Envelope Counter-Trend EA Sequel: How to Think About Busy Trading Hours (Spread Measures / For Beginners)

Hello, I am a black cat.

Last time, we organized “currency pair selection” with three axes: spread × range characteristics × rapid change risk.

This time, as a continuation, leaving aside the stopping decision for now,

we will summarize an entry that is easy for beginners to tackle and tends to show results: choosing the active trading time.

In short, this EA assumes a permissible spread of 2.0 pips (ver1.2). Therefore, the wider the spread during the chosen time, the more the entry, take-profit move, and losses become volatile.

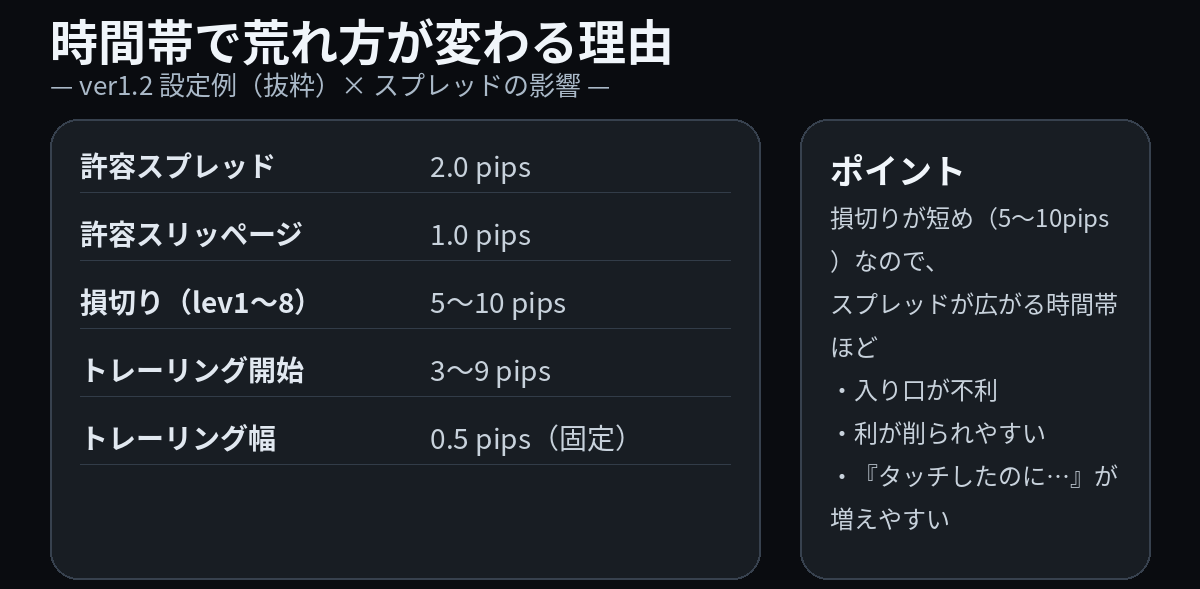

1) Why does volatility change with the time of day

In this EA (ver1.2 configuration example),

・Permissible spread: 2.0 pips

・Permissible slippage: 1.0 pips

・Stop loss: 5–10 pips (varies with leverage)

・Trailing start: 3–9 pips

・Trailing width: 0.5 pips (fixed)

The stop loss is relatively short (5–10 pips), so as spreads widen,

・entry tends to become less favorable

・profits can be eroded even when they occur

・“even though it touched,…” often happens

…this is how the structure works.

(ver1.2 settings × spread impact: why volatility changes by time of day)

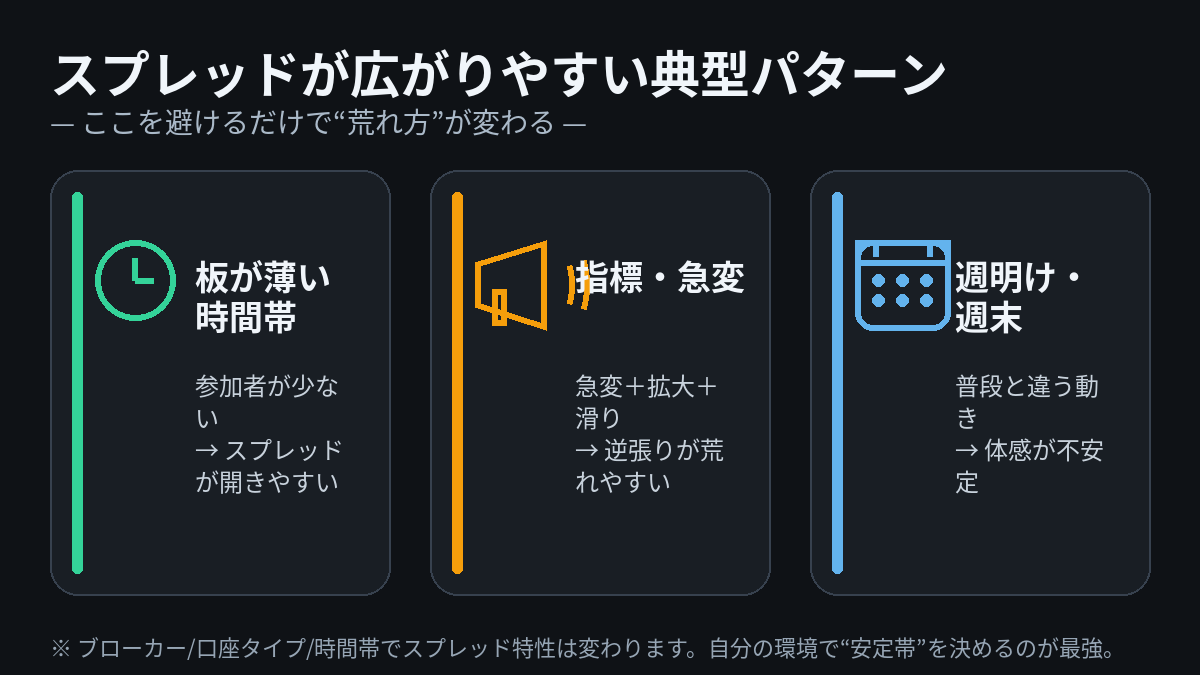

2) Three typical patterns where spreads widen

No need to overthink this; it’s basically these three.

Pattern 1: thin order book time

During periods with few participants, spreads tend to widen.

Even with the same currency pair, the experience can feel different by time of day.

Pattern 2: indicators / rapid changes

In rapid-change moments, enlargements and slippage are more likely, making counter-trend trading rough.

Pattern 3: start of week / end of week

Movement tends to be unconventional and the feel becomes unstable.

(Three典ical patterns where spreads widen: thin order book times / indicators・rapid changes / start/end of week)

3) For beginners: the simplest operating rule

Before deciding to stop, start with just this.

Rule: Use a time band where spreads are more stable as the “active period”

This alone changes the way volatility behaves

It is easier to continue because the stopping decision is less of a hurdle

4) Practice: steps to decide your own “easy-to-operate” time band

Since spread characteristics vary by broker and account type, the strongest approach is to decide based on your own environment.

Narrow the currency pairs to 1–2

Look at the spreads during the desired time band (a few days are fine)

Make the time band where spreads are stable the “active period”

On days with indicator-like rapid changes, don’t force trades (habitualize)

5) Summary

This EA is (by configuration) highly affected by spreads

So just by choosing the time band in which you trade, it tends to stabilize

Before stopping decisions, it is recommended to first create an “active band = time when spreads are stable”

× ![]()