Envelope Counter-Trend EA Sequel: How to Choose Currency Pairs (Spread × Rangeiness × Sudden Change Risk)

It is a black cat.

Last time I summarized three patterns of fixed/upper limit/mild increase for people who are afraid of lot sizes.

We will checklists and explain an easy approach for beginners on “currency pair selection.”

In short, currency pair selection matters more for how volatile it is (how often the leverage progresses) than for win rate. The experience changes quite a bit depending on the currency’s characteristics even with the same settings.

1) Why does performance change with currency pairs

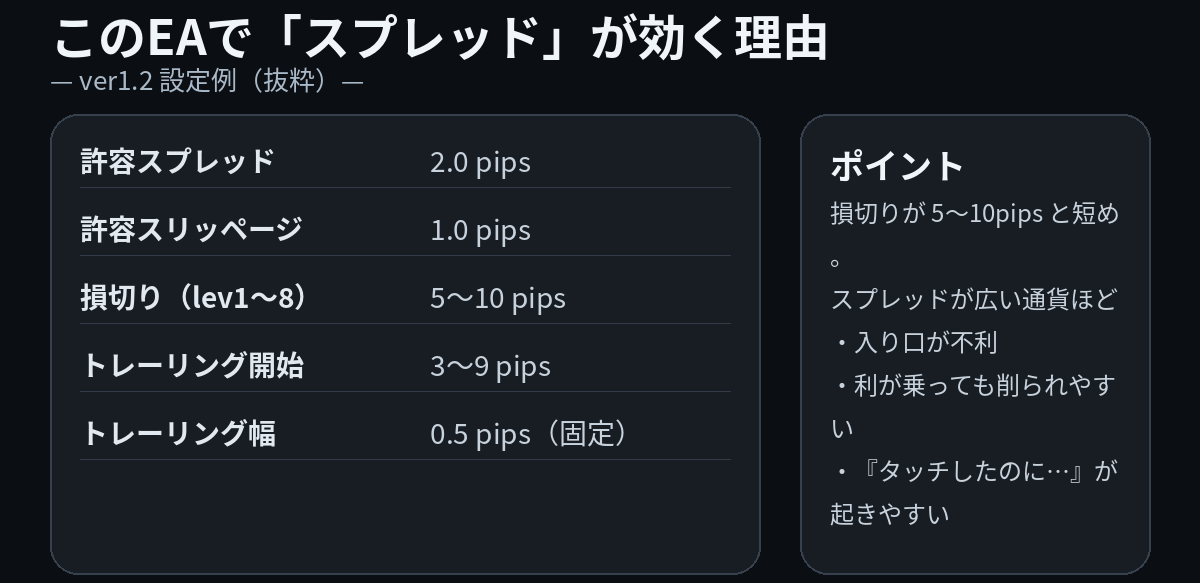

In this EA (ver1.2 setting example),

Allowed spread: 2.0 pips

Allowed slippage: 1.0 pips

Stop loss: 5–10 pips (varies with leverage)

Trailing start: 3–9 pips

Trailing width: 0.5 pips (fixed)

This is the premise.

In other words, because the stop loss is relatively short (5–10 pips),

the currency pairs with wider spreads tend to be disadvantaged at entry

profits can be shaved off even when they’re in profit

leading to a structure where it’s hard to enter or the entry method is unstable

…this is the pattern.

[Figure 1] The reason the “spread” affects this EA (ver1.2 settings excerpt)

