【★Gold・Past-largest volatility as well★】

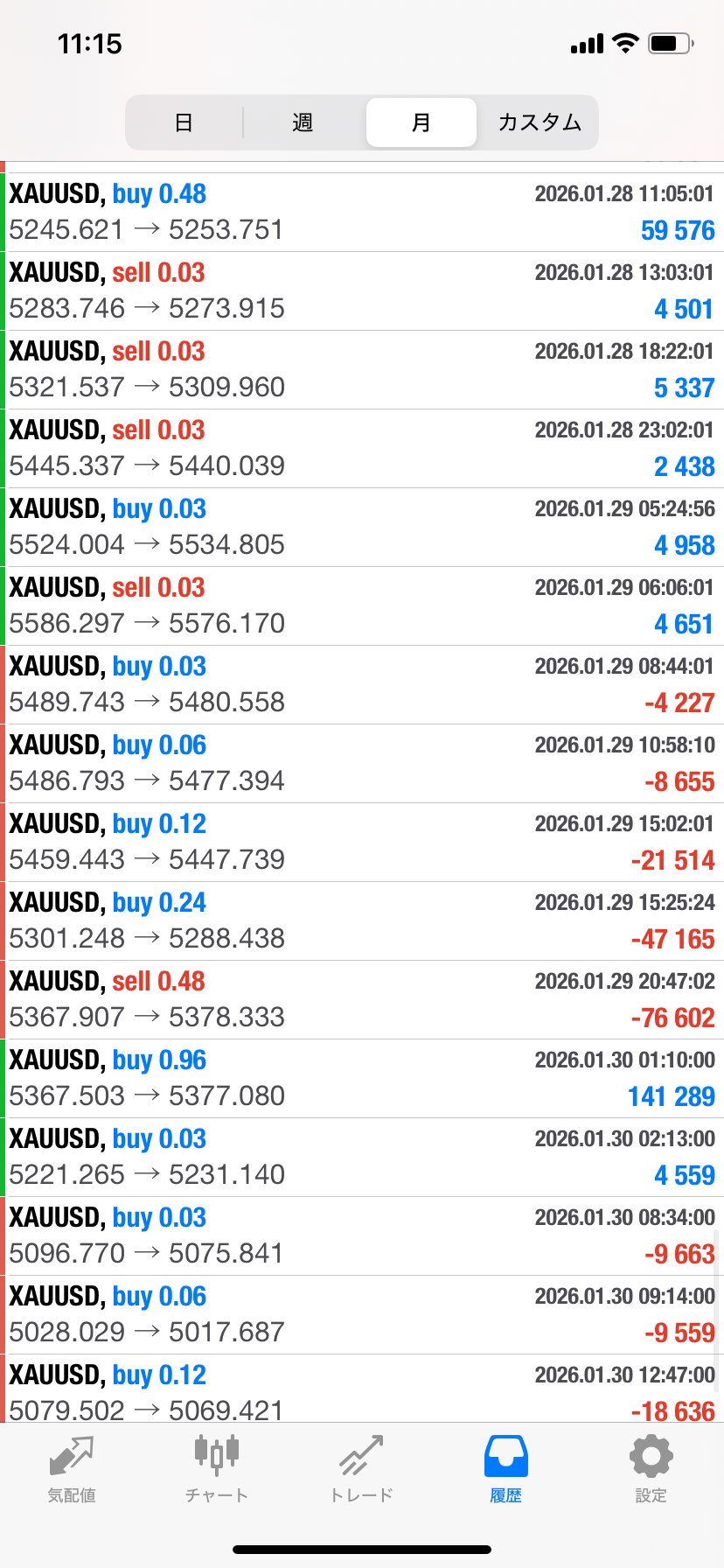

End of January, gold showed exceptionally high volatility, moving roughly from around $4,700 to $5,600 in price fluctuations,

and for January 29-30, it swung up and down from $5,600 to $4,700, with 1-minute candles showing moves of about $10 to $30 each.

It was truly the sharpest drop in history.

In such a situation, I think most EAs must have been in a tough spot.

Since January, I had been running it passively

with the semi-discretionary EA Byakko, and the month-end results are...

Starting with a margin of 100,000 yen

Plus 140,000 yen (maximum 180,000) profit, 140%

Even in that phase there were five consecutive losses in the middle, which was nerve-wracking, but I survived safely.

In the end, it did not turn profitable and the market closed.

There were moments when almost as much as double the contracts slid, so I wondered whether to stop the EA or change from a 1:1 10-dollar range to 15- to 30-dollar range 1:1, but since the concept was to find a form that anyone could win, I endured.

Next week, of course, we can expect a degree of increased volatility, so for now,

I will reset the losing streak to 1 and widen the TPSL until things settle down.

However, even with this month’s rapid rises and falls, the fact that I could survive with a aggressive setting makes me feel, personally, glad I built Byakko.

You can also view the record from the first month in the past Investment Navigator, so please take a look.

Next month, I want the funds started at 100,000 to exceed 500,000

In two months, I plan to aim for a 400% profit rate.

【Semi-discretionary EA Byakko】

https://www.gogojungle.co.jp/tools/indicators/64612?utm_source=share

Currently running with Martingale logic enabled

Practices published in Investment Navigator

(Martingale can be toggled on/off)