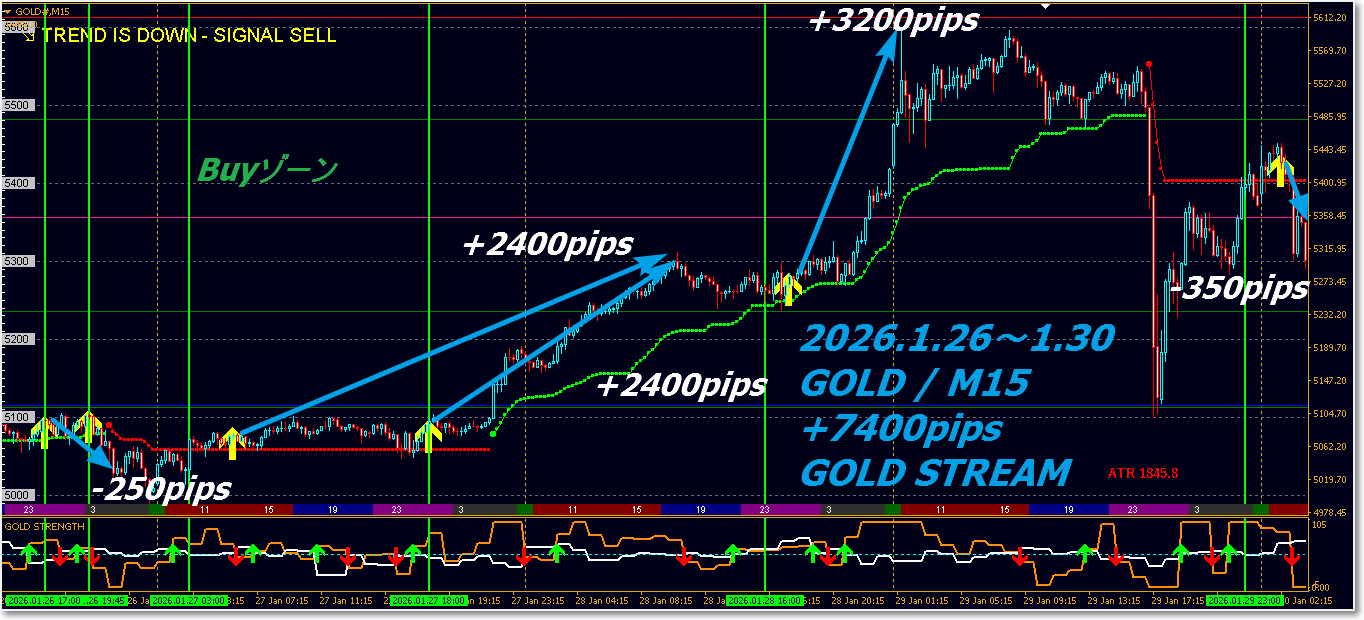

[Last Week Trade Verification] GOLD Day Trade Specialized Model "GOLD STREAM" 2026.1.26~1.30

▼【Last Week Trade Verification】”GOLD STREAM” 2026.1.26~1.30 MAX calculation▼

January 26, 2026 (Mon) – January 30, 2026 (Fri)

GOLD (Gold) Market Outlook

Price Trends

January 26, the gold pricesurpassed $5,000 for the first time in historyand climbed to aroundabout $5,090during the latest trading. This level can be seen as an extension of the strong rise in 2025.

In the early part of the week, strong demand for safe assets fueled buying, continuing to push prices to record levels.

In the latter part of the week (Jan 30), there was a sharp decline. Particularly on Friday, gold prices plunged, with intraday downside exceeding10%at times.

After the drop, prices recovered,and the week saw fluctuations around the high level throughout.Looking at the daily chart, a mix of long upper and lower wicks suggests the uptrend momentum has temporarily softened.

January 26, the gold pricesurpassed $5,000 for the first time in historyand climbed to aroundabout $5,090during the latest trading. This level can be seen as an extension of the strong rise in 2025.

In the early part of the week, strong demand for safe assets fueled buying, continuing to push prices to record levels.

In the latter part of the week (Jan 30), there was a sharp decline. Particularly on Friday, gold prices plunged, with intraday downside exceeding10%at times.

