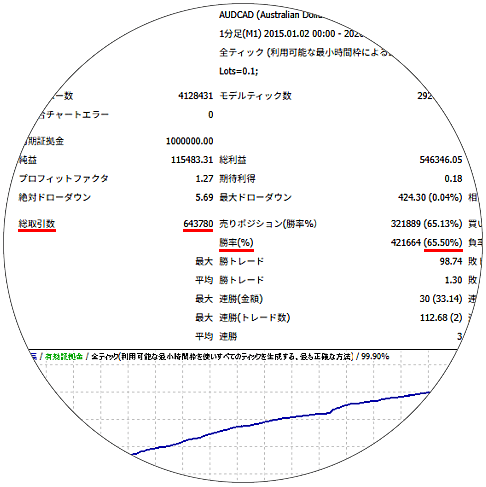

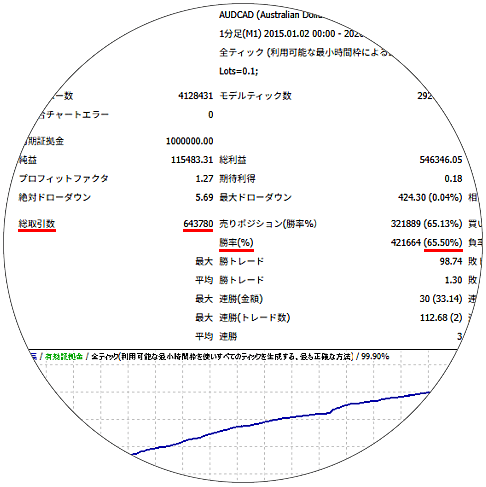

↑Even with just a single currency pair, over 600,000 total trades (i.e., verifications).For details, please check the verification data in the section “● Evidence over Argument”

Please imagine this.

Suppose you flip a coin with a 50% chance of heads, 600,000 times.

If you aim to continue getting heads with a probability of 60% or more in this coin toss,

that can no longer be explained by luck or chance.

In the world of statistics, as the number of trials increases,

the result converges toward the true probability (50%).

Among 600,000 trials,

continuing to exceed the expected value by 10% or more is statistically extremely abnormal,

and cannot be explained by ordinary probability theory—

it may be described as a “miracle.”

Our Sign Indicator

conducted more than 600,000 trades of a single currency pair,

and in many cases the win rate exceeds 65%,

which is not merely a coincidence.

It captures the essence of the market to the extreme and

proves that it can turn randomness into necessity.

This superiority backed by such an enormous sample size is

an unrivaled, one-of-a-kind weapon that leaves no room for imitation.

When talking about the reliability of a trading logic,

“verification period” and “number of verifications (sample size)” are the most important metrics.

Because the foreign exchange market is constantly changing due to seasonal factors, interest rate policies, geopolitical risks, and volatility fluctuations,

it is a non-stationary environment with no uniform market conditions.

Therefore──

If you verify for only the most recent 1–2 months and a few dozen to a few hundred cases,

you cannot see through incidental bargains that merely fit the environment or overfitting to past data.

You cannot claim statistical significance or edge from such short verifications.

That is why you cannot call it statistically meaningful superiority.

① A trustworthy logic satisfies the following conditions.

✓Sufficient long-term verification (spanning at least several years to over a decade)

✓A number of verifications in the thousands to tens of thousands (a statistically meaningful population)

Verification is the process of confirming whether, in any market condition, the rule works consistently.Verification period that is short and sample size that is small cannot claim reproducibility and reliability.

② For statistically based trading to be valid, the following three elements are essential.

✓Long-term, continuous verification

✓Statistical backing from a sufficient sample size

✓Consistent “perfect non-repaint” between past and present

Only when all three conditions are met can you speak of the logic’s reproducibility, expectancy, and edge as a basis for investment decisions.

And──

All of these conditions are fulfilled by our Sign Indicator.

The consistent edge backed by an enormous amount of verification data is

the greatest strength of our Sign Indicator and the genuine proof you won’t find elsewhere.

↑Even with just a single currency pair, over 600,000 total trades (i.e., verifications).For details, please check the verification data in the section “● Evidence over Argument”

Please imagine this.

Suppose you flip a coin with a 50% chance of heads, 600,000 times.

If you aim to continue getting heads with a probability of 60% or more in this coin toss,

that can no longer be explained by luck or chance.

In the world of statistics, as the number of trials increases,

the result converges toward the true probability (50%).

Among 600,000 trials,

continuing to exceed the expected value by 10% or more is statistically extremely abnormal,

and cannot be explained by ordinary probability theory—

it may be described as a “miracle.”

Our Sign Indicator

conducted more than 600,000 trades of a single currency pair,

and in many cases the win rate exceeds 65%,

which is not merely a coincidence.

It captures the essence of the market to the extreme and

proves that it can turn randomness into necessity.

This superiority backed by such an enormous sample size is

an unrivaled, one-of-a-kind weapon that leaves no room for imitation.

× ![]()