Tribonacci_RF Strategy Guide #5: How to Fine-Tune (Preserved Edition)

It is a black cat!!!

By攻略#4, the "initial setup method" is complete.

This time (攻略#5) is a session to decide what to touch without hesitation from the symptoms that appeared during operation (not appearing / appearing too much / chaotic / not growing).

The goal is simple:

Symptoms → Cause → Where to touch (order) should be identifiable at a glance.

1. The big principles of fine-tuning (rules to avoid getting lost)

Rule A: Change only one place at a time

If you touch reference bars, deviation pips, lot distribution, operating band all at once, you won’t know what worked.

Make changes one item at a time.

Rule B: The order of touching is fixed

Fine-tuning is less prone to failure if progressed in the following order.

・Operating conditions (time, spread, account conditions)

・Reference bar count (magnitude of the wave to catch)

・Deviation pips (growth filter)

・Lot distribution (risk and revenue form)

Rule C: Decide the unit of comparison

It’s okay to use rough units like "2–3 days" or "until the signal appears a certain number of times."

Without a unit of comparison, adjustments will never end.

2. First, prepare the environment (pre-parameter risk factors)

When you feel "chaotic," the cause is often not the parameters but the environment.

・Indicator sudden change / beginning of the week / thin market → create operating band

・Spread widening → protect with MaxSpreadPips

・Account conditions (stop level, etc.) → trailing may not move as expected

Before touching parameters, fixing this is the shortest route.

3. By symptom: causes → countermeasures

3-1. When there is “no appearance” (too few signals)

Common causes

・Deviation pips too high (conditions too strict)

・Reference bar count too large (waiting for big waves reduces occurrences)

Recommended order of touching

Slightly decrease deviation pips (be careful not to lower too much)

If still few, slightly reduce reference bar count

Caution

Signals appearing does not mean you will win.

Also check that it isn’t leaning toward too much noise.

3-2. When there are “too many” (entering too much / noise-like)

Common causes

・Deviation pips too low (catching moments with little growth potential)

・Reference bar count too small (catching too many small waves)

Recommended order of touching

Increase deviation pips (top priority)

If still too many, increase reference bar count (catch bigger waves)

Target state

Aim for signals to appear selectively, not constantly.

3-3. When it’s “chaotic” (wins and losses swing extremes / unstable)

Common causes

・Operating band is poor (indicator, thin time, start of week)

・Spread is volatile, trailing is unsettled

・Reference bar count too small, wave quality not stable

Recommended order of touching

・First review time zone, currency pair, and MaxSpreadPips (before parameters)

・Also check account conditions (stop level, etc.)

If it still chaotic, raise reference bar count a little to enlarge the waves

One word

“Chaos” tends to be a sign that the foundation environment is misaligned.

3-4. When you win but don’t grow much (thin profit / not expanding)

Common causes

・Deviation pips too low, many moments with little growth potential

・Trailing too early, ending at small profits

Recommended order of touching

・Slightly raise deviation pips (prioritize growth potential)

・Then recheck trailing conditions (also re-confirm environment and spreads)