After the drop, prices recovered,and the week saw fluctuations around the high level throughout.Looking at the daily chart, a mix of long upper and lower wicks suggests the uptrend momentum has temporarily softened.

Supply-Demand & Investment Factors

Price gains were driven by heightened geopolitical tensions and policy uncertainty creating “safe-haven demand.” U.S. policy directions and international political risk spurred gold buying.

The weekend’s sharp drop was triggered by the announcement of a new Fed chair candidate and the fading of expectations for rate hikes,with the impact of a stronger dollar and higher interest-rate expectationsbeing noted.

Although the market still finds safety-asset appeal,profit-taking and short-covering are mixing in the supply-demand dynamics.

Price gains were driven by heightened geopolitical tensions and policy uncertainty creating “safe-haven demand.” U.S. policy directions and international political risk spurred gold buying.

The weekend’s sharp drop was triggered by the announcement of a new Fed chair candidate and the fading of expectations for rate hikes,with the impact of a stronger dollar and higher interest-rate expectationsbeing noted.

Although the market still finds safety-asset appeal,profit-taking and short-covering are mixing in the supply-demand dynamics.

Investment Trends

In the first half of the week, gold ETFs and futures saw strong buying, resulting in noticeable influx of investment money. This increased volatility andaccelerated new position buildingin certain moments.

The sharp drop in the latter half was due to a sentiment shift from risk-on to risk-off,leading to profit-taking and position unwindingbeing prominent.

Some market participants mixed bottom-fishing with rebound attempts,increasing short-term trading within a range.

In the first half of the week, gold ETFs and futures saw strong buying, resulting in noticeable influx of investment money. This increased volatility andaccelerated new position buildingin certain moments.

The sharp drop in the latter half was due to a sentiment shift from risk-on to risk-off,leading to profit-taking and position unwindingbeing prominent.

Some market participants mixed bottom-fishing with rebound attempts,increasing short-term trading within a range.

Overall Assessment

This week’s gold market was characterized by extreme moves:record highs and sharp declines.

Price levels remained high, butincreased volatility blurred short-term direction.

On the demand-supply side, “safe-asset demand + policy and currency risk” were the main drivers, whileshifts in policy expectations amplified price swings.

Investor sentiment leaned bullish, butprofit-taking and risk-on psychology capped upside, making short-term trading more cautious.

This week’s gold market was characterized by extreme moves:record highs and sharp declines.

Price levels remained high, butincreased volatility blurred short-term direction.

On the demand-supply side, “safe-asset demand + policy and currency risk” were the main drivers, whileshifts in policy expectations amplified price swings.

Investor sentiment leaned bullish, butprofit-taking and risk-on psychology capped upside, making short-term trading more cautious.

Trade Verification Evaluation

GOLD STREAMtrading operated in a high-volatility environment with about 2,290 pips 5-day ADR,sharply narrowing entries based on strength/weakness and correlation analysisas a core design feature.

The displayed +7,400 pips is the theoretical MAX when fully held; the essence of evaluation lies not in the width but inwhich situations the signals worked.

First, entry precision.

In the unstable early market, no entries were taken, and signals fired only when the directionality of strength/weakness and correlation aligned clearly.

As a result, among multiple trend waves within the 5-day ADR,the most persistent main waves were extracted, avoiding unnecessary retracements and minor back-and-forths, which is highly commendable.

Next, trade structure.

Ranges like +2400 pips, +3200 pips are not single-shot hits but the result of treating the continuous, same-direction strength as a wave.

Compared with 5-day ADR of 2290 pips, the width may seem above the environmental range, but this is due to multiple consecutive aligned correlations, not a design flaw.

Next, risk management.

In this trade,the SL is fixed based on the 4-hour chart, so stop-loss width does not drift with market conditions or emotions.

Thus, risk remains constant even during unexpected rapid moves, making expected value calculations clear.

Meanwhile, take-profit is flexible via ATR-based exits and trailing,limiting losses while allowing profits to run when trends extend.

Overall,

this trade is

-

-

and from a professional perspective, the execution quality is high.

MAX width is a reference; in actual operation, even with ATR-based take profits and trailing, there is a clearly reproducible edge.This can be considered a robust edge.