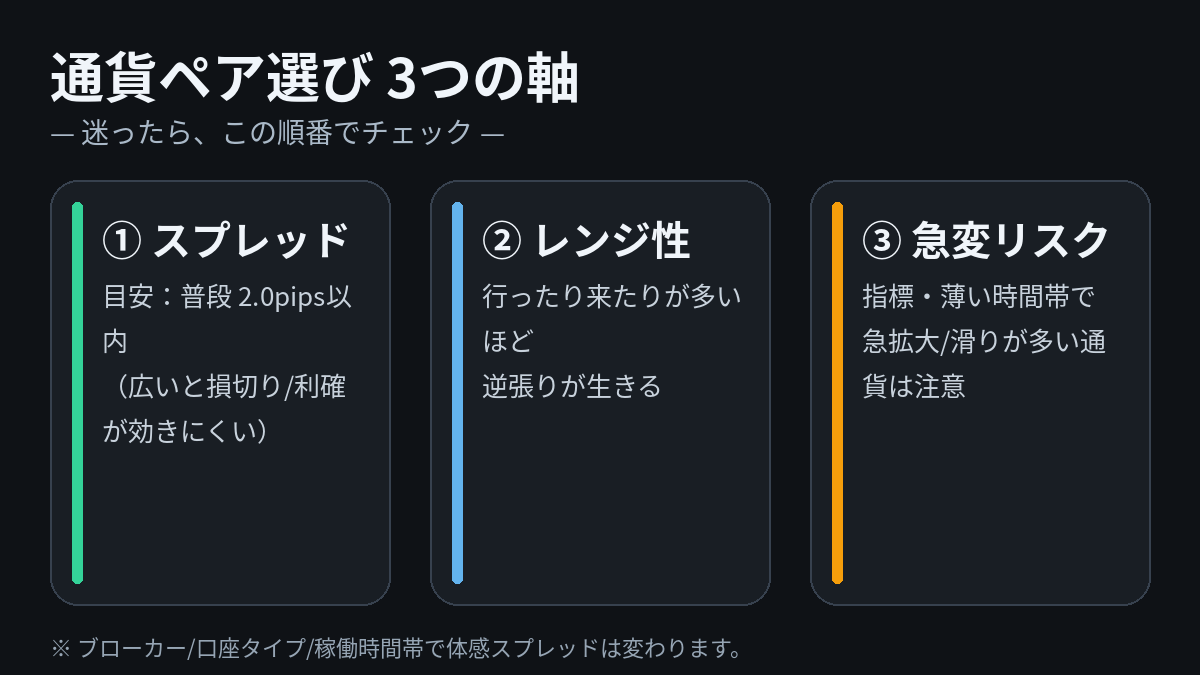

2) Currency pair selection is OK with only 3 axes

If you are unsure, simply look at the following order and you’re good.

① Spread (top priority)

Whether it stays within 2.0 pips during normal trading hours

Avoid currencies where spreads surge during news or thin liquidity

② Range tendency (suitable for mean reversion)

The more it tends to go back and forth (retrace), the more compatible

The more it tends to run in one direction, the faster leverage progresses

③ Sudden change risk (proneness to spikes)

Sudden changes plus spread widening plus slippage can make mean reversion volatile

[Figure 2] Currency pair selection “Three Axes” check diagram

3) For beginners: steps to narrow down to 2–3 candidates

Rather than aiming for perfection, realistically proceed as follows to keep it easy.

Step 1: First narrow candidates to 2–3

Don’t immediately widen to minor currencies; start with those with abundant data and easy comparison.

Examples (candidates only): EURUSD / USDJPY / AUDUSD / GBPUSD, etc.

※ It does not mean that “this currency will surely win.”

Broker and account type can change spread characteristics, so this is about making them easy to consider as candidates.

Step 2: Check spreads in your planned trading hours

Even the same currency can feel different depending on the environment.

In the hours you plan to operate, exclude currencies that are likely to exceed 2.0 pips.

Just this alone will already change how volatile it feels.

Step 3: Compare under the same conditions and look at “volatility” rather than “win rate”

• Same lot design

• Same time frame

• Same period

Compare and prioritize the volatility metrics over win rate

• How often leverage progresses deeply

• How often the drawdown extends

These are given priority.

Beginners tend to continue with currencies that show milder ways of losing.

4) If you’re unsure, this is all you need (final check)

If the following three are all YES, that currency is likely a good match.

① It usually stays within 2.0 pips in normal spreads

② It tends to retrace rather than trend strongly in one direction (range-biased)

③ It rarely has extreme spread spikes during economic indicators or thin hours

5) Product page

Envelope mean-reversion EA (lev8 / lev10) here

× ![]()