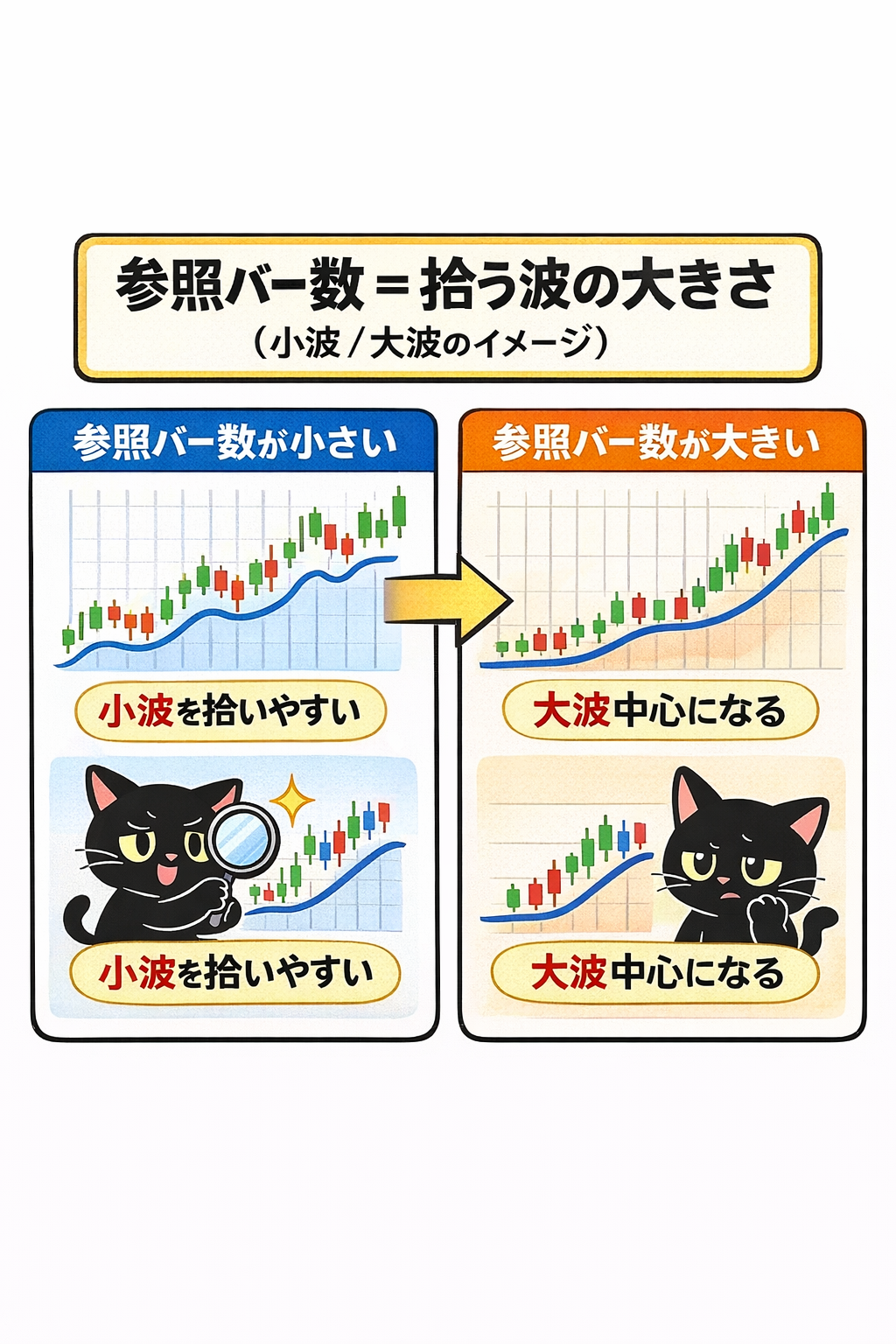

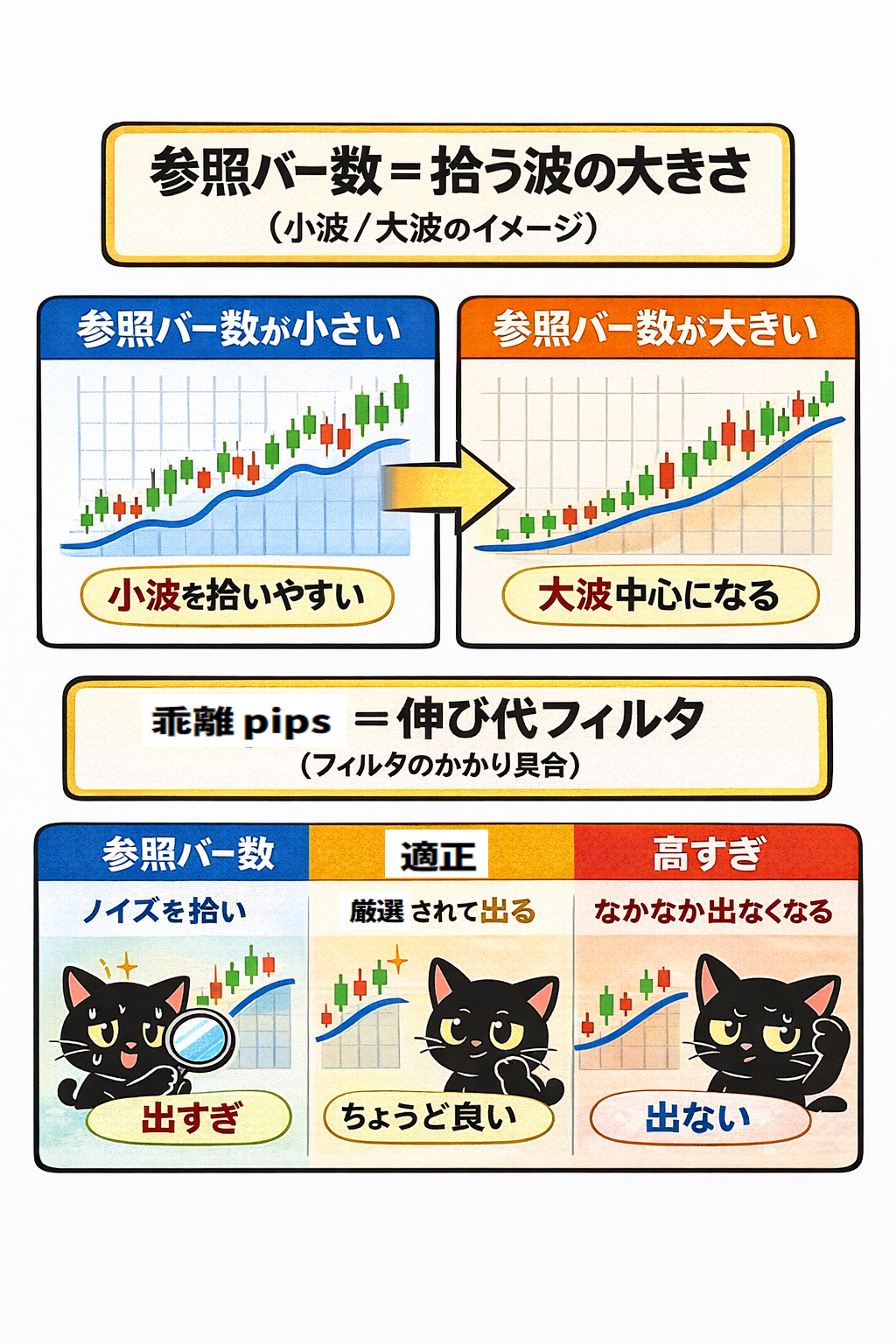

4. Fine-tuning the reference bar count (conclusion: change the size of the caught wave)

The reference bar count is not merely a knob to increase the number of times; it is a knob to change the size of the waves caught.

・Small reference bar count → easier to catch small waves (more frequent, more noise)

・Large reference bar count → centralizes on big waves (fewer occurrences, more stable quality)

If unsure, first fix a baseline (e.g., 120 bars) and adjust from the deviation pips side for safety.

5. Fine-tuning deviation pips (conclusion: growth potential filter)

Deviation pips is a filter that narrows to moments with growth potential.

・Low → catches too much noise / too many signals

・High → often does not appear / waits too long

・Just right → signals appear selectively

Adjust in small steps (if you go up and down too much, it becomes a different thing).

6. Fine-tuning lot distribution (last to touch: for advanced users)

Initially, it is fine to start with equal distribution (same Ratio1–5).

If changing, set a clear objective.

・Want safety → increase shallow ratios

・Want higher returns → increase deep ratios

※Changing the lot size significantly changes feel, so do not touch it together with other items.

Summary: a shortest-path checklist to fix

・If chaotic, first fix operating band / spread / account conditions

・Next, adjust reference bar count (wave size)

・Next, adjust deviation pips (growth potential filter)

・Finally, adjust lot distribution (match your objective)

Make changes one at a time, decide a comparison unit (2–3 days / a certain number of signals) and verify