In summary, this trade is not about large one-time gains, but rather a high-volatility environment where only optimal entries were made, resulting in repeated quantitative gains,

and the quality of the setup is high from a professional viewpoint.

GOLD STREAMtrading operated in a high-volatility environment with about 2,290 pips 5-day ADR,sharply narrowing entries based on strength/weakness and correlation analysisas a core design feature.

The displayed +7,400 pips is the theoretical MAX when fully held; the essence of evaluation lies not in the width but inwhich situations the signals worked.

First, entry precision.

In the unstable early market, no entries were taken, and signals fired only when the directionality of strength/weakness and correlation aligned clearly.

As a result, among multiple trend waves within the 5-day ADR,the most persistent main waves were extracted, avoiding unnecessary retracements and minor back-and-forths, which is highly commendable.

Next, trade structure.

Ranges like +2400 pips, +3200 pips are not single-shot hits but the result of treating the continuous, same-direction strength as a wave.

Compared with 5-day ADR of 2290 pips, the width may seem above the environmental range, but this is due to multiple consecutive aligned correlations, not a design flaw.

Next, risk management.

In this trade,the SL is fixed based on the 4-hour chart, so stop-loss width does not drift with market conditions or emotions.

Thus, risk remains constant even during unexpected rapid moves, making expected value calculations clear.

Meanwhile, take-profit is flexible via ATR-based exits and trailing,limiting losses while allowing profits to run when trends extend.

Overall,

this trade is

and from a professional perspective, the execution quality is high.

MAX width is a reference; in actual operation, even with ATR-based take profits and trailing, there is a clearly reproducible edge.This can be considered a robust edge.

In summary, this trade is not about large one-time gains, but rather a high-volatility environment where only optimal entries were made, resulting in repeated quantitative gains,

and the quality of the setup is high from a professional viewpoint.

■ SILVER (Silver) Market Outlook

Silver prices moved in tandem with gold again this week, remaining at high levels, but during Friday’s sharp decline, silver fell even more than gold,with price volatility expanding. While safe-haven demand and speculative buying continued to support, policy risks and rate-hike expectations weighed on sentiment, leading toincreased intraday range movements in the short term.

▼【Last Week’s Verification】”GOLD STREAM” 2026.1.26~1.30 MAX calculation▼

GOLD / M15 Day Trading Focus

What is GOLD STREAM?

Main Features of GOLD STREAM

1. Gold (XAUUSD) Dedicated Design

GOLD STREAMis optimized for GOLD’s volatility characteristics and correlation structure

A dedicated system for short-term intraday trading.

Emphasizing immediacy and consistency that generic tools struggle to provide.

2. Ready → Signal Two-Stage Notification

-

Ready (Preparation) Notification

Notifies when the conditions are starting to align -

Signal (Confirmation) Notification

Notifies when entry decision criteria are met

This prevents missed signals or erroneous actions due to impatience,allowing calm execution after preparation.

3. Integrated display of “Strength/Correlation Analysis” in a sub-window

Essential elements for GOLD trading

-

Relative Strength

-

Confirmation of Correlation Direction

-

Signal Strength

displayed in a sub-window without repainting, enabling immediate confirmation.

No need to open other charts or apps.

4. Pivot Line Auto Display

Pivot Line can be shown to clearly indicate price targets.

-

Day Trading: Based on Daily Pivot

-

Targeting Ranges: Weekly Pivot as target

Based on GOLD’s unique price movement, you can visually grasp realistic take-profit levels.

5. ATR-Based Auto-Exit Logic (Take-Profit/Trail EA)

The included trailing EA automatically sets optimized take-profit based on ATR (Average True Range).

-

Basic Risk-Reward1 : 2 or better targeted

-

In non-trending markets, trailing protects unrealized gains

Greatly reduces decision fatigue from discretionary exits.

6. Mobile Entry Support

Entry: possible on a smartphone

-

Exit: Trailing EA handles TP / SL / trailing automatically

After entry, exit decisions are automated, enabling a calm, steady trading process.

7. Design to Support Trading Skill Mastery

GOLD STREAM aims not only for short-term results but also

-

Identifying optimal situations with edge

-

Appropriate risk-reward sense

-

Minimizing unnecessary entries

All designed to help traders build lasting winning skills.